nzd/usd price overview:

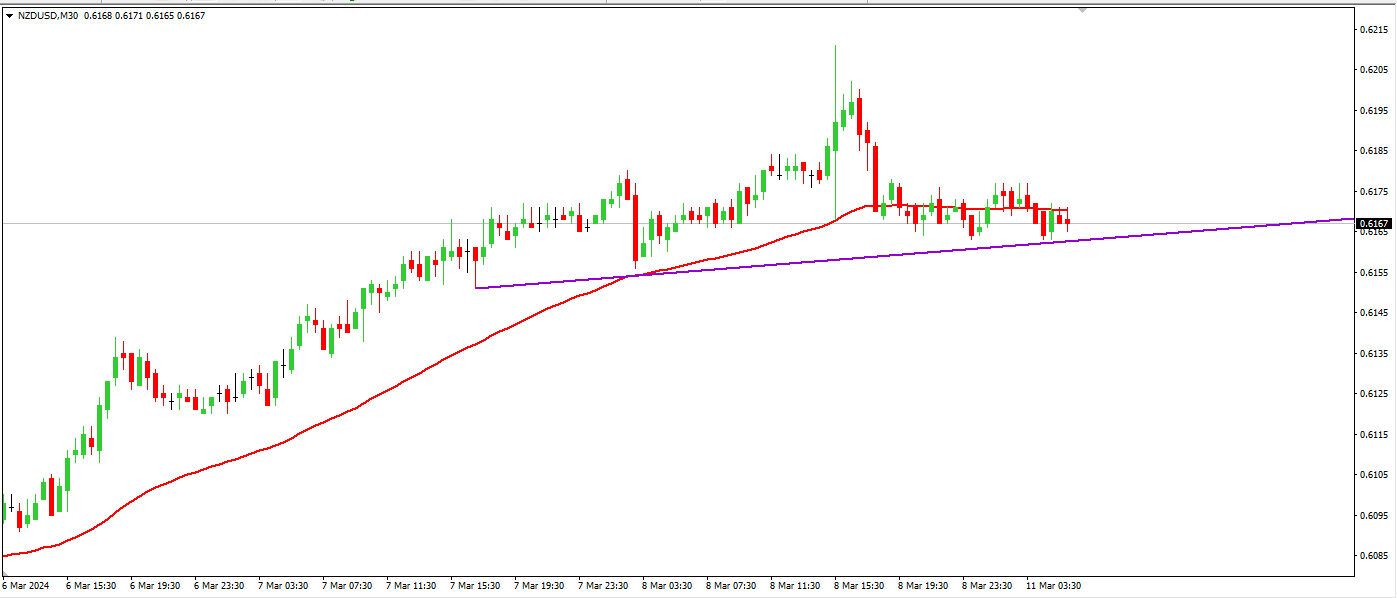

Asalam o Alaikum sab members, main aap sab ka aaj ke liye samay dene ke liye shukriya ada karna chahta hoon. Aaj ki mukhya guftagu ka mawad hoga NZD/USD pair ki takneeki tahlil. NZD/USD ke keemat 0.6166 kshetra mein chal rahi hai. NZD/USD ke keemat abhi hal hi mein ek nisbatan chhoti range mein trade ho rahi hai. Agar aap NZD/USD dwara bana pattern ka jaaeza lenge, to aise lagta hai ke Somvar ko NZD/USD keemat baar baar upar ja sakti hai. Isi tarah, mujhe lagta hai ke NZD/USD ko mad e nazar rakhte hue ab bhi kharidne ka intikhab qabil-e qadar hai. Haal hi mein NZD/USD kharidar ko barqarar Relative Strength Index (RSI) aur haal hi mein dheere dheere taraqqi ko chheda hai. Usi samay, moving average convergence divergence (MACD) indicator negative level ke upar trade kar raha hai. NZD/USD ka 50-EMA aur 20-EMA ke upar barqarar trade yeh bullish bias ko support kar sakta hai. NZD/USD ke liye fori resistance level 0.6336 hai

technical analysis for today:

Agar kharidari dabao mazid barhta hai, to keemat nazdeekiyon ke resistance zone ko 0.6712 par test kar sakti hai. Jab yeh rukawat paar ki jaati hai, to bull log lambay waqt ke reversible correction hurdle ko nishana bana sakte hain jo ke radar par hai, jo ke teesra resistance level hai, 0.7196 mein. Ek aur manzar yeh hai ke keemat palat sakti hai aur 0.5792 support ko dobaara test karne ke liye neeche girne ka aghaz kar sakta hai. Doosri taraf, is time frame mein, fori support 0.5488 NZD/USD keemat ke liye doosri line of defense ka kaam kar sakta hai agar pair neeche palat jata hai. Uske baad, agar NZD/USD keemat gir jati hai aur 0.5121 zone ko par karti hai, to umeed hai ke izaafa option mumkin nahi hoga. Is case mein, hum 0.6712 ka nishana rakh sakte hain ke saath chadhao ka barqarar rukh ka intezar kar sakte hain. Mujhe yeh maanna hai ke yeh waqt hai ke traders ko NZD/USD ke baare mein sochna shuru karna chahiye. Main ne bohot saari articles parhi hain aur videos dekhi hain jo NZD/USD ke is saal ki ahmiyat par baat karte hain.

Asalam o Alaikum sab members, main aap sab ka aaj ke liye samay dene ke liye shukriya ada karna chahta hoon. Aaj ki mukhya guftagu ka mawad hoga NZD/USD pair ki takneeki tahlil. NZD/USD ke keemat 0.6166 kshetra mein chal rahi hai. NZD/USD ke keemat abhi hal hi mein ek nisbatan chhoti range mein trade ho rahi hai. Agar aap NZD/USD dwara bana pattern ka jaaeza lenge, to aise lagta hai ke Somvar ko NZD/USD keemat baar baar upar ja sakti hai. Isi tarah, mujhe lagta hai ke NZD/USD ko mad e nazar rakhte hue ab bhi kharidne ka intikhab qabil-e qadar hai. Haal hi mein NZD/USD kharidar ko barqarar Relative Strength Index (RSI) aur haal hi mein dheere dheere taraqqi ko chheda hai. Usi samay, moving average convergence divergence (MACD) indicator negative level ke upar trade kar raha hai. NZD/USD ka 50-EMA aur 20-EMA ke upar barqarar trade yeh bullish bias ko support kar sakta hai. NZD/USD ke liye fori resistance level 0.6336 hai

technical analysis for today:

Agar kharidari dabao mazid barhta hai, to keemat nazdeekiyon ke resistance zone ko 0.6712 par test kar sakti hai. Jab yeh rukawat paar ki jaati hai, to bull log lambay waqt ke reversible correction hurdle ko nishana bana sakte hain jo ke radar par hai, jo ke teesra resistance level hai, 0.7196 mein. Ek aur manzar yeh hai ke keemat palat sakti hai aur 0.5792 support ko dobaara test karne ke liye neeche girne ka aghaz kar sakta hai. Doosri taraf, is time frame mein, fori support 0.5488 NZD/USD keemat ke liye doosri line of defense ka kaam kar sakta hai agar pair neeche palat jata hai. Uske baad, agar NZD/USD keemat gir jati hai aur 0.5121 zone ko par karti hai, to umeed hai ke izaafa option mumkin nahi hoga. Is case mein, hum 0.6712 ka nishana rakh sakte hain ke saath chadhao ka barqarar rukh ka intezar kar sakte hain. Mujhe yeh maanna hai ke yeh waqt hai ke traders ko NZD/USD ke baare mein sochna shuru karna chahiye. Main ne bohot saari articles parhi hain aur videos dekhi hain jo NZD/USD ke is saal ki ahmiyat par baat karte hain.

تبصرہ

Расширенный режим Обычный режим