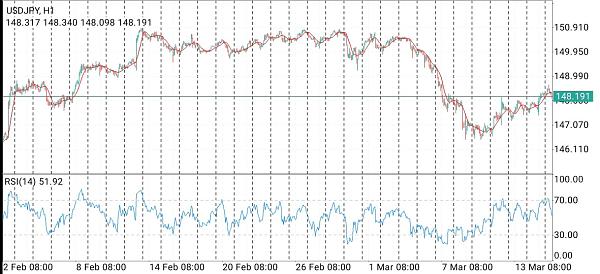

Dekhtay hain USDJPY ki movement ko, kam az kam ek aur upward movement ka mauqa ab bhi mojood hai. Haan, is subah, kam az kam hum ne dekha ke USDJPY phir se bullish tarz par chal sakta hai aur EMA50 par se doori bhi barha. Ye raha, abhi. Main jo intezar kar raha hoon wo hai ke USDJPY is H4 candle mein ek CSM buy bana sake, haan, agar ye ho sakta hai, to phir USDJPY ko ek bara upward movement ka mauqa ho sakta hai. Beshak ye ho sakta hai, dost, agar dekha jaye ke jo abhi mojood hai, to meri asal tawajjo ye hai ke agar main ab bhi khareed raha hoon, to mujhe ab bhi reversal ke mauqe par qaboo rakhna chahiye. Kyun ke agar hum H4 ko dekhein to ab USDJPY phir se overbought position mein hai, to mojooda position se ek aur girawat ka imkaan hai, chahe agar ye sirf ek retrace hi kyun na ho.

Kripya USDJPY market ki situation par tawajjo den. Lagta hai ke kharid-dar qaboo mein hain aur USDJPY ke daam ko mazeed barhne ke liye encourage kar rahe hain pichle kuch trading dinon mein. Main ne dekha ke kharid-dar dabao ek support ya defense area mein se dakhil ho raha hai, jo ke kharid-dar dabao se bhara nahi ja sakta tha aur bech-dar dabao se bhi nahi. Jo USDJPY ke daam ko barhne ke liye utha diya aur MA 100 indicator ko guzar gaya.

Is waqt, main ye naateeja nikalta hoon ke USDJPY market phir se bullish trend ki situation mein chal raha hai kyun ke kharid-dar ne MA 100 indicator ko guzar diya hai, jo ke ek acha mauqa hai agar kharid-dar dabao phir se zyada taqat ke signs dikhayein. kyun ke hosakta hai ke kharid-dar lambay arsay tak USDJPY market ko control karein resistance area tak pohanchne ke maqsad ke sath, jo ke mojooda daam ki harekat se oopar hai.

Kripya USDJPY market ki situation par tawajjo den. Lagta hai ke kharid-dar qaboo mein hain aur USDJPY ke daam ko mazeed barhne ke liye encourage kar rahe hain pichle kuch trading dinon mein. Main ne dekha ke kharid-dar dabao ek support ya defense area mein se dakhil ho raha hai, jo ke kharid-dar dabao se bhara nahi ja sakta tha aur bech-dar dabao se bhi nahi. Jo USDJPY ke daam ko barhne ke liye utha diya aur MA 100 indicator ko guzar gaya.

Is waqt, main ye naateeja nikalta hoon ke USDJPY market phir se bullish trend ki situation mein chal raha hai kyun ke kharid-dar ne MA 100 indicator ko guzar diya hai, jo ke ek acha mauqa hai agar kharid-dar dabao phir se zyada taqat ke signs dikhayein. kyun ke hosakta hai ke kharid-dar lambay arsay tak USDJPY market ko control karein resistance area tak pohanchne ke maqsad ke sath, jo ke mojooda daam ki harekat se oopar hai.

تبصرہ

Расширенный режим Обычный режим