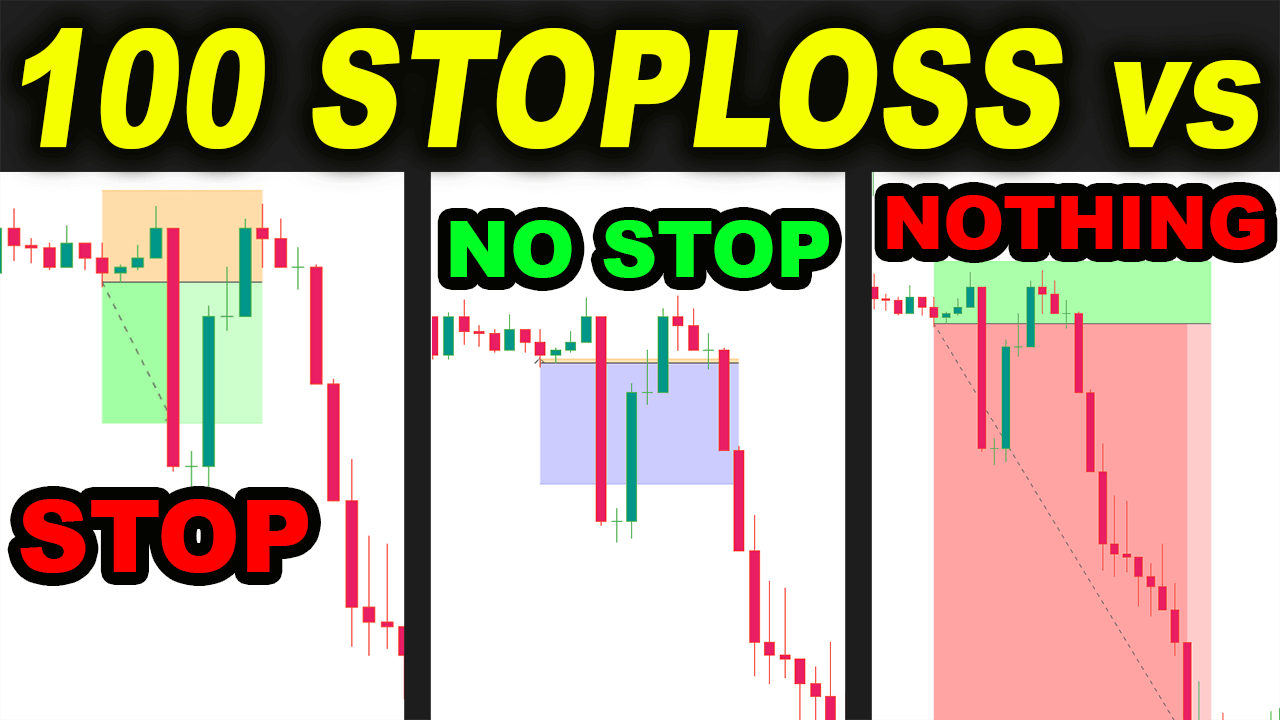

Stop loss ke baghair trading karna bohot risky hota hai. Stop loss, yaani "nuksaan band", ek aham risk management tool hai jo traders istemal karte hain apne nuksaan ko control karne ke liye. Agar kisi trader stop loss ke baghair trading karta hai, toh woh apne trades ko monitor karna aur manual intervention karna bhool sakta hai, jiski wajah se nuksaan ka khatra barh jata hai.

Stop loss ke baghair trading karne ka matlab hai ke trader apne trades mein nuksaan uthane ke liye tayar hota hai. Yeh aksar inexperienced ya overconfident traders ka faisla hota hai jo market ki volatility aur risk ko samajhne mein kami rakhte hain. Stop loss ke baghair trading karne se trader ko nuksaan ka jyada samna karna pad sakta hai aur woh apne poore capital ko bhi kho sakta hai.

Ek behtar approach yeh hota hai ke har trade mein ek munasib stop loss level set kiya jaye taake nuksaan ko minimize kiya ja sake. Stop loss ki madad se trader apne nuksaan ko control kar sakta hai aur emotional trading se bach sakta hai. Isse trader ka trading plan aur strategy bhi mazboot hota hai.

Stop loss ke baghair trading ek bohot risky amal hai jo experienced aur successful traders se bachne ki salahiyat rakhta hai. Is liye, har trader ko apne trades mein stop loss ka istemal karna chahiye taake nuksaan se bacha ja sake aur trading journey ko safar aur faidemand banaya ja sake.

Stop loss ke baghair trading karne ka matlab hai ke trader apne trades mein nuksaan uthane ke liye tayar hota hai. Yeh aksar inexperienced ya overconfident traders ka faisla hota hai jo market ki volatility aur risk ko samajhne mein kami rakhte hain. Stop loss ke baghair trading karne se trader ko nuksaan ka jyada samna karna pad sakta hai aur woh apne poore capital ko bhi kho sakta hai.

Ek behtar approach yeh hota hai ke har trade mein ek munasib stop loss level set kiya jaye taake nuksaan ko minimize kiya ja sake. Stop loss ki madad se trader apne nuksaan ko control kar sakta hai aur emotional trading se bach sakta hai. Isse trader ka trading plan aur strategy bhi mazboot hota hai.

Stop loss ke baghair trading ek bohot risky amal hai jo experienced aur successful traders se bachne ki salahiyat rakhta hai. Is liye, har trader ko apne trades mein stop loss ka istemal karna chahiye taake nuksaan se bacha ja sake aur trading journey ko safar aur faidemand banaya ja sake.

تبصرہ

Расширенный режим Обычный режим