AUD/USD ka Technical Analysis

H-1 Timeframe Analysis

Pichle trading week mein, Australian dollar apne establish range ke lower end par pahunch gaya aur isse rebound karne ki koshish ki. Lekin, poori tarah se recover karne mein asafalta ke baad, price ne reverse kiya aur apna downtrend dobara shuru kiya, flat lower boundary 0.6506 ko tod kar aur usi samay reverse hua. Is natije mein, expected growth ka scenario kabhi poora nahi hua. Isi beech, price chart super-trending red zone mein hai, jo bechne wale ki zyada dabav ko dikhata hai.

Technical taur par, stochastic price ko neeche ki taraf daba raha hai. Neeche diye gaye timeframe ka istemal karte hue, hum dekh rahe hain ki indicators bearish direction ko dikhate hain. Main selling entry ke liye tayar hoon, lekin hum uske broken support level ko complete karne wale retest process ka intezaar kar sakte hain. Yeh ek tez bearish reversal ko confirm karega. Agar price broken levels ke upar move karti hai, toh S/L ko hit karegi. Hum breakout entry milne par apna scenario badal denge. Chart neeche dekhein:

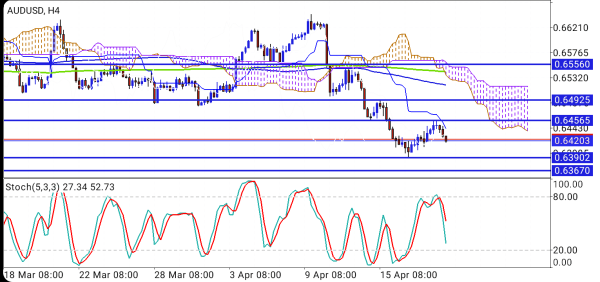

H-4 Timeframe Analysis

Pair abhi kafi nicha hai, haftay ke hilchul se door ja raha hai jo haal hi mein reach kiya tha. Ek key support area ant mein tod kar uchaala gaya, jo favored vector mein ek niche ki shift ki zaroorat ko dikhata hai. Ab, quotes correction ke hisse ke roop mein wapas lane ki koshish kar rahe hain, khona hua hissa wapas jeetne ki koshish kar rahe hain. Lekin, is correction ki seema 0.6506 level ke as-pas mil sakti hai, jahan mukhya resistance area ab maujood hai. Is area se dobara retest aur uske baad rebound, pair ko dobara girne ki ijazat dega, jo 0.6326 aur 0.6272 ke beech ke area ko target karega.

Agar resistance toot jati hai aur price 0.6573 reversal level ko tod deti hai, toh current situation ko cancel karne ka signal mil jaayega. Neeche diye gaye chart ko dekhein:

H-1 Timeframe Analysis

Pichle trading week mein, Australian dollar apne establish range ke lower end par pahunch gaya aur isse rebound karne ki koshish ki. Lekin, poori tarah se recover karne mein asafalta ke baad, price ne reverse kiya aur apna downtrend dobara shuru kiya, flat lower boundary 0.6506 ko tod kar aur usi samay reverse hua. Is natije mein, expected growth ka scenario kabhi poora nahi hua. Isi beech, price chart super-trending red zone mein hai, jo bechne wale ki zyada dabav ko dikhata hai.

Technical taur par, stochastic price ko neeche ki taraf daba raha hai. Neeche diye gaye timeframe ka istemal karte hue, hum dekh rahe hain ki indicators bearish direction ko dikhate hain. Main selling entry ke liye tayar hoon, lekin hum uske broken support level ko complete karne wale retest process ka intezaar kar sakte hain. Yeh ek tez bearish reversal ko confirm karega. Agar price broken levels ke upar move karti hai, toh S/L ko hit karegi. Hum breakout entry milne par apna scenario badal denge. Chart neeche dekhein:

H-4 Timeframe Analysis

Pair abhi kafi nicha hai, haftay ke hilchul se door ja raha hai jo haal hi mein reach kiya tha. Ek key support area ant mein tod kar uchaala gaya, jo favored vector mein ek niche ki shift ki zaroorat ko dikhata hai. Ab, quotes correction ke hisse ke roop mein wapas lane ki koshish kar rahe hain, khona hua hissa wapas jeetne ki koshish kar rahe hain. Lekin, is correction ki seema 0.6506 level ke as-pas mil sakti hai, jahan mukhya resistance area ab maujood hai. Is area se dobara retest aur uske baad rebound, pair ko dobara girne ki ijazat dega, jo 0.6326 aur 0.6272 ke beech ke area ko target karega.

Agar resistance toot jati hai aur price 0.6573 reversal level ko tod deti hai, toh current situation ko cancel karne ka signal mil jaayega. Neeche diye gaye chart ko dekhein:

تبصرہ

Расширенный режим Обычный режим