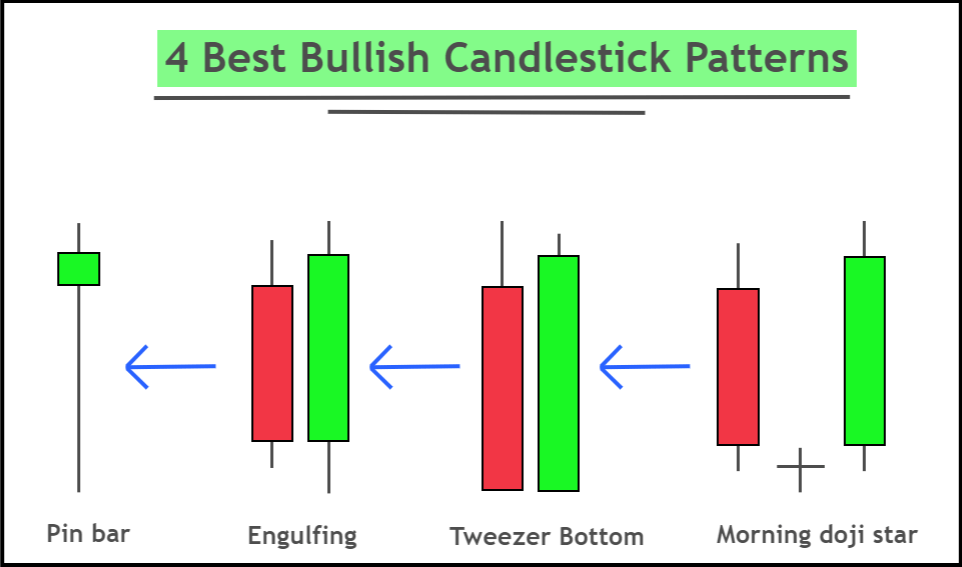

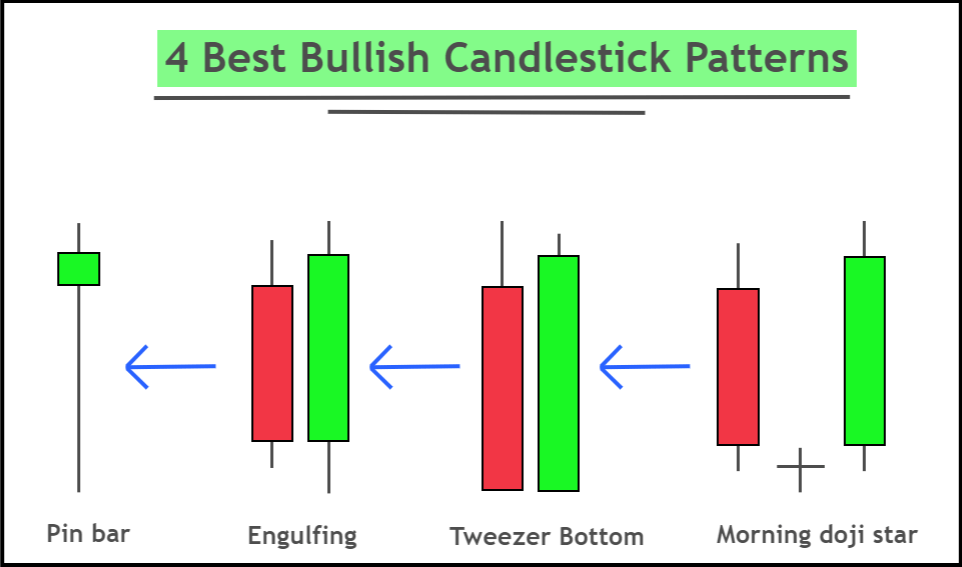

Bullish Graph Example:Bullish candle plans shippers ke liye huge instrument hain jo potential example reversals aur cost improvements ko distinguish karne mein madad dete hain. Lekin sellers ko false signs aur market insecurity ka bhi dhyan dena chahiye. In plans ko unravel karne ke liye other specific pointers aur assessment ki zaroorat hoti hai. Inki madad se agents apne entry aur leave centers improve kar sakte hain, lekin authentic assessment aur practice zaroori hain. Bullish light plans vendors ko market improvements aur potential example changes ko better samajhne mein madad dete hain. As a general rule, in plans ka istemal vendors ki assessment capacities aur trading decisions ko improve karne mein madadgar ho sakta hai, lekin iska istemal karte waqt confirmation aur risk the chiefs ka dhyan dena zaroori hai.Bullish candle plans shippers ko potential example reversal signals give karte hain, showing a shift from pessimistic to bullish feeling.Yeh plans pessimistic example solid areas for ki confirmation dete hain, showing a potential vertical movement.Traders bullish flame plans ki madad se entry aur leave centers certify kar sakte hain, jisse unka potential for benefit increase hota hai. Kabhi bullish flame plans fake signs bhi de sakte hain, jahan certifiable example reversal nahi hota.Market shakiness ke dauran plan ka understanding mushkil hosakta hai.Bullish candle plans ko insist karne ke liye other particular pointers aur cost action examination ki zaroorat hoti hai. Graph Example Development:Candle plans ko akela standard bhrosa nahi karna chahiye; ye tab sab se zyada asar daar hote hain punch unhein dosre specific assessment instruments aur markers ke saath istemal karke potential examples ki tasdeeq kiya jaye. Traders aksar in plans ko dakhil aur nikahat signals ke taur standard istemal karte hain, stop-mishap orders tayyar karke risk ko qabu karne ke liye, maamla agar market waisa nahi chalta jaisa umeed kiya tha.Ikhtitami taur standard, bullish candle plans forex sellers ke liye ahem mechanical assemblies hote hain taake wo potential khareedari mauqayon ko pehchanein aur market designs mein ulat pher ki nishandahi kar sakte hain. Ye plans buyers aur traders ke darmiyan taqat ka tabdeel hony ka visual zaria faraham karte hain, jo agents ko maloomat se basey faislay karne mein madad dete hain. In plans ko dosre particular assessment procedures aur risk the leaders strategies ke saath jorne se, vendors forex market mein kamyabi ki imkanat ko barha sakte hain.Negative flame ke baad aik choti bullish candle aati hai jo pehle edge light ki jism ko poori tarah se apne andar samait leti hai. Ye plan ishara karta hai ke bechne grain ka dabaw kam ho raha hai aur bullish reversal mumkin hai.Three White Officials: Ye plan adolescent muntazim bullish candles se bana hota hai jinmein har aik agle close se ziada shuru hoti hai. Ye ishara karta hai ke force negative se bullish ki taraf mazbooti se move ho raha hai, aksar aik ahem upswing ki taraf le jata hai.Falling three procedures plan aik continuation plan hai jo downtrend ke andar paida hota hai. Is mein aik lambi negative flame ke baad choti bullish candles ki series hoti hai jo pehli negative light ki high aur low mein mahdood hoti hain. Ye ishara karta hai ke market mukhtalif maamle mein harkat ko rok raha hai taake mumkin hai woh neechay ki taraf jari rakhe.

Graph Example Development:Candle plans ko akela standard bhrosa nahi karna chahiye; ye tab sab se zyada asar daar hote hain punch unhein dosre specific assessment instruments aur markers ke saath istemal karke potential examples ki tasdeeq kiya jaye. Traders aksar in plans ko dakhil aur nikahat signals ke taur standard istemal karte hain, stop-mishap orders tayyar karke risk ko qabu karne ke liye, maamla agar market waisa nahi chalta jaisa umeed kiya tha.Ikhtitami taur standard, bullish candle plans forex sellers ke liye ahem mechanical assemblies hote hain taake wo potential khareedari mauqayon ko pehchanein aur market designs mein ulat pher ki nishandahi kar sakte hain. Ye plans buyers aur traders ke darmiyan taqat ka tabdeel hony ka visual zaria faraham karte hain, jo agents ko maloomat se basey faislay karne mein madad dete hain. In plans ko dosre particular assessment procedures aur risk the leaders strategies ke saath jorne se, vendors forex market mein kamyabi ki imkanat ko barha sakte hain.Negative flame ke baad aik choti bullish candle aati hai jo pehle edge light ki jism ko poori tarah se apne andar samait leti hai. Ye plan ishara karta hai ke bechne grain ka dabaw kam ho raha hai aur bullish reversal mumkin hai.Three White Officials: Ye plan adolescent muntazim bullish candles se bana hota hai jinmein har aik agle close se ziada shuru hoti hai. Ye ishara karta hai ke force negative se bullish ki taraf mazbooti se move ho raha hai, aksar aik ahem upswing ki taraf le jata hai.Falling three procedures plan aik continuation plan hai jo downtrend ke andar paida hota hai. Is mein aik lambi negative flame ke baad choti bullish candles ki series hoti hai jo pehli negative light ki high aur low mein mahdood hoti hain. Ye ishara karta hai ke market mukhtalif maamle mein harkat ko rok raha hai taake mumkin hai woh neechay ki taraf jari rakhe. Exchanging Perspective:Flame diagrams forex market mein qeemat ke harkaton ko zahir karne ke liye mashhoor tareeqay hain. Har light chaar mukhya ajza se mushtak hoti hai: shuruaati qeemat, ikhtitami qeemat, zyada qeemat (high), aur kam qeemat (low) ek mukhtalif muddat mein. Light ki jism mein farq shuruaati aur ikhtitami qeemat ke darmiyan hota hai, jabke shadow (yaani ke wick) un maqamat ki range ko zahir karta hai jo high aur low qeemat ke darmiyan hoti hai. Bullish light plans khaas shaklain hoti hain jo market ki jazbat mein negative (nichle raaste ki taraf) se bullish (ooper ki taraf) ki mumkin tahqiqat ka izhar karti hain. Ye plans single light plans ya multi-flame courses of action ho sakti hain. Yahan kuch aam bullish light plans haLight plans forex graphs standard aam taur standard dekhi jane wali surat-e-haal hain jo market mein up cost advancement ki mumkin nishandahi karti hain. Ye plans representatives ke liye ahem gadgets hote hain taake wo mumkin khareedari mauqayon ko pehchanein aur mutabiq trading faislay kar sakein. Samajhna ke bullish candle plans kaise kaam karte hain, intermediaries ki qabliyat ko qabil-e-tasawwur qeemat ke designs ki peshan goi aur risk ko qabu karne mein kafi madadgar sabit ho sakta hai.

Exchanging Perspective:Flame diagrams forex market mein qeemat ke harkaton ko zahir karne ke liye mashhoor tareeqay hain. Har light chaar mukhya ajza se mushtak hoti hai: shuruaati qeemat, ikhtitami qeemat, zyada qeemat (high), aur kam qeemat (low) ek mukhtalif muddat mein. Light ki jism mein farq shuruaati aur ikhtitami qeemat ke darmiyan hota hai, jabke shadow (yaani ke wick) un maqamat ki range ko zahir karta hai jo high aur low qeemat ke darmiyan hoti hai. Bullish light plans khaas shaklain hoti hain jo market ki jazbat mein negative (nichle raaste ki taraf) se bullish (ooper ki taraf) ki mumkin tahqiqat ka izhar karti hain. Ye plans single light plans ya multi-flame courses of action ho sakti hain. Yahan kuch aam bullish light plans haLight plans forex graphs standard aam taur standard dekhi jane wali surat-e-haal hain jo market mein up cost advancement ki mumkin nishandahi karti hain. Ye plans representatives ke liye ahem gadgets hote hain taake wo mumkin khareedari mauqayon ko pehchanein aur mutabiq trading faislay kar sakein. Samajhna ke bullish candle plans kaise kaam karte hain, intermediaries ki qabliyat ko qabil-e-tasawwur qeemat ke designs ki peshan goi aur risk ko qabu karne mein kafi madadgar sabit ho sakta hai.  Morning Star bullish candlestick pattern Morning star aik multi-flame design hai jo negative candle se shuru hota hai, phir aata hai aik choti mushtaba light, aur phir aik bara bullish candle. Ye development ishara karta hai ke dealers apne control mein se bahar nikal rahe hain aur purchasers market mein qaabu karne lagte feed.

Morning Star bullish candlestick pattern Morning star aik multi-flame design hai jo negative candle se shuru hota hai, phir aata hai aik choti mushtaba light, aur phir aik bara bullish candle. Ye development ishara karta hai ke dealers apne control mein se bahar nikal rahe hain aur purchasers market mein qaabu karne lagte feed. Bullish Harami candlestick pattern: Bullish harami tab paida hota hai hit aik bada negative candle ke baad aik choti bullish candle aati hai jo pehle grain candle ki jism ko poori tarah se apne andar samait leti hai. Ye design ishara karta hai ke bechne rib ka dabaw kam ho raha hai aur bullish inversion mumkin feed. Three White Troopers Bullish candlestick pattern: Ye design high schooler muntazim bullish candles se bana hota hai jinmein har aik agle close se ziada shuru hoti hai. Ye ishara karta hai ke energy negative se bullish ki taraf mazbooti se move ho raha hai, aksar aik ahem upswing ki taraf le jata roughage.Falling Three Techniques:Falling three techniques design aik continuation design hai jo downtrend ke andar paida hota hai. Is mein aik lambi negative candle ke baad choti bullish candles ki series hoti hai jo pehli negative light ki high aur low mein mahdood hoti hain.

Bullish Harami candlestick pattern: Bullish harami tab paida hota hai hit aik bada negative candle ke baad aik choti bullish candle aati hai jo pehle grain candle ki jism ko poori tarah se apne andar samait leti hai. Ye design ishara karta hai ke bechne rib ka dabaw kam ho raha hai aur bullish inversion mumkin feed. Three White Troopers Bullish candlestick pattern: Ye design high schooler muntazim bullish candles se bana hota hai jinmein har aik agle close se ziada shuru hoti hai. Ye ishara karta hai ke energy negative se bullish ki taraf mazbooti se move ho raha hai, aksar aik ahem upswing ki taraf le jata roughage.Falling Three Techniques:Falling three techniques design aik continuation design hai jo downtrend ke andar paida hota hai. Is mein aik lambi negative candle ke baad choti bullish candles ki series hoti hai jo pehli negative light ki high aur low mein mahdood hoti hain.

Exchanging Perspective:Flame diagrams forex market mein qeemat ke harkaton ko zahir karne ke liye mashhoor tareeqay hain. Har light chaar mukhya ajza se mushtak hoti hai: shuruaati qeemat, ikhtitami qeemat, zyada qeemat (high), aur kam qeemat (low) ek mukhtalif muddat mein. Light ki jism mein farq shuruaati aur ikhtitami qeemat ke darmiyan hota hai, jabke shadow (yaani ke wick) un maqamat ki range ko zahir karta hai jo high aur low qeemat ke darmiyan hoti hai. Bullish light plans khaas shaklain hoti hain jo market ki jazbat mein negative (nichle raaste ki taraf) se bullish (ooper ki taraf) ki mumkin tahqiqat ka izhar karti hain. Ye plans single light plans ya multi-flame courses of action ho sakti hain. Yahan kuch aam bullish light plans haLight plans forex graphs standard aam taur standard dekhi jane wali surat-e-haal hain jo market mein up cost advancement ki mumkin nishandahi karti hain. Ye plans representatives ke liye ahem gadgets hote hain taake wo mumkin khareedari mauqayon ko pehchanein aur mutabiq trading faislay kar sakein. Samajhna ke bullish candle plans kaise kaam karte hain, intermediaries ki qabliyat ko qabil-e-tasawwur qeemat ke designs ki peshan goi aur risk ko qabu karne mein kafi madadgar sabit ho sakta hai.

Exchanging Perspective:Flame diagrams forex market mein qeemat ke harkaton ko zahir karne ke liye mashhoor tareeqay hain. Har light chaar mukhya ajza se mushtak hoti hai: shuruaati qeemat, ikhtitami qeemat, zyada qeemat (high), aur kam qeemat (low) ek mukhtalif muddat mein. Light ki jism mein farq shuruaati aur ikhtitami qeemat ke darmiyan hota hai, jabke shadow (yaani ke wick) un maqamat ki range ko zahir karta hai jo high aur low qeemat ke darmiyan hoti hai. Bullish light plans khaas shaklain hoti hain jo market ki jazbat mein negative (nichle raaste ki taraf) se bullish (ooper ki taraf) ki mumkin tahqiqat ka izhar karti hain. Ye plans single light plans ya multi-flame courses of action ho sakti hain. Yahan kuch aam bullish light plans haLight plans forex graphs standard aam taur standard dekhi jane wali surat-e-haal hain jo market mein up cost advancement ki mumkin nishandahi karti hain. Ye plans representatives ke liye ahem gadgets hote hain taake wo mumkin khareedari mauqayon ko pehchanein aur mutabiq trading faislay kar sakein. Samajhna ke bullish candle plans kaise kaam karte hain, intermediaries ki qabliyat ko qabil-e-tasawwur qeemat ke designs ki peshan goi aur risk ko qabu karne mein kafi madadgar sabit ho sakta hai.  Morning Star bullish candlestick pattern Morning star aik multi-flame design hai jo negative candle se shuru hota hai, phir aata hai aik choti mushtaba light, aur phir aik bara bullish candle. Ye development ishara karta hai ke dealers apne control mein se bahar nikal rahe hain aur purchasers market mein qaabu karne lagte feed.

Morning Star bullish candlestick pattern Morning star aik multi-flame design hai jo negative candle se shuru hota hai, phir aata hai aik choti mushtaba light, aur phir aik bara bullish candle. Ye development ishara karta hai ke dealers apne control mein se bahar nikal rahe hain aur purchasers market mein qaabu karne lagte feed.

تبصرہ

Расширенный режим Обычный режим