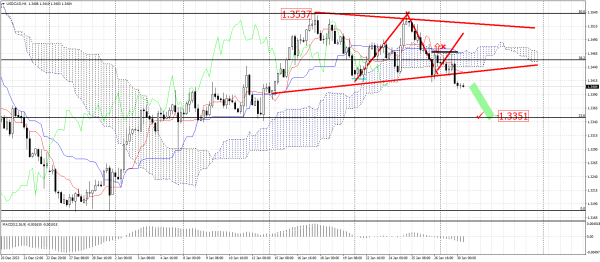

USD/CAD pair mazboot bechnay ka dabawar ka shikaar hai, jo ke daily time frame mein dekha gaya hai aur jise chaar roz se musalsal girne ka silsila hasil hota hai. Aam taur par, yeh jora ek downtrend mein hai, jisme ke keemat 1.3610 par mojood 200 moving average ko darust karte hue hai. USD/CAD pair aglay haftay mein apne girawat ki harkat jaari rakh sakta hai. H1 time frame par, khareedne walon ko 1.3450-1.3515 range ke andar rukawat ka samna hai, jisme ke 18 January 2024 ko 12:00 server time par inkar ka samna kiya gaya. Iske baad, keemat giri, 1.3475 par mojood laal line ya 50-period moving average ko tor kar.

Mera is Saturday ke liye mansoobah shamil karta hai ke 1.3560-1.3490 ke support area ko torne par keemat ki tadaad ka intezar karo. Kamyab tor par hone par, mujhe ek bechne ki order deni chahiye, jiska maqsad kareeb 70 pips ka munafa hai. USD/CAD market mein bearish shirayat bani hui hai, jisme bechne walay control mein hain. 1.3447 ke ahem support area mein mazboot rukawat ka samna hota hai, lekin trend ki raah ko badalne ke liye mukhlis koshishen abhi tak nazdeek ki rukawat ko paar nahi kar saki hain.

Mera is Saturday ke liye mansoobah shamil karta hai ke 1.3560-1.3490 ke support area ko torne par keemat ki tadaad ka intezar karo. Kamyab tor par hone par, mujhe ek bechne ki order deni chahiye, jiska maqsad kareeb 70 pips ka munafa hai. USD/CAD market mein bearish shirayat bani hui hai, jisme bechne walay control mein hain. 1.3447 ke ahem support area mein mazboot rukawat ka samna hota hai, lekin trend ki raah ko badalne ke liye mukhlis koshishen abhi tak nazdeek ki rukawat ko paar nahi kar saki hain.

تبصرہ

Расширенный режим Обычный режим