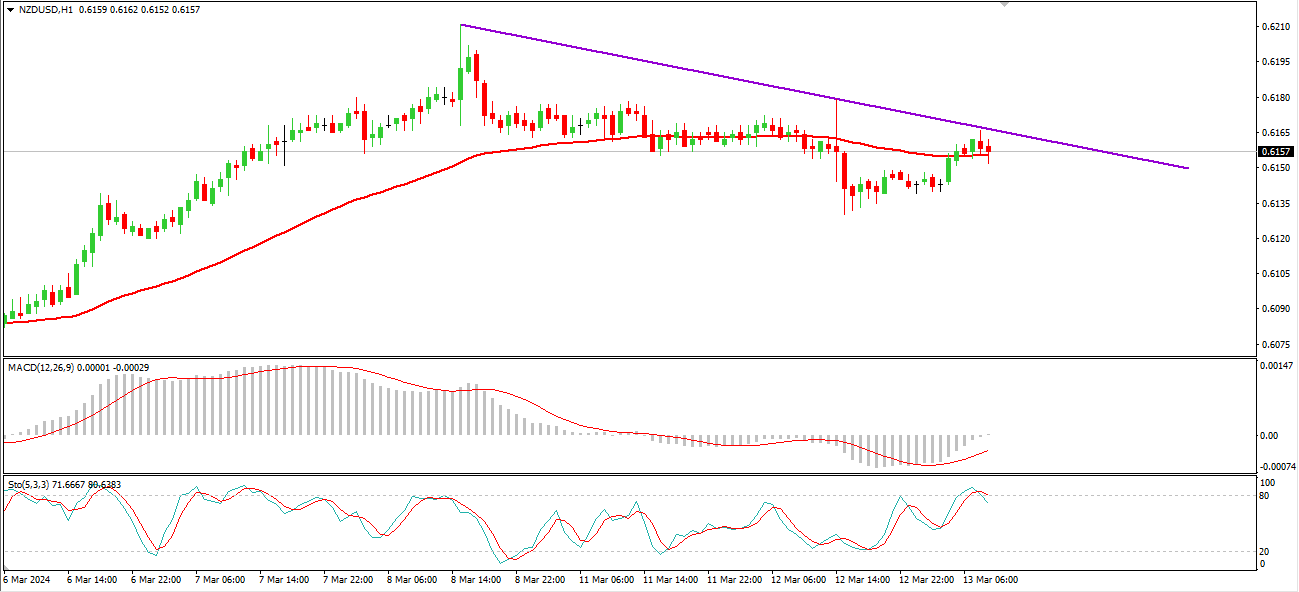

nzd/usd price analysis:

For NZD/USD kal, pehle ke daily range ke highs ko update karne ke baad, qeemat ultey aur bharose ke saath dakshin ki taraf badhi, jo ek bearish mombati bana, jo 0.61585 ke support darje ke neeche qaim hogai. Main ne dekha ke aaj ke kharidari us akhari sahay par mojood hosakti hai aur candlestick ulta chalne ki taraf jaarahi hai. Aaj main 0.61585 ke darje ke aas paas apni mushahidat jaari rakhoonga aur is mamle mein, beshak, situation ko develop karne ke liye do options ho sakte hain. Pehla option clear reversal candle combination ke saath juda hua hai aur keemat ki harekandi ko shuru kar raha hai. Agar yeh plan kaam karta hai, toh main keemat ko phir se 0.62167 ke resistance darje tak lautne ka intezar karunga. Agar keemat is resistance darje ke upar pahunchti hai, toh main ek aur uttar ki taraf chalne wale kadam ka intezar karunga, jo 0.62779 par hai. Is resistance darje ke paas, main ek trade setup ka intezar karunga, jo trade ki mazeed rah ka tay karnay mein madad karega

chart analysis:

Beshak, keemat ko mazeed uttar ki taraf dhakel diya ja sakta hai, jo 0.63694 ke resistance darje par hai, lekin yahan aapko situation par nazar rakhni hogi aur sab kuch keemat par depend karta hai. Kaisi khabar hai?. Kaisi movements hain aur keemat ko muqarrar uttar ki taraf react kaise karegi. Keemat ki doosri taraf ki harqat ke liye ek plan ho sakti hai, clear candle ke saath aur keemat ke neeche ki taraf rukne ki taraf. Agar yeh plan taraqqi deta hai, toh main umeed karta hoon ke keemat ko 0.60688 ke support darje tak ya support darja ko 0.60382 tak lejane ka intezar karunga. Main in support darjat ke qareeb bullish signals ki talash mein jaari rakhunga, ummeed hai ke phir se uttar ki taraf chalne wale keemat ki rukawat hojaegi. Yeh keh kar, aaj mujhe kuch dilchaspi ka nahi lagta. Main dekhta hoon ke ek reversal uttar wala pattern ban sakta hai aur keemat nazdeek ke resistance darjat par kaam karegi, phir main market ke situation se aage badhunga.

For NZD/USD kal, pehle ke daily range ke highs ko update karne ke baad, qeemat ultey aur bharose ke saath dakshin ki taraf badhi, jo ek bearish mombati bana, jo 0.61585 ke support darje ke neeche qaim hogai. Main ne dekha ke aaj ke kharidari us akhari sahay par mojood hosakti hai aur candlestick ulta chalne ki taraf jaarahi hai. Aaj main 0.61585 ke darje ke aas paas apni mushahidat jaari rakhoonga aur is mamle mein, beshak, situation ko develop karne ke liye do options ho sakte hain. Pehla option clear reversal candle combination ke saath juda hua hai aur keemat ki harekandi ko shuru kar raha hai. Agar yeh plan kaam karta hai, toh main keemat ko phir se 0.62167 ke resistance darje tak lautne ka intezar karunga. Agar keemat is resistance darje ke upar pahunchti hai, toh main ek aur uttar ki taraf chalne wale kadam ka intezar karunga, jo 0.62779 par hai. Is resistance darje ke paas, main ek trade setup ka intezar karunga, jo trade ki mazeed rah ka tay karnay mein madad karega

chart analysis:

Beshak, keemat ko mazeed uttar ki taraf dhakel diya ja sakta hai, jo 0.63694 ke resistance darje par hai, lekin yahan aapko situation par nazar rakhni hogi aur sab kuch keemat par depend karta hai. Kaisi khabar hai?. Kaisi movements hain aur keemat ko muqarrar uttar ki taraf react kaise karegi. Keemat ki doosri taraf ki harqat ke liye ek plan ho sakti hai, clear candle ke saath aur keemat ke neeche ki taraf rukne ki taraf. Agar yeh plan taraqqi deta hai, toh main umeed karta hoon ke keemat ko 0.60688 ke support darje tak ya support darja ko 0.60382 tak lejane ka intezar karunga. Main in support darjat ke qareeb bullish signals ki talash mein jaari rakhunga, ummeed hai ke phir se uttar ki taraf chalne wale keemat ki rukawat hojaegi. Yeh keh kar, aaj mujhe kuch dilchaspi ka nahi lagta. Main dekhta hoon ke ek reversal uttar wala pattern ban sakta hai aur keemat nazdeek ke resistance darjat par kaam karegi, phir main market ke situation se aage badhunga.

تبصرہ

Расширенный режим Обычный режим