NZD/USD Technical Analysis:

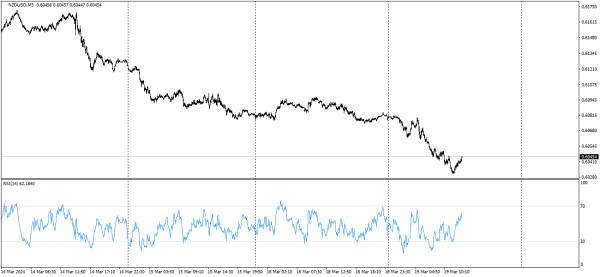

NZD/USD pair ki M5 timeframe par meri intraday tajziya. Market analysis relative strength index trading strategy par mabni hai, jo ke mashhoor RSI hai, jisme maine choudah mahiyat ka istemal kiya hai. Ye indicator asal mein asaan hai, lekin kaar gar sabit hua hai. Jab keemat oversold zone mein dakhil hoti hai, to hamara RSI indicator 30 ki soorat mein aana chahiye, jo ke ham dekhte hain ke keemat: 0.60449 par mojood hai. Main masaraf is waqt ki waqt base par karta hoon, ya ek minute ke liye neeche jaata hoon, jahan ek chhote se keemat ka pullback ho, hum bazaar ke mutaabiq kharidte hain. Profit lena, minimum ratio 1 se 3 hai, yeh woh buniyad hai jo main currency pairs ki trading mein istemal karta hoon. Main apna faida teen guna set karta hoon jo main khatre mein hoon nuqsaan ka. Agar zyada ho, to main position ko rakhta hoon jab tak mujhe wapas ka signal na mile ya mujhe kafi himmat na mil jaye. Ek lamha qadam ke baare mein. Main ne fixed stop loss 15 points ka rakha hai, jo hum be sawal trade kholne ke baad nahi rakte, lekin isay aakhri keemat ke urooj ke peechay phenk dete hain, is taraah se aap khud ko jhooti tootne se bacha sakte hain.

NZD/USD pair abhi thoda neeche ki taraf aata hai, 0.6050 ke aaspaas trade kar raha hai. Technical indicator, 14 din ka relative strength index (RSI) 4 ghante ka chart dekhta hai, 50 ke darje ke neeche hai, jo ke bearish momentum ka aghaz bataata hai. Ye ishara deta hai ke NZD/USD pair mukhya resistance 0.6000 ko test karne ke liye tayyar ho sakta hai. NZD/USD pair ki technical analysis ko maloom karta hai ke bhalayi ki raaye ke ehtemaam ki taraf badal sakta hai, mujhe yun lagta hai. Main ne aaj subah pair kharida. Abhi maine yeh tay nahi kiya hai ke kis rukh mein trade karna hai, zyadatar main bechunga aur ek mazboot giravat ka intezaar karoonga.

NZD/USD pair ki M5 timeframe par meri intraday tajziya. Market analysis relative strength index trading strategy par mabni hai, jo ke mashhoor RSI hai, jisme maine choudah mahiyat ka istemal kiya hai. Ye indicator asal mein asaan hai, lekin kaar gar sabit hua hai. Jab keemat oversold zone mein dakhil hoti hai, to hamara RSI indicator 30 ki soorat mein aana chahiye, jo ke ham dekhte hain ke keemat: 0.60449 par mojood hai. Main masaraf is waqt ki waqt base par karta hoon, ya ek minute ke liye neeche jaata hoon, jahan ek chhote se keemat ka pullback ho, hum bazaar ke mutaabiq kharidte hain. Profit lena, minimum ratio 1 se 3 hai, yeh woh buniyad hai jo main currency pairs ki trading mein istemal karta hoon. Main apna faida teen guna set karta hoon jo main khatre mein hoon nuqsaan ka. Agar zyada ho, to main position ko rakhta hoon jab tak mujhe wapas ka signal na mile ya mujhe kafi himmat na mil jaye. Ek lamha qadam ke baare mein. Main ne fixed stop loss 15 points ka rakha hai, jo hum be sawal trade kholne ke baad nahi rakte, lekin isay aakhri keemat ke urooj ke peechay phenk dete hain, is taraah se aap khud ko jhooti tootne se bacha sakte hain.

NZD/USD pair abhi thoda neeche ki taraf aata hai, 0.6050 ke aaspaas trade kar raha hai. Technical indicator, 14 din ka relative strength index (RSI) 4 ghante ka chart dekhta hai, 50 ke darje ke neeche hai, jo ke bearish momentum ka aghaz bataata hai. Ye ishara deta hai ke NZD/USD pair mukhya resistance 0.6000 ko test karne ke liye tayyar ho sakta hai. NZD/USD pair ki technical analysis ko maloom karta hai ke bhalayi ki raaye ke ehtemaam ki taraf badal sakta hai, mujhe yun lagta hai. Main ne aaj subah pair kharida. Abhi maine yeh tay nahi kiya hai ke kis rukh mein trade karna hai, zyadatar main bechunga aur ek mazboot giravat ka intezaar karoonga.

تبصرہ

Расширенный режим Обычный режим