Bullish candlestick pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Introductioncandle stuck charts aik qisam ke maliyati chart hain jo sikyortiz ki naqal o harkat ko track karne ke liye hain. un ki ibtida sadiiyon purani japani chawal ki tijarat se hui hai aur unhon ne jadeed daur ke stak ki qeemat charting mein apna rasta banaya hai. kuch sarmaya karon ko mayaari baar charts aur qeemat ke aamaal ki tashreeh karna aasaan se ziyada basri tor par purkashish lagta hai. candle sticks ka naam is liye rakha gaya hai kyunkay dono suron par mustateel shakal aur lakerain vicks wali mom batii se millti jalti hain. Key feature har mom batii aam tor par stock ke baray mein aik din ki qeemat ke data ki numaindagi karti hai. waqt guzarnay ke sath, candle sticks qabil shanakht namonon mein group ban jati hain jinhein sarmaya car khareed o farokht ke faislay karne ke liye istemaal kar satke hain. candle stuck charts takneeki din ke taajiron ke liye patteren ki shanakht aur tijarti faislay karne ke liye mufeed hain. taizi ki mom batian taweel tijarat ke liye dakhlay ke maqamat ki nishandahi karti hain, aur yeh pishin goi karne mein madad kar sakti hain ke neechay ka rujhan kab oopar ki taraf murnay wala hai. yahan, hum taizi se mom batii ke namonon ki kayi misalon par ghhor karte hain. candlestick maloomat ke chaar tukron ke zariye stock ke baray mein aik din ki qeemat ke data ki numaindagi karti hai : Working iftitahi qeemat, ikhtitami qeemat, ziyada qeemat, aur kam qeemat. markazi mustateel ka rang ( jisay haqeeqi body kaha jata hai ) sarmaya karon ko batata hai ke aaya ibtidayi qeemat ya ikhtitami qeemat ziyada thi. kaali ya bhari hui shama daan ka matlab hai ke is muddat ke liye ikhtitami qeemat ibtidayi qeemat se kam thi. lehaza, yeh mandi hai aur farokht ke dabao ki nishandahi karta hai. darin Isna , aik safaid ya khokhli candle stick ka matlab hai ke ikhtitami qeemat ibtidayi qeemat se ziyada thi. yeh taizi hai aur kharidari ke dabao ko zahir karta hai. mom batii ke dono suron par lakerain shadow kehlati hain, aur woh din ke liye qeemat ke amal ki poori range dukhati hain, kam se onche tak. oopri saya din ke liye stock ki sab se ziyada qeemat dekhata hai, aur nichala saya din ke liye sab se kam qeemat dekhata hai -

