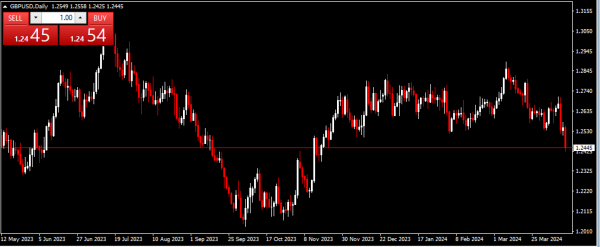

GBP/USD Technical Analysis.

GBP/USD currency pair ke price charts mein gaps nazar aa rahe hain. Ye kuch logon ke liye hairat angaiz ho sakta hai, lekin forex market mein ye mamooli baat hai. Traders ke paas in gaps ka samna karne ke liye mukhtalif strategies hoti hain, jaise ke gap-closing theories istemal karna. Aaj, mein GBP/USD pair ko dobara tajziya karunga. Daily chart dekhne par, hum price movement mein neeche ki taraf gaps ko dekh sakte hain. Dilchasp baat ye hai ke ye neeche ki taraf ke gaps ne price ko lower Bollinger Band area tak le gaye hain, jo ke mazeed neeche ki taraf momentum ko zahir karta hai. Price Bollinger Bands ke darmiyan ilaqa mein hai, taqreeban 1.2655 supply area ke aas paas. Jab maqsood tak pohanch jaye, to mein ek bechnay ka moqa talash karunga, jis ka nishana 1.2690 ke qareeb demand area hai. Magar yeh ahem hai ke bazaar ke dynamics jaldi se tabdeel ho sakte hain. Agar price ahem support/resistance level 1.2580 ko rad kar de, to ye demand se supply mein tabdeel hone ka ishara ho sakta hai.

Ye trend mazboot lag raha hai, ishara hai ke koi bhi mumkin breakout pehle resistance levels 1.2775 aur mazeed baad mein 1.2830 ki taraf ja kar hoga. Akhri level, khaaskar, ahmiyat rakhta hai kyun ke ye mustaqbil mein psychological resistance 1.3000 ka samna karne ki umeedon ko banata hai. Isi doran, is muddat ke dauran, 1.2600 ke support level ka ehem kirdar barkarar rakhne ki tayyari hai, jis se beron ke liye trend par qawi aur mustawar kabu bana rahta hai. Ye level pair ke bearish trajectory ko hifazati taur par ahmiyat rakhta hai. Chart ka tajziya ek wazeh bearish momentum ko zahir karta hai jo GBP/USD pair mein mazbooti se qaim ho chuka hai. Mukhtalif resistance levels ka mojud hona mazeed ki sambhavna ko tasdeeq karta hai ke kisi bhi breakout ke liye darja darja barhna zaroori hai, jahan 1.2775 aur 1.2830 pivatol waypoints ki tarah kaam karte hain.

GBP/USD currency pair ke price charts mein gaps nazar aa rahe hain. Ye kuch logon ke liye hairat angaiz ho sakta hai, lekin forex market mein ye mamooli baat hai. Traders ke paas in gaps ka samna karne ke liye mukhtalif strategies hoti hain, jaise ke gap-closing theories istemal karna. Aaj, mein GBP/USD pair ko dobara tajziya karunga. Daily chart dekhne par, hum price movement mein neeche ki taraf gaps ko dekh sakte hain. Dilchasp baat ye hai ke ye neeche ki taraf ke gaps ne price ko lower Bollinger Band area tak le gaye hain, jo ke mazeed neeche ki taraf momentum ko zahir karta hai. Price Bollinger Bands ke darmiyan ilaqa mein hai, taqreeban 1.2655 supply area ke aas paas. Jab maqsood tak pohanch jaye, to mein ek bechnay ka moqa talash karunga, jis ka nishana 1.2690 ke qareeb demand area hai. Magar yeh ahem hai ke bazaar ke dynamics jaldi se tabdeel ho sakte hain. Agar price ahem support/resistance level 1.2580 ko rad kar de, to ye demand se supply mein tabdeel hone ka ishara ho sakta hai.

Ye trend mazboot lag raha hai, ishara hai ke koi bhi mumkin breakout pehle resistance levels 1.2775 aur mazeed baad mein 1.2830 ki taraf ja kar hoga. Akhri level, khaaskar, ahmiyat rakhta hai kyun ke ye mustaqbil mein psychological resistance 1.3000 ka samna karne ki umeedon ko banata hai. Isi doran, is muddat ke dauran, 1.2600 ke support level ka ehem kirdar barkarar rakhne ki tayyari hai, jis se beron ke liye trend par qawi aur mustawar kabu bana rahta hai. Ye level pair ke bearish trajectory ko hifazati taur par ahmiyat rakhta hai. Chart ka tajziya ek wazeh bearish momentum ko zahir karta hai jo GBP/USD pair mein mazbooti se qaim ho chuka hai. Mukhtalif resistance levels ka mojud hona mazeed ki sambhavna ko tasdeeq karta hai ke kisi bhi breakout ke liye darja darja barhna zaroori hai, jahan 1.2775 aur 1.2830 pivatol waypoints ki tarah kaam karte hain.

تبصرہ

Расширенный режим Обычный режим