Wolf wave pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

What is wolf wave pattern in forexvolf view aik chart patteren hai jo qeemat mein paanch lehar patteren par mushtamil hai jo bunyadi tawazun ki qeemat ka ishara karta hai. is nizaam ko istemaal karne walay sarmaya car patteren ki taraf se ishara kardah muzahmat aur support linon ki bunyaad par apni tijarat ka waqt karte hain. Key takeways Tqniki tajzia mein, wolfe waves qeemat ke patteren hain jo paanch lehron par mushtamil hain jo ke taizi ya mandi ke rujhanaat ki nishandahi karti hain. wolfe wave ke tor par sahih tareeqay se shanakht karne ke liye mayarat ki aik series ko poora karna zaroori hai, jaisay ke lehron ke chakkar teesri aur chothi lehron mein aik jaisi aur allag qeemat ki karwai hain. aik haqeeqi volf view ke liye, patteren mein panchwin lehar ki misaal ke baad qeemat mein break out hoga . Understanding Wolf wave pattern volf view patteren ki shanakht sab se pehlay bil volf aur is ke betay Brian ne ki. volf ke mutabiq, yeh qudrati tor par tamam baazaaron mein paye jatay hain. un ko pehchanney ke liye, taajiron ko qeemat ke ki aik series ki nishandahi karni chahiye jo makhsoos miyaar ke mutabiq hon : lehron ko aik mustaqil waqt ke waqfay par chakkar lagana chahiye. teesri aur chothi lehron ko pehli aur doosri lehron ke zareya banaye gaye channel ke andar rehna chahiye. teesri aur chothi lehron ko pehli aur doosri lehron ke sath hum ahangi dikhani chahiye channel se bahar patteren ke peechay nazriya ke mutabiq, pehli lehar ke aaghaz mein nuqta se khenchi gayi aur chothi lehar ke aaghaz se guzarnay wali aik lakeer panchwin lehar ke ekhtataam ke liye hadaf ki qeemat ki paish goi karti hai. agar koi tajir wolfe wave ki tashkeel ke sath hi is ki sahih shanakht karta hai, to panchwin lehar ka aaghaz taweel ya mukhtasir position lainay ka mauqa faraham karta hai. hadaf ki qeemat lehar ke ekhtataam ki pishin goi karti hai, aur is liye woh maqam jis par tajir ka maqsad position se faida uthana hai Identifying Complex Patterns Using Technical Analysis

takneeki tajzia chart patteren ka istemaal karta hai jaisay volf waves ziyada se ziyada munafe ke liye market ki naqal o harkat aur waqt ki tijarat ki paish goi karne ke liye. tajir jo takneeki tajzia ka istemaal karte hain woh charts ko dekhte hain jo aik muddat ke douran sikyortiz ke liye qeemat ki naqal o harkat ko zahir karte hain. aam tor par, takneeki tajzia supply aur demand ke nazriaat par munhasir hota hai jo qeematon ki makhsoos sthon ko oopar ya neechay zahir karta hai jis se sikyortiz tijarat ke liye jad-o-jehad karen gi. support ki sthin qeematon ke masawi hoti hain taakay hasas ki qeematon ko mustahkam karne aur badhaane ke liye kaafi maang ko Raghib kya ja sakay, jab ke muzahmat ki satah itni ziyada qeematon ke masawi hai ke hasas yaftgan ko hasas baichnay aur munafe lainay, talabb ki satah ko kam karne aur qeematon ki satah ko neechay ya giranay ka baais banti hai . -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Wolf Wave Pattern: Wolf wave pattern forex market mein ek technical analysis tool hai jisay traders use karte hain price patterns aur trend reversals ko identify karne ke liye. Is pattern ka naam "Wolf wave" hai kyun ki iska shape ek lomdi (wolf) ki tarah hota hai. Is pattern mein price chart par specific peaks aur valleys hotey hain, jinhe hum "legs" kehte hain. 1. Legs: Wolf wave pattern mein legs, price chart par peaks aur valleys hote hain. Yeh legs typically 1-4 number tak hote hain aur upar neeche ghoomte hain. In legs ko waves bhi kaha jata hai. Har wave, previous wave ki length ka multiple hota hai. Agar price chart par 1st wave hai, toh 2nd wave uski length double hogi, 3rd wave uski length triple hogi, aur 4th wave uski length four times hogi. 2. Reversal Points: Wolf wave pattern mein reversal points bhi important hote hain. Reversal points price chart par legs ki starting aur ending points hote hain. Yeh points traders ke liye entry aur exit points provide karte hain. Agar price chart par trend upar ki taraf move kar raha hai, toh reversal point downar ki taraf hota hai aur vice versa. 3. Guidelines: Wolf wave pattern ko identify karne ke liye kuch guidelines hain jo traders follow karte hain. Yeh guidelines hai: a. Legs ki length: Har wave ki length previous wave ki length ka multiple hota hai. Traders is guideline se waves ki length estimate karte hain. b. Reversal points: Reversal points ko identify karne ke liye traders previous waves ko dekhte hain. Agar trend upar ki taraf move kar raha hai, toh reversal point downar ki taraf hota hai. Agar trend neeche ki taraf move kar raha hai, toh reversal point upar ki taraf hota hai. 4. Trading Strategy: Wolf wave pattern ko trading strategy ke liye use kiya jata hai. Traders is pattern ko dekh kar entry aur exit points determine karte hain. Agar price chart par wolf wave pattern ban raha hai, toh traders buy ya sell orders place karte hain based on the direction of the pattern. Stop loss aur target levels bhi traders set karte hain to manage risk aur profit ko maximize karne ke liye. Wolf wave pattern forex market mein ek popular technical analysis tool hai. Isko identify karna aur samajhna traders ke liye important hai taaki woh price movements aur trend reversals ko better analyze kar sakein. -

#4 Collapse

Wolf Wave candlestck PatternIntroduction Wolf Wave ek candlestick pattern hai jo technical analysis mein istemal hota hai. Ye pattern market trends aur price movement ko identify karne mein madad karta hai. Is pattern ki identification aur istemal kaafi simple hai, aur iske istemal se traders market ke future direction ko predict kar sakte hain. Wolf Wave pattern chart par price movement ki shape aur geometry ke zariye identify kiya jata hai. Is pattern mein price movement specific peaks aur troughs (unchaayi aur neechayi points) par concentrate hota hai. Ye peaks aur troughs ek specific wave structure mein arrange hote hain. Identification Wolf Wave pattern ki pehchan karne ke liye, aapko kuch steps follow karne hote hain. Sabse pehle, aapko 5 peaks aur 5 troughs dhoondhne hote hain. Ye peaks aur troughs ek zigzag pattern mein hote hain, jaise ki wave banate huye. Jab aap in 5 peaks aur 5 troughs ko dhoondh lete hain, to aap ek specific geometry ko dekh payenge. Wolf Wave pattern ka main feature hai "1-2-1-2-3" structure. Is structure mein, pehle do peaks aur do troughs close hote hain, phir agle do peaks aur do troughs close hote hain, aur akhir mein teesra peak ban jata hai. Is structure ko dekh kar aap Wolf Wave pattern ko confirm kar sakte hain. Guidance for Traders Wolf Wave pattern ko use karne ke liye, traders iske geometry aur price levels ko closely monitor karte hain. Jab pattern confirm hota hai, traders buy aur sell signals generate kar sakte hain.Agar market mein Wolf Wave pattern ban raha hai aur price current level se neechay aa raha hai, to traders ko buy signal mil sakta hai. Iske liye, traders support level par buy kar sakte hain. Support level wo level hota hai jahan se price ka ummeed kiya jata hai ki woh badhna shuru karega. Iske baad traders apne stop loss aur target levels set karte hain.Agar market mein Wolf Wave pattern ban raha hai aur price current level se upar aa raha hai, to traders ko sell signal mil sakta hai. Iske liye, traders resistance level par sell kar sakte hain. Resistance level wo level hota hai jahan se price ka ummeed kiya jata hai ki woh ghatna shuru karega. Iske baad traders apne stop loss aur target levels set karte hain.Wolf Wave pattern mein stop loss levels tight rakhe jaate hain kyunki traders ek specific wave structure par rely karte hain. Target levels ko price movement aur previous trends ke hisab se set kiya jata hai. Summary Wolf Wave pattern ka istemal karne se pehle, traders ko iske sahi identification ke liye practice aur experience ki zaroorat hoti hai. Candlestick patterns ko study karne ke liye achi knowledge aur technical analysis tools ki zaroorat hoti hai.Wolf Wave candlestick pattern ek powerful tool hai jo traders ko market trends aur price movement ke bare mein information deta hai. Iski identification aur istemal kaafi simple hai, aur iske istemal se traders buy aur sell signals generate kar sakte hain. Traders ko is pattern ko samajhne aur istemal karne ke liye practice aur experience ki zaroorat hoti hai -

#5 Collapse

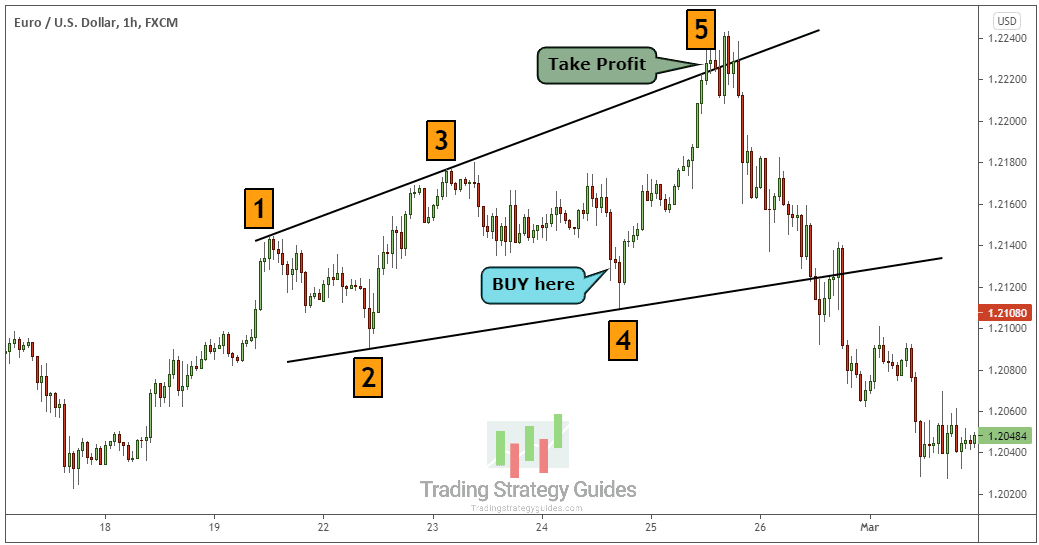

Wolf Wave PatternIntroduction : professional trader wolf wave candlestick pattern par long term trade kartay hein or bad mein short term time frame mein trade kartay hein wolf wave aik kesam ka chart pattern hota hey jo keh forex market mein 5 wave par moshtamel hota hey or forex market mein reversal janay ke paishan goi karta hey yeh forex market mein higher risk o reward ke trading frahm karte hey wolf wave pattern aik kesam ka reversal chart pattern hota hey jo keh forex market kay terminal point ko belkul kareeb dekhata hey or ese tarah aik insdad trend trade keya ja sakta hey nechay dey gay chart ka kabel e aitmad dekhaya geya hey Identification of Wolf Wave Pattern Bill Wolf aik professional trader tha jes nay wolf wave pattern ko introduce kar waya onhon nay kaha aik natural pattern hey jo har market mein kam karta hey es pattern ko identify karnay kay ley nechay dey gay rules ko follow kar saktay hein Rule 1. Wave 1 or 2 kay price channel bananay chihay or wave 3 or 4 ka bhe hona zaroore hey wave 3 or 4 ka channel kay inside mein he rehna chihay Rule 2. Wave 1 or 3 kay barabar hey ya es say zyada hone chihay Rule 3. Wave 1 say 2 or wave 3 say 4 kay darmean mein gap taqreban aik jaisa hona chihay Rule 4 . Wave 5 ko end mein breakout ko indicate karnay kay ley channel ko break karna chihay or bad channel kay inside mein close hona chihay Trade with Wolf Wave Pattern Wolf Wave Pattern kay ley trading strategy bananay kay ley price action analysis ka estamal karna chihay matlab yeh hey keh hum kese dosray technical indicator or oscillator ka estamal nahi karna chihay balkeh khas tor par price kay structure par towajah markoz karen gay jo keh wolf wave pattern ke tashkel karta hey aay ab wolf wave pattern ka estamal kartay hovay aik mokamal trading strategy banay gay pehlay step mein higher time frame step ka tayon karen gay ab es ko serf higher high ya higher low level ko identify karna chihay es say ap ko trend ke direction mein trade karnay mein madad mel sakte hey agla step yeh hta hey keh rules ko bhe identify kar kay estamal karna chihay mesal kay tor par aik higher time frame trend ke direction mein trade karta hey jaisa keh mesal kay tor par higher time frame trend ke direction ko tabdel karta hey aay es bat ko support kartay hein yeh forex market mein basic trend kay bhe opposite hota hey to hum es trade kay set up ko chor daytay hein tesara important step entry hota hey jab price break ho jay to channel inside break mein price kay dbara close honay ka intazar karna chihay channel kai inside mein price close ho jay ge buy ke trade open karen gay target level ke pemaish karne chihay or trend kay lahaz say end men low price say nechay stop loss rakhenTable of Content 1. Introduction 2. Identification 3. Trade with Wolf Wave Pattern

bhali kay badlay bhali

bhali kay badlay bhali

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamualaikum! Umeed hai k ap sb khariyat sy hongy. R apky trading sessions achy jaa rhy hongy.Aj ka hmra or discussion topic "wolf wave pattern". Dekhty hain k ye hmein Kya information deta hai r hmry ilam Mai Kesy ezafa krta hai. Definition volf view aik chart patteren hai jo qeemat mein paanch lehron ke patteren par mushtamil hai jo bunyadi tawazun ki qeemat ko zahir karta hai. is nizaam ko istemaal karne walay sarmaya car patteren ki taraf se ishara kardah hai muzahmat aur support linon ki bunyaad par apni tijarat ka waqt karte hain . keysteps takneeki tajzia mein, wolfe waves qeemat ke patteren hain jo paanch lehron par mushtamil hain jo ke taizi ya mandi ke rujhanaat ki nishandahi karti hain. wolfe wave ke tor par sahih tareeqay se shanakht karne ke liye mayarat ki aik series ko poora karna zaroori hai, jaisay ke lehron ke koi chakkar teesri aur chothi lehron mein aik jaisi aur allag qeemat ki karwai hain. aik haqeeqi volf view ke liye, es Kay patteren mein panchwin lehar ki misaal ke baad qeemat mein break out hoga . wolf wave pattern volf view patteren ki shanakht sab se pehlay bil volf aur is ke betay Brian ne ki. volf ke mutabiq, yeh qudrati tor par tamam baazaaron mein paye jatay hain. un ko koi or sy pehchanney ke liye, taajiron ko qeemat ke dhooghalon ki aik series ki nishandahi karni chahiye jo makhsoos miyaar ke mutabiq hon : lehron ko aik mustaqil waqt ke waqfay se chakkar lagana chahiye. teesri aur chothi lehron ko pehli aur doosri lehron ke zareya banaye gaye channel ke andar rehna chahiye. teesri aur chothi lehron ko pehli aur doosri lehron ke sath hum ahangi dikhani chahiye. wolfe wave koi patteren mein, panchwin lehar channel se bahar nikalti hai. patteren ke peechay nazriya ke mutabiq, pehli lehar ke aaghaz mein nuqta se khenchi gayi aur chothi lehar ke or aaghaz se guzarnay wali aik lakeer panchwin lehar ke or ekhtataam ke liye hadaf ki qeemat ki paish goi karti hai. agar koi tajir wolfe wave ki tashkeel ke sath hi is ki sahih shanakht karta hai, to panchwin lehar ka aaghaz taweel ya mukhtasir position lainay ka mauqa faraham karta hai. es hadaf ki qeemat lehar ke ekhtataam ki pishin goi karti hai, aur is liye woh maqam jis par tajir ka maqsad position se faida uthana hai . Identifying complex pattern using technical analysis takneeki tajzia chart patteren ka istemaal karta hai jaisay volf waves ziyada se ziyada munafe ke liye market ki koi naqal o harkat aur waqt ki tijarat ki paish goi karne ke liye. tajir jo takneeki tajzia ka istemaal karte hain woh charts ko dekhte hain jo aik muddat ke douran sikyortiz ke liye qeemat ki naqal o harkat ko zahir karte hain. aam tor par, takneeki tajzia supply aur demand ke nazriaat par koi bhe munhasir hota hai jo qeematon ki makhsoos sthon ko koi oopar ya neechay zahir karta hai jis se sikyortiz tijarat ke liye jad-o-jehad karen gi. support ki sthin qeematon ke koi masawi hain jo hasas ki qeematon ko mustahkam karne aur badhaane ke liye kaafi maang ko Raghib karne ke liye kaafi kam hoti hain, jab ke muzahmat ki satah itni ziyada qeematon ke masawi hoti hai ke hasas yaftgan ko hasas baichnay aur munafe lainay, talabb ki satah ko kam karne aur qeematon ki satah ko neechay ya giranay ka baais banti hai. jab takneeki tajzia car wolfe waves jaisay koi bhe namonon ko talaash karte hain, to woh break out se faida uthany ki koshish karte hain, jahan hasas ki koi bhe qeematein support aur muzahmati sthon ke zariye ban'nay walay channel se bahar chali jati hain. talabb aur rasad ke wohi qawaneen jo himayat aur muzahmat ki satah peda karte hain yeh bhi tajweez karte hain ke break out ke baad qeematein apna tawazun bahaal kar len gi. ziyada se koi ziyada munafe ke khwahan taajiron ko haqeeqi waqt mein kharidne ya baichnay ke liye sahih points ki nishandahi karne ke qabil hona chahiye. agarchay aisa karne ke liye bohat si tknikin mojood hain, agar tajir patteren ya es Mein rujhanaat ki ghalat shanakht karte hain to woh ahem to koi khatraat se dochar hotay hain. is terhan ki takrenon ke istemaal mein dilchaspi rakhnay walay aam tor par koi bhe tehqeeq ke namonon aur un ke peechay mojood nazriaat ko achi terhan se injaam den ge, kaghazi tijarat mein koi mashgool hon ge taakay un thureon ko line par paisa koi lagaye baghair janpeyn aur hijz ka maqool istemaal karen ya mumkina neechay ki taraf ko mehdood karne ke liye es nuqsaan ki position ko rokain. ghalat waqt ki tijarat kia ho ga..... -

#7 Collapse

Assalam o alikum ksey hn ap sab log umeed karti hunn Kay sabb khyrat say hon gay aj Ka hamara discussion Ka topic hay wo wolf patterewave patterrn hay ay daikhty hain k ye hamy kea information ye deta hay Wolf Wave Patteren Bheriye ki lahar aik asa namoona hay jo panch lehroon par is mushtamil hay jis main talab or rasad aoor tawazan ki qeemat ki larai dikhaiiey deti hay bheriye nay is hikamat.e.amli ko biyan kea jisy zeel main biyan kiya jay ga or is ishary ko tiyar kea jo isi namm sy jana jata hay In sab say is hiqmat Explaination amli ko tijarat main istamal kea jata hay bheriye ki ye lehryain jadedelet leharon ki tarah kam karti hay misal ky toor par wo elet lehroon kay sath nazar any wali aik doo teen char panch lehron ki shakal hasil karty hain or inhy aik aesi shakal kay siyako sabak main dalty hain jiss say sy tajar tezzi ya mandi kay toor lar tijarat kar skty hain tabam donoo lehrin main kuch ikhtylaf hain namoona mukhtasir or lamba bi ho skta hay ye waqat ky fareemo jesy minute ya haftooon main tiyar ho skty hain in ka istamal tajar ye andaza lgany ky liye karty han ky ye qeemat kahan ja rahi hay or kan wahan pubnchy gii ye qyon banta hay or is ka kea matlab hota hay bill bheriye ky mutabik bheriye ki lehrain qudarti toor parrr h peda hony wala harmonic namona hay jo jar waqat tamam maliyati chartses main paiya ja skta hay lakin bill bhariye ky dosry ishary ky istamal kay khelaff hon gy kiyon kay wo tajwee? Karty hain kay bheriye lehry apny tariky kar main tanha hay jesa kay phly zikar kea gea hay namona teezi ya mandi ky rujhanat ki nishan dahi kar skta hay jesa k taham aik leharain hyqadry kam mallon hay kay lakin itna hi mossar harmonic namoona pi hayy jisy bheriye lehron ka namoona kahty hain kholny or qeematt kay ahdaf kai shinakaht kay liye inn par inhasar karty hain tajar ye janany main madad ky liye namoona bi talash karty hain ky aiya kay mushkilat ik kay haq main hain -

#8 Collapse

Asslam-O-Alaikum! Dear members Me ummed kerti hoke ap sb ka forex trading py kam bht acha chl rha hoga. Aj jis topic py hum baat kre gy wo Neeche mention hy. TOPIC :WOLF WAVE PATTERN. Wolf wave aik maqbool chart patteren hai jisay takneeki tajzia mein istemaal kya jata hai taakay mumkina qeematon mein tabdeeli ki nishandahi ki ja sakay. usay sab se pehlay tajir bil volf ne muta-arif karaya tha aur is ki khususiyaat badalti lehron ki aik series se hoti hai jo bhairiye ke danoton ki shakal se millti hain. pattern ko kisi bhi time frame par laago kya ja sakta hai aur aam tor par forex aur stock marketon mein istemaal hota hai . Wolf wave paanch lehron par mushtamil hai, jin par 1, 2, 3, 4 aur 5 ka label lagaya gaya hai. patteren is waqt bantaa hai jab qeemat un lehron ke andar makhsoos miyaar tak pahonch jati hai . wolf wave patteren ki shanakht karne ke liye, darj zail usoolon ka mushahida kya jana chahiye : EXPLANATION : 1. lehar 2 ko lehar 1 ke 100 % se ziyada peechay nahi hatna chahiye . 2. lehar 3 ko lehar 1 ki bulandi se agay barhna chahiye . 3. lehar 4 ko lehar 1 ki qeemat ke ilaqay ke sath overlap nahi hona chahiye, siwaye aik mukhtasir mudakhlat ke . 4. lehar 5 ko lehar 3 ki oonchai ko uboor karna chahiye . market ke majmoi rujhan ki simt ke lehaaz se patteren taizi ya mandi ka ho sakta hai. aik oopri rujhan mein, volf view mumkina kharidari ke mauqa ki numaindagi karta hai, jabkay neechay ke rujhan mein, yeh farokht ke mumkina mauqa ki nishandahi karta hai . wolf wave patteren ki durustagi ki tasdeeq ke liye tajir aksar izafi tools aur isharay istemaal karte hain. aam tor par istemaal honay walay kuch asharion mein moving origins, trained lines, aur jaisay relativ strength index ( rsi ) ya stochastic oscillator shaamil hain . wolf wave patteren ki tijarat karte waqt, tajir aam tor par lehar 5 ke ekhtataam ke qareeb ya is ke baad anay wali islahi lehar ke aaghaz ke qareeb aik dakhli nuqta talaash karte hain. stap las orders aam tor par taizi ke namonon ke liye lehar 4 ki kam se neechay aur mandi ke namonon ke liye lehar 4 ki bulandi se oopar diye jatay hain. munafe ke ahdaaf lehar 1 ke aaghaz aur lehar 4 ke ekhtataam ke darmiyan faaslay ki pemaiesh karkay ya deegar takneeki tajzia ki ka istemaal karkay muqarrar kiye jasaktay hain . yeh note karna zaroori hai ke volf view patteren hai aur is ki shanakht aur tijarat karte waqt swabdid ki zaroorat hoti hai. taajiron ko sirf is tarz ki bunyaad par tijarti faislay karne se pehlay deegar awamil jaisay market ke halaat, hajam, aur bunyadi tajzia par ghhor karna chahiye . aakhir mein, wolf wave aik chart patteren hai jo taajiron ki janib se mumkina qeematon mein tabdeeli ki nishandahi karne ke liye istemaal kya jata hai. yeh paanch lehron par mushtamil hai aur yeh taizi ya mandi hosakti hai. tajir patteren ki tasdeeq aur dakhlay aur kharji raastoon ka taayun karne ke liye izafi isharay aur ozaar istemaal karte hain. taham, kisi bhi doosri tijarti hikmat e amli ki terhan, yeh faul proof nahi hai, aur taajiron ko ahthyat brtni chahiye aur tijarti faislay karne se pehlay deegar awamil par ghhor karna chahiye . -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

wolfe wave har market mein paaya aik qudrati patteren hai. is ki bunyadi shakal balance, ya tawazun ke liye aik larai zahir karta hai, farahmi aur maang ke darmiyan. yeh qudrati tor par waqay patteren ijaad nahi kya gaya tha lekin is ki bajaye farahmi aur mutalba ki passion goi ki satah ke tor par daryaft kya gaya tha. yeh patteren waqt ke lehaaz se bohat ورسٹائل hain, lekin woh gunjaish ke lehaaz se makhsoos hain. misaal ke tor par, volf lehron mein waqt ke Ùریموں ki aik wasee range mein hota hai, minute ke douran ya is se bhi jab tak ke channel par munhasir hai. doosri taraf, gunjaish herat angaiz durustagi ke sath paish goi ki ja sakti hai. is wajah se, jab sahih tareeqay se istehsal kya jata hai, wolfe lehar intehai muaser saabit hosakti hai . wolfe lehar patteren ki shanakht mein overriding Ansar symmetry hai. jaisa ke zail mein dekhaya gaya hai, sab se ziyada durust patteren mojood hain jahan, 1-3-5 ke darmiyan, lehar cyclon ke darmiyan barabar waqt waqfay hain. note karen ke oopar دیگرام par dekhaya gaya lehar 5 nuqta nazar oopar ya neechay ki lehron 1-2 aur 3-4 ki taraf se peda channel se thora sa aik iqdaam hai. yeh iqdaam aam tor par aik ghalat qeemat break out ya channel kharabi hai, aur yeh stock taweel ya mukhtasir darj karne ka behtareen jagah hai. lehar 5 mein ghalat karwai patteren mein ziyada tar waqt hota hai lekin bilkul zaroori miyaar nahi hai. lehar 6 nuqta nuqta 5 se mandarja zail hadaf ki satah hai aur wolfe lehar channel patteren ka sab se ziyada munafe bakhash hissa hai. hadaf ki qeemat ( point 6 ) points 1 aur 4 munsalik karkay paaya jata hai . ذیل mein kaam par patteren ki aik misaal hai. yaad rakhen, lehar 5 aik mukhtasir ya taweel position ke sath karwai karne ka mauqa hai, jabkay lehar 6 hadaf ki qeemat hai. yeh bhi note karna zaroori hai ke wolfe lehron, sab se ziyada patteren trading ki hikmat e amli ke sath sath, intehai masroof hain. munafe bakhash ki kuleed sahih tareeqay se shanakht aur haqeeqi waqt mein un rujhanaat ka istehsal hai, jo is se ziyada mushkil ho sakta hai. nateejay ke tor par, yeh is taknik ki tijarat karne ke liye danishmand hai - jaisa ke aap seekh rahay hain kisi bhi nai taknik hai - live jane se pehlay. aur –apne nuqsanaat ko mehdood karne ke liye stap nuqsanaat ka istemaal karne ke liye yaad rakhen . -

#10 Collapse

What is wolf wave design in forex volf view aik diagram patteren hai jo qeemat mein paanch lehar patteren standard mushtamil hai jo bunyadi tawazun ki qeemat ka ishara karta hai. is nizaam ko istemaal karne walay sarmaya vehicle patteren ki taraf se ishara kardah muzahmat aur support linon ki bunyaad standard apni tijarat ka waqt karte hain.Key takeways Tqniki tajzia mein, wolfe waves qeemat ke patteren hain jo paanch lehron standard mushtamil hain jo ke taizi ya mandi ke rujhanaat ki nishandahi karti hain. wolfe wave ke pinnacle standard sahih tareeqay se shanakht karne ke liye mayarat ki aik series ko poora karna zaroori hai, jaisay ke lehron ke chakkar teesri aur chothi lehron mein aik jaisi aur allag qeemat ki karwai hain. aik haqeeqi volf view ke liye, patteren mein panchwin lehar ki misaal ke baad qeemat mein break out hoga .

Understanding Wolf wave design volf view patteren ki shanakht sab se pehlay bil volf aur is ke betay Brian ne ki. volf ke mutabiq, yeh qudrati peak standard tamam baazaaron mein paye jatay hain. un ko pehchanney ke liye, taajiron ko qeemat ke ki aik series ki nishandahi karni chahiye jo makhsoos miyaar ke mutabiq hon : lehron ko aik mustaqil waqt ke waqfay standard chakkar lagana chahiye. teesri aur chothi lehron ko pehli aur doosri lehron ke zareya banaye gaye channel ke andar rehna chahiye. teesri aur chothi lehron ko pehli aur doosri lehron ke sath murmur ahangi dikhani chahiyechannel se bahar patteren ke peechay nazriya ke mutabiq, pehli lehar ke aaghaz mein nuqta se khenchi gayi aur chothi lehar ke aaghaz se guzarnay wali aik lakeer panchwin lehar ke ekhtataam ke liye hadaf ki qeemat ki paish goi karti hai. agar koi tajir wolfe wave ki tashkeel ke sath hey is ki sahih shanakht karta hai, to panchwin lehar ka aaghaz taweel ya mukhtasir position lainay ka mauqa faraham karta hai. hadaf ki qeemat lehar ke ekhtataam ki pishin goi karti hai, aur is liye woh maqam jis standard tajir ka maqsad position se faida uthana hai

Recognizing Complex Examples Utilizing Specialized Investigation takneeki tajzia graph patteren ka istemaal karta hai jaisay volf waves ziyada se ziyada munafe ke liye market ki naqal o harkat aur waqt ki tijarat ki paish goi karne ke liye. tajir jo takneeki tajzia ka istemaal karte hain woh diagrams ko dekhte hain jo aik muddat ke douran sikyortiz ke liye qeemat ki naqal o harkat ko zahir karte hain. aam peak standard, takneeki tajzia supply aur request ke nazriaat standard munhasir hota hai jo qeematon ki makhsoos sthon ko oopar ya neechay zahir karta hai jis se sikyortiz tijarat ke liye jad-o-jehad karen gi. support ki sthin qeematon ke masawi hoti hain taakay hasas ki qeematon ko mustahkam karne aur badhaane ke liye kaafi maang ko Raghib kya ja sakay, hit ke muzahmat ki satah itni ziyada qeematon ke masawi hai ke hasas yaftgan ko hasas baichnay aur munafe lainay, talabb ki satah ko kam karne aur qeematon ki satah ko neechay ya giranay ka baais banti hai .

-

#11 Collapse

WOLF WAVE PATTERN DEFINITION wolf wave Ek chart pattern hai Jo price Mein 5 Wave ke pattern per mushtamil hai Jo equilibrium ki price ko zahar karta hai is system ko use Karne Wale investor pattern ki taraf se Ishara Karda resistance aur support lines ki based per apni trade ka Waqt Karte Hain wave ko ek consistent ke time ke Waqfe per chakkar Lagana chahie third and fourth waves ko first and second waves Ke zariya banae Gaye channel ke andar Rahana chahie wolf wave pattern ki dantified sabse pahle Bill wolf aur uske bete brian Ne ki wolfe ke mutabik yah naturally Tor per Tamam market Mein Paye Jaate Hain unko recognize ke liye traders ko price Ke Do ghoolon Ki Ek series ki maloomat Karni chahie Jo specifies criteria ke mutabik ho wolf wave pattern Mein 5th wave channel se out Nikalti Hai WOLF WAVE REVERSAL POINT Pattern ke behind theory ke mutabik Pahli Wave ke aagaaz mein nukta se guzarne Wali Ek lakir paanchon waves ke ikhtatam ke liye target ki price ki Pesh gui karti hai agar koi trader wolf wave ki tashkeel ke sath iski properly identify karta hai to fifth wave kagaz long ya short position lene ka opportunity frahim karta hai target ki price Wave ke end pash Goi karti hai aur isliye vah Makam Jis per trader ka aim position se fayda uthana hai world ke sabse Bare crypto exchanges mein se ek aapke liye ready hai

WOLF WAVE REVERSAL POINT Pattern ke behind theory ke mutabik Pahli Wave ke aagaaz mein nukta se guzarne Wali Ek lakir paanchon waves ke ikhtatam ke liye target ki price ki Pesh gui karti hai agar koi trader wolf wave ki tashkeel ke sath iski properly identify karta hai to fifth wave kagaz long ya short position lene ka opportunity frahim karta hai target ki price Wave ke end pash Goi karti hai aur isliye vah Makam Jis per trader ka aim position se fayda uthana hai world ke sabse Bare crypto exchanges mein se ek aapke liye ready hai  UNDERSTANDING WOLF WAVE Securely tarike se trade karte hue competitive fees aur dedicate customer support say enjoy hoen aapko binance tolls Tak bhi Rasoi Hasil Hogi jo aapki trade history ko dekhna investment ka manage prices ke chart dekhna aur 0 fees ke sath conversion ko Pahle Se Kahin zyada Aasan banate hain free mein account banaen aur global cripto m per milian trader are investor ke sath Shamil Hon Is Tarah ka knowledge rakhne se aap ko ya know mien help milegi market mein demand aur supply ki ke level ka andaza Kaise Lagaya Ja sakta hai is mazmoon Mein Main everything karunga Jo is traders ke tashkeel ke bare mein Janna ki Need hai

UNDERSTANDING WOLF WAVE Securely tarike se trade karte hue competitive fees aur dedicate customer support say enjoy hoen aapko binance tolls Tak bhi Rasoi Hasil Hogi jo aapki trade history ko dekhna investment ka manage prices ke chart dekhna aur 0 fees ke sath conversion ko Pahle Se Kahin zyada Aasan banate hain free mein account banaen aur global cripto m per milian trader are investor ke sath Shamil Hon Is Tarah ka knowledge rakhne se aap ko ya know mien help milegi market mein demand aur supply ki ke level ka andaza Kaise Lagaya Ja sakta hai is mazmoon Mein Main everything karunga Jo is traders ke tashkeel ke bare mein Janna ki Need hai

-

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What Is Wolf wave pattern Wolf wave pattern ek technical chart pattern hai, jise traders price charts ke through identify karke trading decisions lete hain. Is pattern ka naam wolf wave hai, kyunki iska shape ek lomdi (wolf) ki tarah hota hai. Wolf wave pattern typically price chart par five waves se form hota hai. Yeh pattern ek reversal pattern hai, yani ki trend reversal ko indicate karta hai. Is pattern ka formation generally kafi time period mein complete hota hai. Wolf wave pattern ke formation mein following waves hote hain: 1. Wave 1: Yeh wave downtrend ke end ko indicate karta hai aur price mein reversal ke initial signs dikhata hai. Price wave 1 mein up-move karti hai. 2. Wave 2: Wave 1 ke baad price mein minor retracement hoti hai, jisse wave 2 form hoti hai. Price wave 2 mein neeche move karti hai, lekin wave 1 ke low level se neeche nahi jaati hai. 3. Wave 3: Wave 3 uptrend ke main wave hoti hai aur typically sabse lambi hoti hai. Price wave 3 mein strong up-move karti hai aur wave 1 ke high level tak ya usse bhi upar move kar sakti hai. 4. Wave 4: Wave 3 ke baad price mein correction aur consolidation hoti hai. Price wave 4 mein neeche move karti hai, lekin wave 3 ke high level se neeche nahi jaati hai. 5. Wave 5: Wave 5 mein price fir se up-move karti hai aur wave 3 ke high level ko breach kar sakti hai. Wave 5 complete hone ke baad, traders ko trend reversal ki possibility ke baare mein aware hona chahiye. Wolf wave pattern ke identification aur trading ke liye, traders price chart par waves ko dhyan se observe karte hain. Price levels, retracements, aur wave relationships ko analyze karke pattern ko identify karte hain. Fibonacci retracement levels aur other technical indicators bhi is pattern ke identification mein help kar sakte hain. Traders typically wave 5 ke completion aur reversal ki confirmation ke liye wait karte hain, jisse ki unhe entry aur exit points determine karne mein help mil sake. Stop-loss order aur risk management ko bhi consider karte huye trades ko manage kiya jata hai. Yeh tha wolf wave pattern ka asan tareeke se samjhaya gaya hai. Lekin pattern ko accurately identify karna aur trading decisions lena traders ke liye practice, experience, aur technical analysis ki understanding ki zaroorat hoti hai. Wolf wave pattern works Wolf wave pattern ka main purpose hota hai trend reversal ko identify karna. Is pattern ki help se traders price charts par trend reversal ke potential points ko dhundh sakte hain. Wolf wave pattern mein specific price levels aur wave relationships ko observe karke traders trend reversal ka possibility assess karte hain. Wolf wave pattern mein traders price chart par five waves ko track karte hain. Wave 1, wave 2, wave 3, wave 4, aur wave 5 ka formation hota hai. Wave 1 aur wave 2 downtrend ke signs ko indicate karte hain, jabki wave 3, wave 4, aur wave 5 uptrend ke signs ko show karte hain. Traders is pattern ko identify karke trend reversal ki possibilities ko assess kar sakte hain. Jab price wave 5 complete hoti hai aur reversal signs dikhte hain, tab traders selling positions enter karke existing uptrend se profit earn kar sakte hain. Iske alawa, traders bhi buying positions enter karke downtrend ke signs ke baad potential reversal ke liye trade kar sakte hain. Wolf wave pattern ka use karne ke liye traders price chart par wave relationships aur price levels ko closely monitor karte hain. Fibonacci retracement levels aur other technical indicators ka bhi use kiya jata hai, jisse pattern ki strength aur validity ko confirm kiya ja sakta hai. Pattern identification ke baad, traders ko entry aur exit points determine karna hota hai. Stop-loss orders aur risk management techniques ka bhi istemal kiya jata hai, taki unexpected price movements se protection mil sake. Wolf wave pattern ka use karke traders trend reversal ko identify karke profitable trades execute kar sakte hain. Lekin is pattern ko accurately identify karna aur trading decisions lena traders ke liye practice, experience, aur technical analysis ki understanding ki zaroorat hoti hai. Wolf wave pattern ki trading strategy Wolf wave pattern ka trading strategy traders ko trend reversal points identify karne aur unpar trading decisions lena mein help karti hai. Yahan, wolf wave pattern ki trading strategy ka asan tareeka diya gaya hai: 1. Pattern Identification: Sabse pehle, traders ko wolf wave pattern ko price chart par identify karna hota hai. Pattern ki five waves, yani wave 1, wave 2, wave 3, wave 4, aur wave 5, ko dhyan se observe kare. Price levels aur wave relationships ko analyze karke pattern ki validity aur strength ko confirm kare. 2. Wave Relationships: Wave relationships ko samajhna pattern ke trading strategy mein important hota hai. Traders wave 1 aur wave 2 ke relationship ko dekhte hain, jahaan wave 2 wave 1 ke neeche move karti hai, lekin wave 1 ke low level se neeche nahi jaati hai. Iske baad, wave 3 wave 1 ke high level tak ya usse bhi upar move karti hai. Wave 4 wave 3 ke neeche move karti hai, lekin wave 3 ke high level se neeche nahi jaati hai. 3. Entry Point: Wave 5 complete hone ke baad, traders ko entry point determine karna hota hai. Trend reversal ko confirm karne ke liye additional indicators ka use kiya jaa sakta hai, jaise ki momentum oscillators, trend lines, ya candlestick patterns. Agar trend reversal bullish hai, to traders buying positions enter kar sakte hain. Agar trend reversal bearish hai, to traders selling positions enter kar sakte hain. 4. Stop-loss aur Risk Management: Har trade mein risk management ka dhyan rakhna zaroori hota hai. Traders ko stop-loss order set karna chahiye, taki unexpected price movements se protection mile. Stop-loss level ko handle ke opposite side ya pattern ki characteristics ke hisab se set kiya jata hai. Risk-reward ratio ko consider karke trade ko manage karna important hota hai. 5. Exit Point: Traders ko target price ya reversal signs ke basis par exit point determine karna hota hai. Agar target price set kiya gaya hai, to traders wahaan profit booking ke liye trade ko close kar sakte hain. Agar reversal signs dikhte hain, to traders trade ko close karke potential reversal ke liye prepared ho sakte hain. Trading strategy mein disciplined approach, risk management, aur market analysis ka dhyan rakhna zaroori hota hai. Practice, experience, aur pattern ki sahi identification ke liye observation skills bhi important hote hain. Yeh tha wolf wave pattern ki asan tareeke se samjhaya gaya trading strategy. Lekin pattern ko accurately identify karna aur trading decisions lena traders ke liye practice, experience, aur technical analysis ki understanding ki zaroorat hoti hai. Trade in Wolf wave pattern 1. Sahi Pattern Identification: Sahi pattern identification trading success ka ek crucial aspect hai. Wolf wave pattern ko sahi tarike se identify kare, jaise ki five waves ke formation, wave relationships, aur price levels ko observe karke. Sahi pattern identification ke liye practice aur experience ka hona zaroori hai. 2. Confirmation Signals: Pattern identification ke baad, confirmation signals ki talaash kare. Additional technical indicators jaise ki momentum oscillators, trend lines, ya candlestick patterns ka use karke reversal signals ko confirm kare. Confirmation signals, pattern ki validity aur strength ko enhance kar sakte hain. 3. Entry Point aur Stop-Loss Order: Entry point determine karne ke liye pattern ke breakout point, resistance levels, aur reversal signs ko consider kare. Stop-loss order set kare, taki unexpected price movements se protection mile. Stop-loss level ko pattern ki characteristics aur risk tolerance ke hisab se set kare. 4. Risk Management: Har trade mein risk management ka dhyan rakhna zaroori hai. Risk-reward ratio ko consider kare, taki potential profit potential loss se jyada ho. Apne risk tolerance ke andar trade size aur position size ko adjust kare. Discipline se apne risk management rules follow kare. 5. Target Price aur Exit Strategy: Target price set kare, jisse ki profit booking kiya ja sake. Target price ko pattern ki characteristics, previous price levels, aur market conditions ke hisab se determine kare. Reversal signs ko closely monitor kare aur exit strategy ko taiyar rakhe. Agar reversal signs dikhte hain, to trade ko close karke potential reversal ke liye prepared ho jaye. 6. Market Analysis: Market analysis aur overall market conditions ka dhyan rakhe. Price action, volume patterns, aur other technical indicators ka istemal karke market sentiment aur trend ke baare mein sahi samajh paye. Multiple time frames ka analysis kare, taki sahi entry aur exit points determine kiye ja sake. 7. Practice aur Learning: Pattern recognition aur trading skills ko improve karne ke liye regular practice aur learning ka hona zaroori hai. Historical price charts par backtesting kare aur live market mein demo trading kare. Trading community se connect rahe aur knowledge aur experiences share kare. Yeh the kuch asan tips wolf wave pattern par successful trading ke liye. Lekin trading mein kamyabi ke liye discipline, patience, aur consistent learning zaroori hai. Apne trading plan ko stick kare aur emotions ko control kare. Har trade se seekhe aur apni trading strategy ko refine karte rahe. -

#13 Collapse

what is wolf wave pattern My dear members kesy hain aap sab umeed krti hu k sab khriyat sy hun gy humara aaj ka topic hai wolf wave k bary main to hum aapko apny knowledge k mutabiq share kren gay wolf wave k bary main, Wolf Wave pattern jo k forex trading mein aik boht e popular analysis hai. Ye pattern price charts par dekhy jaty hain or price swings ko identify karty hai Wolf Wave pattern mein typically 5 waves hoti hain jinhy wave 1 sy wave 5 tak number kiya jata hai Yeh waves zigzag odr harmonic movement show karty hain Yeh pattern price action or Fibonacci retracement levels k combination par based hota hai Wolf Wave pattern ko confirm karny k liye hum log commonly Fibonacci retracement levels or price extensions ka bhi istmal karty hain Ye levels humen future price targets or stop loss levels ko pehchanny main madad karty hain Yeh pattern trading strategies or risk management k sath combine kiya ja sakta hai lekin is ka istmal karny sy pehly humen proper analysis or practice karna chahiye Forex market mein trading karne k liye humen technical analysis tools or patterns k saath risk management money management or trading discipline ka bhi boht khyal rakhna hota hai. Wolf wave trading strategy Dear forex friends wolf wave trading k liye b aik strategy ka hona boht lazmi hota hai Ye strategy high time frame charts par zyada effective hoti hai orr trend reversal or trend continuation ki identification mein madad karti hai Yahan main aap ko Wolf Wave trading strategy ki kuch important concepts orr steps btati hun Sab sy pehly humen trend ko identify karna hai Is k liye humen price chart par swings or highs lows ko dekh sakty hain Agar uptrend hai to hum swing lows par focus karen gy or agar downtrend hai to swing highs par focus karen gay. Identifications of wolf wave Wave identification k baad humen pivot points tayyar karna hai Pivot points highs or lows sy banaye jaty hain Agar uptrend hai to humen 1st pivot point low sy 2nd pivot point high sy or 3rd pivot point phir sy low sy bnany hoty hain Agar downtrend hai to 1st pivot point high sy 2nd pivot point low sy or 3rd pivot point phir sy high sy bnany hoty hain Jab aap pivot points tayyar kar len to ab aapko waves count karna hai Waves ko count karny k liye aapko specific price levels ko dekhna hota hai Uptrend mein aap wave count karny k liye pivot points or swing lows ka istmal kren gy Downtrend mein aap wave count karny k liye pivot points or swing highs ka istmal kren gay Entry points ko identify karny k liye aap ko specific conditions ko follow karna hota hai Jab price 3rd pivot point ko cross kar k opposite direction mein jati hai to ye entry point signal hai Uptrend mein entry point sell hota hai jab price 3rd pivot point ko cross kar k nichy jaata hai Downtrend mein, entry point buy hota hai jab price 3rd pivot point ko cross kar k upar jaata ha humen apni Har trade mein stop loss or target levels ko define karna zaroori hai Stop loss humari trade k opposite side par rakha jata hai, jis sy humen nuksaan kam hota hai Target levels humari price movement orr risk tolerance k hisab sy set karny hoty hain. -

#14 Collapse

What is wolf wave design in forex volf view aik graph patteren hai jo qeemat mein paanch lehar patteren standard mushtamil hai jo bunyadi tawazun ki qeemat ka ishara karta hai. is nizaam ko istemaal karne walay sarmaya vehicle patteren ki taraf se ishara kardah muzahmat aur support linon ki bunyaad standard apni tijarat ka waqt karte hain. Key takeways Tqniki tajzia mein, wolfe waves qeemat ke patteren hain jo paanch lehron standard mushtamil hain jo ke taizi ya mandi ke rujhanaat ki nishandahi karti hain. wolfe wave ke pinnacle standard sahih tareeqay se shanakht karne ke liye mayarat ki aik series ko poora karna zaroori hai, jaisay ke lehron ke chakkar teesri aur chothi lehron mein aik jaisi aur allag qeemat ki karwai hain. aik haqeeqi volf view ke liye, patteren mein panchwin lehar ki misaal ke baad qeemat mein break out hoga .Understanding Wolf wave design volf view patteren ki shanakht sab se pehlay bil volf aur is ke betay Brian ne ki. volf ke mutabiq, yeh qudrati pinnacle standard tamam baazaaron mein paye jatay hain. un ko pehchanney ke liye, taajiron ko qeemat ke ki aik series ki nishandahi karni chahiye jo makhsoos miyaar ke mutabiq hon : lehron ko aik mustaqil waqt ke waqfay standard chakkar lagana chahiye. teesri aur chothi lehron ko pehli aur doosri lehron ke zareya banaye gaye channel ke andar rehna chahiye. teesri aur chothi lehron ko pehli aur doosri lehron ke sath murmur ahangi dikhani chahiyechannel se bahar patteren ke peechay nazriya ke mutabiq, pehli lehar ke aaghaz mein nuqta se khenchi gayi aur chothi lehar ke aaghaz se guzarnay wali aik lakeer panchwin lehar ke ekhtataam ke liye hadaf ki qeemat ki paish goi karti hai. agar koi tajir wolfe wave ki tashkeel ke sath hello is ki sahih shanakht karta hai, to panchwin lehar ka aaghaz taweel ya mukhtasir position lainay ka mauqa faraham karta hai. hadaf ki qeemat lehar ke ekhtataam ki pishin goi karti hai, aur is liye woh maqam jis standard tajir ka maqsad position se faida uthana hai -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

INTRUDUCE: Asslamoalaikum piyary bhai omeed hy ap bilkul thik hoon gy Forex tradings Marketing main apna work dilchapi ky sath work karty hen DETAILS OF WOLF WAVE PATTREN***&& Dear members piyary members Wolf vave Candlictick Pattren takneeki tajzia chart patteren ka istemaal karta hai jaisay volf waves ziyada se ziyada munafe ke liye market ki naqal o harkat aur waqt ki tijarat ki paish goi karne ke liye. tajir jo takneeki tajzia ka istemaal karte hain woh charts ko dekhte hain jo aik muddat ke douran sikyortiz ke liye qeemat ki naqal o harkat ko zahir karte hain takneeki tajzia supply aur demand ke nazriaat par munhasir hota hai jo qeematon ki makhsoos sthon ko oopar ya neechay zahir karta hai jis se sikyortiz tijarat ke liye perfect hota Hai SUPPORT ki sthin qeematon ke masawi hoti hain taakay hasas ki qeematon ko mustahkam karne aur badhaane ke liye kaafi maang ko Raghib kya ja sakay, jab ke muzahmat ki satah itni ziyada qeematon ke masawi hai ke hasas yaftgan ko hasas baichnay aur munafe lainay, talabb ki satah ko kam karne aur qeematon ki satah market lower ki tarf jati hey. KEY TAKEAWAYES;Piyary friends Wolf view patteren ki shanakht sab se pehlay bil volf aur is ke betay Brian ne yeh qudrati tor par tamam baazaaron mein paye jatay hain. un ko pehchanney ke liye bhot sara time lagta hey our taajiron ko qeemat ke ki aik series ki nishandahi karni chahiye jo makhsoos miyaar ke mutabiq hon : lehron ko aik mustaqil waqt ke waqfay par chakkar lagana chahiye. teesri aur chothi lehron ko pehli aur doosri lehron ke zareya banaye gaye channel ke andar rehna chahiye. teesri aur chothi lehron ko pehli aur doosri lehron ke sath hum ahangi rakhty hey.EXPLANATION***!! Forex exchanging Marketing main Wolf vave Candlictick Pattren key CHANNEL peechay nazriya ke mutabiq, pehli lehar ke aaghaz mein nuqta se khenchi gayi aur chothi lehar ke aaghaz se guzarnay wali aik lakeer panchwin lehar ke ekhtataam ke liye hadaf ki qeemat ki paish goi karti hai. agar koi tajir wolfe wave ki tashkeel ke sath hi is ki sahih shanakht karta hai, to panchwin lehar ka aaghaz taweel ya mukhtasir position lainay ka mauqa faraham karta hai. hadaf ki qeemat lehar ke ekhtataam ki pishin goi karti hai, aur is liye woh maqam jis par tajir ka maqsad position se faida hasil hota Hai our es Mei lower CANDL bhe tajir hazraat ko faida dety hein. TRADINGS WITH WOLF WAVE PATTREN!!! Yeh Pattren tradings Wolfe waves qeemat ke patteren hain jo paanch lehron par mushtamil hain jo ke taizi ya mandi ke rujhanaat ki nishandahi karti hain. wolfe wave ke tor par sahih tareeqay se shanakht karne ke liye mayarat ki aik series ko poora karna zaroori hai, jaisay ke lehron ke chakkar teesri aur chothi lehron mein aik jaisi aur allag qeemat ki karwai hain. aik haqeeqi volf view ke patteren mein panchwin lehar ki misaal ke baad qeemat mein break out karty hen our price bhi change karty hen.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 08:42 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим