Wolf wave design in k nam yeh Smjhny mn hmari madad karny mn kar aamad hain k woh kisqisam ko namoony hain or hmein outline mn inko khn talash karna hai is mamlay mn hanging man itna he bura hai jitna isay lagta hai yeh negative inversion design hai tamam v. infaradi candles ki tameer mn singe information focuses ka istamal kia jata hai woh khulay ,qareebi ,aala or aadna hain. no doubt information focuses Jan,ny waly merchants ko bailon or reachon k darmyian jang ki Halat ko wazhaiy karny mn madad karty hain jo kah market mn hissa leny walon ki aksaryiat hai candle design her waqt k bhi fareemon mn zahir ho sakty hain.Hanging man aik Candle design ka namoona hai chun kah yeh reverse pattren hai is liay pattren k zahir hony sy phlay is kaleay kuch hona zaroori hai market kaleay yeh zaroori nhi hai lkn pattren k zahir hony sy phlay qeematon mn qabilay shanakht izafa hota hai.Trade k aggaz mn inaam ki j miqdar ka taayian karna bhi mushkil ho sakta hai kunkah candle design aam toor standard munafy k ahdaaf farham nha karta hai is k bajaiy dealers ko kise bhi qisam ki exchange sy bahir nikalny kaleay degar candles k example ki zarort hote hai ya tejarati hikmat ay aamali istamal karty hain jo kah hanging man pattren k zaraiy shuru hote hai is bat ki bhi koi yaqeen dehani nhi hai kah hanging man banny k terrible qeemat kam ho jaiy ge chaiy aik tasdeeqi candle ho yahi waja h Hanging Man Example kya hy Hanging man design ki tasdeeq nhi hoti jaders dusri specialized examination instruments aur pointers ka istemal karte hain. Is design ko dekh kar, merchants apni exchanging systems aur choices banate hain."Hanging Man" is a candle design utilized in forex exchanging. It is a solitary candle design that commonly shows up toward the finish of an upturn and recommends an expected inversion in the cost heading. The Hanging Man design is framed when the open, high, and close costs are near one another, with a long lower shadow and next to zero upper shadow.Hanging Man candle design Forex mein ek negative inversion design hai. Yeh design regularly upswing ke baad dikhta hai aur negative cost inversion ko demonstrate karta hai. Hanging Man design mein ek little body hota hai jo ub tk qeemat aagli mudat ya is k foran awful gir na jaiy hanging man qeemat ko hanging cadle ki oonchi qeemat sy bioppar nhi jana chahaiy kun k yeh mumkina toor standard aik qeemat ki paish qadmi ka ishara hai Agar qeemat hanging man k terrible girti hai to is sy pattren ki tasddeq hote j hai or candle k brokers isay lambi position sy nikalny or mukhtasir position mn dakhil hony k toor standard istamal karty hain hanging man ki tasddeq hony k jo terrible aik nai mukhtasir position mn dakhil hony ki soraat mn aik stop nuqsan hanging man ki oonchai k oppar rakha ja sakta hai.hanging mn pattren is waqt hota hai jb kam az kam chand candles kaleay qeemat zyadi honi chaeiy yeh aik bari paish pontoon ki zarort nhi hai yeh ho sakta hai lkn pattren aik bary neechy k rojhan k darmyianb aik mukhtasir mudat k izafy k andar bhi ho sakta hai.Hanging man ki aik haad or bhut sy candle design yeh hai k tasdeeq ka intazar karny k nateejy mn dakhly ka makam khrab ho sakta hai qeemat do adwar k andar itni teezi sy barh sakti hai k merchants mumkina inaam khatray ka jawaz nhi boycott sakta hai.

`

X

new posts

-

#31 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#32 Collapse

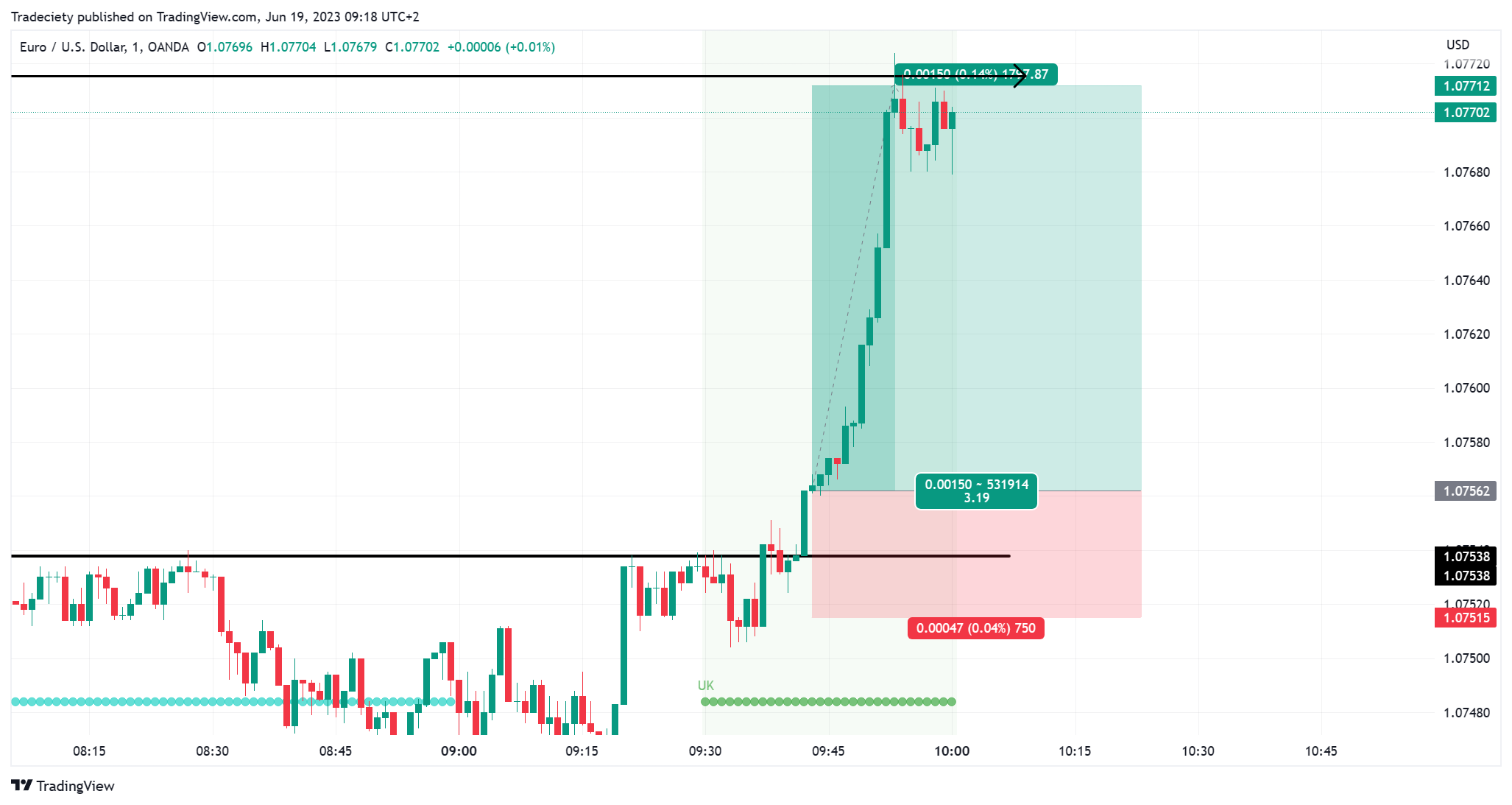

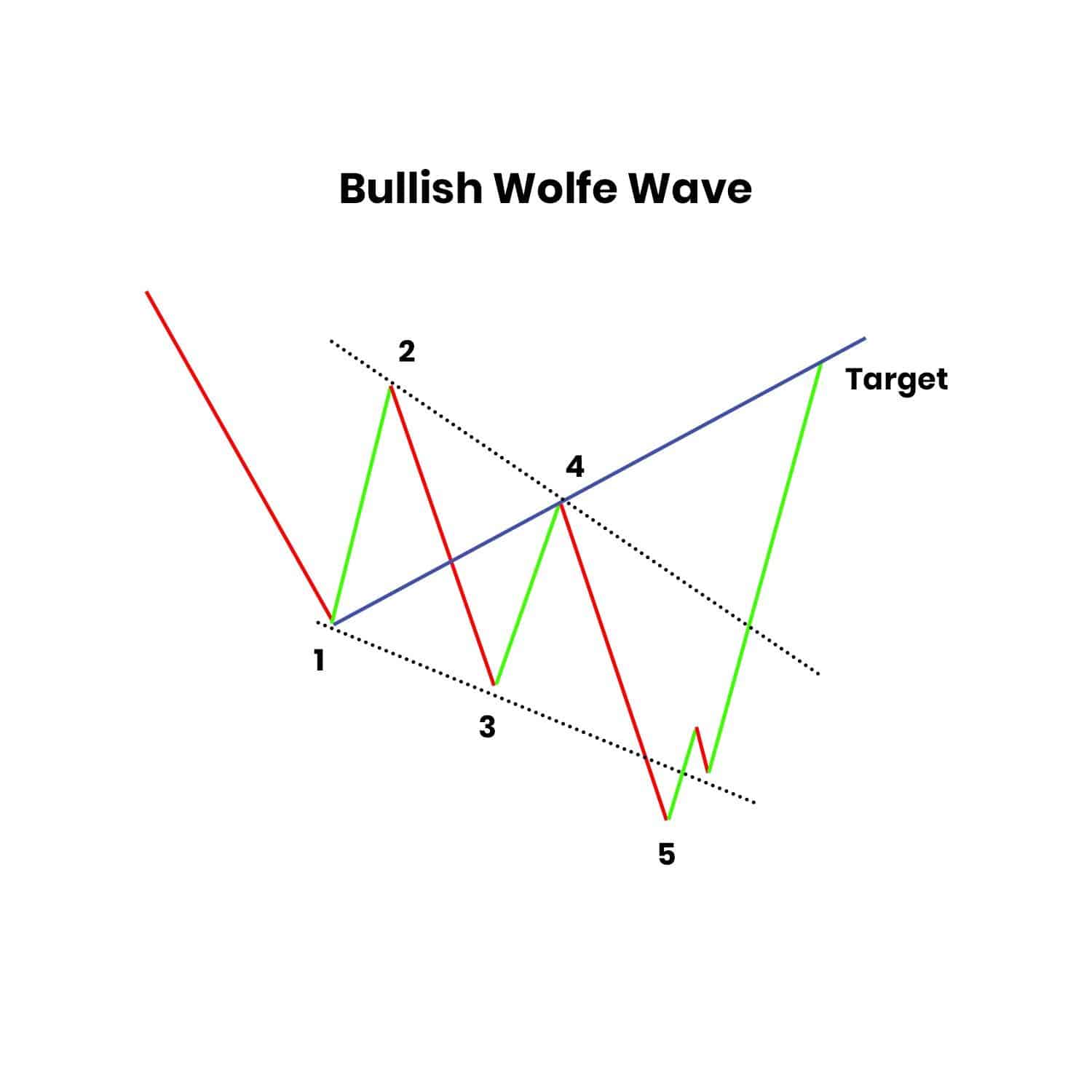

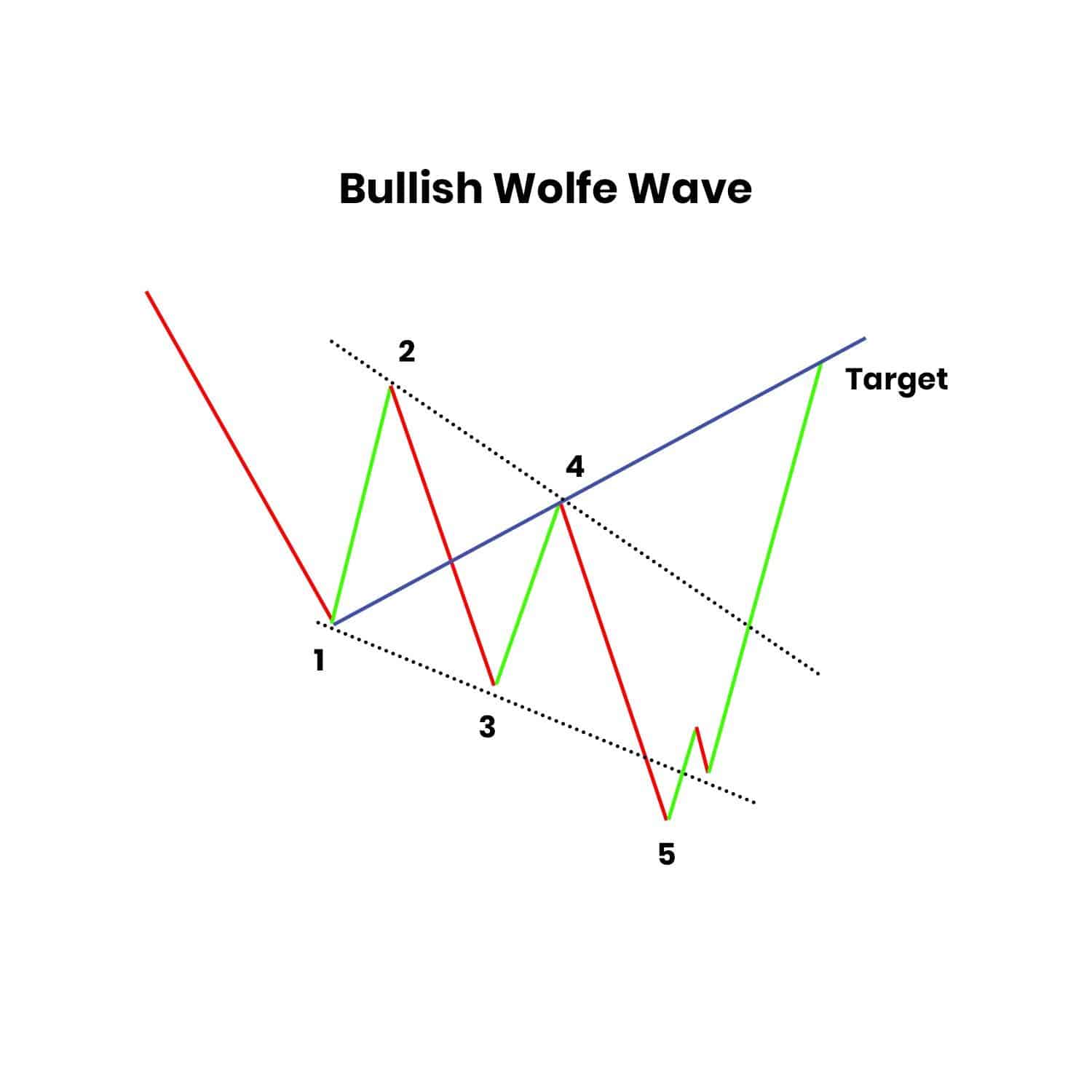

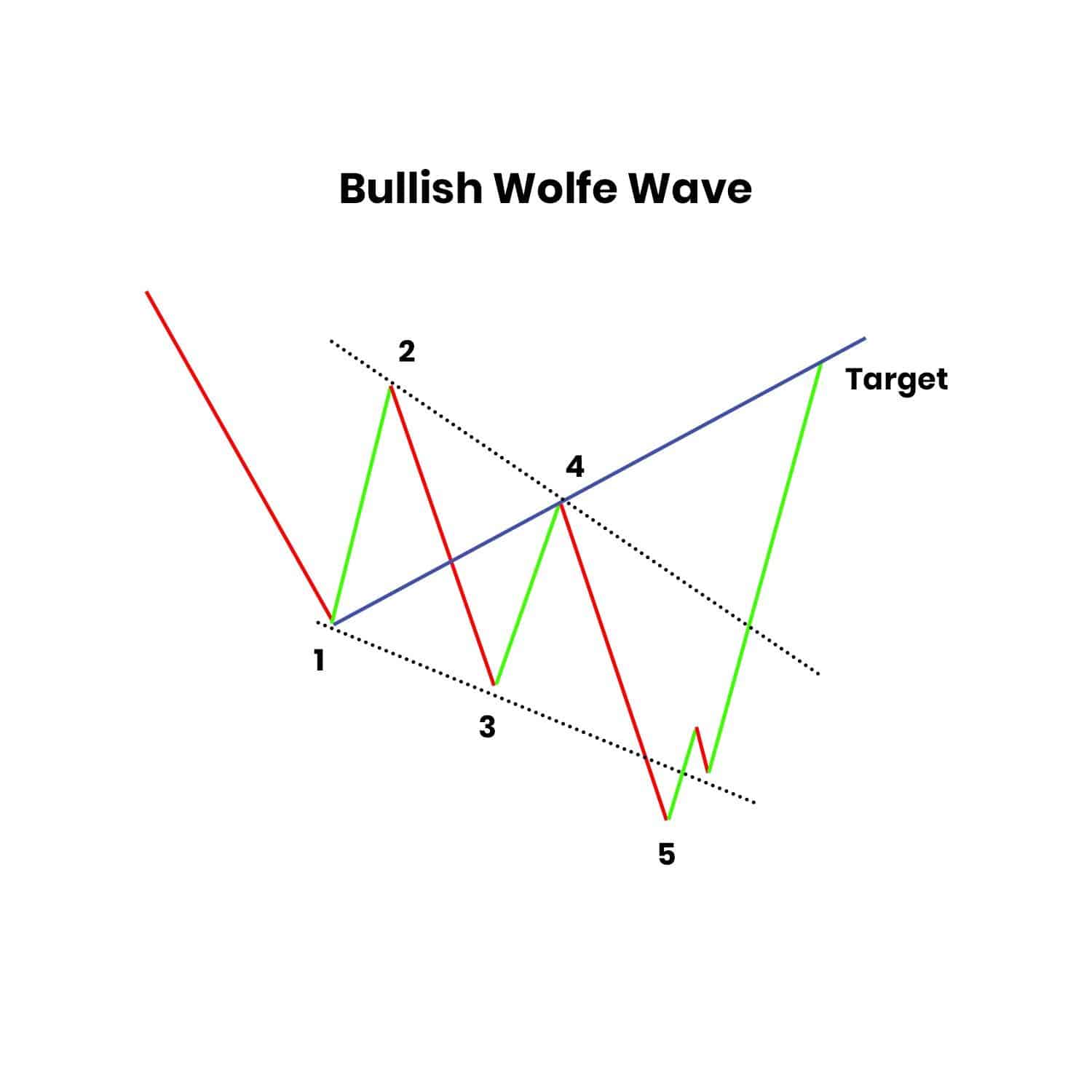

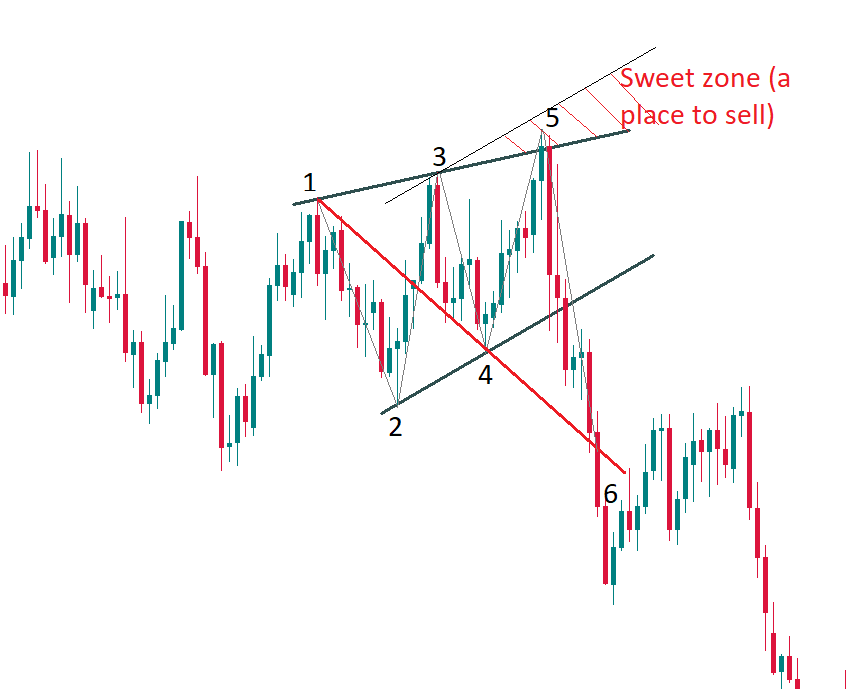

Bullish Wolfe Wave pattern: Aam tor par matawazi channels and masawi channels are available, according to bhairiye ki laharen. Aik dosray ke matawazi hain, is ka matlab yeh hai ke volf lehar patteren ko do trained lines ke andar bantay hue dekha jaye ga. Nisbatan masawi lambai ki paanch qeemti tangen hon gi, and jo hum ahangi zahir karti dikhayi deti hain, according to a bearish volf view patternen ke tanazur mein.aik misaal dekh satke hain, neechay di gayi misaal mein aap taizi se wolfe lehar ke patteren ki.neechay ki taraf barhta hai, bullish wolfe wave ka dhancha pehli taang se shuru hota hai. As well as qeematein lehar do mein onche hona shuru ho jayen gi, kisi waqt lehar aik kam jhool peda kere gi. Lehar teen neechay ki taraf barhna shuru kar day gi, Lehar ke aaghaz se neechay khatam ho jaye gi, Lehar 4 jo oopar jaye gi, and Lehar 2 ke neechay onche jhulay banaye gi.Is maqam par hum aik trained line plot karna chahain ge jo views one and three ke ekhtataam ko 1-3 trained line banati hai. Aik hi waqt mein, hum lehar do ke ekhtataam ko view for ke ekhtataam ke sath jornay wali aik trained line banaye gi. Hum dekhna chahtay hain ki 1-3 trained line aur 2-4 trained line nisbatan matawazi hain, according to aik baar phir. Lehar paanch ko lehar three ke soyng lo se neechay jana chahiye and 1-3 trained line ke nichale hissay ki khilaaf warzi karni chahiye are examples of what happened in the past. Bearish Wolfe Wave Pattern: Jahan oopar ki dhalwan 1-3 trained line oopar ki dhalwan 2-4 trained line ke nisbatan mumasil zavia par hogi, bearish Wolfe Wave patteren bhi aik matawazi channel ke andar waqay hogi. Bearish volf view patteren tangon ke liye baanch qeematon par mushtamil hota hai jo lambai mein nisbatan aik jaisi hoti hain and kuch satah ki hum ahangi ko zahir karti hain.Bearish wolf wave's saakht and tafseelaat are both in favor right now. bearish volf lehar patteren ki misaal dekh satke hain zail mein aap aik baar.Bearish wolfe wave patterns are currently in effect, and they are seen in Taang One. Is ke baad taang two shuru hoti hai or is taang one ke aaghaz ke oopar neechay zhulte hue neechay ki taraf barh jati hai. Phir Taang Three Ban Jaye Gi and Taang One Ke Siray Se Oppar Khatam Hojaye Gi respectively. Is ke baad taang for aati hai, jo three taang ki taraf barhta hai, and two taang ke neechay jhulay ke oopar khatam hota hai.

Bearish Wolfe Wave Pattern: Jahan oopar ki dhalwan 1-3 trained line oopar ki dhalwan 2-4 trained line ke nisbatan mumasil zavia par hogi, bearish Wolfe Wave patteren bhi aik matawazi channel ke andar waqay hogi. Bearish volf view patteren tangon ke liye baanch qeematon par mushtamil hota hai jo lambai mein nisbatan aik jaisi hoti hain and kuch satah ki hum ahangi ko zahir karti hain.Bearish wolf wave's saakht and tafseelaat are both in favor right now. bearish volf lehar patteren ki misaal dekh satke hain zail mein aap aik baar.Bearish wolfe wave patterns are currently in effect, and they are seen in Taang One. Is ke baad taang two shuru hoti hai or is taang one ke aaghaz ke oopar neechay zhulte hue neechay ki taraf barh jati hai. Phir Taang Three Ban Jaye Gi and Taang One Ke Siray Se Oppar Khatam Hojaye Gi respectively. Is ke baad taang for aati hai, jo three taang ki taraf barhta hai, and two taang ke neechay jhulay ke oopar khatam hota hai.  Hanging Man Example kya hy Specialized testing tools and pointers with a focus on the hanging man design were used in the study. Is design ko dekh kar, traders apni trading systems aur options banate hain.A candle pattern called "Hanging Man" is used in forex trading. It is a single candle pattern that often appears at the conclusion of an upturn and signals an anticipated inversion in the price trend. When the open, high, and close costs are close to one another, the Hanging Man design is framed, with a lengthy bottom shadow and almost no above shadow.Forex's Hanging Man candle design has a negative inversion pattern. Yeh regular upswing in design is bad, and negative cost inversion is shown to be true. Hanging Man design mein ek little body hota hai jo ub tk qeemat aagli mudat ya is k foran awful gir na jaiy hanging man qeemat ko hanging cadle ki oonchi qeemat sy bioppar nhi jana chahaiy kun k yeh mumkina toor standard aikL mn pattren is waqt hota hai jb kam az kam chand candles kaleay qeemat zyadi honi chaeiy yeh aik bari paish pontoon ki zarort nhi hai yeh ho sakta hai lkn pattren aik bary neechy k rojhan k darmyianb aik mukhtasir mudat k izafy k andar bhi ho sakta hai.Aik haad or bhut sy candle design yeh hai, hanging man ki itni teezi sy barh sakti hai, k traders mumkina inaam khatray ka jawaz nhi boycott sakti hai.

Hanging Man Example kya hy Specialized testing tools and pointers with a focus on the hanging man design were used in the study. Is design ko dekh kar, traders apni trading systems aur options banate hain.A candle pattern called "Hanging Man" is used in forex trading. It is a single candle pattern that often appears at the conclusion of an upturn and signals an anticipated inversion in the price trend. When the open, high, and close costs are close to one another, the Hanging Man design is framed, with a lengthy bottom shadow and almost no above shadow.Forex's Hanging Man candle design has a negative inversion pattern. Yeh regular upswing in design is bad, and negative cost inversion is shown to be true. Hanging Man design mein ek little body hota hai jo ub tk qeemat aagli mudat ya is k foran awful gir na jaiy hanging man qeemat ko hanging cadle ki oonchi qeemat sy bioppar nhi jana chahaiy kun k yeh mumkina toor standard aikL mn pattren is waqt hota hai jb kam az kam chand candles kaleay qeemat zyadi honi chaeiy yeh aik bari paish pontoon ki zarort nhi hai yeh ho sakta hai lkn pattren aik bary neechy k rojhan k darmyianb aik mukhtasir mudat k izafy k andar bhi ho sakta hai.Aik haad or bhut sy candle design yeh hai, hanging man ki itni teezi sy barh sakti hai, k traders mumkina inaam khatray ka jawaz nhi boycott sakti hai.

-

#33 Collapse

: Wolf wave plan in k nam yeh Smjhny mn hmari madad karny mn kar aamad hain k woh kisqisam ko namoony hain or hmein frame mn inko khn talash karna hai is mamlay mn hanging man itna he bura hai jitna isay lagta hai yeh negative reversal plan hai tamam v. infaradi candles ki tameer mn sear data centers ka istamal kia jata hai woh khulay ,qareebi ,aala or aadna hain. without a doubt data centers Jan,ny waly sellers ko bailon or reachon k darmyian jang ki Halat ko wazhaiy karny mn madad karty hain jo kah market mn hissa leny walon ki aksaryiat hai candle plan her waqt k bhi fareemon mn zahir ho sakty hain.Hanging man aik Light plan ka namoona hai chun kah yeh speak pattren hai is liay pattren k zahir hony sy phlay is kaleay kuch hona zaroori hai market kaleay yeh zaroori nhi hai lkn pattren k zahir hony sy phlay qeematon mn qabilay shanakht izafa hota hai.Trade k aggaz mn inaam ki j miqdar ka taayian karna bhi mushkil ho sakta hai kunkah candle plan aam toor standard munafy k ahdaaf farham nha karta hai is k bajaiy dealers ko kise bhi qisam ki trade sy bahir nikalny kaleay degar candles k model ki zarort hote hai ya tejarati hikmat ay aamali istamal karty hain jo kah hanging man pattren k zaraiy shuru hote hai is bat ki bhi koi yaqeen dehani nhi hai kah hanging man banny k horrendous qeemat kam ho jaiy ge chaiy aik tasdeeqi fire ho yahi waja h Hanging Man Model kya hy Hanging man plan ki tasdeeq nhi hoti jaders dusri particular assessment contraptions aur markers ka istemal karte hain. Is plan ko dekh kar, sellers apni trading systems aur decisions banate hain."Hanging Man" is a flame configuration used in forex trading. It is a single candle plan that consistently appears close to the completion of an upswing and proposes a normal reversal in the expense course. The Hanging Man configuration is outlined when the open, high, and close expenses are close to each other, with a long lower shadow and essentially no upper shadow.Hanging Man flame plan Forex mein ek negative reversal plan hai. Yeh plan normally rise ke baad dikhta hai aur negative expense reversal ko show karta hai. Hanging Man plan mein ek little body hota hai jo ub tk qeemat aagli mudat ya is k foran horrible gir na jaiy hanging man qeemat ko hanging cadle ki oonchi qeemat sy bioppar nhi jana chahaiy kun k yeh mumkina toor standard aik qeemat ki paish qadmi ka ishara hai Agar qeemat hanging man k terrible girti hai to is sy pattren ki tasddeq hote j hai or flame k representatives isay lambi position sy nikalny or mukhtasir position mn dakhil hony k toor standard istamal karty hain hanging man ki tasddeq hony k jo dreadful aik nai mukhtasir position mn dakhil hony ki soraat mn aik stop nuqsan hanging man ki oonchai k oppar rakha ja sakta hai.hanging mn pattren is waqt hota hai jb kam az kam chand candles kaleay qeemat zyadi honi chaeiy yeh aik bari paish boat ki zarort nhi hai yeh ho sakta hai lkn pattren aik bary neechy k rojhan k darmyianb aik mukhtasir mudat k izafy k andar bhi ho sakta hai.Hanging man ki aik haad or bhut sy candle plan yeh hai k tasdeeq ka intazar karny k nateejy mn dakhly ka makam khrab ho sakta hai qeemat do adwar k andar itni teezi sy barh sakti hai k vendors mumkina inaam khatray ka jawaz nhi blacklist sakta hai. -

#34 Collapse

: Wolf wave plan in k nam yeh Smjhny mn hmari madad karny mn kar aamad hain k woh kisqisam ko namoony hain or hmein outline mn inko khn talash karna hai is mamlay mn hanging man itna he bura hai jitna isay lagta hai yeh negative inversion plan hai tamam v. infaradi candles ki tameer mn burn server farms ka istamal kia jata hai woh khulay ,qareebi ,aala or aadna hain. undoubtedly server farms Jan,ny waly merchants ko bailon or reachon k darmyian jang ki Halat ko wazhaiy karny mn madad karty hain jo kah market mn hissa leny walon ki aksaryiat hai candle plan her waqt k bhi fareemon mn zahir ho sakty hain.Hanging man aik Light arrangement ka namoona hai chun kah yeh talk pattren hai is liay pattren k zahir hony sy phlay is kaleay kuch hona zaroori hai market kaleay yeh zaroori nhi hai lkn pattren k zahir hony sy phlay qeematon mn qabilay shanakht izafa hota hai.Trade k aggaz mn inaam ki j miqdar ka taayian karna bhi mushkil ho sakta hai kunkah candle plan aam toor standard munafy k ahdaaf farham nha karta hai is k bajaiy sellers ko kise bhi qisam ki exchange sy bahir nikalny kaleay degar candles k model ki zarort hote hai ya tejarati hikmat ay aamali istamal karty hain jo kah hanging man pattren k zaraiy shuru hote hai is bat ki bhi koi yaqeen dehani nhi hai kah hanging man banny k awful qeemat kam ho jaiy ge chaiy aik tasdeeqi fire ho yahi waja h Hanging Man Model kya hy Hanging man plan ki tasdeeq nhi hoti jaders dusri specific appraisal contraptions aur markers ka istemal karte hain. Is plan ko dekh kar, merchants apni exchanging frameworks aur choices banate hain."Hanging Man" is a fire design utilized in forex exchanging. It is a solitary flame plan that reliably shows up near the fulfillment of a rise and proposes an ordinary inversion in the cost course. The Hanging Man setup is illustrated when the open, high, and close costs are near one another, with a long lower shadow and basically no upper shadow.Hanging Man fire plan Forex mein ek negative inversion plan hai. Yeh plan regularly rise ke baad dikhta hai aur negative cost inversion ko show karta hai. Hanging Man plan mein ek little body hota hai jo ub tk qeemat aagli mudat ya is k foran awful gir na jaiy hanging man qeemat ko hanging cadle ki oonchi qeemat sy bioppar nhi jana chahaiy kun k yeh mumkina toor standard aik qeemat ki paish qadmi ka ishara hai Agar qeemat hanging man k horrible girti hai to is sy pattren ki tasddeq hote j hai or fire k delegates isay lambi position sy nikalny or mukhtasir position mn dakhil hony k toor standard istamal karty hain hanging man ki tasddeq hony k jo frightful aik nai mukhtasir position mn dakhil hony ki soraat mn aik stop nuqsan hanging man ki oonchai k oppar rakha ja sakta hai.hanging mn pattren is waqt hota hai jb kam az kam chand candles kaleay qeemat zyadi honi chaeiy yeh aik bari paish boat ki zarort nhi hai yeh ho sakta hai lkn pattren aik bary neechy k rojhan k darmyianb aik mukhtasir mudat k izafy k andar bhi ho sakta hai.Hanging man ki aik haad or bhut sy candle plan yeh hai k tasdeeq ka intazar karny k nateejy mn dakhly ka makam khrab ho sakta hai qeemat do adwar k andar itni teezi sy barh sakti hai k sellers mumkina inaam khatray ka jawaz nhi boycott sakta hai. -

#35 Collapse

Assalam o Alaikum! Wolf wave pattern wolf wave trading aik tijarti hikmat e amli hai jo wolf wave patteren ko istemaal karti hai taakay mumkina rujhan ki tabdeeli aur tijarti mawaqay ki nishandahi ki ja sakay. agarchay volf view patteren bazat khud barah e raast candle stuck patteren se mutaliq nahi hai, traders patteren ki tasdeeq karne aur bakhabar tijarti faislay karne ke liye aksar candle stuck ke tajzia ko deegar takneeki isharay ke sath shaamil karte hain. Explanation yeh hain aik taiz wolf view patteren ki khususiyaat : 1. point 1 : qeemat chart mein aik ahem kam point ( tough) ki numaindagi karta hai. 2. point 2 : point 1 ke baad pehlay ahem high point ( chouti ) ko nishaan zad karta hai. 3. point 3 : aik ounchay nichale nuqta ( tough ) ki numaindagi karta hai jo point 2 ke baad bantaa hai. usay point 1 se ouncha hona chahiye. 4. point 4 : point 2 ke baad dosray ahem high point ( chouti ) ki numaindagi karta hai. usay point 2 se kam lekin point 3 se ziyada hona chahiye. 5. point 5 : aik ounchay nichale nuqta ( tough) ki numaindagi karta hai jo point 4 ke baad bantaa hai. usay points 1 aur 3 se ziyada hona chahiye. blush volf view patteren batata hai ke point 5 ban'nay ke baad, qeemat ke ulat jane aur oopar ki simt jari rehne ka imkaan hai. bearish volf view patteren ki khususiyaat taizi ke patteren ki aaina daar tasweer hain, jo mumkina neechay ki taraf rujhan ko tabdeel karne ki nishandahi karti hai. woh tajir jo wolf wave patteren ko pehchante hain woh tijarat mein daakhil honay ya bahar niklny ke liye bator rehnuma istemaal kar satke hain. trading karne se pehlay patteren ki toseeq karne ke liye woh aam tor par tasdeeqi signals, jaisay candle stuck patteren ya deegar takneeki isharay talaash karte -

#36 Collapse

Wolf wave plan in k nam yeh Smjhny mn hmari madad karny mn kar aamad hain k woh kisqisam ko namoony hain or hmein frame mn inko khn talash karna hai is mamlay mn hanging man itna he bura hai jitna isay lagta hai yeh negative reversal plan hai tamam v. infaradi candles ki tameer mn burn data centers ka istamal kia jata hai woh khulay ,qareebi ,aala or aadna hain. almost certainly data centers Jan,ny waly vendors ko bailon or reachon k darmyian jang ki Halat ko wazhaiy karny mn madad karty hain jo kah market mn hissa leny walon ki aksaryiat hai flame plan her waqt k bhi fareemon mn zahir ho sakty hain.Hanging man aik Light plan ka namoona hai chun kah yeh switch pattren hai is liay pattren k zahir hony sy phlay is kaleay kuch hona zaroori hai market kaleay yeh zaroori nhi hai lkn pattren k zahir hony sy phlay qeematon mn qabilay shanakht izafa hota hai.Trade k aggaz mn inaam ki j miqdar ka taayian karna bhi mushkil ho sakta hai kunkah candle plan aam toor standard munafy k ahdaaf farham nha karta hai is k bajaiy sellers ko kise bhi qisam ki trade sy bahir nikalny kaleay degar candles k model ki zarort hote hai ya tejarati hikmat ay aamali istamal karty hain jo kah hanging man pattren k zaraiy shuru hote hai is bat ki bhi koi yaqeen dehani nhi hai kah hanging man banny k awful qeemat kam ho jaiy ge chaiy aik tasdeeqi candle ho yahi waja h Hanging Man Model kya hy Hanging man plan ki tasdeeq nhi hoti jaders dusri particular assessment instruments aur pointers ka istemal karte hain. Is plan ko dekh kar, dealers apni trading frameworks aur decisions banate hain."Hanging Man" is a flame configuration used in forex trading. It is a singular light plan that generally appears close to the completion of an upswing and suggests a normal reversal in the expense heading. The Hanging Man configuration is outlined when the open, high, and close expenses are close to each other, with a long lower shadow and close to zero upper shadow.Hanging Man light plan Forex mein ek negative reversal plan hai. Yeh plan routinely rise ke baad dikhta hai aur negative expense reversal ko exhibit karta hai. Hanging Man plan mein ek little body hota hai jo ub tk qeemat aagli mudat ya is k foran dreadful gir na jaiy hanging man qeemat ko hanging cadle ki oonchi qeemat sy bioppar nhi jana chahaiy kun k yeh mumkina toor standard aik qeemat ki paish qadmi ka ishara hai Agar qeemat hanging man k awful girti hai to is sy pattren ki tasddeq hote j hai or flame k intermediaries isay lambi position sy nikalny or mukhtasir position mn dakhil hony k toor standard istamal karty hain hanging man ki tasddeq hony k jo horrible aik nai mukhtasir position mn dakhil hony ki soraat mn aik stop nuqsan hanging man ki oonchai k oppar rakha ja sakta hai.hanging mn pattren is waqt hota hai jb kam az kam chand candles kaleay qeemat zyadi honi chaeiy yeh aik bari paish barge ki zarort nhi hai yeh ho sakta hai lkn pattren aik bary neechy k rojhan k darmyianb aik mukhtasir mudat k izafy k andar bhi ho sakta hai.Hanging man ki aik haad or bhut sy light plan yeh hai k tasdeeq ka intazar karny k nateejy mn dakhly ka makam khrab ho sakta hai qeemat do adwar k andar itni teezi sy barh sakti hai k dealers mumkina inaam khatray ka jawaz nhi blacklist sakta hai.

in k nam yeh Smjhny mn hmari madad karny mn kar aamad hain k woh kisqisam ko namoony hain or hmein frame mn inko khn talash karna hai is mamlay mn hanging man itna he bura hai jitna isay lagta hai yeh negative reversal plan hai tamam v. infaradi candles ki tameer mn burn data centers ka istamal kia jata hai woh khulay ,qareebi ,aala or aadna hain. almost certainly data centers Jan,ny waly vendors ko bailon or reachon k darmyian jang ki Halat ko wazhaiy karny mn madad karty hain jo kah market mn hissa leny walon ki aksaryiat hai flame plan her waqt k bhi fareemon mn zahir ho sakty hain.Hanging man aik Light plan ka namoona hai chun kah yeh switch pattren hai is liay pattren k zahir hony sy phlay is kaleay kuch hona zaroori hai market kaleay yeh zaroori nhi hai lkn pattren k zahir hony sy phlay qeematon mn qabilay shanakht izafa hota hai.Trade k aggaz mn inaam ki j miqdar ka taayian karna bhi mushkil ho sakta hai kunkah candle plan aam toor standard munafy k ahdaaf farham nha karta hai is k bajaiy sellers ko kise bhi qisam ki trade sy bahir nikalny kaleay degar candles k model ki zarort hote hai ya tejarati hikmat ay aamali istamal karty hain jo kah hanging man pattren k zaraiy shuru hote hai is bat ki bhi koi yaqeen dehani nhi hai kah hanging man banny k awful qeemat kam ho jaiy ge chaiy aik tasdeeqi candle ho yahi waja h Hanging Man Model kya hy Hanging man plan ki tasdeeq nhi hoti jaders dusri particular assessment instruments aur pointers ka istemal karte hain. Is plan ko dekh kar, dealers apni trading frameworks aur decisions banate hain."Hanging Man" is a flame configuration used in forex trading. It is a singular light plan that generally appears close to the completion of an upswing and suggests a normal reversal in the expense heading. The Hanging Man configuration is outlined when the open, high, and close expenses are close to each other, with a long lower shadow and close to zero upper shadow.Hanging Man light plan Forex mein ek negative reversal plan hai. Yeh plan routinely rise ke baad dikhta hai aur negative expense reversal ko exhibit karta hai. Hanging Man plan mein ek little body hota hai jo ub tk qeemat aagli mudat ya is k foran dreadful gir na jaiy hanging man qeemat ko hanging cadle ki oonchi qeemat sy bioppar nhi jana chahaiy kun k yeh mumkina toor standard aik qeemat ki paish qadmi ka ishara hai Agar qeemat hanging man k awful girti hai to is sy pattren ki tasddeq hote j hai or flame k intermediaries isay lambi position sy nikalny or mukhtasir position mn dakhil hony k toor standard istamal karty hain hanging man ki tasddeq hony k jo horrible aik nai mukhtasir position mn dakhil hony ki soraat mn aik stop nuqsan hanging man ki oonchai k oppar rakha ja sakta hai.hanging mn pattren is waqt hota hai jb kam az kam chand candles kaleay qeemat zyadi honi chaeiy yeh aik bari paish barge ki zarort nhi hai yeh ho sakta hai lkn pattren aik bary neechy k rojhan k darmyianb aik mukhtasir mudat k izafy k andar bhi ho sakta hai.Hanging man ki aik haad or bhut sy light plan yeh hai k tasdeeq ka intazar karny k nateejy mn dakhly ka makam khrab ho sakta hai qeemat do adwar k andar itni teezi sy barh sakti hai k dealers mumkina inaam khatray ka jawaz nhi blacklist sakta hai. -

#37 Collapse

Wolf wave pattern introduction Aslaam o alaikum Forex team members Kia haal hein aap sbky aaj hum baat kry gy Wolf wave pattern k topic pr. Wolf wave pattern ek technical analysis ka pattern hai jo financial markets, jaise ki stocks, currencies, ya commodities, mein price movements ko analyze karne ke liye istemal hota hai. Is pattern ko spot karne ke liye traders specific price points par focus karte hain jo ek particular sequence mein hote hain. Wolf wave pattern ka main aim hota hai price ke swings ko identify karna aur future price movements ko predict karna. Ye pattern ek "zigzag" ya "wave" ki tarah hota hai, jisme aksar 5 waves hote hain. In waves ko connect karke ek pattern banta hai. Wolf wave pattern formation Wolf wave pattern ek technical analysis tool hai jo trading me istemal hota hai. Is pattern ka basic idea market me repeating price patterns ko pehchanne ka hai. Is pattern ko identify karne ke liye aapko market ke price movements ko closely observe karna hota hai. Wolf wave pattern ka formation typically 5 waves se hota hai, jinme 3 bullish (upward) waves aur 2 bearish (downward) waves hoti hain. Ye waves Fibonacci ratios aur channel lines ke madhyam se determine kiye ja sakte hain. Wolf wave pattern ko recognize karne ke liye aapko market charts par closely price movements dekhni hoti hain aur Fibonacci ratios ka istemal karke potential entry aur exit points ko identify kar sakte hain. How to trade Wolf wave pattern Wolf wave pattern ek technical analysis tool hai jo price charts ko analyze karke potential trading opportunities ko identify karne mein madadgar ho sakta hai. Wolf wave pattern ko trade karne ke liye, neeche diye gaye steps follow kar sakte hain: Chart Setup: Sabse pehle, trading platform par ek price chart open karein. Wolf wave pattern usually 1-hour or 4-hour charts par jyada effective hota hai. Pattern Recognition: Wolf wave pattern ko pehchanne ke liye, aapko specific price swings ko dekhna hoga. Ye pattern usually 5 price swings se bana hota hai. Ismein 3 bullish (upward) swings aur 2 bearish (downward) swings hote hain. Pattern Validation: Once you spot the potential Wolf wave pattern, verify it by checking if the price swings follow the typical proportions of the pattern. Wolf wave patterns have specific Fibonacci-based relationships between the waves. Entry Point: Entry point ko define karne ke liye, aap last bullish swing ke breakout point par entry kar sakte hain. Is point par aap long position le sakte hain. Stop Loss aur Target: Trade ko manage karne ke liye stop loss aur target levels set karein. Stop loss aapko protect karega agar trade opposite direction mein move hota hai, aur target level aapko profit booking mein madad karega. Risk Management: Hamesha ek sound risk management strategy apnayein. Position size ko control karein taki aap apne capital ko protect kar sakein. Monitor the Trade: Trade open karne ke baad, market ko closely monitor karein. Price action ke changes ko dekhte rahein aur trade ko manage karein. Exit Strategy: Jab price target level tak pahunch jaye ya fir trade unfavorable direction mein move kar raha ho, to trade ko exit karein. -

#38 Collapse

Wolf wave plan in k nam yeh Smjhny mn hmari madad karny mn kar aamad hain k woh kisqisam ko namoony hain or hmein outline mn inko khn talash karna hai is mamlay mn hanging man itna he bura hai jitna isay lagta hai yeh negative inversion plan hai tamam v. infaradi candles ki tameer mn consume server farms ka istamal kia jata hai woh khulay ,qareebi ,aala or aadna hain. very likely server farms Jan,ny waly merchants ko bailon or reachon k darmyian jang ki Halat ko wazhaiy karny mn madad karty hain jo kah market mn hissa leny walon ki aksaryiat hai fire plan her waqt k bhi fareemon mn zahir ho sakty hain.Hanging man aik Light arrangement ka namoona hai chun kah yeh switch pattren hai is liay pattren k zahir hony sy phlay is kaleay kuch hona zaroori hai market kaleay yeh zaroori nhi hai lkn pattren k zahir hony sy phlay qeematon mn qabilay shanakht izafa hota hai.Trade k aggaz mn inaam ki j miqdar ka taayian karna bhi mushkil ho sakta hai kunkah flame plan aam toor standard munafy k ahdaaf farham nha karta hai is k bajaiy venders ko kise bhi qisam ki exchange sy bahir nikalny kaleay degar candles k model ki zarort hote hai ya tejarati hikmat ay aamali istamal karty hain jo kah hanging man pattren k zaraiy shuru hote hai is bat ki bhi koi yaqeen dehani nhi hai kah hanging man banny k terrible qeemat kam ho jaiy ge chaiy aik tasdeeqi candle ho yahi waja h Hanging Man Model kya hy Hanging man plan ki tasdeeq nhi hoti jaders dusri specific evaluation instruments aur pointers ka istemal karte hain. Is plan ko dekh kar, sellers apni exchanging systems aur choices banate hain."Hanging Man" is a fire design utilized in forex exchanging. A solitary light arrangement for the most part shows up near the fulfillment of a rise and proposes a typical inversion in the cost heading. The Hanging Man setup is framed when the open, high, and close costs are near one another, with a long lower shadow and near zero upper shadow.Hanging Man light arrangement Forex mein ek negative inversion plan hai. Yeh plan regularly rise ke baad dikhta hai aur negative cost inversion ko display karta hai. Hanging Man plan mein ek little body hota hai jo ub tk qeemat aagli mudat ya is k foran loathsome gir na jaiy hanging man qeemat ko hanging cadle ki oonchi qeemat sy bioppar nhi jana chahaiy kun k yeh mumkina toor standard aik qeemat ki paish qadmi ka ishara hai Agar qeemat hanging man k dreadful girti hai to is sy pattren ki tasddeq hote j hai or fire k middle people isay lambi position sy nikalny or mukhtasir position mn dakhil hony k toor standard istamal karty hain hanging man ki tasddeq hony k jo awful aik nai mukhtasir position mn dakhil hony ki soraat mn aik stop nuqsan hanging man ki oonchai k oppar rakha ja sakta hai.hanging mn pattren is waqt hota hai jb kam az kam chand candles kaleay qeemat zyadi honi chaeiy yeh aik bari paish barge ki zarort nhi hai yeh ho sakta hai lkn pattren aik bary neechy k rojhan k darmyianb aik mukhtasir mudat k izafy k andar bhi ho sakta hai.Hanging man ki aik haad or bhut sy light arrangement yeh hai k tasdeeq ka intazar karny k nateejy mn dakhly ka makam khrab ho sakta hai qeemat do adwar k andar itni teezi sy barh sakti hai k sellers mumkina inaam khatray ka jawaz nhi boycott sakta hai. -

#39 Collapse

Wolf wave pattern.. je aj ham baat krta hai je Wolf wave pattern forex market mein ek technical analysis tool hai. jee han essa traders use karte hain price patterns aur trend reversals ko identify karne ke liye. jee han aur Is pattern ka naam Wolf wave hai. hanji kyun ka iski shape ek wolf jassi hoti hain. kuch lomdi ki tarah hota hai. jee han Is pattern mein price chart par ak specific peaks aur valleys hotey hain,hanji aur jinhe hum legs kehte hain.hanji aur ap ko wo dakhna ma ak Wolf wave pattern mein legs, price chart par peaks aur valleys hote hain.hanji aur ya ak legs typically 1 ya 3 ya 4 number tak hote hain je aur ya upar neeche ghoomte hain. aur In legs ko waves bhi kaha jata hai.jee han aur Har wave previous wave ki length ka multiple hota hai. Agar price chart par 1st wave hai aur ap toh 2nd wave uski length double hi hogi,jee asa aga sa 3rd wave uski length triple hogi,phr aur aga sa uski langth 4th wave uski length four times hong hoti hain. Explanation.. jee phr yeh note karna bhi zaroori hai ke wolf view patteren hain. je aur is ki shanakht aur tijarat karte waqt apko bhot ahtyat aur tajurbah ki zaroorat hoti hai. asa taajiron ko sirf is tarz ki bunyaad par aur tijarti faislay karne se pehlay bhot ahtyat aur deegar awamil jaisay market ke halaat ko madanazar rakh kr hajam, aur bunyadi tajzia par ghhor karna chahiye hota hain.phr ya aakhir mein, wolf wave aik chart patteren hai is sa jo bi taajiron ki janib se mumkina aur qeematon mein aga ki tabdeeli ki nishandahi karne ke liye hi istemaal kya jata hai.jee han aur ap aga yeh dakha ga ka ya paanch lehron par mushtamil hain. aur yeh tazi sa tajir is patteren ki tasdeeq kra aur dakh lay aur kharji raastoon ka taayun karne ke liye izafi isharay aur ozaar istemaal karte hain. hanji asa ap taham, kisi bhi doosri tijarti aur bi hikmat e amli ki terhan, aga yeh faul proof nahi hai,hanji aga aur taajiron ko ahthyat brtni chahiye aur tijarti faislay karne se pehlay ahtyat aur deegar awamil par ghhor karna chahiye phr hi ap achi tijarat kar skta hain. -

#40 Collapse

Wolf Wave Candlestick Pattern: Wolf Wave ek candle design hai jo specialized examination mein istemal hota hai. Ye design market patterns aur cost development ko recognize karne mein madad karta hai. Is design ki recognizable proof aur istemal kaafi basic hai, aur iske istemal se brokers market ke future heading ko foresee kar sakte hain. Wolf Wave design diagram standard cost development ki shape aur calculation ke zariye distinguish kiya jata hai. Is design mein cost development explicit pinnacles aur box (unchaayi aur neechayi focuses) standard concentrate hota hai. Ye tops aur box ek explicit wave structure mein organize hote hain.Identification : Wolf Wave design ki pehchan karne ke liye, aapko kuch steps follow karne hote hain. Sabse pehle, aapko 5 pinnacles aur 5 box dhoondhne hote hain. Ye tops aur box ek crisscross example mein hote hain, jaise ki wave banate huye. Punch aap in 5 pinnacles aur 5 box ko dhoondh lete hain, to aap ek explicit calculation ko dekh payenge. Wolf Wave design ka principal include hai "1-2-1-2-3" structure. Is structure mein, pehle do tops aur do box close hote hain, phir agle do tops aur do box close hote hain, aur akhir mein teesra top boycott jata hai. Is structure ko dekh kar aap Wolf Wave design ko affirm kar sakte hain. .

Direction for Dealers : Wolf Wave design ko use karne ke liye, dealers iske calculation aur cost levels ko intently screen karte hain. Poke design affirm hota hai, dealers purchase aur sell signals create kar sakte hain.Agar market mein Wolf Wave design boycott raha hai aur cost current level se neechay aa raha hai, to merchants ko purchase signal mil sakta hai. Iske liye, merchants support level standard purchase kar sakte hain. Support level wo level hota hai jahan se cost ka ummeed kiya jata hai ki woh badhna shuru karega. Iske baad dealers apne stop misfortune aur target levels set karte hain.Agar market mein Wolf Wave design boycott raha hai aur cost current level se upar aa raha hai, to brokers ko sell signal mil sakta hai. Iske liye, brokers opposition level standard sell kar sakte hain. Opposition level wo level hota hai jahan se cost ka ummeed kiya jata hai ki woh ghatna shuru karega. Iske baad merchants apne stop misfortune aur target levels set karte hain.Wolf Wave design mein stop misfortune levels tight rakhe jaate hain kyunki brokers ek explicit wave structure standard depend karte hain. Target levels ko cost development aur past patterns ke hisab se set kiya jata hai.

Outline : Wolf Wave design ka istemal karne se pehle, dealers ko iske sahi recognizable proof ke liye practice aur experience ki zaroorat hoti hai. Candle designs ko study karne ke liye achi information aur specialized examination apparatuses ki zaroorat hoti hai.Wolf Wave candle design ek amazing asset hai jo merchants ko market patterns aur cost development ke exposed mein data deta hai. Iski ID aur istemal kaafi basic hai, aur iske istemal se dealers purchase aur sell signals create kar sakte hain. Brokers ko is design ko samajhne aur istemal karne ke liye practice aur experience ki zaroorat hoti hai ..

-

#41 Collapse

Introduction Dear friends wolf view aik chart patteren hai jo qeemat mein paanch lehar pattern par mushtamil hai jo bunyadi tawazun ki qeemat ka ishara karta hai is nizaam ko istemaal karne walay sarmaya car patteren ki taraf se ishara kardah muzahmat aur support linon ki bunyaad par apni tijarat ka waqt karte Hain Wolf Wave Pattern Dear friends Tqniki tajzia mein wolfe waves qeemat ke patteren hain jo paanch lehron par mushtamil hain jo ke taizi ya mandi ke rujhanaat ki nishandahi karti hain wolfe wave ke tor par sahih tareeqay se shanakht karne ke liye mayarat ki aik series ko poora karna zaroori hai jaisay ke lehron ke chakkar teesri aur chothi lehron mein aik jaisi aur allag qeemat ki karwai hain aik haqeeqi volf view ke liye pattern mein panchwin lehar ki misaal ke baad qeemat mein break out Hoga Explain Wolf Wave Dear friends wolf view patteren ki shanakht sab se pehlay bil volf aur is ke betay Brian ne ki. volf ke mutabiq, yeh qudrati tor par tamam baazaaron mein paye jatay hain un ko pehchanney ke liye taajiron ko qeemat ke ki aik series ki nishandahi karni chahiye jo makhsoos miyaar ke mutabiq hon lehron ko aik mustaqil waqt ke waqfay par chakkar lagana chahiye teesri aur chothi lehron ko pehli aur doosri lehron ke zareya banaye gaye channel ke andar rehna chahiye teesri aur chothi lehron ko pehli aur doosri lehron ke sath hum ahangi dikhani chahiye channel se bahar patteren ke peechay nazriya ke mutabiq pehli lehar ke aaghaz mein nuqta se khenchi gayi aur chothi lehar ke aaghaz se guzarnay wali aik lakeer panchwin lehar ke ekhtataam ke liye hadaf ki qeemat ki paish goi karti hai agar koi tajir wolfe wave ki tashkeel ke sath hi is ki sahih shanakht karta hai to panchwin lehar ka aaghaz taweel ya mukhtasir position lainay ka mauqa faraham karta HaiIdentificationDear friends takneeki tajzia chart patteren ka istemaal karta hai jaisay volf waves ziyada se ziyada munafe ke liye market ki naqal o harkat aur waqt ki tijarat ki paish goi karne ke liye tajir jo takneeki tajzia ka istemaal karte hain woh charts ko dekhte hain jo aik muddat ke douran sikyortiz ke liye qeemat ki naqal o harkat ko zahir karte hain aam tor par takneeki tajzia supply aur demand ke nazriaat par munhasir hota hai jo qeematon ki makhsoos sthon ko oopar ya neechay zahir karta hai jis se sikyortiz tijarat ke liye jad o jehad karen gi support ki sthin qeematon ke masawi hoti hain taakay hasas ki qeematon ko mustahkam karne aur badhaane ke liye kaafi maang ko Raghib kya ja sakay jab ke muzahmat ki satah itni ziyada qeematon ke masawi hai ke hasas yaftgan ko hasas baichnay aur munafe lainay talabb ki satah ko kam karne aur qeematon ki satah ko neechay ya giranay ka baais banti hai

-

#42 Collapse

WOLF WAVE PATTERN DEFINITION Pattern ke sath market ki movement ki predicting trade decision karne ke liye sabse effective tool mein se ek hai chart pattern bahut kam price action underling buying and selling pressure ki basis hai vah support and resistance level ke sath sath Trend lines ke Zyada Complex versions se bante Hain patterns ka ek proven track record aur day trader reversal ya continuation ke signal ki identify ke liye UN per inehisar Karte Hain traders Janne Main help ke liye pattern bhi look Karte Hain Ke Aaya Mushkilat unke favor Mein Hain however yeh ek slightly less known lekin utna hi effective harmonic pattern hai Jise wolf wave pattern Kahate Hain Agar aapane harmonic pattern ka studied Kiya Hai tu aap probably pattern ki More common type jisse butterfly gartly Bat cypher and crape pattern se Vakyf Ho Gaye WHY IT FORM AND WHAT IT MEAN bill wolf other indicator ke use ke against Honge suggest karte hain kya wolf wave Apne methodology Mein alone hai bill wolf ke mutabik wolf wave naturally Paida hone wala harmonic pattern hai jo Har time Tamam financial chart main Paya Ja sakta hai pattern Bearish ya bullish trend indicate kar sakta hai wolf wave ko ek future time ke interval se cycle karna padta hai 3rd and 4th wave ko first and second Wave ke sath symmetry dikhani Hogi third and fourth wave ko first and second wave Ke zariya banae Gaye channel ke andar Rahana hoga

WHY IT FORM AND WHAT IT MEAN bill wolf other indicator ke use ke against Honge suggest karte hain kya wolf wave Apne methodology Mein alone hai bill wolf ke mutabik wolf wave naturally Paida hone wala harmonic pattern hai jo Har time Tamam financial chart main Paya Ja sakta hai pattern Bearish ya bullish trend indicate kar sakta hai wolf wave ko ek future time ke interval se cycle karna padta hai 3rd and 4th wave ko first and second Wave ke sath symmetry dikhani Hogi third and fourth wave ko first and second wave Ke zariya banae Gaye channel ke andar Rahana hoga  WOLF WAVE EXAMPLE Break out line aapko trade Mein enter hone ke liye best place Dikhati Hai aap resistance ke bilkul Above ya point five se upar Ek Stop loss Rakh sakte hain Hamare trade room ko breath and develop ke liye Humne usi point five ke Above rakhne ka intekhab Kiya Hai zero.08 fy share potential loss ke liye 46.9$ Paar Rakha jata hai bearish aur bullish wali wolf wave donon ki trade same ways Se Hoti Hai wave five ke channel Mein enter hone 46.82$ per Dobara enter hone ke bad trade mein enter hon again enter hone per pattern ki confirming hoti hai

WOLF WAVE EXAMPLE Break out line aapko trade Mein enter hone ke liye best place Dikhati Hai aap resistance ke bilkul Above ya point five se upar Ek Stop loss Rakh sakte hain Hamare trade room ko breath and develop ke liye Humne usi point five ke Above rakhne ka intekhab Kiya Hai zero.08 fy share potential loss ke liye 46.9$ Paar Rakha jata hai bearish aur bullish wali wolf wave donon ki trade same ways Se Hoti Hai wave five ke channel Mein enter hone 46.82$ per Dobara enter hone ke bad trade mein enter hon again enter hone per pattern ki confirming hoti hai

- Mentions 0

-

سا0 like

-

#43 Collapse

Introduction of wolf wave pattern Dear fellows aj hum market ki prediction k liye aik important wolf wave pattren kay related discussion krain ge Wolf Pattern five waves se milkar banta hay. Jis main seller aur buyer ki fight ki waja se market stability ki taraf move kerti hain. wolf Pattern some time frames main perfect kam karta hy Laikin tamam candlesticks pattern ki tarah iski effectivity and tasdiq kay liye humein sirf akely candlesticks pattern say he help nahi milti lakin iskay sath hamain fundamental analysis bhi karny party hain takayhum apni trade say behtar traqe se trend ki reversal main order place karte huye achi kamai kar sakain takke loss say bhi bachne ki kossish ki ja ske tak hum profit le sakain. interpretation of wolf wave pattern dear friends kisi bi pattern per kam krne k liye knowldge hona boht zarori ha tk hum apna work bihtre traiqe se kr skain Wolfe wave theory ik bhot he informative theory hai is kay istemal Kar kay hum trading main kamyabi Hasil kar sakte hain ,aur is main hum Apna knowledge or tujrba increased kar skte hain. Hum dkhte hain ki forex market Jb Bhi active hoti ha Hai To yeh Kisi Na Kisi trend main hrket kr rhi Hoti Hai. yah market ka down jane ka time bhi ho skta hai aur Market ka uptrend bhi ho sakta hai. Market main Jb Bhi Yai active kiya jata hay hto aap Kisi bhi support yah resistance per hi bante Huae nazer ate hain is main bhut Sary patterns bante hain jinko aap follow kar sakte hain.our apni trading main bihtere la sakte hainaur market mein kamyabi hasil ker lety hein. Technical analysis. Yeh pattern market mein traders ka favourite pattern hotra hy kyu kay yeh market ki prediction mein bhout zuada help kerta hy.yeh pattern jab market mein creat hota hai tou market continue aik hi trend main movement ker rehi hoti hai lekin continuous retracement lety huey again trend ko follow kerna start ker deti hay.ess leye Ham her retracement sy faida hasil ker sakty hain trend ko follow kerty huey trade open ker ky but jab market maximum support ya resistance per rerach ker chuki ho tou trend ko follow kerty huey tou wahan per yeh risk nehi lena chahiay ky aesa bhi jo sakta hay kay market trend kp follow na kery aur apni direction change ker kay opposit side per movement start ker dey,jis traders ko big losss bi ho sakta hyjis trading ko bachany kay leye stop loss ko use kiya jata hy ta kay tarders ka capital bach jaye aur small loss recover ho sakta but big loss ko recover kerna so,metime possible nahi rehta. -

#44 Collapse

WOLF WAVE PATTERN DEFINITION Pattern ke sath market ki movement ki predicting trade decision karne ke liye sabse effective tool mein se ek hai chart pattern bahut kam price action underling buying and selling pressure ki basis hai vah support and resistance level ke sath sath Trend lines ke Zyada Complex versions se bante Hain patterns ka ek proven track record aur day trader reversal ya continuation ke signal ki identify ke liye UN per inehisar Karte Hain traders Janne Main help ke liye pattern bhi look Karte Hain Ke Aaya Mushkilat unke favor Mein Hain however yeh ek slightly less known lekin utna hi effective harmonic pattern hai Jise wolf wave pattern Kahate Hain Agar aapane harmonic pattern ka studied Kiya Hai tu aap probably pattern ki More common type jisse butterfly gartly Bat cypher and crape pattern se Vakyf Ho Gaye WHY IT FORM AND WHAT IT MEAN bill wolf other indicator ke use ke against Honge suggest karte hain kya wolf wave Apne methodology Mein alone hai bill wolf ke mutabik wolf wave naturally Paida hone wala harmonic pattern hai jo Har time Tamam financial chart main Paya Ja sakta hai pattern Bearish ya bullish trend indicate kar sakta hai wolf wave ko ek future time ke interval se cycle karna padta hai 3rd and 4th wave ko first and second Wave ke sath symmetry dikhani Hogi third and fourth wave ko first and second wave Ke zariya banae Gaye channel ke andar Rahana hoga

WHY IT FORM AND WHAT IT MEAN bill wolf other indicator ke use ke against Honge suggest karte hain kya wolf wave Apne methodology Mein alone hai bill wolf ke mutabik wolf wave naturally Paida hone wala harmonic pattern hai jo Har time Tamam financial chart main Paya Ja sakta hai pattern Bearish ya bullish trend indicate kar sakta hai wolf wave ko ek future time ke interval se cycle karna padta hai 3rd and 4th wave ko first and second Wave ke sath symmetry dikhani Hogi third and fourth wave ko first and second wave Ke zariya banae Gaye channel ke andar Rahana hoga  WOLF WAVE EXAMPLE Break out line aapko trade Mein enter hone ke liye best place Dikhati Hai aap resistance ke bilkul Above ya point five se upar Ek Stop loss Rakh sakte hain Hamare trade room ko breath and develop ke liye Humne usi point five ke Above rakhne ka intekhab Kiya Hai zero.08 fy share potential loss ke liye 46.9$ Paar Rakha jata hai bearish aur bullish wali wolf wave donon ki trade same ways Se Hoti Hai wave five ke channel Mein enter hone 46.82$ per Dobara enter hone ke bad trade mein enter hon again enter hone per pattern ki confirming hoti hai

WOLF WAVE EXAMPLE Break out line aapko trade Mein enter hone ke liye best place Dikhati Hai aap resistance ke bilkul Above ya point five se upar Ek Stop loss Rakh sakte hain Hamare trade room ko breath and develop ke liye Humne usi point five ke Above rakhne ka intekhab Kiya Hai zero.08 fy share potential loss ke liye 46.9$ Paar Rakha jata hai bearish aur bullish wali wolf wave donon ki trade same ways Se Hoti Hai wave five ke channel Mein enter hone 46.82$ per Dobara enter hone ke bad trade mein enter hon again enter hone per pattern ki confirming hoti hai

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#45 Collapse

wolf pettern wolfe wave har market mein paaya aik qudrati patteren hai. is ki bunyadi shakal balance, ya tawazun ke liye aik larai zahir karta hai, farahmi aur maang ke darmiyan. yeh qudrati pinnacle standard waqay patteren ijaad nahi kya gaya tha lekin is ki bajaye farahmi aur mutalba ki enthusiasm goi ki satah ke peak standard daryaft kya gaya tha. yeh patteren waqt ke lehaaz se bohat ورسٹائل hain, lekin woh gunjaish ke lehaaz se makhsoos hain. misaal ke peak standard, volf lehron mein waqt ke Ùریموں ki aik wasee range mein hota hai, minute ke douran ya is se bhi poke tak ke channel standard munhasir hai. doosri taraf, gunjaish herat angaiz durustagi ke sath paish goi ki ja sakti hai. is wajah se, hit sahih tareeqay se istehsal kya jata hai, wolfe lehar intehai muaser saabit hosakti hai . explantion volf view patteren ki shanakht sab se pehlay bil volf aur is ke betay Brian ne ki. volf ke mutabiq, yeh qudrati top standard tamam baazaaron mein paye jatay hain. un ko pehchanney ke liye, taajiron ko qeemat ke ki aik series ki nishandahi karni chahiye jo makhsoos miyaar ke mutabiq hon : lehron ko aik mustaqil waqt ke waqfay standard chakkar lagana chahiye. teesri aur chothi lehron ko pehli aur doosri lehron ke zareya banaye gaye channel ke andar rehna chahiye. teesri aur chothi lehron ko pehli aur doosri lehron ke sath mumble ahangi dikhani chahiyechannel se bahar patteren ke peechay nazriya ke mutabiq, pehli lehar ke aaghaz mein nuqta se khenchi gayi aur chothi lehar ke aaghaz se guzarnay wali aik lakeer panchwin lehar ke ekhtataam ke liye hadaf ki qeemat ki paish goi karti hai. agar koi tajir wolfe wave ki tashkeel ke sath hello is ki sahih shanakht karta hai, to panchwin lehar ka aaghaz taweel ya mukhtasir position lainay ka mauqa faraham karta hai. hadaf ki qeemat lehar ke ekhtataam ki pishin goi karti hai, aur is liye woh maqam jis standard tajir ka maqsad position se faida uthana hai

explantion volf view patteren ki shanakht sab se pehlay bil volf aur is ke betay Brian ne ki. volf ke mutabiq, yeh qudrati top standard tamam baazaaron mein paye jatay hain. un ko pehchanney ke liye, taajiron ko qeemat ke ki aik series ki nishandahi karni chahiye jo makhsoos miyaar ke mutabiq hon : lehron ko aik mustaqil waqt ke waqfay standard chakkar lagana chahiye. teesri aur chothi lehron ko pehli aur doosri lehron ke zareya banaye gaye channel ke andar rehna chahiye. teesri aur chothi lehron ko pehli aur doosri lehron ke sath mumble ahangi dikhani chahiyechannel se bahar patteren ke peechay nazriya ke mutabiq, pehli lehar ke aaghaz mein nuqta se khenchi gayi aur chothi lehar ke aaghaz se guzarnay wali aik lakeer panchwin lehar ke ekhtataam ke liye hadaf ki qeemat ki paish goi karti hai. agar koi tajir wolfe wave ki tashkeel ke sath hello is ki sahih shanakht karta hai, to panchwin lehar ka aaghaz taweel ya mukhtasir position lainay ka mauqa faraham karta hai. hadaf ki qeemat lehar ke ekhtataam ki pishin goi karti hai, aur is liye woh maqam jis standard tajir ka maqsad position se faida uthana hai

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:24 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим