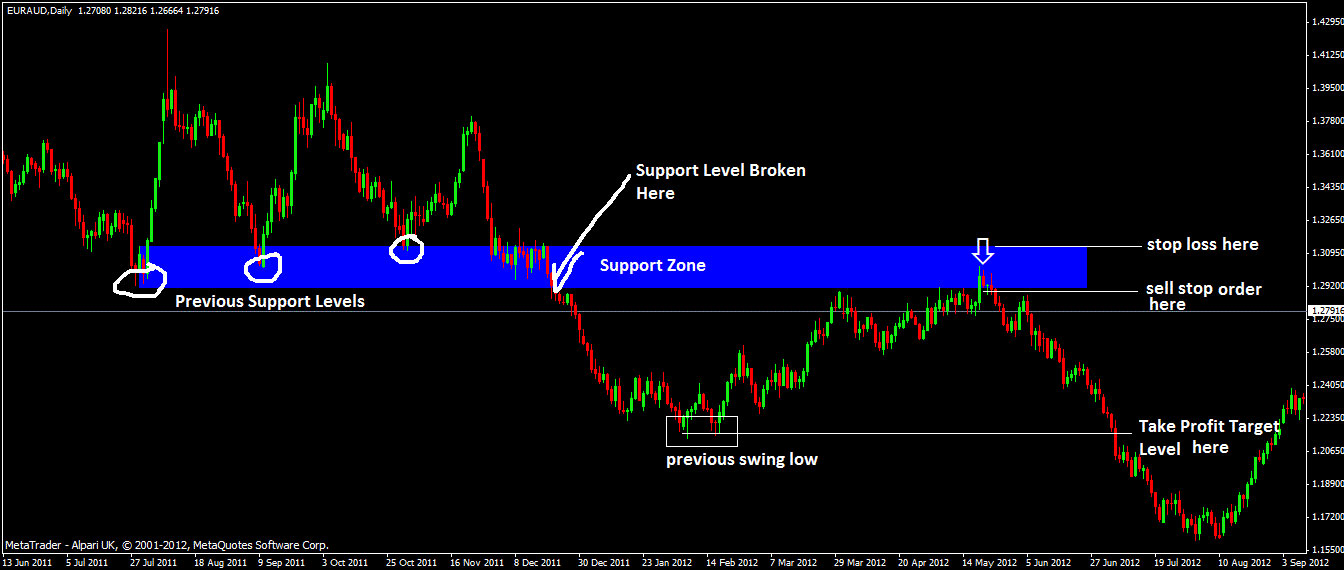

Support and resistance wo point hota hai jis point tak aaty hi price wapis chaly jati hai ap ne kisi b currency ka chart open kia ho us per ap ne sab se pahly support and resistance ki line laga lani hai jis se ap ko profit banany me asani ho gi

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

support and resistance point kia hota hai

support and resistance point kia hota hai

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Forex trading mein support aur resistance points bahut important hote hain. In points ke use se traders ek currency pair ke price movements ko predict kar sakte hain. Support aur resistance points ka concept simple hai, jismein traders specific price levels ko observe karte hain, jinhein market ka price action resist karta hai. Support Points Support points wo price levels hote hain, jinhein market ka price action neeche nahi jaata hai. Jab market ka price action support level tak pahunchta hai, to yeh level support point kehlaya jaata hai. Support points ko observe karne ke baad, traders price movements ko predict kar sakte hain. Support points ko observe karne ka sabse aasan tarika previous lows ko analyze karna hai. Support points ko identify karne ke liye, traders price charts ka use karte hain. Support points ki identification mein, traders ko price charts par specific patterns aur levels search karne ki zaroorat hoti hai. Support points par traders ke orders execute hote hain, kyun ki woh support points par ek bounce back ki possibility expect karte hain. Resistance Points Resistance points wo price levels hote hain, jinhein market ka price action cross karne mein struggle karta hai. Jab market ka price action resistance level tak pahunchta hai, to yeh level resistance point kehlaya jaata hai. Resistance points ko observe karne ke baad, traders price movements ko predict kar sakte hain. Resistance points ko observe karne ka sabse aasan tarika previous highs ko analyze karna hai. Resistance points ko identify karne ke liye, traders price charts ka use karte hain. Resistance points ki identification mein, traders ko price charts par specific patterns aur levels search karne ki zaroorat hoti hai. Resistance points par traders ke orders execute hote hain, kyun ki woh resistance points par ek breakout ki possibility expect karte hain. Support aur Resistance Points ka Importance Support aur resistance points ka use karke, traders currency pair ke price movements ko predict kar sakte hain. Support aur resistance points ka use karke, traders market trends aur price patterns ko identify kar sakte hain. Support aur resistance points ke use se, traders apne trading strategies ko improve kar sakte hain. Support aur resistance points ka use karke, traders market trends aur reversals ko identify kar sakte hain. Support aur resistance points ke use se, traders apne trades ke liye stop loss aur take profit levels set kar sakte hain. Support aur resistance points ka use karne se, traders risk management strategies ko improve kar sakte hain. Support aur resistance points ko identify karne ke liye traders kaafi saare tools ka use kar sakte hain, jaise ki price charts, technical indicators aur Fibonacci retracements. Traders support aur resistance points ko manual analysis se bhi identify kar sakte hain. Support aur resistance points ki identification mein, traders ko ek important concept ke bare mein pata hona chahiye, jise false breakout kehte hain. False breakout, ek aisi situation hoti hai, jahan market ka price action resistance level cross karke, ek breakout ka impression create karta hai, lekin phir market ka price action phir se wapas resistance level ke under aa jata hai. False breakout se bachne ke liye, traders ko support aur resistance points ke saath saath, market ka price action aur momentum bhi observe karna chahiye. Support aur resistance points ko observe karne ke liye traders ko market ke news aur events ka bhi dhyaan rakhna chahiye. News aur events ki wajah se market ke price movements mein sudden changes aa sakte hain, jisse support aur resistance points affect ho sakte hain. Traders ko news aur events ke impact ko assess karke apne trades ko manage karna chahiye. Support aur resistance points ka use karke, traders ko market ke direction aur momentum ka idea milta hai. Jab traders support aur resistance points ko identify karte hain, to woh market trends aur price patterns ko analyze karne mein bhi help milta hai. Traders support aur resistance points ke use se, apne trading strategies ko improve kar sakte hain, aur apne trades ko better manage kar sakte hain.

Support aur Resistance Points ka Importance Support aur resistance points ka use karke, traders currency pair ke price movements ko predict kar sakte hain. Support aur resistance points ka use karke, traders market trends aur price patterns ko identify kar sakte hain. Support aur resistance points ke use se, traders apne trading strategies ko improve kar sakte hain. Support aur resistance points ka use karke, traders market trends aur reversals ko identify kar sakte hain. Support aur resistance points ke use se, traders apne trades ke liye stop loss aur take profit levels set kar sakte hain. Support aur resistance points ka use karne se, traders risk management strategies ko improve kar sakte hain. Support aur resistance points ko identify karne ke liye traders kaafi saare tools ka use kar sakte hain, jaise ki price charts, technical indicators aur Fibonacci retracements. Traders support aur resistance points ko manual analysis se bhi identify kar sakte hain. Support aur resistance points ki identification mein, traders ko ek important concept ke bare mein pata hona chahiye, jise false breakout kehte hain. False breakout, ek aisi situation hoti hai, jahan market ka price action resistance level cross karke, ek breakout ka impression create karta hai, lekin phir market ka price action phir se wapas resistance level ke under aa jata hai. False breakout se bachne ke liye, traders ko support aur resistance points ke saath saath, market ka price action aur momentum bhi observe karna chahiye. Support aur resistance points ko observe karne ke liye traders ko market ke news aur events ka bhi dhyaan rakhna chahiye. News aur events ki wajah se market ke price movements mein sudden changes aa sakte hain, jisse support aur resistance points affect ho sakte hain. Traders ko news aur events ke impact ko assess karke apne trades ko manage karna chahiye. Support aur resistance points ka use karke, traders ko market ke direction aur momentum ka idea milta hai. Jab traders support aur resistance points ko identify karte hain, to woh market trends aur price patterns ko analyze karne mein bhi help milta hai. Traders support aur resistance points ke use se, apne trading strategies ko improve kar sakte hain, aur apne trades ko better manage kar sakte hain.  Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Support Points: Definition and Importance: Support aur resistance factors forex aur stock marketplace mein istemaal hone wale critical technical ideas hain. Ye factors traders ko marketplace ke fee moves ko examine karne aur future traits ka prediction karne mein madad karte hain. Support aur resistance factors investors ko marketplace trends samajhne mein madad karte hain, taaki woh apne trading selections ko behtar tareeqe se le sakein. Support point market mein aisi degree hoti hai jahan par price decline karte waqt customers ki taqat zahir hoti hai aur fee ko stabilize karti hai. Jab marketplace mein kisi inventory ya currency ka charge area of interest jaata hai, toh assist factor buyers ke liye aik potential buying level ban jata hai. Jab charge assist point tak pohnchta hai, toh wahan par buyers shopping for orders region kar sakte hain, kyunke woh ummeed karte hain ke price wapas upar jaayega. Support factor ko breach karna rate ki further decline ki indication hai aur investors ko promoting decisions leni chahiye. Resistance point market mein aisi degree hoti hai jahan par fee increase karte waqt sellers ki taqat zahir hoti hai aur rate ko rokti hai. Jab marketplace mein kisi inventory ya foreign money ka price upar jaata hai, toh resistance factor investors ke liye aik potential selling stage ban jata hai. Jab charge resistance point tak pohnchta hai, toh wahan par investors selling orders area kar sakte hain, kyunke woh ummeed karte hain ke charge wapas area of interest jaayega. Resistance factor ko breach karna fee ki in addition boom ki indication hai aur traders ko buying choices leni chahiye. Support aur resistance factors ki identification technical evaluation tools aur charge charts ke zariye ki jaati hai. Traders price charts par preceding charge moves ko examine karke help aur resistance stages ko identify karte hain. Yeh tiers horizontal strains ke shape mein chart par darj kiye jaate hain. Support aur resistance points ka level strong hota hai jab woh a couple of instances mein price ko rokne ya stabilize karne ka kaam karta hai. Identifying Support and Resistance Points: Technical Analysis Tools: Support aur resistance points ki importance market sentiment aur trading extent ke saath judi hoti hai. Jab kisi stock ya foreign money ka rate assist ya resistance factor ko breach karta hai, toh woh market sentiment ke alternate ka indication hota hai. Support aur resistance factors traders ko capability entry aur exit points provide karte hain, jinhe buyers apne trading techniques mein shamil kar sakte hain. Samajhne mein aane wale stages aur tendencies buyers ko buying and selling selections lene mein madad karte hain. Traders support aur resistance levels ke saath price motion aur different technical signs ka bhi istemaal karte hain, taaki woh marketplace ke future actions ko sahi tareeqe se are expecting kar sakein. Support aur resistance points ki sahi samajh trading success mein ahem hissa hai aur buyers inko apni analysis mein shamil karte hain. Support aur resistance points foreign exchange aur stock marketplace mein traders ke liye critical hote hain. Ye points price degrees hote hain jin par marketplace mein rate movements ke course trade hote hain. Inko identify karke traders marketplace traits aur price reversals ko samajhte hain, jisse unko trading selections lene mein madad milti hai. Support factors, jaise ki naam se pata chalta hai, marketplace mein charge ko assist dete hain. Ye ranges aksar preceding charge lows se judte hain, jahan par investors ko shopping for opportunities milte hain. Jab charge guide level tak pahunchta hai, toh wahan par consumers active ho jate hain aur fee ko upar uthane ki koshish karte hain. Agar support stage sturdy hai, toh fee us stage se bounce back karke upar jaane ka prayaas karti hai. Traders guide level par buy orders vicinity karke charge ki upward movement se profit kamate hain. Lekin agar support degree breach ho jata hai, toh ye ek bearish signal hai aur traders ko selling selections lena chahiye. Resistance factors, then again, rate ko rokne aur downward motion ko create karne mein madad karte hain. Ye degrees aksar previous charge highs se judte hain. Jab rate resistance level tak pahunchta hai, toh wahan par dealers energetic ho jate hain aur price ko neeche le jane ki koshish karte hain. Agar resistance level robust hai, toh rate us stage se bounce back karke neeche jaane ki koshish karti hai. Traders resistance stage par promote orders place karke fee ki downward movement se income kamate hain. Lekin agar resistance degree breach ho jata hai, toh ye ek bullish sign hai aur investors ko shopping for selections lena chahiye.

Identifying Support and Resistance Points: Technical Analysis Tools: Support aur resistance points ki importance market sentiment aur trading extent ke saath judi hoti hai. Jab kisi stock ya foreign money ka rate assist ya resistance factor ko breach karta hai, toh woh market sentiment ke alternate ka indication hota hai. Support aur resistance factors traders ko capability entry aur exit points provide karte hain, jinhe buyers apne trading techniques mein shamil kar sakte hain. Samajhne mein aane wale stages aur tendencies buyers ko buying and selling selections lene mein madad karte hain. Traders support aur resistance levels ke saath price motion aur different technical signs ka bhi istemaal karte hain, taaki woh marketplace ke future actions ko sahi tareeqe se are expecting kar sakein. Support aur resistance points ki sahi samajh trading success mein ahem hissa hai aur buyers inko apni analysis mein shamil karte hain. Support aur resistance points foreign exchange aur stock marketplace mein traders ke liye critical hote hain. Ye points price degrees hote hain jin par marketplace mein rate movements ke course trade hote hain. Inko identify karke traders marketplace traits aur price reversals ko samajhte hain, jisse unko trading selections lene mein madad milti hai. Support factors, jaise ki naam se pata chalta hai, marketplace mein charge ko assist dete hain. Ye ranges aksar preceding charge lows se judte hain, jahan par investors ko shopping for opportunities milte hain. Jab charge guide level tak pahunchta hai, toh wahan par consumers active ho jate hain aur fee ko upar uthane ki koshish karte hain. Agar support stage sturdy hai, toh fee us stage se bounce back karke upar jaane ka prayaas karti hai. Traders guide level par buy orders vicinity karke charge ki upward movement se profit kamate hain. Lekin agar support degree breach ho jata hai, toh ye ek bearish signal hai aur traders ko selling selections lena chahiye. Resistance factors, then again, rate ko rokne aur downward motion ko create karne mein madad karte hain. Ye degrees aksar previous charge highs se judte hain. Jab rate resistance level tak pahunchta hai, toh wahan par dealers energetic ho jate hain aur price ko neeche le jane ki koshish karte hain. Agar resistance level robust hai, toh rate us stage se bounce back karke neeche jaane ki koshish karti hai. Traders resistance stage par promote orders place karke fee ki downward movement se income kamate hain. Lekin agar resistance degree breach ho jata hai, toh ye ek bullish sign hai aur investors ko shopping for selections lena chahiye.  Market Sentiment and Trading Volume: Factors Influencing Support and Resistance Levels: Support aur resistance tiers ke saath trading quantity aur market sentiment bhi critical elements hai. High trading volume ke saath guide aur resistance tiers ka importance badh jata hai. Jab rate guide ya resistance level ko breach karta hai, toh traders ka sentiment exchange ho jata hai aur rate mein vast movements dekhne ko milte hain. Market sentiment aur buying and selling extent ko monitor karte hue traders help aur resistance degrees par trading techniques banate hain. Support aur resistance points ko pick out karne ke liye buyers technical analysis equipment ka istemal karte hain. Price charts, trend lines, Fibonacci retracement aur pivot factors jaise equipment unko aid aur resistance tiers ko spot karne mein madad karte hain. Traders previous price facts ko analyze karte hain aur essential price degrees ko mark karte hain, jahan par price ka conduct alternate hota hai. Support aur resistance factors ka istemal karke traders access aur exit points ko perceive karte hain. Support stage par purchase karna aur resistance level par promote karna investors ke liye low-chance high-reward possibilities create karta hai. Iske saath hi, ye levels forestall loss aur take profit degrees ko set karne mein bhi madad karte hain. Samay ke saath, guide aur resistance stages evolve hote rehte hain. Market dynamics, information occasions aur price volatility ke karan ye ranges shift ho sakte hain. Traders ko ordinary evaluation aur market monitoring karna chahiye, taki wo support aur resistance degrees ke changes ko become aware of kar sakein. In conclusion, guide aur resistance factors market mein fee movements aur trends ko samajhne aur expect karne mein buyers ko madad karte hain. Ye tiers traders ko fee movement aur market psychology ki understanding offer karte hain. Support aur resistance degrees market mein important factors hote hain, jinhe investors apni buying and selling techniques mein include karte hain.

Market Sentiment and Trading Volume: Factors Influencing Support and Resistance Levels: Support aur resistance tiers ke saath trading quantity aur market sentiment bhi critical elements hai. High trading volume ke saath guide aur resistance tiers ka importance badh jata hai. Jab rate guide ya resistance level ko breach karta hai, toh traders ka sentiment exchange ho jata hai aur rate mein vast movements dekhne ko milte hain. Market sentiment aur buying and selling extent ko monitor karte hue traders help aur resistance degrees par trading techniques banate hain. Support aur resistance points ko pick out karne ke liye buyers technical analysis equipment ka istemal karte hain. Price charts, trend lines, Fibonacci retracement aur pivot factors jaise equipment unko aid aur resistance tiers ko spot karne mein madad karte hain. Traders previous price facts ko analyze karte hain aur essential price degrees ko mark karte hain, jahan par price ka conduct alternate hota hai. Support aur resistance factors ka istemal karke traders access aur exit points ko perceive karte hain. Support stage par purchase karna aur resistance level par promote karna investors ke liye low-chance high-reward possibilities create karta hai. Iske saath hi, ye levels forestall loss aur take profit degrees ko set karne mein bhi madad karte hain. Samay ke saath, guide aur resistance stages evolve hote rehte hain. Market dynamics, information occasions aur price volatility ke karan ye ranges shift ho sakte hain. Traders ko ordinary evaluation aur market monitoring karna chahiye, taki wo support aur resistance degrees ke changes ko become aware of kar sakein. In conclusion, guide aur resistance factors market mein fee movements aur trends ko samajhne aur expect karne mein buyers ko madad karte hain. Ye tiers traders ko fee movement aur market psychology ki understanding offer karte hain. Support aur resistance degrees market mein important factors hote hain, jinhe investors apni buying and selling techniques mein include karte hain. Combining Support and Resistance with Other Technical Indicators: Support aur resistance factors ke significance ko samajhne ke liye, ek instance samjhte hain. Maan lijiye ki ek inventory ka charge $50 hai aur uska guide stage $45 hai. Jab charge $45 tak pahunchta hai, toh wahan par buyers active hote hain aur price ko upar le jane ki koshish karte hain. Is degree par investors buy orders location karke income kamate hain. Agar price guide degree se bounce back karta hai aur $50 ke upar jaata hai, toh resistance degree $fifty five ho sakta hai. Yahan par sellers lively ho jate hain aur fee ko neeche le jane ki koshish karte hain. Traders resistance stage par sell orders place karke earnings kamate hain. Is tarah se support aur resistance levels investors ko fee ke moves ka context provide karte hain. Support aur resistance ranges ko samajhne ke liye traders rate charts, fashion strains, moving averages, aur different technical indicators ka istemal karte hain. In tools se previous rate facts ko examine karke crucial ranges ko spot kiya jata hai. Support aur resistance tiers horizontal lines ya zones ke shape mein chart par constitute kiye jate hain. Price charts par previous rate highs aur lows se join karke traders help aur resistance ranges pick out karte hain. Support aur resistance degrees ka power unke repeated testings aur confirmations se pata chalta hai. Agar charge ek stage ko more than one times touch karke bounce back karti hai, toh us level ka energy zyada hota hai. Is tarah ke ranges ko robust help aur resistance tiers maana jata hai. Traders in stages ko technical analysis ke saath fundamental evaluation aur market news ke saath bhi integrate karte hain, taki unko rate movements ko higher expect karne mein madad mile. Conclusion: The Role of Support and Resistance Points in Trading: Support aur resistance levels ki significance trading strategies mein bhi hoti hai. Breakout aur breakdown techniques mein traders help aur resistance levels ke breach par input karte hain. Jab price kisi level ko breach karta hai, toh woh ek capability fashion exchange ka signal ho sakta hai. Agar rate assist level ko breach karke area of interest ja raha hai, toh woh bearish sign hai aur investors selling choices le sakte hain. Agar price resistance level ko breach karke upar ja raha hai, toh woh bullish signal hai aur buyers shopping for selections le sakte hain. Support aur resistance points trading mein danger management aur income concentrated on mein bhi madad karte hain. Traders in stages par prevent loss aur take income tiers set karke apne trades ko control karte hain. Stop loss assist aur resistance stages ke neeche set kiya jata hai, jisse investors apni losses ko manipulate kar sakte hain. Take earnings stages resistance aur support levels ke paas set kiye jate hain, taki investors price ka reversal hone par apne profits ko seize kar sakein.

In conclusion, assist aur resistance points trading mein fee moves, traits, aur market psychology ko samajhne mein madad karte hain. Ye ranges traders ko potential entry aur exit points provide karte hain aur unko buying and selling selections lene mein confidence dete hain. Traders ko in stages ko pick out karna aur analyze karna zaroori hai

In conclusion, assist aur resistance points trading mein fee moves, traits, aur market psychology ko samajhne mein madad karte hain. Ye ranges traders ko potential entry aur exit points provide karte hain aur unko buying and selling selections lene mein confidence dete hain. Traders ko in stages ko pick out karna aur analyze karna zaroori hai

-

#4 Collapse

Dear members I hope aap sab khariyat sy hoon gy Forex tradings Marketing main Supporting level bhot hi mashor Trendiness ky sath daromdar karta Hai our eik laheya amal apna ta hey kiyon ky tradings ky liye perfect hota Hai our yeh Pattren mukhtalif chart ki hikmat amali change karty hen aur resistance points ka use karke, traders currency pair ke price movements ko predict kar sakte hain. Support aur resistance points ka use karke, traders market trends aur price patterns ko identify kar sakte hain. Support aur resistance points ke use se, traders apne trading strategies ko improve kar sakte hain. Support aur resistance points ka use karke, traders market trends aur reversals ko identify kar sakte hain. Support aur resistance points ke use se, traders apne trades ke liye stop loss aur take profit levels set kar sakte hain. Support aur resistance points ka use karne se, traders risk management strategies ko improve kar sakte hain.Support aur resistance points ko identify karne ke liye traders kaafi saare tools ka use kar sakte hain, jaise ki price charts, technical indicators aur Fibonacci retracements. Traders support aur resistance points ko manual analysis se bhi pehchan alag hoti hey.. Dear members ap SUPPORT LEVEL aur RESISTANCE LEVEL POINTS ki Intruduce traders ko ek important concept ke bare mein pata hona chahiye, jise false breakout kehte hain. False breakout, ek aisi situation hoti hey our market ka price action resistance level cross karke, ek breakout ka impression create karta hai, lekin phir market ka price action phir se wapas resistance level ke under aa jata hai. False breakout se bachne ke liye, traders ko support aur resistance points ke saath saath, market ka price action aur momentum bhi observe karna chahiyeSupport aur resistance points ko observe karne ke liye traders ko market ke news aur events ka bhi dhyaan rakhna chahiye. News aur events ki wajah se market ke price movements mein sudden jisse support aur resistance points affect ho sakte hain. Traders ko news aur events ke impact ko assess karke apne trades ko manage karna chahiye. Support aur resistance points ka use karke, traders ko market ke direction aur momentum ka idea milta hai. Jab traders support aur resistance points ko identify karte hain, to woh market trends aur price patterns ko analyze karne mein bhi help milta hai. Traders support aur resistance points ke use se, apne trading strategies ko improvement kartt Hei our Traders hazraat Tradings karty howy benifet hasil kar sakty hen our successful in the forex trading marketing mein Market ko check karty howy signal frahm kiye jaty hen...

-

#5 Collapse

INTRUDUCTION OF SUPPORT POINTS; Dear members I hope aap sab khariyat sy hoon gy Forex tradings Marketing main Supporting level bhot hi mashor Trendiness ky sath daromdar karta Hai our eik laheya amal apna ta hey kiyon ky tradings ky liye perfect hota Hai our yeh Pattren mukhtalif chart ki hikmat amali change karty hen aur resistance points ka use karke, traders currency pair ke price movements ko predict kar sakte hain. Support aur resistance points ka use karke, traders market trends aur price patterns ko identify kar sakte hain. Support aur resistance points ke use se, traders apne trading strategies ko improve kar sakte hain. Support aur resistance points ka use karke, traders market trends aur reversals ko identify kar sakte hain. Support aur resistance points ke use se, traders apne trades ke liye stop loss aur take profit levels set kar sakte hain. Support aur resistance points ka use karne se, traders risk management strategies ko improve kar sakte hain.Support aur resistance points ko identify karne ke liye traders kaafi saare tools ka use kar sakte hain, jaise ki price charts, technical indicators aur Fibonacci retracements. Traders support aur resistance points ko manual analysis se bhi pehchan alag hoti hey.. DETAILS OF RESISTANCE POINTS; Dear members ap SUPPORT LEVEL aur RESISTANCE LEVEL POINTS ki Intruduce traders ko ek important concept ke bare mein pata hona chahiye, jise false breakout kehte hain. False breakout, ek aisi situation hoti hey our market ka price action resistance level cross karke, ek breakout ka impression create karta hai, lekin phir market ka price action phir se wapas resistance level ke under aa jata hai. False breakout se bachne ke liye, traders ko support aur resistance points ke saath saath, market ka price action aur momentum bhi observe karna chahiyeSupport aur resistance points ko observe karne ke liye traders ko market ke news aur events ka bhi dhyaan rakhna chahiye. News aur events ki wajah se market ke price movements mein sudden jisse support aur resistance points affect ho sakte hain. Traders ko news aur events ke impact ko assess karke apne trades ko manage karna chahiye. Support aur resistance points ka use karke, traders ko market ke direction aur momentum ka idea milta hai. Jab traders support aur resistance points ko identify karte hain, to woh market trends aur price patterns ko analyze karne mein bhi help milta hai. Traders support aur resistance points ke use se, apne trading strategies ko improvement kartt Hei our Traders hazraat Tradings karty howy benifet hasil kar sakty hen our successful in the forex trading marketing mein Market ko check karty howy signal frahm kiye jaty hen...

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

aaj ke liye Gold ka takneeki tajzia:-- aam tor par, qeemat 1958 tak pounchanay ke baad neechay ki taraf chali gayi, aik satah jis se oopar jora thora sa oopar ki taraf toot gaya, lekin aam tor par, aik ulat sun-hwa, aur qeemat neechay ki taraf chali gayi. is jore ke liye aik mandi ki harkat mutawaqqa hai, aur mein ne usay pehlay hi chart par plot kar diya hai ke yeh kaisa nazar aaye ga. 2nd bearish iqdaam ban'nay ke baad qeemat 4th bearish iqdaam mein kam hona shuru ho jaye gi. kam az kam hadaf 1977 aur ziyada se ziyada 1967 ka hadaf muqarrar kya gaya hai. is satah tak pounchanay par, jora mumkina tor par ulat jaye ga, aur qeemat barhna shuru ho jaye gi, pehlay hi 5 win bearish movement mein. agar kal qeemat apni jagah par latak rahi hai to mein wolfe ko kuch mukhtalif tareeqay se dobarah tashkeel day sakta hon, lekin mujhe phir bhi umeed hai ke qeemat jald hi kam hona shuru ho jaye gi. H1 muddat ke liye sonay ka takneeki tajzia.:-- sonay ki qeemat mein kami ki wajah se, kuch hadge funds ab is mein sarmaya kaari kar satke hain. –apne mohtaat tajziye se, mujhe impulse view three ki aik jani pehchani tasweer millti hai jo pehlay hi zor pakar rahi hai. is mein koi shak nahi ke yeh sab se taweel tasalsul ki lehar hai. fi al haal, kots 1980 se oopar trade kar rahay hain, aur macd line farokht ki taraf rujhan ki nishandahi karti hai. fibnacci extension grid ka istemaal karte hue, hum dekh satke hain ke qeemat harkat pazeeri ost ki 1965 ki satah se guzar chuki hai, jo zahir karti hai ke qeemat oopar ki taraf barh rahi hai. stap nuqsaan par tawajah dena yakeeni banayen, kyunkay yeh aap ke dpazt ko mustaqbil mein kisi bhi ahem nuqsaan se bachaaye ga. mujhe umeed hai ke woh madadgaar saabit ho saktay hain, aur mein hamesha behtar intizam par ziyada se ziyada tawajah markooz karne ki koshish karta hon. H4 Time Frame Outlook:--- 4 ghantay ke time frame par sona gir raha hai aur is waqt 4 ghantay ki candle mazboot mandi ke tor par agay barh rahi hai lekin chand minton mein anay wali khabron ki wajah se sona nichale time frame chart par mustard ho raha hai lekin yeh mazeed neechay ki harkat ka ishara ho sakta hai aur agar hum dekhen. 4 ghantay ka time frame chart phir hum dekh satke hain ke aik mazboot rizstns trained line gold ko rizstns ke tor par thaamay hue hai aur is trained line par sonay ko kayi baar mustard kar diya gaya hai aur sonay ne 1951 dollar par aik taaza qareebi mudti support level tashkeel diya hai is liye agar yeh khabar taizi ke tor par samnay aayi to sona girnay wala hai aur agar sona support level se neechay toot jata hai to sona 1914 dollar ki purani kaleedi support level ki taraf barhay ga jo taweel mudti sona baichnay walon ke liye acha hadaf ho sakta hai taham agar sona muzahmati rujhan line se oopar toot jata hai to yeh oopar jaye ga. muzahmati satah ki taraf $ 2046 jo ke taweel mudti kharidaron ke liye bhi aik acha hadaf hai aur isi liye mojooda waqt mein yeh behtar hoga ke sonay ke muzahmati rujhan ki lakeer se oopar totnay ya support level se neechay totnay ka intzaar kya jaye . -

#7 Collapse

Support aur resistance points forex trading mein ahem hotay hain. Ye levels hain jin mein traders ko market ke behavior aur price movement ko samajhne mein madad milti hai. Support point wo level hota hai jahan se price ka expected giravat rok kar upar uthne ka intezar hota hai. Jabke resistance point wo level hota hai jahan se price ka expected izafa rok kar neeche jaane ka intezar hota hai. In points ko samajh kar, traders apne trades ko sahi waqt par enter aur exit kar sakte hain.

Market mein price ka movement aksar support aur resistance levels ke around hota hai. Agar price support level tak gir jata hai, to traders expect karte hain ke price wahan se phir se upar uth jayegi. Isi tarah, agar price resistance level tak pahunch jata hai, to traders expect karte hain ke price wahan se neeche gir jayegi.

Support aur resistance levels ko samajhne ke liye, traders price charts ka istemal karte hain. Ye levels horizontal lines ke form mein represent kiye jate hain, jo ke price history mein woh levels hote hain jahan se price ka movement rukta hai ya phir change hota hai. In levels ko samajh kar, traders apne trading strategies ko improve kar sakte hain aur market ke movement ko predict kar sakte hain.

Support aur resistance levels ka use karte waqt, traders ko kuch zaroori points yaad rakhne chahiye:- Multiple Touches: Achhe support aur resistance levels woh hote hain jo ki multiple bar price ke saath interact karte hain. Matlab, agar kisi level ko price ne kai baar touch kiya hai aur phir se wahan se badal gaya hai, to wo level strong support ya resistance level maana jata hai.

- Price Action: Price action, yaani ke price ke movement ko dekhna, support aur resistance levels ko samajhne mein madadgar hota hai. Agar price ek support level tak pahunchti hai aur phir se upar uth jati hai, to ye ek bullish signal ho sakta hai. Vahi agar price ek resistance level tak pahunchti hai aur phir se neeche jaati hai, to ye ek bearish signal ho sakta hai.

- Breakouts: Kabhi kabhi, price support ya resistance level ko break kar deti hai. Ye breakout ka scenario hota hai, jismein price ek direction mein tezi se move karti hai. Breakout hone par, traders ko careful rehna chahiye aur confirmatory signals ka intezar karna chahiye, taake wo false breakout se bach sakein.

- Volume: Support aur resistance levels ko samajhne ke liye, traders ko volume ka bhi dhyan dena chahiye. Agar kisi level par high volume ke saath price ka movement hota hai, to ye indicate karta hai ke wo level strong hai aur traders ke interest ka bhi pata chalta hai.

- Timeframe: Different timeframes par, support aur resistance levels alag alag dikhayi ja sakte hain. Short-term traders apne trading timeframe ke according levels ko dekhte hain, jabke long-term investors lambi avadhi ke levels ko dhyan mein rakhte hain.

Support aur resistance levels forex trading mein zaroori hain kyunki ye traders ko market ke behavior ko samajhne mein madad karte hain aur unhe sahi waqt par trades enter aur exit karne mein help karte hain. Isliye, har trader ko in levels ko samajhna aur unka istemal karna aham hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#8 Collapse

Support aur resistance points technical analysis mein istemal hotay hain taake traders ko market ke movements ko samajhne mein madad mile. Ye points price chart par indicate karte hain ke kis level par buyers (support) aur sellers (resistance) zyada active hote hain.

Support point woh level hota hai jahan traders expect karte hain ke price girne ke baad wapas se rise karega. Ye aksar market mein demand ke strong hone par paya jata hai. Jab price support level tak pohanchti hai, traders expect karte hain ke price increase hoga ya leastwise wahan se reversal hoga. Support level ko break karna, yaani ke price us level se nichay chalay jana, bearish trend ka sign hota hai.

Waise hi, resistance point woh level hota hai jahan traders expect karte hain ke price rise ke baad ruk jayega ya gir jayega. Ye aksar market mein supply ke strong hone par paya jata hai. Jab price resistance level tak pohanchti hai, traders expect karte hain ke price decrease hoga ya leastwise wahan se reversal hoga. Resistance level ko break karna, yaani ke price us level se ooper chalay jana, bullish trend ka sign hota hai.

Support aur resistance points ko identify karna, traders ke liye critical hai kyunki ye unhein market ke possible reversals aur trends ke bare mein hint dete hain. Traders support aur resistance points ko use karke apni trading strategies ko plan karte hain, jaise ke buy aur sell orders ke placement, stop-loss levels ka setup karna, aur profit targets ka decide karna.

Support aur resistance points ko determine karne ke liye, traders alag alag technical analysis tools ka istemal karte hain jaise ke price charts, moving averages, Fibonacci retracement levels, aur pivot points. In tools ke istemal se, traders previous price movements aur market psychology ko analyze karte hain taake unhein support aur resistance levels ko identify karne mein madad mile.

Support aur resistance levels market ke dynamics aur price action ke hisaab se badalte rehte hain. Market mein volatility aur liquidity ke changes, economic events, aur other factors ke impact se support aur resistance levels mein changes aate rehte hain. Isliye, traders ko regularly apne analysis ko update karna zaroori hota hai taake woh market ke latest conditions ko dhyaan mein rakhte hue trading decisions le sakein.

Overall, support aur resistance points trading mein important tools hain jo traders ko market ke movements ka better understanding aur trading strategies ka plan karne mein madad karte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:09 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим