what is stop loss order:

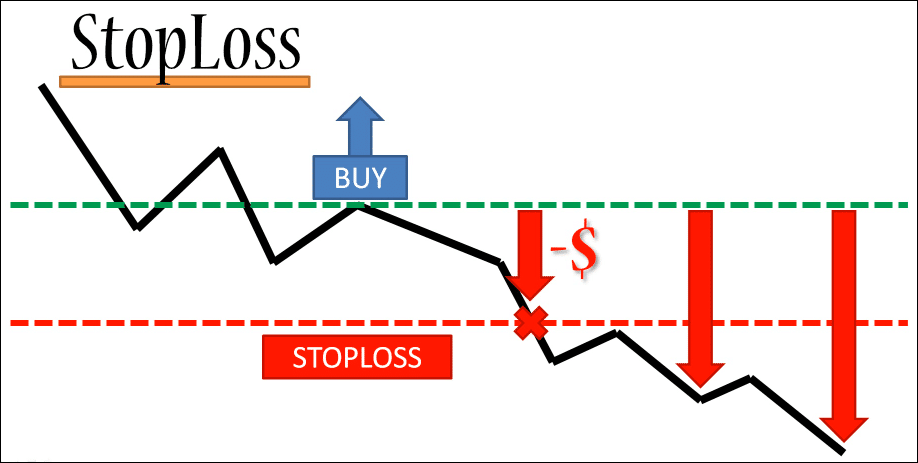

forex market mein stop loss order aik aisa function hey jo keh forex mein broker ke taraf paish kea jata hey takeh zyada otar charhao kay doran forex market mein loss ko mehdood kea ja sakay jo keh forex mein starting price ke trade kay opposite chalte hey es level ko stop loss level or entry price say door price ke aik specific rakam kay ley lago kea ja sakta hey aik stop loss lng ya short trade kay ley monsalek kea ja sakta hey jo keh kese forex trading ke strategy kay ley monsalek kea ja sakta hey

forex mein stop loss strategies

forex market trade ko best bananay kay ley darj zail panch strategies ka estamal kea ja sakta hey

setting static stop

trader stop loss ko mokhtas karnay kay sath aik stable price par forex stop ko set kar saktay hein or stop ko montakel ya tabdel kar saktay hein jab tak trade stop ya trade ko mokhtas na kar day ya stop ko mehdood na kar day es stop mechnism ke asane es ke sadge hey or trader ko es bat ko yakene bananay ke salehat hote hey keh woh kam say kam aik risk o reward kat tanasob ko yakene banay ke talash mein hey

ager ki trader aik stable 100 pips ke trade kay sath trade karay to aik stable 100 pips ka stop loss set kar raha hey jaisa keh pechle mesal mein hey aik stable market mein 50 pips kay stop loss ka kea matlab hey or aik porsakon market mein es 50 pips kay stop ka kea matlab hey

ager market khamosh hey t 50 pips aik bare movement ho sakte hey ager market unstable hey to enhe 50 pips ko aik chote movement samjha ja sakta hey average true range ya pivot point ya prices mein tabdele jaisay indicator ka estamal kartay hovay trader ko apnay risk ka monasab estamal kartay hovay or ekhterat ka zyada darust analysis karnay kay ley hale market ka ekhteyar ka esttamal karnay ke ejazat day sakta hey

Manual Trailing Stop

on trader kay ley jo sab say zyada control chahtay hein forex stop ko trade daste tor par montakel kar sakta hey kunkeh position on kay haq mein jate hey

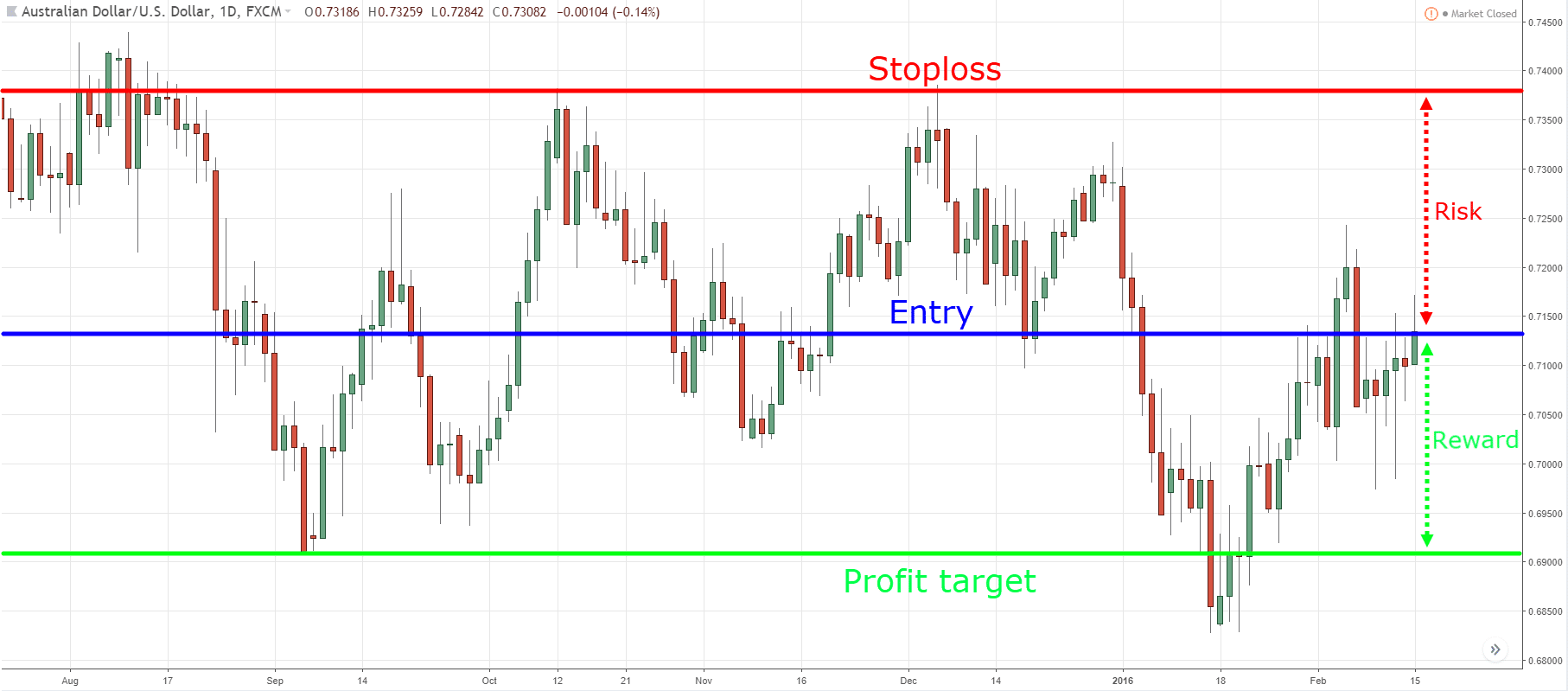

nechay deya geya chart short position mein movement ko wazah karta hey jaisay jaisay position trade kay haq mein agay jate hey trader bad mein stop level ko mazeed nechay lay kar jata hey jab trend finally reversal jata hey or new highs ban jate hein to position stop ho jate hein

Trailing stop

yeh sochana zarore hey keh kuch trader apnay circle mein trailing stop ko nafaz karnay ke ejazat daytay hein

jamad stop loss new trader kay point of view mein bohut zyada behtare la saktay hein laken dosray trader apnay paisay kay intazam ko behtar bananay kay ley stops ko mokhtalef tarekon say estamal kar saktay hein trailing stop aisay stop ko kehtay hein jo trader kay haq mein key ja saktay hein trade mein wrong honay ko mazeed kam kea ja sakta hey

mesal kay tor par aik trader 1.1720 EUR/USD ke long position mein enry lay sakta hey 1.1553 par 167 pips ke trade kar sakta hey ager trade 1.1720 tak chale jate hey to trader apnay stop ko 1.1553 ke ebtadai yane entry price par rakh sakta hey or stop ko 1.1720 par adjust karnay par bhe ghor kar sakta hey

yeh trader kay ley kuch cheezen karta hey jo keh stop ko entry price tak lay kar jate hey jesay break even bhe kaha jata hey takeh EUR/USD reverse ho jay or trade kay opposite trade ke ja sakay to kam say kam loss say bach jay ga ager trade entry price par adjust ke jay

Fixed Trailing stop

trader trailing stop bhe adjust kar saktay hein takeh stop batadreej adjust kea ja sakay 10 pips ke movement kay bad stop ko adjust kea ja sakta hey

1.3050 ke entry price kay bad 1.3100 tak EUR/USD ko buy karnay walay trader ke mesal ko estamal kartay hovay EUR/USD 1.3110 tak janay kay bad 10 pips ka stop 1.3060 par stop ko adjust kea ja sakta hey or EUR/USD ke 10 pips ke movement par 1.3120 par mazeed 10 pips ke movement kay bad stop aik bar phir 10 pip agay ka set kea jata hey jo keh 1.3070 hota hey yeh amal os time tak jare rahay ga jab tak stop level hit na ho jay

forex market mein stop loss order aik aisa function hey jo keh forex mein broker ke taraf paish kea jata hey takeh zyada otar charhao kay doran forex market mein loss ko mehdood kea ja sakay jo keh forex mein starting price ke trade kay opposite chalte hey es level ko stop loss level or entry price say door price ke aik specific rakam kay ley lago kea ja sakta hey aik stop loss lng ya short trade kay ley monsalek kea ja sakta hey jo keh kese forex trading ke strategy kay ley monsalek kea ja sakta hey

forex mein stop loss strategies

forex market trade ko best bananay kay ley darj zail panch strategies ka estamal kea ja sakta hey

setting static stop

trader stop loss ko mokhtas karnay kay sath aik stable price par forex stop ko set kar saktay hein or stop ko montakel ya tabdel kar saktay hein jab tak trade stop ya trade ko mokhtas na kar day ya stop ko mehdood na kar day es stop mechnism ke asane es ke sadge hey or trader ko es bat ko yakene bananay ke salehat hote hey keh woh kam say kam aik risk o reward kat tanasob ko yakene banay ke talash mein hey

ager ki trader aik stable 100 pips ke trade kay sath trade karay to aik stable 100 pips ka stop loss set kar raha hey jaisa keh pechle mesal mein hey aik stable market mein 50 pips kay stop loss ka kea matlab hey or aik porsakon market mein es 50 pips kay stop ka kea matlab hey

ager market khamosh hey t 50 pips aik bare movement ho sakte hey ager market unstable hey to enhe 50 pips ko aik chote movement samjha ja sakta hey average true range ya pivot point ya prices mein tabdele jaisay indicator ka estamal kartay hovay trader ko apnay risk ka monasab estamal kartay hovay or ekhterat ka zyada darust analysis karnay kay ley hale market ka ekhteyar ka esttamal karnay ke ejazat day sakta hey

Manual Trailing Stop

on trader kay ley jo sab say zyada control chahtay hein forex stop ko trade daste tor par montakel kar sakta hey kunkeh position on kay haq mein jate hey

nechay deya geya chart short position mein movement ko wazah karta hey jaisay jaisay position trade kay haq mein agay jate hey trader bad mein stop level ko mazeed nechay lay kar jata hey jab trend finally reversal jata hey or new highs ban jate hein to position stop ho jate hein

Trailing stop

yeh sochana zarore hey keh kuch trader apnay circle mein trailing stop ko nafaz karnay ke ejazat daytay hein

jamad stop loss new trader kay point of view mein bohut zyada behtare la saktay hein laken dosray trader apnay paisay kay intazam ko behtar bananay kay ley stops ko mokhtalef tarekon say estamal kar saktay hein trailing stop aisay stop ko kehtay hein jo trader kay haq mein key ja saktay hein trade mein wrong honay ko mazeed kam kea ja sakta hey

mesal kay tor par aik trader 1.1720 EUR/USD ke long position mein enry lay sakta hey 1.1553 par 167 pips ke trade kar sakta hey ager trade 1.1720 tak chale jate hey to trader apnay stop ko 1.1553 ke ebtadai yane entry price par rakh sakta hey or stop ko 1.1720 par adjust karnay par bhe ghor kar sakta hey

yeh trader kay ley kuch cheezen karta hey jo keh stop ko entry price tak lay kar jate hey jesay break even bhe kaha jata hey takeh EUR/USD reverse ho jay or trade kay opposite trade ke ja sakay to kam say kam loss say bach jay ga ager trade entry price par adjust ke jay

Fixed Trailing stop

trader trailing stop bhe adjust kar saktay hein takeh stop batadreej adjust kea ja sakay 10 pips ke movement kay bad stop ko adjust kea ja sakta hey

1.3050 ke entry price kay bad 1.3100 tak EUR/USD ko buy karnay walay trader ke mesal ko estamal kartay hovay EUR/USD 1.3110 tak janay kay bad 10 pips ka stop 1.3060 par stop ko adjust kea ja sakta hey or EUR/USD ke 10 pips ke movement par 1.3120 par mazeed 10 pips ke movement kay bad stop aik bar phir 10 pip agay ka set kea jata hey jo keh 1.3070 hota hey yeh amal os time tak jare rahay ga jab tak stop level hit na ho jay

In conclusion, stop loss order strategy forex trading mein ek aham tool hai jo traders ko nuqsaan se bachane aur risk management ko improve karne mein madad karta hai. Is strategy ke istemaal se, ham emotions se bach sakte hain aur apne trading decisions ko disciplined aur consistent bana sakte

In conclusion, stop loss order strategy forex trading mein ek aham tool hai jo traders ko nuqsaan se bachane aur risk management ko improve karne mein madad karta hai. Is strategy ke istemaal se, ham emotions se bach sakte hain aur apne trading decisions ko disciplined aur consistent bana sakte

تبصرہ

Расширенный режим Обычный режим