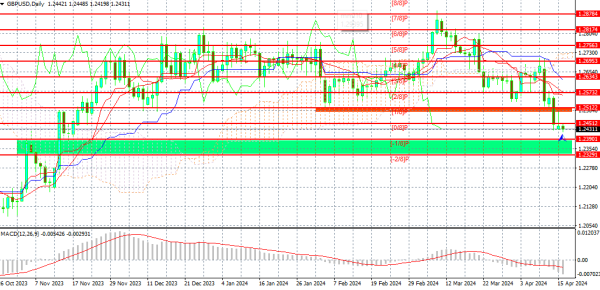

GBPUSD

GBP/USD jodi ne bhi peer ko aik minor bullish correction shuru karne ki koshish ki, lekin din ke doosre hisse mein neeche ki taraf jaari movement ho gayi. Yaad rakhen ke pichhle haftay aik ahem waqiya waqe ho gaya - jodi ne 4 mahine ke sideways channel ko chhoda aur ab mazid taiz downtrend shuru ho sakta hai. Pichhle haftay se dar lag raha tha ke naya hafta doosre bina maqool tareeqay se pound ki uthar chadhao se shuru hoga, lekin ab tak yeh mani nahi gayi hai. British pound euro ke saath girna chahiye, kyun ke US dollar ko uthane ke bohot se aur bhi wajahat hain.

Jodi ke girne ka mukhya sabab Federal Reserve ki hawkish policy hai, jab ke market ne US central bank se monitory easing ka umeed kiya tha. Yeh umeedain sabit nahi hui, kyun ke United States mein inflation barh rahi hai. Usi waqt, United Kingdom mein is haftay tak inflation 3% tak pohanch sakta hai, jo ke Bank of England ko pehli policy easing ki timing ka mawqaa denge.

5-minute timeframe par movement aur trading signals behtar nahi the. European trading session ke doran, 1.2457 ke level ke ird gird aik buy signal ban gaya, lekin price sirf kuch pips ke farq se 1.2502 ke maqam tak nahi pohanch saki. Baad mein, 1.2457 ke level se rebound hua, lekin price dobara target level tak nahi pohanchi. Is liye, pehle do signals ko jhootle signals samjha ja sakta hai, aur teesra signal 1.2457 ke level ke ird gird nahi hona chahiye tha. Dono trades se sirf manfi profit mila agar trades haath se band kiye gaye hote.

Tuesday ke liye trading tips: Ghanton chart par, GBP/USD jodi ke paas ab asal technical asool hain ke 4 mahine ke flat phase ko khatam kiya jaye. 1.2502 ke maqam ko paar karne ke baad, traders ko aik naya downtrend ka intezar ho sakta hai. Bunyadi aur macroeconomic pehlu dollar ko British one ke muqable mein zyada sahara dete hain. Is liye, hum sirf jodi se neeche ki taraf jaari movement ka intezar karte hain.

Tuesday ko, naye traders ko 1.2502 ke neeche sell signals dhoondhne chahiye. Aik correction aasakta hai, lekin yeh koi mazboot movement nahi hogi. Agar price jald hi 1.2502 ke maqam se upar nahi lautti, to downtrend ka mawqaa aur zyada barh jayega.

5M chart par mukhya levels hain 1.2270, 1.2310, 1.2372-1.2387, 1.2457, 1.2502, 1.2544, 1.2605-1.2611, 1.2648, 1.2691, 1.2725, 1.2787-1.2791. Aaj, UK ko bayrozgari, bayrozgari ke dawayen aur average earnings ke reports jari kiye jayenge. Yeh data jodi ke movement par asar daal sakta hai, lekin downtrend ka jari rehna expected hai. US sirf minor reports jari karega.

GBP/USD jodi ne bhi peer ko aik minor bullish correction shuru karne ki koshish ki, lekin din ke doosre hisse mein neeche ki taraf jaari movement ho gayi. Yaad rakhen ke pichhle haftay aik ahem waqiya waqe ho gaya - jodi ne 4 mahine ke sideways channel ko chhoda aur ab mazid taiz downtrend shuru ho sakta hai. Pichhle haftay se dar lag raha tha ke naya hafta doosre bina maqool tareeqay se pound ki uthar chadhao se shuru hoga, lekin ab tak yeh mani nahi gayi hai. British pound euro ke saath girna chahiye, kyun ke US dollar ko uthane ke bohot se aur bhi wajahat hain.

Jodi ke girne ka mukhya sabab Federal Reserve ki hawkish policy hai, jab ke market ne US central bank se monitory easing ka umeed kiya tha. Yeh umeedain sabit nahi hui, kyun ke United States mein inflation barh rahi hai. Usi waqt, United Kingdom mein is haftay tak inflation 3% tak pohanch sakta hai, jo ke Bank of England ko pehli policy easing ki timing ka mawqaa denge.

5-minute timeframe par movement aur trading signals behtar nahi the. European trading session ke doran, 1.2457 ke level ke ird gird aik buy signal ban gaya, lekin price sirf kuch pips ke farq se 1.2502 ke maqam tak nahi pohanch saki. Baad mein, 1.2457 ke level se rebound hua, lekin price dobara target level tak nahi pohanchi. Is liye, pehle do signals ko jhootle signals samjha ja sakta hai, aur teesra signal 1.2457 ke level ke ird gird nahi hona chahiye tha. Dono trades se sirf manfi profit mila agar trades haath se band kiye gaye hote.

Tuesday ke liye trading tips: Ghanton chart par, GBP/USD jodi ke paas ab asal technical asool hain ke 4 mahine ke flat phase ko khatam kiya jaye. 1.2502 ke maqam ko paar karne ke baad, traders ko aik naya downtrend ka intezar ho sakta hai. Bunyadi aur macroeconomic pehlu dollar ko British one ke muqable mein zyada sahara dete hain. Is liye, hum sirf jodi se neeche ki taraf jaari movement ka intezar karte hain.

Tuesday ko, naye traders ko 1.2502 ke neeche sell signals dhoondhne chahiye. Aik correction aasakta hai, lekin yeh koi mazboot movement nahi hogi. Agar price jald hi 1.2502 ke maqam se upar nahi lautti, to downtrend ka mawqaa aur zyada barh jayega.

5M chart par mukhya levels hain 1.2270, 1.2310, 1.2372-1.2387, 1.2457, 1.2502, 1.2544, 1.2605-1.2611, 1.2648, 1.2691, 1.2725, 1.2787-1.2791. Aaj, UK ko bayrozgari, bayrozgari ke dawayen aur average earnings ke reports jari kiye jayenge. Yeh data jodi ke movement par asar daal sakta hai, lekin downtrend ka jari rehna expected hai. US sirf minor reports jari karega.

تبصرہ

Расширенный режим Обычный режим