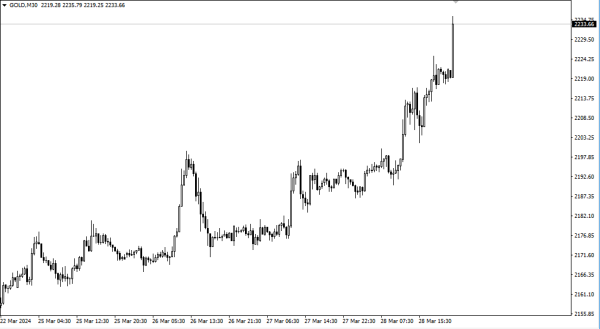

Mausam mein, kharidari karnewale 2162 range ko torne ki koshish kar rahe hain. Agar hum ise kar sakte hain aur iske oopar mazidar ban sakte hain to yeh ek acha signal hoga kharidne ka. Hum 2158 tak ke rate par izafa hone ke baad aur iske oopar mazidar banne ke baad kharidari ko jari rakh sakte hain. Chhoti si neeche ki impulse ke baad izafa jari rah sakta hai. Jab humein ek mazboot correctional fall milta hai to yeh munasib qeemat par kharidna behtar hoga. American session mein chhoti si neeche ki impulse ke baad hum izafa jari rakh sakte hain aur 2156 ke oopar mazidar banne ke baad majbooti se gahriyon mein concentrate karna behtar hoga.

Mausam ke doran, jab kharidari karnewale 2162 range ko torne ki koshish kar rahe hain, to yeh ek mukhtasar tafseel hai jo hamen is qadam ko samajhne mein madad karegi. Agar hum is muqam tak pohonch sakte hain aur iske oopar izafa ho sakta hai, to yeh ek aham nishaan hai kharidne ka. Humen 2158 tak ke rate par izafa hone ke baad aur uske oopar mazidar banne ke baad kharidari ko jari rakhna chahiye. Ek choti si neeche ki impulse ke baad, ek mazeed izafa bhi mumkin hai. Jab hum ek mazboot correctional fall ka samna karte hain, to munasib qeemat par kharidna hamare liye behtar hai. American session mein, chhoti si neeche ki impulse ke baad, hum izafa ko barqarar rakh sakte hain aur 2156 ke oopar mazidar banne ke baad, hamen gahriyon mein tawajjo deni chahiye.

Mausam ke doran, jab kharidari karnewale 2162 range ko torne ki koshish kar rahe hain, to yeh ek mukhtasar tafseel hai jo hamen is qadam ko samajhne mein madad karegi. Agar hum is muqam tak pohonch sakte hain aur iske oopar izafa ho sakta hai, to yeh ek aham nishaan hai kharidne ka. Humen 2158 tak ke rate par izafa hone ke baad aur uske oopar mazidar banne ke baad kharidari ko jari rakhna chahiye. Ek choti si neeche ki impulse ke baad, ek mazeed izafa bhi mumkin hai. Jab hum ek mazboot correctional fall ka samna karte hain, to munasib qeemat par kharidna hamare liye behtar hai. American session mein, chhoti si neeche ki impulse ke baad, hum izafa ko barqarar rakh sakte hain aur 2156 ke oopar mazidar banne ke baad, hamen gahriyon mein tawajjo deni chahiye.

تبصرہ

Расширенный режим Обычный режим