Money Management : Money managment aik ahem harba hai jisay tamam taajiron ko –apne sarmaye ko mehfooz rakhnay ke liye istemaal karna chahiye. –apne khatray aur tijarti hajam ko munasib tareeqay se munazzam karkay, tajir is baat ko yakeeni bana saktay hain ke woh taweel safar ke liye market mein rehne aur munafe bakhash tijarti mawaqay se faida uthany ke qabil hain.

Taajiron ke liye money managment ka maqsad un ke khatray ko mehdood karna hai jabkay un ke tijarti account mein apni position ke size ko barha ya ghata kar ziyada se ziyada taraqqi haasil karna hai.

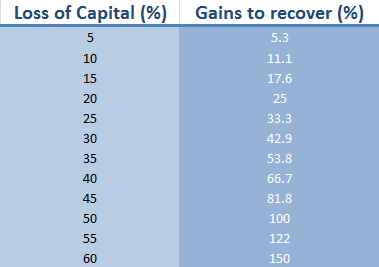

Taajiron ke liye money managment ka aik aur ahem pehlu rissk control hai. stap lasz muqarrar karkay aur un ki numayesh ko mehdood karkay, tajir –apne sarmaye ko mukhtasir muddat mein barray nuqsaan se bacha satke hain. mazeed bar-aan, tijarat ko barha kar aur kisi bhi di gayi tijarat par –apne account ke Sirf aik chhootey feesad ko khatray mein daal kar, tajir is baat ko yakeeni bana satke hain ke agar un ki tijarat un ke khilaaf jati hai to woh bohat ziyada raqam se mahroom nah hon.

1. Funds mukhtas karna

is mein koi shak nahi ke baazaaron mein taqreeban laa-mehdood tijarti mawaqay mojood hain .

chahay tajir forex, stock, index, commodities, ya crypto mein dilchaspi rakhtay hon, is baat ke imkanaat hain ke woh aik aisa tijarti mauqa talaash kar satke hain jo un ke tijarti andaaz ke mutabiq ho.

taham, aik cheez hai jo un tijarti mawaqay se faida uthany ki raah mein rukawat ban sakti hai .

2. Position ka size

Position ka size aap ke funds ki taqseem ko aik aur satah par le aata hai .

un ke bunyadi tor par, position sayzng ki techniques mein yeh faisla karna shaamil hai ke fi tijarat kitni raqam mukhtas karni hai aur fi tijarat kitna khatrah mol lena hai .

misaal ke tor par, aik tajir eur / usd, usd / jpy, aur usd / cad tijarat karna chahta hai. un ke tijarti sarmaye ke hajam aur un forex joron ko trade karne ke Sabiqa tujarbay par munhasir hai, tajir har tijarat ke liye mukhtalif raqam mukhtas karna chahta hai.

3.Stop loss nuqsaan ka istemaal

Stoploss orders ka istemaal money management trading ki kamyaab hikmat e amli ka teesra jazo hai.

stap las order ka istemaal karte waqt, tajir rait mein aik lakeer khenchte hain aur un nuqsanaat ki tadaad ko mehdood karte hain jin ka woh samnay aana chahtay hain.

Taajiron ke liye money managment ka maqsad un ke khatray ko mehdood karna hai jabkay un ke tijarti account mein apni position ke size ko barha ya ghata kar ziyada se ziyada taraqqi haasil karna hai.

Taajiron ke liye money managment ka aik aur ahem pehlu rissk control hai. stap lasz muqarrar karkay aur un ki numayesh ko mehdood karkay, tajir –apne sarmaye ko mukhtasir muddat mein barray nuqsaan se bacha satke hain. mazeed bar-aan, tijarat ko barha kar aur kisi bhi di gayi tijarat par –apne account ke Sirf aik chhootey feesad ko khatray mein daal kar, tajir is baat ko yakeeni bana satke hain ke agar un ki tijarat un ke khilaaf jati hai to woh bohat ziyada raqam se mahroom nah hon.

1. Funds mukhtas karna

is mein koi shak nahi ke baazaaron mein taqreeban laa-mehdood tijarti mawaqay mojood hain .

chahay tajir forex, stock, index, commodities, ya crypto mein dilchaspi rakhtay hon, is baat ke imkanaat hain ke woh aik aisa tijarti mauqa talaash kar satke hain jo un ke tijarti andaaz ke mutabiq ho.

taham, aik cheez hai jo un tijarti mawaqay se faida uthany ki raah mein rukawat ban sakti hai .

2. Position ka size

Position ka size aap ke funds ki taqseem ko aik aur satah par le aata hai .

un ke bunyadi tor par, position sayzng ki techniques mein yeh faisla karna shaamil hai ke fi tijarat kitni raqam mukhtas karni hai aur fi tijarat kitna khatrah mol lena hai .

misaal ke tor par, aik tajir eur / usd, usd / jpy, aur usd / cad tijarat karna chahta hai. un ke tijarti sarmaye ke hajam aur un forex joron ko trade karne ke Sabiqa tujarbay par munhasir hai, tajir har tijarat ke liye mukhtalif raqam mukhtas karna chahta hai.

3.Stop loss nuqsaan ka istemaal

Stoploss orders ka istemaal money management trading ki kamyaab hikmat e amli ka teesra jazo hai.

stap las order ka istemaal karte waqt, tajir rait mein aik lakeer khenchte hain aur un nuqsanaat ki tadaad ko mehdood karte hain jin ka woh samnay aana chahtay hain.

تبصرہ

Расширенный режим Обычный режим