Jab aap trading ki duniya mein dakhil hote hain, to ek sab se ahem chezein mein se aik ye hai ke aap seekhein ke kaise ek munafa bhari strategy banai jaye. Lekin, market ko sahi taur par samajhna aur uss par amal karna bhi ahem hai. Itni sari price patterns mein se, aap swing failure pattern ka faida uthane ki koshish kar sakte hain.

Swing Failure Patterns Ke Bare Mein Ek Nazar

Swing Failure pattern trend reversal ko dikhata hai kyun ke ye signal karta hai ke mojooda trend kamzor ho raha hai aur aik naya trend ban raha hai. Ye pattern traders ko madad karta hai ke wo ye decide kar sakein ke wo market mein kab dakhil ho sakte hain ya nikal sakte hain, jahan aap trend ke shuruwat mein dakhil ho sakte hain aur jab opposite trend banne lage to bahar nikal sakte hain. Is pattern ko early identify karna aapki trading plan banane mein madad karega.

Swing failure tab hota hai jab mojooda price trend ek uptrend mein naye high na banaye ya downtrend mein naye low na banaye. Is tarah, swing failure pattern trader ko ek achhi entry price milne mein madad karta hai trend ke shuruwat mein.

Yeh ek asool hai ke aap market mein trend ke mutabiq dakhil ho. Isi tarah, market mein dakhil hone ke liye liquidity paida karne ke liye swing high ke neeche ya swing low ke upar ek stop loss target ki taraf rukawat daalna.

- Agar market uptrend mein hai, to naye highs (higher highs) ya naye lows (higher lows) banaye ja rahe hain. Ye pattern tab dikhai deta hai jab prices naye highs banane mein nakam ho jaate hain. Dusri taraf, downtrend mein, ye pattern tab dikhai deta hai jab naye lows nahi bante.

- Is pattern ke liye valid hone ke liye, price movement ko uptrend mein last higher low level ya downtrend mein last lower high ko todna hoga.

- Ye pattern, Relative Strength Index (RSI) indicator ke saath combine karke direction reversal ke roop mein bharosa kiya ja sakta hai. RSI ek technical indicator hai jo past prices aur current prices ko dikhaata hai.

- Swing failure pattern tab hota hai jab price line aur RSI line ek dusre se divide hote hain. Ye kamzor momentum ka ishara hai, jo aam taur par market oversold ya overbought hoti hai.

- RSI line ka wo point jahan RSI line last swing low ke neeche hai, use fail point kehte hain aur ye ek sell signal ko darust karta hai. Dusri taraf, jab RSI last trend ke lowest price (lowest low) ke upar hota hai, to ye ek buy signal ko darust karta hai.

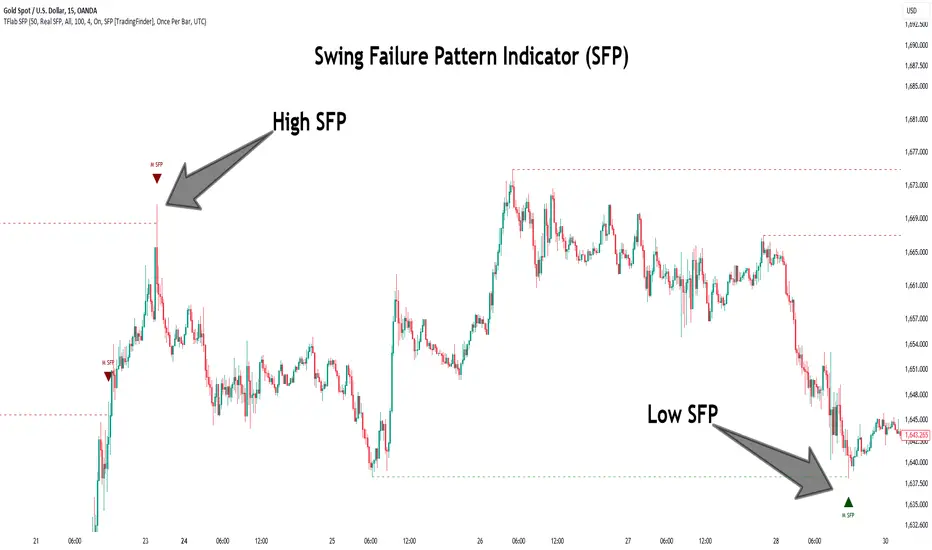

Isko aur zyada saaf samajhne ke liye, yahan chart par aik example hai:

- Niche di gayi graphic image mein, aap dekh sakte hain ke swing low aur high banaye ja rahe hain jab tak swing high ko test karne par nakam ho jaata hai.

- Hum wait karte hain jab swing low bana ho, phir break through the failure swing ko confirm karke sell entry ka intezar karte hain. Jab confirm entry milta hai, to sell position enter hoti hai.

- Jab sell position enter hoti hai, aap target profit tay kar sakte hain, lekin main aksar sirf market structure ko target profit ke taur par istemal karta hoon.

Left side mein, aap dekh sakte hain ke price ne successfully market structure target tak pahuncha hai, jo ke support level hai.

Bullish Failure Swing Pattern

Bullish swing failure pattern tab banta hai jab indicator overbought level ya upper extreme level ki taraf jaata hai aur phir ek correction ke liye neeche aata hai, phir naye highest price tak pohunchne ke bajaye gir jaata hai aur ek "M" pattern banata hai. Naye highest price na banane ko swing failure define kiya jata hai, aur ye ishara hai ke uptrend khatam ho jayega aur kisi bhi waqt ulta ho sakta hai.

Bearish Failure Swing Pattern

Bearish swing failure pattern tab hoti hai jab indicator oversold ya extreme oversold levels ki taraf jaata hai aur phir correct hota hai, lekin phir naye lowest price ki taraf jaane ke bajaye phir se upar chala jaata hai, jisse "W" pattern ban jaata hai. Naye lowest price banane mein nakami, swing failure ke roop mein define hoti hai aur yeh ishara karta hai ke downtrend ka momentum kamzor ho raha hai aur traders ko ek buy position mein dakhil hona chahiye.

Swing failure patterns W, M, failure swing top, aur non-failure swing top ke roop mein ho sakti hain:

- Failure Swing Top: Yeh ek shart hai jahan price upar jaati hai lekin RSI upar nahi badhti aur failure swing ke neeche gir jaati hai, yeh ek sell position ka ishara karta hai.

- Non-Failure Swing Top: Yeh ek shart hai jahan price neeche jaati hai lekin RSI neeche nahi jaati, yeh ek buy position ka ishara karta hai.

Upar di gayi do conditions jo bearish market mein hoti hain, unhein failure swing bottom aur non-failure swing bottom kehte hain.

Conclusion

Hamesha bilkul sahi nahi hota, lekin swing failure pattern ek asaan aur effective trading strategy hai jo trend kamzor hone aur potential trend reversals ko pehchanne mein madad karta hai. Traders is pattern ka istemal entry aur exit opportunities ko pehchanne aur ek behtar profit ke liye trading strategy banane ke liye kar sakte hain.

تبصرہ

Расширенный режим Обычный режим