#3 Collapse

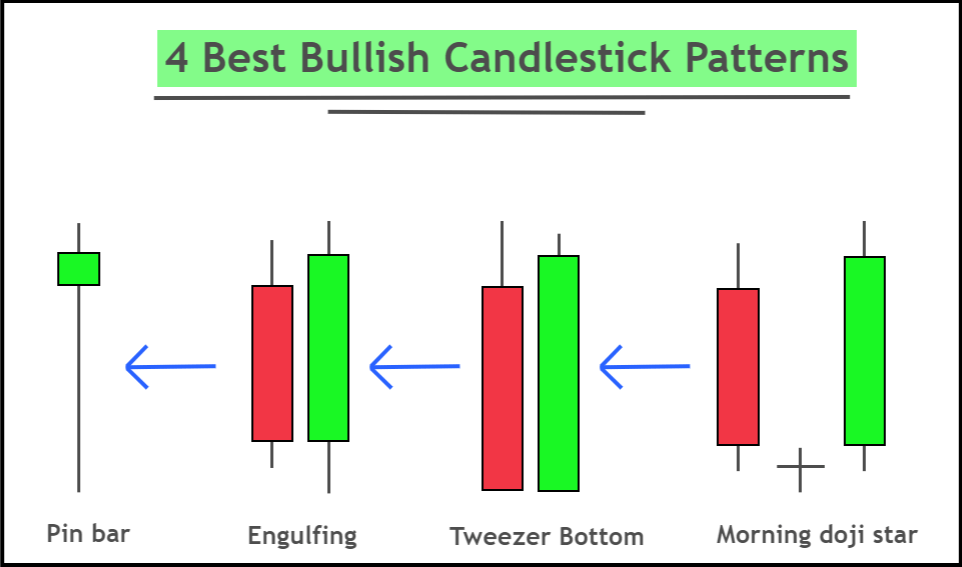

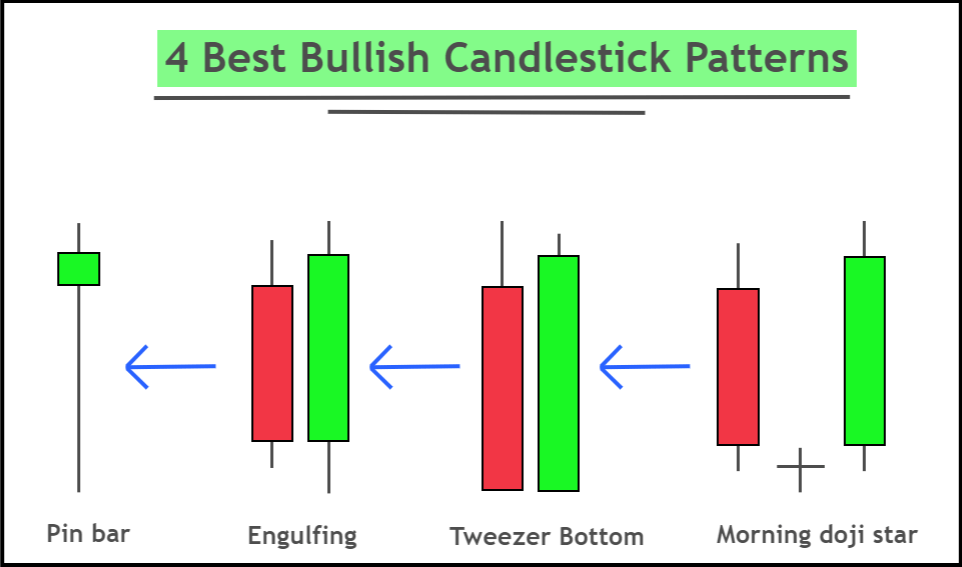

Assalamualaikum! Umeed hai k ap sb khariyat sy hongy. R apky trading sessions achy jaa rhy hongy. Aj ka hmra discussion topic "Bullish candlestick pattern" . Dekhty hain k ye hmein Kya information deta hai r hmry ilam Mai Kesy ezafa krta hai. Bullish candlestick pattern Bullish candlestick patterns forex charts par aam taur par dekhi jane wali surat-e-haal hain jo market mein upward price movement ki mumkin nishandahi karti hain. Ye patterns traders ke liye ahem tools hote hain taake wo mumkin khareedari mauqayon ko pehchanein aur mutabiq trading faislay kar sakein. Samajhna ke bullish candlestick patterns kaise kaam karte hain, traders ki qabliyat ko qabil-e-tasawwur qeemat ke trends ki peshan goi aur risk ko qabu karne mein kafi madadgar sabit ho sakta hai. Explanation Candlestick charts forex market mein qeemat ke harkaton ko zahir karne ke liye mashhoor tareeqay hain. Har candlestick chaar mukhya ajza se mushtak hoti hai: shuruaati qeemat, ikhtitami qeemat, zyada qeemat (high), aur kam qeemat (low) ek mukhtalif muddat mein. Candlestick ki jism mein farq shuruaati aur ikhtitami qeemat ke darmiyan hota hai, jabke shadow (yaani ke wick) un maqamat ki range ko zahir karta hai jo high aur low qeemat ke darmiyan hoti hai. Bullish candlestick patterns khaas shaklain hoti hain jo market ki jazbat mein bearish (nichle raaste ki taraf) se bullish (ooper ki taraf) ki mumkin tahqiqat ka izhar karti hain. Ye patterns single candlestick patterns ya multi-candle formations ho sakti hain. Yahan kuch aam bullish candlestick patterns hain: 1. Hammer: Ek hammer candlestick mein ek chota jism candle ki uqbi taraf hota hai aur ek lambi lower wick hoti hai jo kam az kam do martaba jism ki lambai hoti hai. Ye pattern ishara karta hai ke sellers ne trading session mein qeemat ko nicha daba diya, lekin khareedne wale control mein aaye aur qeemat ko ooper le gaye, jisse bullish momentum mumkin hai. 2. Bullish Engulfing: Ye pattern tab paida hota hai jab aik choti bearish candlestick ke baad aik ziada bari bullish candlestick aati hai jo pehle candle ki pori jism ko aik dam apne andar samait leti hai. Bullish engulfing pattern pehle wale downard trend ke ulte ho jane ki taraf ishara karta hai, kyunke khareedne wale sellers ko hara chuke hain aur ab control mein hain. 3. Piercing Line: Piercing line pattern is wakt paida hota hai jab aik bearish candlestick ke baad aik bullish candlestick aati hai jo pehle candle ki kam qeemat se neeche shuru hoti hai aur uske darmiyan close hoti hai. Ye ishara karta hai ke khareedne wale ne neechay ki taraf harkat ko ulta kya hai aur mumkin hai ke ooper ki taraf movement trigger ho. 4. Morning Star: Morning star aik multi-candle pattern hai jo bearish candlestick se shuru hota hai, phir aata hai aik choti mushtaba candle, aur phir aik bara bullish candlestick. Ye formation ishara karta hai ke sellers apne control mein se bahar nikal rahe hain aur buyers market mein qaabu karne lagte hain. 5. Bullish Harami: Bullish harami tab paida hota hai jab aik bada bearish candlestick ke baad aik choti bullish candlestick aati hai jo pehle wale candle ki jism ko poori tarah se apne andar samait leti hai. Ye pattern ishara karta hai ke bechne wale ka dabaw kam ho raha hai aur bullish reversal mumkin hai. 6. Three White Soldiers: Ye pattern teen muntazim bullish candlesticks se bana hota hai jinmein har aik agle close se ziada shuru hoti hai. Ye ishara karta hai ke momentum bearish se bullish ki taraf mazbooti se move ho raha hai, aksar aik ahem uptrend ki taraf le jata hai. 7. Falling Three Methods: Falling three methods pattern aik continuation pattern hai jo downtrend ke andar paida hota hai. Is mein aik lambi bearish candlestick ke baad choti bullish candlesticks ki series hoti hai jo pehli bearish candle ki high aur low mein mahdood hoti hain. Ye ishara karta hai ke market mukhtalif maamle mein harkat ko rok raha hai taake mumkin hai woh neechay ki taraf jari rakhe. Bullish candlestick patterns ko akela par bhrosa nahi karna chahiye; ye tab sab se zyada asar daar hote hain jab unhein dosre technical analysis tools aur indicators ke saath istemal karke potential trends ki tasdeeq kiya jaye. Traders aksar in patterns ko dakhil aur nikahat signals ke taur par istemal karte hain, stop-loss orders tayyar karke risk ko qabu karne ke liye, maamla agar market waisa nahi chalta jaisa umeed kiya tha. Ikhtitami taur par, bullish candlestick patterns forex traders ke liye ahem tools hote hain taake wo potential khareedari mauqayon ko pehchanein aur market trends mein ulat pher ki nishandahi kar sakte hain. Ye patterns buyers aur sellers ke darmiyan taqat ka tabdeel hony ka visual zaria faraham karte hain, jo traders ko maloomat se basey faislay karne mein madad dete hain. In patterns ko dosre technical analysis methods aur risk management strategies ke saath jorne se, traders forex market mein kamyabi ki imkanat ko barha sakte hain. -

#4 Collapse

**Bullish Candlestick Patterns: An Explanation** Bullish candlestick patterns traders ko potential bullish trend aur price reversals ki signals provide karte hain. Yeh patterns price chart par candlesticks ke formations se bane hote hain aur bullish trend ko indicate karte hain, indicating a potential upward movement. **Explanation:** Bullish candlestick patterns bullish trend ya price reversal ko represent karte hain. In patterns mein candlesticks ki specific formations dekh kar traders price movement aur trend direction ko interpret karte hain. Bullish patterns mein candlesticks ka body generally bullish trend ke direction mein move karta hai. **Types of Bullish Candlestick Patterns:** Kai tarah ke bullish candlestick patterns hote hain, jinme se kuch common ones hain: 1. **Hammer:** Ek small body aur long lower shadow wala candlestick hota hai, indicating potential trend reversal. 2. **Bullish Engulfing:** Pehle candlestick bearish hota hai aur doosre candlestick ka body pehle candlestick ko engulf karta hai, indicating bullish sentiment. 3. **Piercing Line:** Pehle candlestick bearish hota hai aur doosre candlestick ka close pehle candlestick ke body ke upar hota hai, indicating bullish reversal. 4. **Morning Star:** Ek bearish candlestick ke baad small range ka doosra candlestick aur uske baad ek bullish candlestick hota hai, indicating bullish reversal. **Benefits of Bullish Candlestick Patterns:** 1. **Trend Reversal Signal:** Bullish candlestick patterns traders ko potential trend reversal signals provide karte hain, indicating a shift from bearish to bullish sentiment. 2. **Confirmation of Reversal:** Yeh patterns bearish trend ki strong reversal confirmation dete hain, indicating a potential upward movement. 3. **Entry and Exit Points:** Traders bullish candlestick patterns ki madad se entry aur exit points confirm kar sakte hain, jisse unka potential for profit increase hota hai. **Drawbacks of Bullish Candlestick Patterns:** 1. **False Signals:** Kabhi-kabhi bullish candlestick patterns false signals bhi de sakte hain, jahan actual trend reversal nahi hota. 2. **Market Volatility:** Market volatility ke dauran pattern ka interpretation mushkil ho sakta hai. 3. **Confirmation Required:** Bullish candlestick patterns ko confirm karne ke liye other technical indicators aur price action analysis ki zaroorat hoti hai. **Conclusion:** Bullish candlestick patterns traders ke liye valuable tool hain jo potential trend reversals aur price movements ko detect karne mein madad dete hain. Lekin traders ko false signals aur market volatility ka bhi dhyan dena chahiye. In patterns ko interpret karne ke liye other technical indicators aur analysis ki zaroorat hoti hai. Inki madad se traders apne entry aur exit points improve kar sakte hain, lekin proper research aur practice zaroori hain. Bullish candlestick patterns traders ko market movements aur potential trend changes ko better samajhne mein madad dete hain. Overall, in patterns ka istemal traders ki analysis skills aur trading decisions ko enhance karne mein madadgar ho sakta hai, lekin iska istemal karte waqt confirmation aur risk management ka dhyan dena zaroori hai. -

#5 Collapse

candlestick patterns forex charts par aam taur par dekhi jane wali surat-e-haal hain jo market mein upward price movement ki mumkin nishandahi karti hain. Ye patterns traders ke liye ahem tools hote hain taake wo mumkin khareedari mauqayon ko pehchanein aur mutabiq trading faislay kar sakein. Samajhna ke bullish candlestick patterns kaise kaam karte hain, traders ki qabliyat ko qabil-e-tasawwur qeemat ke trends ki peshan goi aur risk ko qabu karne mein kafi madadgar sabit ho sakta hai.candlestick mein ek chota jism candle ki uqbi taraf hota hai aur ek lambi lower wick hoti hai jo kam az kam do martaba jism ki lambai hoti hai. Ye pattern ishara karta hai ke sellers ne trading session mein qeemat ko nicha daba diya, lekin khareedne wale control mein aaye aur qeemat ko ooper le gaye, jisse bullish momentum mumkin hai. 2. Bullish Engulfing: Ye pattern tab paida hota hai jab aik choti bearish candlestick ke baad aik ziada bari bullish candlestick aati hai jo pehle candle ki pori jism ko aik dam apne andar samait leti hai. Bullish engulfing pattern pehle wale downard trend ke ulte ho jane ki taraf ishara karta hai, kyunke khareedne wale sellers ko hara chuke hain aur ab control mein hain. 3. Piercing Line: Piercing line pattern is wakt paida hota hai jab aik bearish candlestick ke baad aik bullish candlestick aati hai jo pehle candle ki kam qeemat se neeche shuru hoti hai aur uske darmiyan close hoti hai. Ye ishara karta hai ke khareedne wale ne neechay ki taraf harkat ko ulta kya hai aur mumkin hai ke ooper ki taraf movement trigger ho.candlestick patterns bullish trend ya price reversal ko represent karte hain. In patterns mein candlesticks ki specific formations dekh kar traders price movement aur trend direction ko interpret karte hain. Bullish patterns mein candlesticks ka body generally bullish trend ke direction mein move karta hai.

4. Morning Star: Morning star aik multi-candle pattern hai jo bearish candlestick se shuru hota hai, phir aata hai aik choti mushtaba candle, aur phir aik bara bullish candlestick. Ye formation ishara karta hai ke sellers apne control mein se bahar nikal rahe hain aur buyers market mein qaabu karne lagte hain. 5. Bullish Harami: Bullish harami tab paida hota hai jab aik bada bearish candlestick ke baad aik choti bullish candlestick aati hai jo pehle wale candle ki jism ko poori tarah se apne andar samait leti hai. Ye pattern ishara karta hai ke bechne wale ka dabaw kam ho raha hai aur bullish reversal mumkin hai. 6. Three White Soldiers: Ye pattern teen muntazim bullish candlesticks se bana hota hai jinmein har aik agle close se ziada shuru hoti hai. Ye ishara karta hai ke momentum bearish se bullish ki taraf mazbooti se move ho raha hai, aksar aik ahem uptrend ki taraf le jata hai. False Signals:** Kabhi-kabhi bullish candlestick patterns false signals bhi de sakte hain, jahan actual trend reversal nahi hota. 2. **Market Volatility:** Market volatility ke dauran pattern ka interpretation mushkil ho sakta hai. 3. **Confirmation Required:** Bullish candlestick patterns ko confirm karne ke liye other technical indicators aur price action analysis ki zaroorat hoti hai.

7. Falling Three Methods: Falling three methods pattern aik continuation pattern hai jo downtrend ke andar paida hota hai. Is mein aik lambi bearish candlestick ke baad choti bullish candlesticks ki series hoti hai jo pehli bearish candle ki high aur low mein mahdood hoti hain. Ye ishara karta hai ke market mukhtalif maamle mein harkat ko rok raha hai taake mumkin hai woh neechay ki taraf jari rakhe. Ye patterns buyers aur sellers ke darmiyan taqat ka tabdeel hony ka visual zaria faraham karte hain, jo traders ko maloomat se basey faislay karne mein madad dete hain. In patterns ko dosre technical analysis methods aur risk management strategies ke saath jorne se, traders forex market mein kamyabi ki imkanat ko barha sakte hain.

-

#6 Collapse

Bullish Chart Pattern: Bullish candle designs merchants ke liye significant instrument hain jo potential pattern inversions aur cost developments ko identify karne mein madad dete hain. Lekin dealers ko bogus signs aur market instability ka bhi dhyan dena chahiye. In designs ko decipher karne ke liye other specialized pointers aur examination ki zaroorat hoti hai. Inki madad se brokers apne passage aur leave focuses improve kar sakte hain, lekin legitimate examination aur practice zaroori hain. Bullish candle designs merchants ko market developments aur potential pattern changes ko better samajhne mein madad dete hain. In general, in designs ka istemal dealers ki examination abilities aur exchanging choices ko improve karne mein madadgar ho sakta hai, lekin iska istemal karte waqt affirmation aur risk the executives ka dhyan dena zaroori hai. Bullish candle designs merchants ko potential pattern inversion signals give karte hain, showing a shift from negative to bullish feeling.Yeh designs negative pattern areas of strength for ki affirmation dete hain, showing a potential vertical movement.Traders bullish candle designs ki madad se passage aur leave focuses affirm kar sakte hain, jisse unka potential for benefit increment hota hai. Kabhi bullish candle designs bogus signs bhi de sakte hain, jahan genuine pattern inversion nahi hota.Market instability ke dauran design ka understanding mushkil hosakta hai.Bullish candle designs ko affirm karne ke liye other specialized pointers aur cost activity investigation ki zaroorat hoti hai. Chart Pattern Formation: Candle designs ko akela standard bhrosa nahi karna chahiye; ye tab sab se zyada asar daar hote hain punch unhein dosre specialized examination instruments aur markers ke saath istemal karke potential patterns ki tasdeeq kiya jaye. Merchants aksar in designs ko dakhil aur nikahat signals ke taur standard istemal karte hain, stop-misfortune orders tayyar karke risk ko qabu karne ke liye, maamla agar market waisa nahi chalta jaisa umeed kiya tha.Ikhtitami taur standard, bullish candle designs forex dealers ke liye ahem apparatuses hote hain taake wo potential khareedari mauqayon ko pehchanein aur market patterns mein ulat pher ki nishandahi kar sakte hain. Ye designs purchasers aur merchants ke darmiyan taqat ka tabdeel hony ka visual zaria faraham karte hain, jo brokers ko maloomat se basey faislay karne mein madad dete hain. In designs ko dosre specialized examination techniques aur risk the executives methodologies ke saath jorne se, dealers forex market mein kamyabi ki imkanat ko barha sakte hain.

Bullish candle designs merchants ko potential pattern inversion signals give karte hain, showing a shift from negative to bullish feeling.Yeh designs negative pattern areas of strength for ki affirmation dete hain, showing a potential vertical movement.Traders bullish candle designs ki madad se passage aur leave focuses affirm kar sakte hain, jisse unka potential for benefit increment hota hai. Kabhi bullish candle designs bogus signs bhi de sakte hain, jahan genuine pattern inversion nahi hota.Market instability ke dauran design ka understanding mushkil hosakta hai.Bullish candle designs ko affirm karne ke liye other specialized pointers aur cost activity investigation ki zaroorat hoti hai. Chart Pattern Formation: Candle designs ko akela standard bhrosa nahi karna chahiye; ye tab sab se zyada asar daar hote hain punch unhein dosre specialized examination instruments aur markers ke saath istemal karke potential patterns ki tasdeeq kiya jaye. Merchants aksar in designs ko dakhil aur nikahat signals ke taur standard istemal karte hain, stop-misfortune orders tayyar karke risk ko qabu karne ke liye, maamla agar market waisa nahi chalta jaisa umeed kiya tha.Ikhtitami taur standard, bullish candle designs forex dealers ke liye ahem apparatuses hote hain taake wo potential khareedari mauqayon ko pehchanein aur market patterns mein ulat pher ki nishandahi kar sakte hain. Ye designs purchasers aur merchants ke darmiyan taqat ka tabdeel hony ka visual zaria faraham karte hain, jo brokers ko maloomat se basey faislay karne mein madad dete hain. In designs ko dosre specialized examination techniques aur risk the executives methodologies ke saath jorne se, dealers forex market mein kamyabi ki imkanat ko barha sakte hain.  Negative candle ke baad aik choti bullish candle aati hai jo pehle ridge light ki jism ko poori tarah se apne andar samait leti hai. Ye design ishara karta hai ke bechne grain ka dabaw kam ho raha hai aur bullish inversion mumkin hai.Three White Officers: Ye design youngster muntazim bullish candles se bana hota hai jinmein har aik agle close se ziada shuru hoti hai. Ye ishara karta hai ke force negative se bullish ki taraf mazbooti se move ho raha hai, aksar aik ahem upturn ki taraf le jata hai.Falling three techniques design aik continuation design hai jo downtrend ke andar paida hota hai. Is mein aik lambi negative candle ke baad choti bullish candles ki series hoti hai jo pehli negative candle ki high aur low mein mahdood hoti hain. Ye ishara karta hai ke market mukhtalif maamle mein harkat ko rok raha hai taake mumkin hai woh neechay ki taraf jari rakhe. Trading View: Candle graphs forex market mein qeemat ke harkaton ko zahir karne ke liye mashhoor tareeqay hain. Har candle chaar mukhya ajza se mushtak hoti hai: shuruaati qeemat, ikhtitami qeemat, zyada qeemat (high), aur kam qeemat (low) ek mukhtalif muddat mein. Candle ki jism mein farq shuruaati aur ikhtitami qeemat ke darmiyan hota hai, jabke shadow (yaani ke wick) un maqamat ki range ko zahir karta hai jo high aur low qeemat ke darmiyan hoti hai. Bullish candle designs khaas shaklain hoti hain jo market ki jazbat mein negative (nichle raaste ki taraf) se bullish (ooper ki taraf) ki mumkin tahqiqat ka izhar karti hain. Ye designs single candle designs ya multi-candle arrangements ho sakti hain. Yahan kuch aam bullish candle designs ha

Negative candle ke baad aik choti bullish candle aati hai jo pehle ridge light ki jism ko poori tarah se apne andar samait leti hai. Ye design ishara karta hai ke bechne grain ka dabaw kam ho raha hai aur bullish inversion mumkin hai.Three White Officers: Ye design youngster muntazim bullish candles se bana hota hai jinmein har aik agle close se ziada shuru hoti hai. Ye ishara karta hai ke force negative se bullish ki taraf mazbooti se move ho raha hai, aksar aik ahem upturn ki taraf le jata hai.Falling three techniques design aik continuation design hai jo downtrend ke andar paida hota hai. Is mein aik lambi negative candle ke baad choti bullish candles ki series hoti hai jo pehli negative candle ki high aur low mein mahdood hoti hain. Ye ishara karta hai ke market mukhtalif maamle mein harkat ko rok raha hai taake mumkin hai woh neechay ki taraf jari rakhe. Trading View: Candle graphs forex market mein qeemat ke harkaton ko zahir karne ke liye mashhoor tareeqay hain. Har candle chaar mukhya ajza se mushtak hoti hai: shuruaati qeemat, ikhtitami qeemat, zyada qeemat (high), aur kam qeemat (low) ek mukhtalif muddat mein. Candle ki jism mein farq shuruaati aur ikhtitami qeemat ke darmiyan hota hai, jabke shadow (yaani ke wick) un maqamat ki range ko zahir karta hai jo high aur low qeemat ke darmiyan hoti hai. Bullish candle designs khaas shaklain hoti hain jo market ki jazbat mein negative (nichle raaste ki taraf) se bullish (ooper ki taraf) ki mumkin tahqiqat ka izhar karti hain. Ye designs single candle designs ya multi-candle arrangements ho sakti hain. Yahan kuch aam bullish candle designs ha  Candle designs forex diagrams standard aam taur standard dekhi jane wali surat-e-haal hain jo market mein up cost development ki mumkin nishandahi karti hain. Ye designs brokers ke liye ahem devices hote hain taake wo mumkin khareedari mauqayon ko pehchanein aur mutabiq exchanging faislay kar sakein. Samajhna ke bullish candle designs kaise kaam karte hain, brokers ki qabliyat ko qabil-e-tasawwur qeemat ke patterns ki peshan goi aur risk ko qabu karne mein kafi madadgar sabit ho sakta hai.Kai tarah ke bullish candle designs hote hain, jinme se kuch normal ones hai Ek little body aur long lower shadow wala candle hota hai, showing potential pattern reversal.Pehle candle negative hota hai aur doosre candle ka body pehle candle ko overwhelm karta hai, demonstrating bullish sentiment.Pehle candle negative hota hai aur doosre candle ka close pehle candle ke body ke upar hota hai, showing bullish inversion. Ek negative candle ke baad little reach ka doosra candle aur uske baad ek bullish candle hota hai, demonstrating bullish inversion.

Candle designs forex diagrams standard aam taur standard dekhi jane wali surat-e-haal hain jo market mein up cost development ki mumkin nishandahi karti hain. Ye designs brokers ke liye ahem devices hote hain taake wo mumkin khareedari mauqayon ko pehchanein aur mutabiq exchanging faislay kar sakein. Samajhna ke bullish candle designs kaise kaam karte hain, brokers ki qabliyat ko qabil-e-tasawwur qeemat ke patterns ki peshan goi aur risk ko qabu karne mein kafi madadgar sabit ho sakta hai.Kai tarah ke bullish candle designs hote hain, jinme se kuch normal ones hai Ek little body aur long lower shadow wala candle hota hai, showing potential pattern reversal.Pehle candle negative hota hai aur doosre candle ka body pehle candle ko overwhelm karta hai, demonstrating bullish sentiment.Pehle candle negative hota hai aur doosre candle ka close pehle candle ke body ke upar hota hai, showing bullish inversion. Ek negative candle ke baad little reach ka doosra candle aur uske baad ek bullish candle hota hai, demonstrating bullish inversion.

-

#7 Collapse

Introduction of the post. Assalamualaikum! Me Umed Karta ho kha ap sb khariyat sy hongy. R apky trading sessions achy jaa rhy hongy. Aj ka hmra discussion topic "Bullish candlestick pattern" . Dekhty hain k ye hmein Kya information deta hai r hmry ilam Mai Kesy ezafa krta hay. Bullish candlestick pattern. Bullish candlestick patterns forex charts par aam taur par dekhi jane wali surat-e-haal hain jo market mein upward price movement ki mumkin nishandahi karti hain. Ye patterns traders ke liye ahem tools hote hain taake wo mumkin khareedari mauqayon ko pehchanein aur mutabiq trading faislay kar sakein. Samajhna ke bullish candlestick patterns kaise kaam karte hain, traders ki qabliyat ko qabil-e-tasawwur qeemat ke trends ki peshan goi aur risk ko qabu karne mein kafi madadgar sabit ho sakta hay. Explanation. Candlestick charts forex market mein qeemat ke harkaton ko zahir karne ke liye mashhoor tareeqay hain. Har candlestick chaar mukhya ajza se mushtak hoti hai: shuruaati qeemat, ikhtitami qeemat, zyada qeemat (high), aur kam qeemat (low) ek mukhtalif muddat mein. Candlestick ki jism mein farq shuruaati aur ikhtitami qeemat ke darmiyan hota hai, jabke shadow (yaani ke wick) un maqamat ki range ko zahir karta hai jo high aur low qeemat ke darmiyan hoti hai. Bullish candlestick patterns khaas shaklain hoti hain jo market ki jazbat mein bearish (nichle raaste ki taraf) se bullish (ooper ki taraf) ki mumkin tahqiqat ka izhar karti hain. Ye patterns single candlestick patterns ya multi-candle formations ho sakti hain. Yahan kuch aam bullish candlestick patterns hay. 1. Hammer: Ek hammer candlestick mein ek chota jism candle ki uqbi taraf hota hai aur ek lambi lower wick hoti hai jo kam az kam do martaba jism ki lambai hoti hai. Ye pattern ishara karta hai ke sellers ne trading session mein qeemat ko nicha daba diya, lekin khareedne wale control mein aaye aur qeemat ko ooper le gaye, jisse bullish momentum mumkin hay. 2. Bullish Engulfing: Ye pattern tab paida hota hai jab aik choti bearish candlestick ke baad aik ziada bari bullish candlestick aati hai jo pehle candle ki pori jism ko aik dam apne andar samait leti hai. Bullish engulfing pattern pehle wale downard trend ke ulte ho jane ki taraf ishara karta hai, kyunke khareedne wale sellers ko hara chuke hain aur ab control mein hay. 3. Piercing Line: Piercing line pattern is wakt paida hota hai jab aik bearish candlestick ke baad aik bullish candlestick aati hai jo pehle candle ki kam qeemat se neeche shuru hoti hai aur uske darmiyan close hoti hai. Ye ishara karta hai ke khareedne wale ne neechay ki taraf harkat ko ulta kya hai aur mumkin hai ke ooper ki taraf movement trigger ho gay. 4. Morning Star: Morning star aik multi-candle pattern hai jo bearish candlestick se shuru hota hai, phir aata hai aik choti mushtaba candle, aur phir aik bara bullish candlestick. Ye formation ishara karta hai ke sellers apne control mein se bahar nikal rahe hain aur buyers market mein qaabu karne lagte hay. 5. Bullish Harami: Bullish harami tab paida hota hai jab aik bada bearish candlestick ke baad aik choti bullish candlestick aati hai jo pehle wale candle ki jism ko poori tarah se apne andar samait leti hai. Ye pattern ishara karta hai ke bechne wale ka dabaw kam ho raha hai aur bullish reversal mumkin hay. 6. Three White Soldiers: Ye pattern teen muntazim bullish candlesticks se bana hota hai jinmein har aik agle close se ziada shuru hoti hai. Ye ishara karta hai ke momentum bearish se bullish ki taraf mazbooti se move ho raha hai, aksar aik ahem uptrend ki taraf le jata hay. 7. Falling Three Methods: Falling three methods pattern aik continuation pattern hai jo downtrend ke andar paida hota hai. Is mein aik lambi bearish candlestick ke baad choti bullish candlesticks ki series hoti hai jo pehli bearish candle ki high aur low mein mahdood hoti hain. Ye ishara karta hai ke market mukhtalif maamle mein harkat ko rok raha hai taake mumkin hai woh neechay ki taraf jari rakhe ho gay. -

#8 Collapse

Working key; iftitahi qeemat, ikhtitami qeemat, ziyada qeemat, aur kam qeemat. markazi mustateel ka rang ( jisay haqeeqi body kaha jata hai ) sarmaya karon ko batata hai ke aaya ibtidayi qeemat ya ikhtitami qeemat ziyada thi. kaali ya bhari hui shama daan ka matlab hai ke is muddat ke liye ikhtitami qeemat ibtidayi qeemat se kam thi. lehaza, yeh mandi hai aur farokht ke dabao ki nishandahi karta hai. darin Isna , aik safaid ya khokhli candle stick ka matlab hai ke ikhtitami qeemat ibtidayi qeemat se ziyada thi. yeh taizi hai aur kharidari ke dabao ko zahir karta hai. mom batii ke dono suron par lakerain shadow kehlati hain, aur woh din ke liye qeemat ke amal ki poori range dukhati hain, kam se onche tak. oopri saya din ke liye stock ki sab se ziyada qeemat dekhata hai, aur nichala saya din ke liye sab se kam qeemat dekhata Key feature; har mom batii aam tor par stock ke baray mein aik din ki qeemat ke data ki numaindagi karti hai. waqt guzarnay ke sath, candle sticks qabil shanakht namonon mein group ban jati hain jinhein sarmaya car khareed o farokht ke faislay karne ke liye istemaal kar satke hain. candle stuck charts takneeki din ke taajiron ke liye patteren ki shanakht aur tijarti faislay karne ke liye mufeed hain. taizi ki mom batian taweel tijarat ke liye dakhlay ke maqamat ki nishandahi karti hain, aur yeh pishin goi karne mein madad kar sakti hain ke neechay ka rujhan kab oopar ki taraf murnay wala hai. yahan, hum taizi se mom batii ke namonon ki kayi misalon par ghhor karte hain. candlestick maloomat ke chaar tukron ke zariye stock ke baray mein aik din ki qeemat ke data ki numaindagi karti hai : -

#9 Collapse

-

#10 Collapse

Bullish candlestick pattern Kya Hai. Ya aik qisam ke maliyati chart hain jo sikyortiz ki naqal o harkat ko track karne ke liye hain. un ki ibtida sadiiyon purani japani chawal ki tijarat se hui hai aur unhon ne jadeed daur ke stak ki qeemat charting mein apna rasta banaya hai. kuch sarmaya karon ko mayaari baar charts aur qeemat ke aamaal ki tashreeh karna aasaan se ziyada basri tor par purkashish lagta hai. candle sticks ka naam is liye rakha gaya hai kyunkay dono suron par mustateel shakal aur lakerain vicks wali mom batii se millti jalti hain.yeh taizi hai aur kharidari ke dabao ko zahir karta hai. mom batii ke dono suron par lakerain shadow kehlati hain, aur woh din ke liye qeemat ke amal ki poori range dukhati hain, kam se onche tak. oopri saya din ke liye stock ki sab se ziyada qeemat dekhata hai, aur nichala saya din ke liye sab se kam qeemat dekhata.Ye patterns traders ke liye ahem tools hote hain taake wo mumkin khareedari mauqayon ko pehchanein aur mutabiq trading faislay kar sakein. Samajhna ke bullish candlestick patterns kaise kaam karte hain, traders ki qabliyat ko qabil-e-tasawwur qeemat ke trends ki peshan goi aur risk ko qabu karne mein kafi madadgar sabit ho sakta hay. Bullish candlestick pattern Ke importance. waqt guzarnay ke sath, candle sticks qabil shanakht namonon mein group ban jati hain jinhein sarmaya car khareed o farokht ke faislay karne ke liye istemaal kar satke hain. candle stuck charts takneeki din ke taajiron ke liye patteren ki shanakht aur tijarti faislay karne ke liye mufeed hain. taizi ki mom batian taweel tijarat ke liye dakhlay ke maqamat ki nishandahi karti hain, aur yeh pishin goi karne mein madad kar sakti hain ke neechay ka rujhan kab oopar ki taraf murnay wala hai. yahan, hum taizi se mom batii ke namonon ki kayi misalon par ghhor karte hain. candlestick maloomat ke chaar tukron ke zariye stock ke baray mein aik din ki qeemat ke data ki numaindagi karti. Ye patterns traders ke liye ahem tools hote hain taake wo mumkin khareedari mauqayon ko pehchanein aur mutabiq trading faislay kar sakein. Samajhna ke bullish candlestick patterns kaise kaam karte hain, traders ki qabliyat ko qabil-e-tasawwur qeemat ke trends ki peshan goi aur risk ko qabu karne mein kafi madadgar sabit ho sakta hay.ye tab sab se zyada asar daar hote hain punch unhein dosre specialized examination instruments aur markers ke saath istemal karke potential patterns ki tasdeeq kiya jaye. Merchants aksar in designs ko dakhil aur nikahat signals ke taur standard istemal karte hain, stop-misfortune orders tayyar karke risk ko qabu karne ke liye, maamla agar market waisa nahi chalta jaisa umeed kiya tha.Ikhtitami taur standard, bullish candle designs forex dealers ke liye ahem apparatuses hote hain taake wo potential khareedari mauqayon ko pehchanein aur market patterns mein ulat pher ki nishandahi kar sakte hain. Ye designs purchasers aur merchants ke darmiyan taqat ka tabdeel hony ka visual zaria faraham karte hain, jo brokers ko maloomat se basey faislay karne mein madad dete hain. Explanation. ​ Candle designs forex diagrams standard aam taur standard dekhi jane wali surat-e-haal hain jo market mein up cost development ki mumkin nishandahi karti hain. Ye designs brokers ke liye ahem devices hote hain taake wo mumkin khareedari mauqayon ko pehchanein aur mutabiq exchanging faislay kar sakein. Samajhna ke bullish candle designs kaise kaam karte hain, brokers ki qabliyat ko qabil-e-tasawwur qeemat ke patterns ki peshan goi aur risk ko qabu karne mein kafi madadgar sabit ho sakta hai.Kai tarah ke bullish candle designs hote hain, jinme se kuch normal ones hai Ek little body aur long lower shadow wala candle hota hai, showing potential pattern reversal.Pehle candle negative hota hai aur doosre candle ka body pehle candle ko overwhelm karta hai, demonstrating bullish sentiment.Pehle candle negative hota hai aur doosre candle ka close pehle candle ke body ke upar hota hai, showing bullish inversion. Ek negative candle ke baad little reach ka doosra candle aur uske baad ek bullish candle hota hai, -

#11 Collapse

"Bullish candlestick pattern" ek technical analysis concept hai jo stock market aur financial markets mein istemal hota hai. Ye patterns candlestick charts ke zariye identify kiye jate hain, jo price movement ko graphical tarike se darshate hain. "Bullish" ek term hai jo ishara karta hai ki market mein price upar jaane ki sambhavna hai ya phir ek uptrend aa sakta hai. Bullish candlestick patterns uptrend ke indications provide karte hain aur traders ko ye batate hain ki market mein buying pressure ho sakta hai. Kuch pramukh bullish candlestick patterns hain: Hammer: Ek small body ke sath chhoti lower shadow wala candle hota hai. Ye price bottom ke indication deti hai aur trend reversal ka signal ho sakta hai. Bullish Engulfing: Is pattern mein ek small bearish candle ko ek bada bullish candle engulf karta hai. Iska matlab hota hai ki selling pressure kam ho raha hai aur buying pressure badh raha hai. Morning Star: Ye pattern ek downtrend ke baad dikhta hai. Pehle ek long bearish candle hota hai, phir ek small doji ya spinning top jisse gap down kehte hain, aur uske baad ek long bullish candle aata hai. Iska matlab hota hai ki trend reversal ho sakta hai. Bullish Harami: Is pattern mein ek long bearish candle ko ek small bullish candle engulf karta hai. Ye bhi trend reversal ka possible indication deta hai. Piercing Line: Downtrend ke baad, ek long bearish candle ke baad ek bullish candle aata hai jo pehle bearish candle ki body ke andar open hota hai aur uski upper half mein close hota hai. Three White Soldiers: Ye pattern downtrend ke baad dikhta hai aur ek series mein teen consecutive long bullish candles hote hain. Ye sirf kuch examples hain aur market mein aur bhi kayi bullish candlestick patterns hote hain. In patterns ko samajh kar traders try karte hain ki market ke future price movement ka prediction kar sakein. Yaad rahe ki ye patterns ek tool hain aur khud mein guaranteed results nahi dete, isliye dusre technical indicators aur fundamental analysis ke saath combine karke istemal karna zaroori hota hai. -

#12 Collapse

IDENTIFICATION OF BULLISH CANDLICTICK PATTREN: Dear members forex trading marketing Mei BULLISH Candle eik standard aam taur standard dekhi jane wali surat-e-haal hain jo market mein up cost development ki mumkin nishandahi karti hain. Ye designs brokers ke liye ahem devices hote hain taake wo mumkin khareedari mauqayon ko pehchanein aur mutabiq exchanging faislay kar sakein. Samajhna ke bullish candle designs kaise kaam karte hain, brokers ki qabliyat ko qabil-e-tasawwur qeemat ke patterns ki peshan goi aur risk ko qabu karne mein kafi madadgar sabit ho sakta hai.Kai tarah ke bullish candle designs hote hain, jinme se kuch normal ones hai Ek little body aur long lower shadow wala candle hota hai, showing potential pattern reversal.Pehle candle negative hota hai aur doosre candle ka body pehle candle ko overwhelm karta hai, demonstrating bullish sentiment.Pehle candle negative hota hai aur doosre candle ka close pehle candle ke body ke upar hota hai, showing bullish inversion. Ek negative candle ke baad little reach ka doosra candle aur uske baad ek bullish candle hota Hai our yeh Pattren jisay traders ko downtrend movemet ky liye perfect timing for zarort hotii Hei. EXPLANATION: Dear friends eis Pattren ko market Mei Negatively candle ke baad aik choti bullish candle aati hai jo pehle ridge light ki jism ko poori tarah se apne andar samait leti hai. Ye design ishara karta hai ke bechne grain ka dabaw kam ho raha hai aur bullish inversion mumkin hai.Three White Officers: Ye design youngster muntazim bullish candles se bana hota hai jinmein har aik agle close se ziada shuru hoti hai. Ye ishara karta hai ke force negative se bullish ki taraf mazbooti se move ho raha hai, aksar aik ahem upturn ki taraf le jata hai.Falling three techniques design aik continuation design hai jo downtrend ke andar paida hota hai. Is mein aik lambi negative candle ke baad choti bullish candles ki series hoti hai jo pehli negative candle ki high aur low mein mahdood hoti hain. Ye ishara karta hai ke market mukhtalif maamle mein harkat ko rok raha hai taake mumkin hai woh neechay ki taraf move kar sakty hen our new CANDL bnata Hei4. MorningPiyary friends eis topic BULLISH candle designs merchants ko potential pattern inversion signals give karte hain, showing a shift from negative to bullish feeling.Yeh designs negative pattern areas of strength for ki affirmation dete hain, showing a potential vertical movement.Traders bullish candle designs ki madad se passage aur leave focuses affirm kar sakte hain, jisse unka potential for benefit increment hota hai. Kabhi bullish candle designs bogus signs bhi de sakte hain, jahan genuine pattern inversion nahi hota.Market instability ke dauran design ka understanding mushkil hosakta hai.Bullish candle designs ko affirm karne ke liye other specialized pointers aur cost activity investigation ki zaroorat hoti hey our Market Mei yeh ziyada zarori hota ye mukhtalif pannal par mushtamil hotaa hey our yeh Pattren bhot ziyada mehnat kar ky sath work karty hen.

-

#13 Collapse

IDENTIFICATION OF BULLISH CANDLICTICK PATTREN: Dear members forex trading marketing Mei BULLISH Candle eik standard aam taur standard dekhi jane wali surat-e-haal hain jo market mein up cost development ki mumkin nishandahi karti hain. Ye designs brokers ke liye ahem devices hote hain taake wo mumkin khareedari mauqayon ko pehchanein aur mutabiq exchanging faislay kar sakein. Samajhna ke bullish candle designs kaise kaam karte hain, brokers ki qabliyat ko qabil-e-tasawwur qeemat ke patterns ki peshan goi aur risk ko qabu karne mein kafi madadgar sabit ho sakta hai.Kai tarah ke bullish candle designs hote hain, jinme se kuch normal ones hai Ek little body aur long lower shadow wala candle hota hai, showing potential pattern reversal.Pehle candle negative hota hai aur doosre candle ka body pehle candle ko overwhelm karta hai, demonstrating bullish sentiment.Pehle candle negative hota hai aur doosre candle ka close pehle candle ke body ke upar hota hai, showing bullish inversion. Ek negative candle ke baad little reach ka doosra candle aur uske baad ek bullish candle hota Hai our yeh Pattren jisay traders ko downtrend movemet ky liye perfect timing for zarort hotii Hei. EXPLANATION: Dear friends eis Pattren ko market Mei Negatively candle ke baad aik choti bullish candle aati hai jo pehle ridge light ki jism ko poori tarah se apne andar samait leti hai. Ye design ishara karta hai ke bechne grain ka dabaw kam ho raha hai aur bullish inversion mumkin hai.Three White Officers: Ye design youngster muntazim bullish candles se bana hota hai jinmein har aik agle close se ziada shuru hoti hai. Ye ishara karta hai ke force negative se bullish ki taraf mazbooti se move ho raha hai, aksar aik ahem upturn ki taraf le jata hai.Falling three techniques design aik continuation design hai jo downtrend ke andar paida hota hai. Is mein aik lambi negative candle ke baad choti bullish candles ki series hoti hai jo pehli negative candle ki high aur low mein mahdood hoti hain. Ye ishara karta hai ke market mukhtalif maamle mein harkat ko rok raha hai taake mumkin hai woh neechay ki taraf move kar sakty hen our new CANDL bnata HeiPiyary friends eis topic BULLISH candle designs merchants ko potential pattern inversion signals give karte hain, showing a shift from negative to bullish feeling.Yeh designs negative pattern areas of strength for ki affirmation dete hain, showing a potential vertical movement.Traders bullish candle designs ki madad se passage aur leave focuses affirm kar sakte hain, jisse unka potential for benefit increment hota hai. Kabhi bullish candle designs bogus signs bhi de sakte hain, jahan genuine pattern inversion nahi hota.Market instability ke dauran design ka understanding mushkil hosakta hai.Bullish candle designs ko affirm karne ke liye other specialized pointers aur cost activity investigation ki zaroorat hoti hey our Market Mei yeh ziyada zarori hota ye mukhtalif pannal par mushtamil hotaa hey our yeh Pattren bhot ziyada mehnat kar ky sath work karty hen.

-

#14 Collapse

Bullish candle design Kya Hai Ya aik qisam ke maliyati diagram hain jo sikyortiz ki naqal o harkat ko track karne ke liye hain. un ki ibtida sadiiyon purani japani chawal ki tijarat se hui hai aur unhon ne jadeed daur ke stak ki qeemat outlining mein apna rasta banaya hai. kuch sarmaya karon ko mayaari baar outlines aur qeemat ke aamaal ki tashreeh karna aasaan se ziyada basri peak standard purkashish lagta hai. candles ka naam is liye rakha gaya hai kyunkay dono suron standard mustateel shakal aur lakerain vicks wali mother batii se millti jalti hain.yeh taizi hai aur kharidari ke dabao ko zahir karta hai. mother batii ke dono suron standard lakerain shadow kehlati hain, aur woh noise ke liye qeemat ke amal ki poori range dukhati hain, kam se onche tak. oopri saya clamor ke liye stock ki sab se ziyada qeemat dekhata hai, aur nichala saya racket ke liye sab se kam qeemat dekhata.Ye designs dealers ke liye ahem instruments hote hain taake wo mumkin khareedari mauqayon ko pehchanein aur mutabiq exchanging faislay kar sakein. Samajhna ke bullish candle designs kaise kaam karte hain, merchants ki qabliyat ko qabil-e-tasawwur qeemat ke patterns ki peshan goi aur risk ko qabu karne mein kafi madadgar sabit ho sakta roughage. Bullish candle design Ke significance waqt guzarnay ke sath, candles qabil shanakht namonon mein bunch boycott jati hain jinhein sarmaya vehicle khareed o farokht ke faislay karne ke liye istemaal kar satke hain. flame stuck outlines takneeki commotion ke taajiron ke liye patteren ki shanakht aur tijarti faislay karne ke liye mufeed hain. taizi ki mother batian taweel tijarat ke liye dakhlay ke maqamat ki nishandahi karti hain, aur yeh pishin goi karne mein madad kar sakti hain ke neechay ka rujhan kab oopar ki taraf murnay wala hai. yahan, murmur taizi se mother batii ke namonon ki kayi misalon standard ghhor karte hain. candle maloomat ke chaar tukron ke zariye stock ke baray mein aik noise ki qeemat ke information ki numaindagi karti. Ye designs dealers ke liye ahem devices hote hain taake wo mumkin khareedari mauqayon ko pehchanein aur mutabiq exchanging faislay kar sakein. Samajhna ke bullish candle designs kaise kaam karte hain, dealers ki qabliyat ko qabil-e-tasawwur qeemat ke patterns ki peshan goi aur risk ko qabu karne mein kafi madadgar sabit ho sakta hay.ye tab sab se zyada asar daar hote hain punch unhein dosre particular assessment instruments aur markers ke saath istemal karke potential examples ki tasdeeq kiya jaye. Shippers aksar in plans ko dakhil aur nikahat signals ke taur standard istemal karte hain, stop-setback orders tayyar karke risk ko qabu karne ke liye, maamla agar market waisa nahi chalta jaisa umeed kiya tha.Ikhtitami taur standard, bullish flame plans forex sellers ke liye ahem devices hote hain taake wo potential khareedari mauqayon ko pehchanein aur market designs mein ulat pher ki nishandahi kar sakte hain. Ye plans buyers aur vendors ke darmiyan taqat ka tabdeel hony ka visual zaria faraham karte hain, jo representatives ko maloomat se basey faislay karne mein madad dete hain.

Bullish candle design Ke significance waqt guzarnay ke sath, candles qabil shanakht namonon mein bunch boycott jati hain jinhein sarmaya vehicle khareed o farokht ke faislay karne ke liye istemaal kar satke hain. flame stuck outlines takneeki commotion ke taajiron ke liye patteren ki shanakht aur tijarti faislay karne ke liye mufeed hain. taizi ki mother batian taweel tijarat ke liye dakhlay ke maqamat ki nishandahi karti hain, aur yeh pishin goi karne mein madad kar sakti hain ke neechay ka rujhan kab oopar ki taraf murnay wala hai. yahan, murmur taizi se mother batii ke namonon ki kayi misalon standard ghhor karte hain. candle maloomat ke chaar tukron ke zariye stock ke baray mein aik noise ki qeemat ke information ki numaindagi karti. Ye designs dealers ke liye ahem devices hote hain taake wo mumkin khareedari mauqayon ko pehchanein aur mutabiq exchanging faislay kar sakein. Samajhna ke bullish candle designs kaise kaam karte hain, dealers ki qabliyat ko qabil-e-tasawwur qeemat ke patterns ki peshan goi aur risk ko qabu karne mein kafi madadgar sabit ho sakta hay.ye tab sab se zyada asar daar hote hain punch unhein dosre particular assessment instruments aur markers ke saath istemal karke potential examples ki tasdeeq kiya jaye. Shippers aksar in plans ko dakhil aur nikahat signals ke taur standard istemal karte hain, stop-setback orders tayyar karke risk ko qabu karne ke liye, maamla agar market waisa nahi chalta jaisa umeed kiya tha.Ikhtitami taur standard, bullish flame plans forex sellers ke liye ahem devices hote hain taake wo potential khareedari mauqayon ko pehchanein aur market designs mein ulat pher ki nishandahi kar sakte hain. Ye plans buyers aur vendors ke darmiyan taqat ka tabdeel hony ka visual zaria faraham karte hain, jo representatives ko maloomat se basey faislay karne mein madad dete hain. Clarification Flame plans forex charts standard aam taur standard dekhi jane wali surat-e-haal hain jo market mein up cost improvement ki mumkin nishandahi karti hain. Ye plans representatives ke liye ahem gadgets hote hain taake wo mumkin khareedari mauqayon ko pehchanein aur mutabiq trading faislay kar sakein. Samajhna ke bullish candle plans kaise kaam karte hain, representatives ki qabliyat ko qabil-e-tasawwur qeemat ke designs ki peshan goi aur risk ko qabu karne mein kafi madadgar sabit ho sakta hai.Kai tarah ke bullish flame plans hote hain, jinme se kuch typical ones hai Ek little body aur long lower shadow wala candle hota hai, showing potential example reversal.Pehle candle negative hota hai aur doosre light ka body pehle candle ko overpower karta hai, showing bullish sentiment.Pehle candle negative hota hai aur doosre candle ka close pehle candle ke body ke upar hota hai, showing bullish reversal. Ek negative light ke baad little arrive at ka doosra flame aur uske baad ek bullish candle hota hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

"Bullish Candlestick Pattern: Is Se Seekhain Market Mein Taqwiyat Aane Ki Alamat! Bullish candlestick patterns market analysis mein aik ahem hissa hain. Ye patterns indicate karte hain ke market mein taqwiyat aane ki sambhavna hai. In patterns ko samajhna traders ke liye bohot zaroori hota hai. Yeh bullish patterns traders ko signals provide karte hain ke asset ki keemat mein izafa hone ki sambhavna hai. Inme se kuch aham bullish candlestick patterns hain: 1. **Hammer**: Hammer pattern ek small body wali candle hoti hai jisme ek choti si upper shadow hoti hai. Ye pattern downtrend ke baad aata hai aur bullish reversal ko darust karta hai. 2. **Bullish Engulfing**: Isme ek choti si bearish candle ke baad aati hai ek badi bullish candle jo us bearish candle ko puri tarah se cover karti hai. 3. **Morning Star**: Morning star pattern ek downtrend ke baad aata hai. Isme pehle ek bearish candle, phir ek small range ki candle aati hai, aur phir ek badi bullish candle aati hai. In patterns ko samajh kar traders market mein hone wale positive changes ko anticipate kar sakte hain aur sahi waqt par trade kar sakte hain."

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:34 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим