NZD/USD: Sellers guzashta budh ko nzd / usd jori ke zariye market ko control karne ke liye wapas aaya, jaisa ke mein ne rozana time frame ke zariye mushahida kya. taweel mudti mein, baichnay walay ka agla qeemat ka hadaf giray zone ya 0. 6024-0. 6067 ki satah par kamzor support ko torna hai. yeh ilaqa ab bhi kaafi taaza hai aur is mein ab tak dobarah test ka koi tajurbah nahi sun-hwa hai . Mazeed bar-aan, jab mein ne aik ghantay ke time frame ka mushahida kya, to maloom sun-hwa ke khredar abhi tak red zone mein daakhil nahi ho saka tha ya 0. 6222-0. 6242 ki satah par muzahmat ki tasdeeq nahi kar saka tha, 22. 00 insta forex brokr suroor time par replations ka saamna karne ke baad, agli 20 July ko farokht ki qeemat 20 se 362 tak ka hadaf hai. green zone ya 0. 6173-0. 6188 ki satah par ghair tajurbah shuda support. agar qeemat is ilaqay mein daakhil honay ke qabil hai jo abhi bhi kaafi taaza hai aur is neechay jane walay rujhan se durust tareeqay se nimatnay ka koi tajurbah nahi hai, to farokht ke order par dobarah ghhor kya ja sakta hai. munafe ka hadaf 0. 6120 ki satah par hoga. Agar mein oopar tasweer mein daikhta hon ke aaj raat tak nzdusd jore ki qeemat ki harkat neechay ki taraf ya mandi ka muzahira kar rahi hai, yeh is qeemat se dekha ja sakta hai jo majmoi tor par moving average line se neechay hai aur dosray andikitrz, yani rsi 14 indicator se, value 50 % ki darmiyani qader se neechay hai, jo ke 40 %, uncle aur sis ki had mein hai. is liye, agar mustaqbil mein qeemat barhna jari rakh sakti hai, to mumkin hai ke qeemat barh jaye aur meri raye mein is jumaraat ko paisay kamanay ke liye wapsi ke liye khareed orders ka intikhab hamaray liye bohat acha hai. Shukrya.

`

X

new posts

-

#1051 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#1052 Collapse

INTRODUCE OF NZD/USD Technical Outlook: NZD/USD mein hi ik trah topic say Is mauqa par shuru mein kaha gaya ke haftay ke aaghaz mein NZD/USD pair price ki honay wali pishrft ko dekhnay ki koshish karen kyunkay agar vaqatan koi muzahmati break out hota hai to sab kuch pehlay se mutawaqqa sorat e haal ko mansookh kar day ga, hamein bas agli salahiyat ka intzaar karnay hai. yeh dekhnay ke liye ke kya pishrft ki jaye gi. umyeed ki jati hai ke London ke open session se pehlay pehlay se hi neechay ki qeemat ki position ho gi taakayy hum kayi support levels se guzarnay se pehlay pivotpoint line samait kayi levels ko dobarah test kar saken taakay pehlay ki tawaqqa ke mutabiq kami ko poora karne par tawajah di ja sakay. is mauqa par bharosa karne se, farokht knndgan ke liye aik mauqa hoga ke woh islaah ki tayari ka intzaar karte hue farokht par zor den, kyunkay is se ziyada se trad laima laazmi ho jay gii.....Ess patteren say hi ham marketing band honay tak nzdusd jori ki qeemat ki harkat ko oopar ki tasweer mein daikhta hon, to yeh qeemat ki harkat ki karkardagi mein thi jo neechay ki taraf correction ya mandi ki taraf barh rahi thi, uncle aur sis. usay is qeemat se dekha ja sakta hai jo ke majmoi tor par moving average indicatorline se oopar hai aur deegar isharay, yani rsi 14 indicator se, qader 50 % ki darmiyani qader se neechay hai, jo ke 45 % ki had mein hai, chacha aur behan is liye, agar mustaqbil mein qeemat mein kami jari reh sakti hai, to yeh mumkin hai ke qeemat neechay aajay aur meri ray sa trad lo gi...... Resistance 4 : 0.6465x Resistance 3 : 0.6424x Resistance 2 : 0.6399x Pivot point : 1.6258x Support 0 : 0.6517x Support 2 : 0.6291x Support 3 : 0.5250x ess price ki asal mn qeematen mojooda muzahmati ilaqay ko 0.6482 par toar deti hai to aik durust farokht kanandah signal masool hoga. taakay mumkina munafe ke maqasid ke sath farokht ke orders ki qeemat 0.6242 ki range mein rakhi jaye jo kal paiir ko asiayi session ke aaghaz par America ke session say hi trading asaani say hi hoti rahy gii......

-

#1053 Collapse

NZD / USD H4 Chart Salam dusto! h4 time frame par yeh dekha gaya hai ke qeematon ki pichli harkat ne kaafi mazboot oopar ki taraf rujhan ka tajurbah kya, jis ki nishandahi 0. 65024 ki satah par onche jhool ki tashkeel se hui. yeh bulandi is baat ki nishandahi karti hai ke talabb –apne urooj par pahonch gayi hai aur kam hona shuru ho rahi hai, is liye qeemat ki simt mein tabdeeli ka imkaan hai. is tajziye mein, baichnay walay ka dabao bunyadi tawajah hai. bulandi par pounchanay ke baad, baichnay walay ka dabao kaafi mazboot tha aur qeemat mein izafay ko 0. 61609 ki kaleedi satah par rakhnay ke qabil tha. is se zahir hota hai ke kayi baichnay walay is satah par farokht karne ke liye tayyar hain, jo kharidaron ki maang ko poora karta hai. 0. 62608 ki satah se oopar ki islaah ke baad, qeemat phir 0. 62615 ki satah tak pahonch gayi, lekin usay mustard kar diya gaya aur wapas neechay chala gaya. yeh mustard zahir karta hai ke baichnay walay ka dabao ab bhi mazboot hai, aur woh dobarah qeemat ki naqal o harkat ko control karne mein kamyaab ho gaye. farokht knndgan ke musalsal dabao ke sath, qeemat pichlle support level ais demand mein daakhil ho gayi hai jo 0. 60638 se 0. 60957 ki had mein hai. yeh bunyadi maang kharidaron ke liye aik purkashish ilaqa hai, taakay qeematon mein simt ko ulatnay ki salahiyat ho ya aik khaas muddat ke andar flat harkatein ho jayen a aisi soorat e haal mein farokht ka ishara munasib maloom hota hai. taham, zehen mein rakhen ke market hamesha mutharrak rehti hai aur koi bhi tajzia 100 % kamyabi ki zamanat nahi day sakta. lehaza, hamesha munasib rissk managment ka istemaal karna zaroori hai, jaisay ke mumkina nuqsanaat ko mehdood karne ke liye stap las set karna, aur yeh samjhna ke market hamesha simt badal sakti hai . -

#1054 Collapse

NZD/USD the Forex market Trading Analysis: Technical and Fundamental Factors "NZD/USD" ka tashkhees (analysis) foreign exchange trading mein ahem hota hai, kyun ke ye do mukhtalif currencies, yaani New Zealand Dollar (NZD) aur United States Dollar (USD), ke darmiyan change charge ko darust karne mein madad deta hai. Ye evaluation investors ko samjhne aur market ke mukhtalif asraat aur taqazay ko samajhne mein madad karta hai, jisse woh behtar faislay kar saken.Tashkhees ke liye, kai mukhtalif tools aur strategies istemal kiye jate hain. Ek ahem device "technical evaluation" hai, jisme beyond fee patterns aur market facts ko dekhte hue future ke charge moves ka andaaza lagaya jata hai. Is mein "candlestick charts" aur "signs" jaise gear istemal kiye jate hain. Dusra tareeqa "fundamental analysis" hai, jisme economic indicators, critical bank ke faislay aur geopolitical activities ke asraat ko samjha jata hai.NZD/USD pair ke liye, New Zealand ki arzi aur maliyat halat, dairy products ka export aur US ki financial statistics jaise elements ahem hote hain. Agar New Zealand ki dairy enterprise mein tabdeeli ho ya fir US Federal Reserve apni monetary coverage mein tabdeeli karay, to is pair ke exchange fee par asar par sakta hai.Isi tarah, marketplace sentiment bhi ahem hota hai. Jab buyers zyada optimistic hote hain aur unstable property jaise ke stocks mein make investments karte hain, to USD ki in comparison to NZD mein cost kam ho sakti hai. Jab market mein uncertainty hoti hai, to USD ki call for barh sakti hai, jis se NZD/USD price mein girawat aati hai. Managing Risks in NZD/USD Forex Trading: Strategies and Considerations Forex trading mein NZD/USD evaluation karne ke liye investors ko contemporary occasions aur international marketplace trends ko bariki se monitor karna chahiye. Technical aur essential evaluation ko mila kar trends aur potential access/exit factors ka pata lagaya ja sakta hai. Lekin yaad rahe, forex trading mein rishwat (danger) bhi hota hai. Exchange charges mein tabdeeli achanak aur bila soch samajh ke bhi ho sakti hain, jis se traders ko nuksan ho sakta hai. Is liye, threat control techniques istemal karna zaroori hai.Aakhir mein, NZD/USD ka analysis foreign exchange trading mein buyers ko market ki know-how aur behtar faislay karne mein madad deta hai. Lekin, yaad rahe ke koi bhi evaluation one hundred% sahi nahi hoti aur market hamesha unpredictable hoti hai. Is liye, hamesha savdhani aur ilm se kaam lena chahiye aur danger ko samjha kar hi buying and selling karni chahiye. -

#1055 Collapse

NZD/USD: H4 time frame analysis: NZD/USD market se aaj ke takneeki data ki takmeel ke tor par, mein h4 time frame ka istemaal karte hue, aik chhootey chart par market ki naqal o harkat ki nigrani karoon ga. yeh baat bilkul wazeh hai ke mahinay ke aaghaz mein mom batii ab bhi saada moving average andikitrz 60 aur 150 se oopar ja rahi thi, lekin guzashta haftay ke trading session mein daakhil honay ke baad aaj raat market ke band honay tak sorat e haal mandi ki simt barh rahi thi. aik qitaar, khaas tor par chouthay tijarti session mein. aakhri din jis ne lagataar mandi ki shakal ki shammen dekhi theen. yeh dekha ja sakta hai ke qeemat ab paiir ko honay wali ibtidayi qeemat se bohat neechay hai jis ki wajah se is haftay ki market mazboot mandi ka shikaar nazar aati hai. Mein ne aik baar phir rsi isharay ( 14 ) ki bunyaad par market ki haalat dekhnay ki koshish ki jo is baat ka ishara dekhata hai ke Laim line 30 ki satah ki had ke qareeb gir gayi hai jo is haftay market ki aik ahem misaal hai. kami macd isharay (12,26,29 ) par jahan Baraz ke baad nuqtay wali peeli lakeer ab bhi musalsal 0 ki satah se neechay ja rahi hai jo barhatay aur kam hotay dikhayi dete hain, yeh is baat ka ishara hai ke market neechay ki taraf barh rahi hai. Daily time frame: Daily chart pay qeemat ki naqal o harkat ki soorat e haal ki bunyaad par jo ke nzdusd currency ke jore mein guzashta haftay ke tijarti session mein dekhe jane walay rozana time frame par paish aaya jahan farokht knndgan ke assar o rasookh ka ziyada ghalba tha, is soorat e haal ko candle stuck movement se dekha ja sakta hai jo musalsal neechay ki taraf bherne ka mushahida kya gaya tha. mangal se paiir tak. aaj raat khaas tor par agar hum guzashta chand dinon mein trading mein rozana ki naqal o harkat par nazar dalain jo guzashta paiir ki ibtidayi qeemat ke muqablay mein kam qeemat ki pozishnon ke sath bearish candle ki aik qitaar banati hai. yeh haalat intehai utaar charhao mein dekhi jane wali mandi ki sorat e haal ko bayan karti hai. Agar aap dekhte hain ke is haftay honay wali mandi ki harkat pichlle haftay ke rujhan ka tasalsul hai, to is ka matlab hai ke market mein ab bhi apni oopar ki harkat ko jari rakhnay ki salahiyat mojood hai. market ka tajzia karne ke liye istemaal honay walay isharay ki sharait ke hawalay se. rsi 14 wazeh tor par Laim line ki simt dekhata hai. pehlay, yeh line aksar satah 50 se oopar jati thi, lekin ab yeh ab bhi satah 30 ke qareeb gir rahi hai. Shukrya. -

#1056 Collapse

NZD/USD Market August 14, 2023: Hourly time frame: Dear Friends! Mumkina entry point ka hawala talaash karne ke liye, phir mein h1 time frame par mazeed tajzia bhi karoon ga, aur agar mein ghhor se daikhon to yeh oopar lagta hai ke ab bhi kaafi mazboot muzahmati ilaqa mojood hai jisay mein ne halkay neelay rang ke zone se nishaan zad kya hai. is liye apne tijarti mansoobay ke liye, mein pehlay muzahmati ilaqay mein qeemat ke durust honay ka intzaar karoon ga, jo ke taqreeban 0.60741 hai, baad mein mein is umeed par wahan farokht ka order lon ga ke nzdusd qeemat neechay aa jaye aur fori tor par is ki kami ko peecha karne ke liye jari rakha jaye. kam support level. aur sab se ahem baat yeh hai ke paisay ka hamesha samajhdaari se intizam kya jaye taakay trading ke nataij itminan bakhash munafe bakhash nataij peda kar saken. H4 Time frame: H4 time frame ki nigrani jari rakhen, jab mein nzd/usd market par trained line line khinchtaa hon to yeh kaafi wazeh lagta hai ke market ke rujhan ko baichnay walon ke control karne ka ziyada imkaan hai, mojooda nzdusd qeemat ki haalat bohat kam ho gayi hai aur trained line support area tak pahonch gayi hai. is liye is baat ka bohat ziyada imkaan hai ke yeh baad mein uuchaal le ga taakay neechay girnay ko jari rakhnay se pehlay islaah ka marhala le le. is liye jo dost nzdusd market mein andrajaat farokht karne ja rahay hain, un ke liye behtar hai ke sab se pehlay qareebi muzahmati ilaqay mein qeemat durust honay ka intzaar karen, aur yaqeenan aap ko sabr karna hoga aur durust bounce ki tasdeeq ka intzaar karna hoga taakay aap kar saken. aik durust aur kam rissk entry point haasil karen. Shukrya. -

#1057 Collapse

Aaiye NZD/USD yaumiyah chart aur iske takniki setup par ek nazar dalte hain. Mai Fibonacci grid ka istemal karta hun, aur ham wazeh taur par dekh sakte hain keh qimat guzishtah Jumerat ko 138.2 ke retracement level tak gir gayi aur fir ruk gayi. Jumah ko, yah jodi flat karobar kar rahi thi aur Peer ko, isme koi girawat nahin dikh rahi hai. Yah jodi ke liye ek aham nuqtah ho sakta hai. Pichli bar, quotes ne support ko tod diya tha lekin kaledi satah ka test karne me nakam raha. Lehaza yah bahut mumkin hai keh qimat jald hi ooper ki taraf palat jaye. Filhal, yah joda raste me bearish candlesticks banate hue tezi se swing high se niche ki taraf badh raha hai. Kuch nayab ucchal majmui tasweer ko tabdil nahin karti hain kiyunkeh qimat unke bad niche ki taraf palat jati hai. Intraday pivot satah sirf scalpers ke liye purkashish honge lekin mai is se zyada hasil karna chahunga. Badqismati se, aaj buniyadi mahaz par kuch bhi aham nahin hai. Mangal ki sham ko, America me gharon ki maujudah farokht ka data shaye kiya jayega. Is dauran, New Zealand me khabron ka pas manzar ghair yaqini bana hua hai. Lehaza, takniki tajziyah tawajjoh dene wala buniyadi awamil hoga. Intraday trade karne walon ke liye, yaumiyah pivot satah mundarja zail hain: din ke karobar ke liye - 0.5925, kharidari ke liye - 0.5943 aur 0.5964 par, short jane ke liye - 0.5905 aur 0.5888 par. Yah woh hadd hai jiska mai aaj ke liye tajwiz karta hun. Janch karen keh kya yah satahen aap ki tejarati hikmat amli ke mutabiq hai.

- Mentions 0

-

سا0 like

-

#1058 Collapse

NZD/USD price overviews: Aaj mein NZD/USD jori ka tajzia karne ki koshish karoon ga. kal, paiir ko, abhi bhi bohat ziyada tabdeelian nahi huien, is liye tajzia kam o besh wohi tha jo guzashta itwaar ko tha. abhi ke liye nzdusd ki tehreek ab bhi side way hai. mom batii ki position ab bhi 0.5924 ki qeemat se ziyada daur nahi hai. bohat mazboot baichnay walay ke dabao ne nzdusd ko barhna mushkil bana diya. agar side way aik taweel arsay se is terhan raha hai, to aam tor par mustaqbil qareeb mein aik bohat bara qeemti dhamaka hoga. aisa hi hota hai ke aaj raat Amrici session mein ziyada assar wali khabrain bhi ayen gi jis se market jarehana andaaz mein chalne ka imkaan hai. woh jore jin ka usd se koi talluq hai woh yakeeni tor par mutasir hon ge, Bashmole nzdusd bhi. umeed hai ke is ka assar Amrici dollar ko kamzor kar sakta hai. masla yeh hai ke, kal se Amrici dollar hamesha mazboot ho raha hai, jis ki wajah se nzdusd musalsal girta ja raha hai. Chart analysis: H1 time frame: H1 nzdusd time frame par ab bhi 0. 5882 ki qeemat par demand area mein daakhil nahi ho saka hai. jab tak ilaqay mein daakhil nahi sun-hwa hai, mein taweel pozishnin kholnay ki koshish jari rakhnay ka iradah rakhta hon. jahan tak hadaf ka talluq hai, mera andaza hai ke nzdusd 0. 6619 ki qeemat tak barh jaye ga. agar yeh sach hai ke nzdusd barhay ga, to baad mein aik naya support tashkeel diya jaye ga jis ka maqsad qeemat ko zahir karna hai. jahan tak hadaf ka talluq hai, mera andaza hai ke nzdusd 0. 6619 ki qeemat tak barh jaye ga. agar yeh sach hai ke nzdusd barhay ga, to baad mein aik naya support tashkeel diya jaye ga jis ka maqsad qeemat ko zahir karna hai. jahan tak hadaf ka talluq hai, mera andaza hai ke nzdusd 0. 6619 ki qeemat tak barh jaye ga. agar yeh sach hai ke nzdusd barhay ga, to baad mein aik naya support tashkeel diya jaye ga jis ka maqsad qeemat ko zahir karna hai. Misali sale entry point ke tajzia ke liye, pehlay oopar jane ke liye qeemat ke durust honay ka intzaar karen. islahi marhalay ke ma muddat 100 tak bherne ka imkaan. is satah par, agar mustard honay ka koi ishara milta hai, to is ke paas neechay ka rujhan jari rakhnay ke liye neechay ki taraf pal back ke liye qeemat ki bunyaad ban'nay ka mauqa hai. oopar ki taraf tasheeh ke mauqa ki tasdeeq isharay se bhi hoti hai jo oopar ki taraf ishara kar raha hai. Candle is waqt sun-hwa jab ki satah ke qareeb aaya aur phir neechay ki taraf uboor kar gaya. aik manfi hadaf paiir ke kam ki jaanch karna hoga. agar qeemat neechay ajati hai to break kam hoti hai yeh is baat ki tasdeeq kere ga ke mandi ka rujhan jari hai. agla manfi hadaf 0.5853 ki taraf hai. Shukrya.

- Mentions 0

-

سا0 like

-

#1059 Collapse

NZD/USD: Chart pay NZD/USD jore ne 0.5985 ki wazeh muzahmat banai, jis se nzd / usd ki qeemat guzashta jummay ko dobarah junoob ki taraf neechay aagai. agar, market khilnay ke baad, hum jungli tor par oopar ki taraf nahi urrtay aur muqarrar kardah 0. 5985 se oopar qadam jamanay mein nakaam rehtay hain, to is soorat mein mein nzd / usd ki nat buri southern price movement ko laago karne ke imkaan se ittafaq karoon ga, jis ka izhaar fi al haal mutawaqqa aur mumkina qeemat mein kami ke tor par kya ja sakta hai, kahin satah ke ilaqay mein jama shuda raqam ke sath taqreeban 0.5884 par waqay hai, aur is manzar naame ke mutabiq, neechay nzd/usd jora chal sakta hai. Agar aap h1 chart par nazar dalain, to ab aik oopar ki taraf rujhan hai Ø› taraqqi ki do laharen theen aur ab hum ghaliban neechay ki taraf lout jayen ge. jummay ko, taraqqi ki doosri lehar ke baad, qeemat 0. 5987 par yomiya muzahmat ke sath satah par pahonch gayi aur wapas rule karne ke liye satah se yaksaa tor par neechay wapas aa gayi. ost yomiya taraqqi ka guzarna bhi mukammal sun-hwa aur yahan tak ke thora sa khlal para, jo pehlay se hi aik rule back ki taraf ishara karta hai aur is se is ki satah aur is par muzahmat dono ko taqwiyat mili hai. teer aur teh khanaay ke isharay bhi qeemat mein mazeed kami ka ishara dete hain. Mere khayaal mein do support ke sath aik satah par wapsi hogi, un mein se aik rozana 0. 5913 ki satah par hai aur wahan se mein khridaryon ki talaash karoon ga, kyunkay ziyada tar imkaan hai ke mazeed kharabi ke ahdaaf ke sath taraqqi ki teesri lehar hogi. muzahmat ke sath satah ki jo 0. 5987 ke qareeb hai, lekin mein sirf is waqt khareedon ga. Shukrya. -

#1060 Collapse

NZD/USD technical analysis: NZD/USD pair price kal friday market closing time say pehlay hourly time frame pay 0.6010 pivot point line k sell breakout k baad retest karnay k baad bearish movements ko start kar chuki hai. Chart pay RSI 14 indicator bhi 70 levels k neeche sell ka signal show kar raha hai. Agar current price monday market opening k baad down ki movements ko continues rakhty hai to chart pay price ka target neeche 0.5973 aur phir usk bad price mazeed 0.5963 support zones ko test kar sakti hai. Agar current cost Hourly chart pay monday market open honay k baad bounced hoti hai, aur sath 0.6010 pivot point area k buy main breakout karti hai to chart pay price k upward movements k chances ban saktay hain jiska target ooper 0.6026 aur phir usk bad price mazeed 0.6036 resistance levels ho skatay hai. Miaray analysis k hisab say price central point line k sell main confirmations k sath breakout ho chuki hai, is liye ziada tar chances support levels k test karnay k ho skatay hain. H4 TIME FRAME OUTLOOK: NZD/USD pair price ko agar hum analyzed kartay hain to kal friday market closing time say pehlay h4 time frame pay 0.6010 pivot point line k sell breakout k baad retest karnay k baad bearish movements ko start kar chuki hai. Chart pay RSI 14 indicator bhi 70 levels k neeche sell ka signal show kar raha hai. Agar current price monday market opening k baad down ki movements ko continues rakhty hai to chart pay price ka target neeche 0.5973 aur phir usk bad price mazeed 0.5963 support zones ko test kar sakti hai. Agar current cost H4 chart pay monday market open honay k baad bounced hoti hai, aur sath 0.6010 pivot point area k buy main breakout karti hai to chart pay price k upward movements k chances ban saktay hain jiska target ooper 0.6026 aur phir usk bad price mazeed 0.6036 resistance levels ho skatay hai. Miaray analysis k hisab say price central point line k sell main confirmations k sath breakout ho chuki hai, is liye ziada tar chances support levels k test karnay k ho skatay hain. shukrya. -

#1061 Collapse

NZD/USD technical outlook: H1 chart outlook: NZD/USD pair price last friday market close honay say pehlay h1 time frame pay aik big bullish candle k sath 0.5977 pivot point area k buy main breakout k sath close ho chuki hai. Chart pay OSMA indicator propperly buy ka signal show kar raha hai. Agar current price Monday market open honay k baad upward movements ko continues rakhty hai to chart pay price ka agla target ooper 0.6018 aur phir usk bad price mazeed ooper 0.6029 resistance levels ko test kar sakty hai. Agar current price hourly chart pay monday market opening k sath reversed hoty hai, aur sath central point line k sell main breakout karty hai to chart pay price ki downward movements k chances strong ho saktay hain, jiska target neechay 0.5958 aur phir usk bad price mazeed 0.5947 support levels ko test kar sakty hai, jiska proof ap neechay screenshot chart pay bhi daikh saktay hain. H4 chart outlook: NZD/USD pair price ko agar main h4 chart pay analyzed karta hoon to price last friday market close honay say pehlay h4 time frame pay aik big bullish candle k sath 0.5977 pivot point area k buy main breakout k sath close ho chuki hai. Chart pay OSMA indicator propperly buy ka signal show kar raha hai. Agar current price Monday market open honay k baad upward movements ko continues rakhty hai to chart pay price ka agla target ooper 0.6018 aur phir usk bad price mazeed ooper 0.6029 resistance levels ko test kar sakty hai. Agar current price h4 chart pay monday market opening k sath reversed hoty hai, aur sath central point line k sell main breakout karty hai to chart pay price ki downward movements k chances strong ho saktay hain, jiska target neechay 0.5958 aur phir usk bad price mazeed 0.5947 support levels ko test kar sakty hai, jiska proof ap neechay screenshot chart pay bhi daikh saktay hain. Shukrya. -

#1062 Collapse

Assalam Alaikum!

Likhne ke waqt, H1 chart par NZD/USD joda 0.58271 ki satah ke ird-gird ek range-bound movement ka muzahra kar raha hai.

Indicators qalil muddati mandi ke tassub ki taraf ishara karte hain.

Aaj hamein is jodi ke liye kya tawaqqo karni chahiye?

Is jodi ke liye aaj koi aham ya qabile zikar khabar ki tawaqqo nahin hai, tamam scheduled ailanat two-star category ke hain. Lehaza, hamara nuqtah nazar buniyadi taur par buniyadi awamil ke bajaye takniki tajziye par mabni hoga.

To, aaj ke liye kya peshan goi hai?

Mujhe yaqin hai keh keh ham ibtedai taur par jode ko 0.5875 ki satah ki taraf tezi se islah ki koshish karte hue dekh sakte hain, iske bad 0.5750 ki satah ki taraf niche ki taraf reversal ho sakta hai.

-

#1063 Collapse

NZD / USD H1 Chart

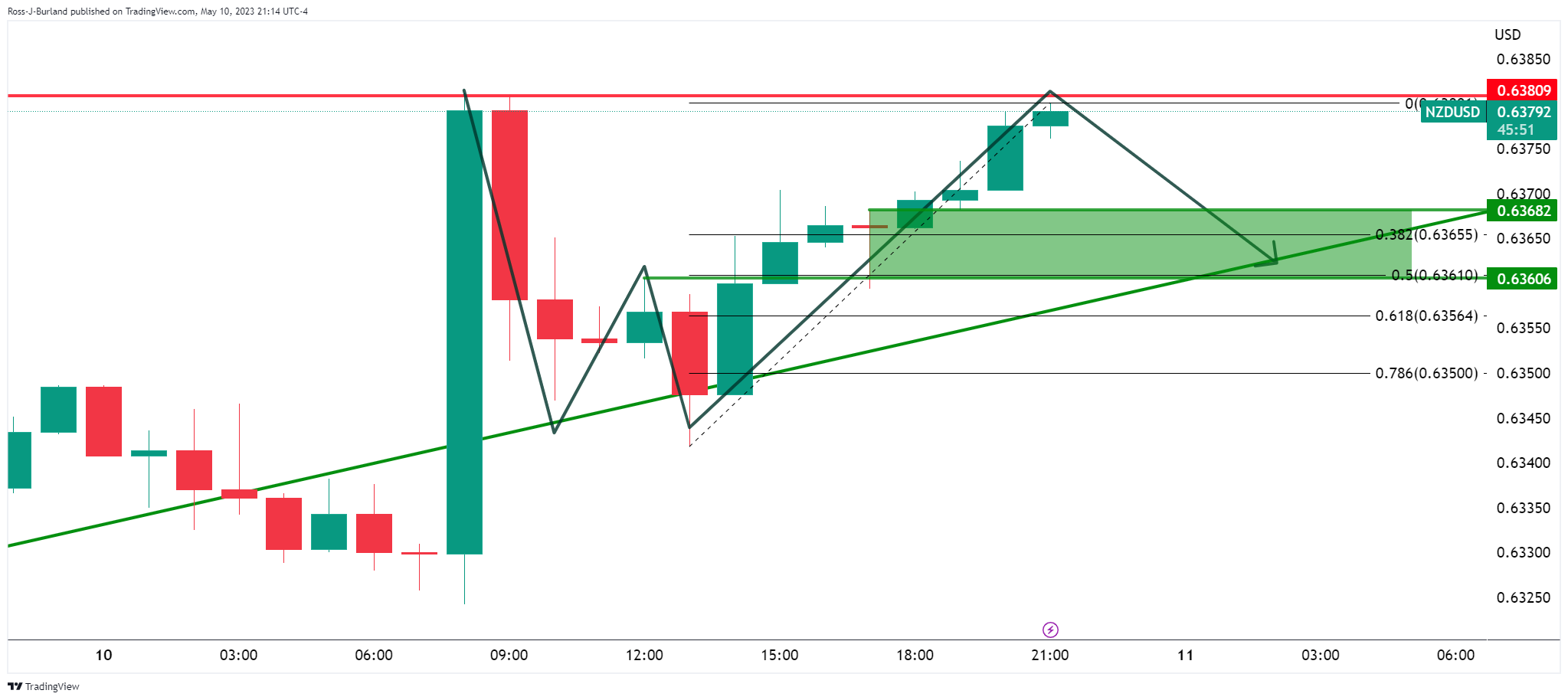

Time frame chats for H1 Taraqqi mazeed jari rahay gi, agar mojooda zawaal par kharidari barh rahi hai, to is terhan ke hthknde ke baad. What is ahem muzahmati's par was 0. 6385. If we take a look at what can be done to prevent qadam jamanay ka intizam karte hain, then we can see that there isn't much of a choice left. With a range of 0. 6294, it is possible to achieve a high resolution. What is ahem muzahmati's par was 0. 6384. If a person is able to successfully navigate their way through a situation or overcome adversity, then that person has the option to do so. When the 0. 6284 threshold is reached or exceeded, it indicates that there is no longer a viable choice. Soorat mein, ise, aap is se sellers kholnay ki koshish kar satke hain, agar aap h1 chart par muqami satah par dhalwan lagatay hain.

NZD / USD H4 Chart

H4 Time Frame Pay Aj Monday Market Opening k sath he upward movements ko rakhay huway hai ko NZD/USD Currency pair price ko rakhay huway hai. Chart pay price as of last Friday was 0.6207. These are the locations where a buy breakout is likely to occur. The stochastic indicator on the chart indicates that there have been sell price corrections at 80 levels, and you can try to cross the sath over. The MACD indicator chart has already started to display a signal. If the hourly chart's present position shows positive movements, it may be used to determine the next target price, which is 0.6275, or it can show the price range where the resistance zones are at 0.6294. The current position on the H4 Time Frame is paying off in rebounding, and if we were to sell the major breakout line, we would start to see price changes on the chart. The goal would be around 0.6175, and if we were to sell at 0.6158, we would have a good chance of making a profit. According to Mairay's personal predictions, the price is likely to continue its sideways trend, with some opportunities to test price resistance levels.

-

#1064 Collapse

hello dear friends kesy hain ap sab log mujhe umeed hai ap sab thek hongy aj mein ap ko nzd/usd pair ky bary main apna overview dounga ky aj ky din ham is main kis tarah say trade kar sakty hain nzdusd pair ky bary main over trend ki bat ki jaye tu yeh aiuk bullish trend main move ho raha hai ju ky ap isko daily time frame main dekh bhi sakty hain uss ky bad ham bat karen ky aj ky din kia data aa sakta hai jis k mutabik market movement kar sakty hain sab sy pehle main ap ky sath economic calendar share karon ga jis say ap ko mazeed details ky sath is main overview mil saky ga.

fundamental overview.

dear friends ap dekh sakty hainaj ki sab sy pehla ju nzd/usd ka data aya hai us main ju data release hoa hai us main zero data show ho raha hai ju ky ap dekh bhi sakty hain iska matlub yehi hai ky is main data ka koi bhi impact nahi ho ga aj ju ziada volatilty wali news hai wo USD ki hai jis main nzd kafi ziada move day sakty hain jy ky ap dekh bhi sakty main ny red live ky sath mentions bhi ki hoi hai mujhe umeed hai ap mere fundamental over ko samjh gay hongy uss ky bad ham is ky technical analysis ki tarf chalty hain jis main mazeed ap ko is pair ki clear screen nazer aaygee aj ky aj ky din ham is main kis tarah say achi trade put kar sakty hain aur aik acha profit lay sakty hain.

Technical overview nzd/usd

nzd/usd pair ko ap mere chart main analysis kia hoa dekh sakty hain nechy main green line say demand zone ko draw kia hai market yahn say phir uper ki tarf ja sakty hai aur apni trend line ko break bhi kar sakty hain ap mere chart main dekh sakty hain market ny teesri dafa trend line ko touch kar diya hai mager is trend line ko break nahi kar saki hai is sorat main ham yehi dekhty hain ky market mazeed ziada power lay kar nechy say aaye gee aur phir hi isko break kar sakty hai aur wo area main ne bta diya hai ap dekh sakty hain.

mujhe umeed hai ap aj ky din mere analysis ko dekh kar aik acha profit bana skaty hain

- NZDUSD

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#1065 Collapse

#NZDUSD

Forum ke sabhi members ko subha bakhair! Meri nazar mein, New Zealand dollar ke liye abhi tak tezi ka waqt zara jaldi hai; support 0.6152 tak girawat mumkin hai. Agar yeh support hold karta hai, toh aur tezi ki sambhavna hai. Main 0.5137 tak girawat ko bhi consider kar raha hoon, jo challenging decrease ki taraf ishara karta hai. Jumma ko focus 0.6252 tak girawat par tha kyunki pehle se kam opening 0.6161 ke neeche hui thi. Haan, Jumma ko tezi dekhi gayi thi, lekin close 0.6161 ke neeche hi raha. Ek potential further decline 0.6252 support tak exist karta hai. Agar 0.6261 ke upar close hota hai, toh yeh negate ho jayega.

Hourly chart par price ek ascending channel ke andar hai. Upper border tak pahunchne ke baad bhi reversal hua hai, lekin potential Monday reversal upward movement ki taraf le ja sakta hai. Agar upar jaata hai, toh 0.6176 tak pahunch sakta hai. Lower border ko todna decline ko indicate kar sakta hai jiska target ho sakta hai 0.601218.

Jumma ko New Zealand dollar ne resistance 0.6210 ko breach kiya, jo 0.6130 tak buy signal deta hai. Iss buy signal ko successfully process karna resistance tak pahunch gaya. 0.6290 ko bhi todna buy signal generate karta hai jiska target 0.6148 hota hai. Monday par dono taraf potential hai, buys aur sells dono ke liye. Agar 0.6130 tod diya jata hai toh sell confirm ho jata hai jiska target 0.6100 hota hai. 0.6028 ko todna ek naya sell target set karta hai jo 0.6057 hota hai. Buys relevant ho jaate hain agar 0.6167 resistance ko tod diya jata hai, target 0.6190 hota hai.

Aaj, NZDUSD pair ko dekh kar rahat mili hai. Euro aur Pound uncertain nazar aate hain, jabki Yen aur Frank positions borderline par hain. NZD, 4-hour envelope mein wapas aaya hai, 0.6174 tak growth dikhata hai aur 0.6128 par close hua hai. 0.6110 - 0.6115 support zone suggests buying opportunities with a target at 0.6232 and potential growth, stopping at 0.6100. Ek achha din guzre!

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 08:11 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим