Re: Piercing Line

Dear jab ap apny analysis chart pay karty hain tu ap pay depend karta hai kay kon sa indicator ap use kar rahy hain. Price line jo ap chart pay pattern draw karty hain waha sy ap kay time frame kay mutabiq jo ap range define karain gy kay ap ki support or resistance ki value kiya ai hai tu waha sy starting point sy exit price tak ap ki price line mention ho jati hai phir ap ko chose karna hai kay us range mai ap nay kaisy apni trades ko manage karna hai.

Dear jab ap apny analysis chart pay karty hain tu ap pay depend karta hai kay kon sa indicator ap use kar rahy hain. Price line jo ap chart pay pattern draw karty hain waha sy ap kay time frame kay mutabiq jo ap range define karain gy kay ap ki support or resistance ki value kiya ai hai tu waha sy starting point sy exit price tak ap ki price line mention ho jati hai phir ap ko chose karna hai kay us range mai ap nay kaisy apni trades ko manage karna hai.

Piercing Line pattern ko behtar samajhne ke liye kuch steps hote hain:

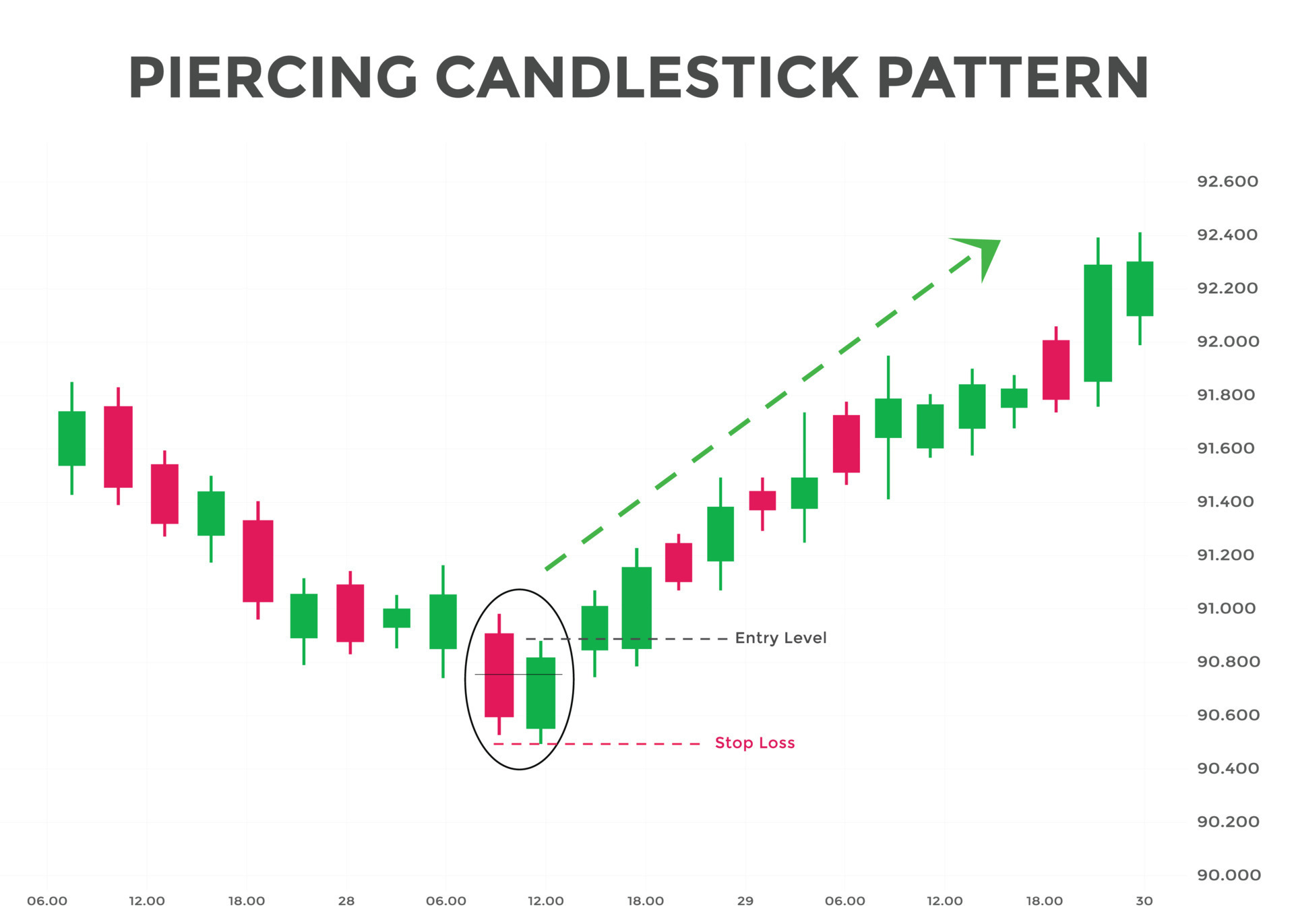

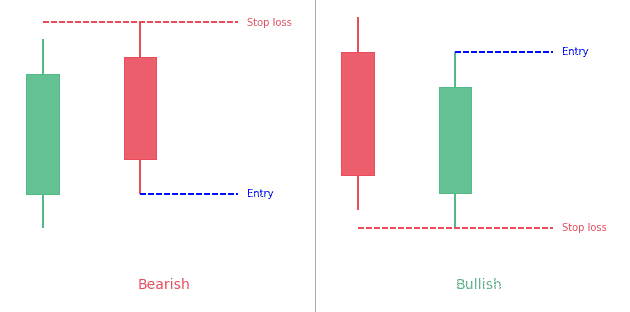

Piercing Line pattern ko behtar samajhne ke liye kuch steps hote hain: Traders Piercing Line pattern par amal karne se pehle additional confirmation signals ka bhi intezaar karte hain. Wo overall market context, volume analysis, ya dusre technical indicators jaise ki trendlines, support aur resistance levels ko confirmatory signals ke taur par consider kar sakte hain. Yeh zaroori hai ki jaise hi koi dusra technical pattern, Piercing Line bhi foolproof nahi hai. Kabhi kabhi ye false signals de sakta hai ya maamooli trend change ke bajaye chote reversals mein result kar sakta hai. Isliye, Piercing Line pattern ko trading strategy mein shamil karte waqt risk management aur sahi trade execution ka dhyan rakhna zaroori hai.

Traders Piercing Line pattern par amal karne se pehle additional confirmation signals ka bhi intezaar karte hain. Wo overall market context, volume analysis, ya dusre technical indicators jaise ki trendlines, support aur resistance levels ko confirmatory signals ke taur par consider kar sakte hain. Yeh zaroori hai ki jaise hi koi dusra technical pattern, Piercing Line bhi foolproof nahi hai. Kabhi kabhi ye false signals de sakta hai ya maamooli trend change ke bajaye chote reversals mein result kar sakta hai. Isliye, Piercing Line pattern ko trading strategy mein shamil karte waqt risk management aur sahi trade execution ka dhyan rakhna zaroori hai.

تبصرہ

Расширенный режим Обычный режим