Introduction:

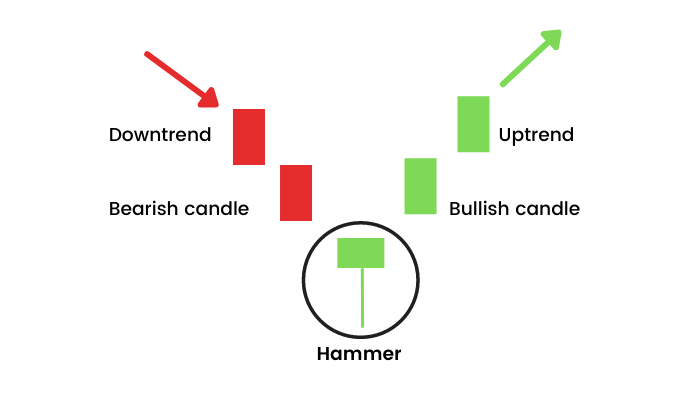

forex market mein bullish hammer candlestick chart pattern aik kesam ka single candlestick chart pattern hota hey jo keh forex market mein price kay chart par pay jate hein yeh forex market mein dosree candlestick chart pattern say mokhtalef ho sakte hey kunkeh forexmarket mein es ko single candlestick chart pattern ka turning point ka naam bhe deya jata hey yeeh forex market mein kame kay trend ke taraf eshara deya ja sakta hey

hammer candlestick pattern ke nechay de gaytaweer es point ko identify karte hey yeh forex market mein dosray candlestick pattern say mokhtalef bhe ho saktay hein hammer pattern bananay kay ley currency pair kay new lows ko identify keya ja sakta hey or forex market mein price ko pehlay wazah tor par sell keya ja sakta hey or new lows bananay kay ley price ka pehlay wazah tor par ezafa karna chihay takeh forex market ke e kamee kay bad price mein wazah ezafa hona chihay jes ke wajah say priceaik chote ce body rakhte hein yeh forx market ke start mein price close hote hey

es bat ko yad rakhna chihay keh forex market mein hammer candlestick ke body lambai kam say kam double long wick kay sath hona chihay es pattern ke body ke lambai say kam a kam double long wick hona chihay yeh candle stick khod ya to red hote hey ya phir green hote hey jo keh forex market kay reversal trend ko identify kar sakte hey

zyada tar vullish hammer pattern bearish hanging man candlestick pattern kay sath olajh jata hey hanging man candlestick mein aik chote body hote hey

Trade with bullish hammer pattern

bullish hammer candlestick pattern mokhtalef kesam kay chart or time frame say mel kar banta hey nechay de gay aik 20 may say 31 April tak ke de gay hey AUD/USD kay chart ke aik mesal de gay hey 31 may tak 892 pips tak ger geya hey forx market mein es kame kay trend ka end aik bullish hammer candlestick kay sath keya geya hey es kay bad price nay ajj kay price action kay zarey say 792 pips ka ezafa kar deya hey

chonkeh hammer candlestick pattern aik strong candlestick pattern hota hey jo keh forex market mein es ke jagah par depend karta hey forex trader es ko dosray indicator kay sath estamal kar sakta hey Fibonacci retracement kay sath bhe estamal kar saktay hein hammer candlestick pattern support level mei ghos jay ge buy kay jazbat ke body kay oper close ho jay ge buy kay aik new chance kay sath e kay bad support kay nechay stop loss set kartay hein takeh reversal janay say account safe rah sakay

forex market mein bullish hammer candlestick chart pattern aik kesam ka single candlestick chart pattern hota hey jo keh forex market mein price kay chart par pay jate hein yeh forex market mein dosree candlestick chart pattern say mokhtalef ho sakte hey kunkeh forexmarket mein es ko single candlestick chart pattern ka turning point ka naam bhe deya jata hey yeeh forex market mein kame kay trend ke taraf eshara deya ja sakta hey

hammer candlestick pattern ke nechay de gaytaweer es point ko identify karte hey yeh forex market mein dosray candlestick pattern say mokhtalef bhe ho saktay hein hammer pattern bananay kay ley currency pair kay new lows ko identify keya ja sakta hey or forex market mein price ko pehlay wazah tor par sell keya ja sakta hey or new lows bananay kay ley price ka pehlay wazah tor par ezafa karna chihay takeh forex market ke e kamee kay bad price mein wazah ezafa hona chihay jes ke wajah say priceaik chote ce body rakhte hein yeh forx market ke start mein price close hote hey

es bat ko yad rakhna chihay keh forex market mein hammer candlestick ke body lambai kam say kam double long wick kay sath hona chihay es pattern ke body ke lambai say kam a kam double long wick hona chihay yeh candle stick khod ya to red hote hey ya phir green hote hey jo keh forex market kay reversal trend ko identify kar sakte hey

zyada tar vullish hammer pattern bearish hanging man candlestick pattern kay sath olajh jata hey hanging man candlestick mein aik chote body hote hey

Trade with bullish hammer pattern

bullish hammer candlestick pattern mokhtalef kesam kay chart or time frame say mel kar banta hey nechay de gay aik 20 may say 31 April tak ke de gay hey AUD/USD kay chart ke aik mesal de gay hey 31 may tak 892 pips tak ger geya hey forx market mein es kame kay trend ka end aik bullish hammer candlestick kay sath keya geya hey es kay bad price nay ajj kay price action kay zarey say 792 pips ka ezafa kar deya hey

chonkeh hammer candlestick pattern aik strong candlestick pattern hota hey jo keh forex market mein es ke jagah par depend karta hey forex trader es ko dosray indicator kay sath estamal kar sakta hey Fibonacci retracement kay sath bhe estamal kar saktay hein hammer candlestick pattern support level mei ghos jay ge buy kay jazbat ke body kay oper close ho jay ge buy kay aik new chance kay sath e kay bad support kay nechay stop loss set kartay hein takeh reversal janay say account safe rah sakay

تبصرہ

Расширенный режим Обычный режим