mera bhe trading idea yahi hai k humean koi khas indicators ki bjeay candles ka knowledge hasil ker k to pher us k oper trade kerni chay pher he us main kamyaab hooon gay

`

X

new posts

-

#166 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#167 Collapse

yes aap ne bohat achi post ki hai aor aap ne sahi kaha hai k market agar apna trend continue rakhe gi to phir loss bhi ho sakta hai is lye is strategy ko us time use kare jab market side way main chal rahi ho yaani koi news time naa ho aor market fast naa ho -

#168 Collapse

Aap ka investment kay baray main forex trading ka jo knowledge tha strategy kay baray main mean inverse strategy kay baray main laikin idea aap ka b theek hay inverse ka b kay 15 min kay chart per kam karna kafi riski hay or is main aap market fluctuations zada face karni paray gi -

#169 Collapse

Ap ki baat theak hai likan inverse strategy es waqat apply ki jati hai jab ap ko market ky bary mai bohat zada aur ap date information hoti hai tou ap inverse strategy par bhe trade kr sakty ho. -

#170 Collapse

-

#171 Collapse

Re: Inverse strategy

Ap ko internet sy byshumar strategies mil jati hai. jaisy yeh inverse strategy hai jis ko ap use kar kay yeh pata chal jata hai kay market ka bullish or bearish trend kitna tha us kay bad mairket apna reverse mai jati hai. es ki waja yeh hoti hai kay market oversold ya overbought ho chuki hoti hai tu es time bhout sy trader jo hoty hain woh RSI or MCAD ka be use kar kay es tarha kay reverse kay achy signal lay skaty hain. khair ap apni strategy ko jitna acha samjain gy us kadar ap ko profit hoga. -

#172 Collapse

Inverse Strategy Explained: Trading Against Market Trends: Forex buying and selling mein inverse method ek aham tareeqa hai jisay traders apni trading activities mein istemaal karte hain. Ye ek tajarba kara tareeqa hai jis mein traders marketplace ki motion ke khilaf alternate karte hain, yaani jab market upar jata hai, toh woh sell karte hain, aur jab marketplace neeche jata hai, toh woh buy karte hain. Inverse method foreign exchange trading mein ahem tareeqa hai, kyunke iski madad se buyers market ki opposite path mein alternate karke faida hasil kar sakte hain. Inverse strategy istemaal karne ka wajood tajarba, tajurbe, aur market ki samajh par hai. Ye tareeqa traders ko market trends aur rate movements ko analyze karne ke liye mazboot nazariye deti hai. Jab buyers marketplace trends ko samajhte hain aur unko are expecting karne ki koshish karte hain, toh woh inverse method ka istemaal karte hain takay woh market ke contrary route mein trade kar sakein. Inverse strategy ki madad se traders marketplace ke reversal points ko pehchan sakte hain. Jab market ka trend change hone lagta hai aur price direction neeche ki taraf muda hai, toh traders purchase positions khareedte hain takay woh marketplace ka uptrend ka faida utha sakein. Isi tarah, jab marketplace ka fashion trade ho kar upar muda hai, toh investors promote positions khareedte hain takay woh market ka downtrend ka faida utha sakein. Inverse method mein buyers market ki actions ko intently reveal karte hain aur sahi access aur exit points ka intezar karte hain. Identifying Reversal Points with Inverse Strategy: Inverse method istemaal karne ka ek tareeqa hai ki traders fashion traces aur technical indicators ka istemal karte hain. Trend strains market ke fee movements ko music karne mein madadgar hoti hain, aur technical indicators jaise ki moving averages, RSI, aur MACD bhi investors ko market ki samajhne mein assist karte hain. Inverse approach mein buyers in tools ka istemal karke marketplace ke reversal points ko pick out karte hain. Inverse strategy istemaal karne ke fayde aur nuksan hote hain. Is tareeqe ka istemal karne se traders high-chance positions mein input karte hain, kyunke woh marketplace ki movement ke khilaf alternate kar rahe hote hain. Agar buyers sahi access aur go out factors nahi chunte, toh unko nuksan ho sakta hai. Lekin jab is approach ko tajurbah kar traders istemal karte hain aur marketplace trends ko theek se samajhte hain, toh woh is tareeqe se acha munafa hasil kar sakte hain. Aakhir mein, inverse strategy forex buying and selling mein ek mukhtasar aur tez tareeqa hai jisay traders marketplace ki motion ke khilaf trade karne ke liye istemal karte hain. Ye tareeqa investors ko market ke contrary course mein change karne ki salahiyat deta hai. Iske istemal ke liye tajurba, marketplace analysis aur technical indicators ki samajh zaroori hoti hai. Inverse strategy ko theek tareeqe se istemal karne se traders ko munafa hasil

Identifying Reversal Points with Inverse Strategy: Inverse method istemaal karne ka ek tareeqa hai ki traders fashion traces aur technical indicators ka istemal karte hain. Trend strains market ke fee movements ko music karne mein madadgar hoti hain, aur technical indicators jaise ki moving averages, RSI, aur MACD bhi investors ko market ki samajhne mein assist karte hain. Inverse approach mein buyers in tools ka istemal karke marketplace ke reversal points ko pick out karte hain. Inverse strategy istemaal karne ke fayde aur nuksan hote hain. Is tareeqe ka istemal karne se traders high-chance positions mein input karte hain, kyunke woh marketplace ki movement ke khilaf alternate kar rahe hote hain. Agar buyers sahi access aur go out factors nahi chunte, toh unko nuksan ho sakta hai. Lekin jab is approach ko tajurbah kar traders istemal karte hain aur marketplace trends ko theek se samajhte hain, toh woh is tareeqe se acha munafa hasil kar sakte hain. Aakhir mein, inverse strategy forex buying and selling mein ek mukhtasar aur tez tareeqa hai jisay traders marketplace ki motion ke khilaf trade karne ke liye istemal karte hain. Ye tareeqa investors ko market ke contrary course mein change karne ki salahiyat deta hai. Iske istemal ke liye tajurba, marketplace analysis aur technical indicators ki samajh zaroori hoti hai. Inverse strategy ko theek tareeqe se istemal karne se traders ko munafa hasil

-

#173 Collapse

Forex members, both the Bullish Homing Pigeon Candlestick Pattern and the Bearish Homing Pigeon Candlestick Pattern are excellent and remarkable patterns that can be easily analyzed. It is important for us to take the time to understand and comprehend these patterns fully. By doing so, we can significantly improve our ability to identify profitable trading opportunities and provide valuable insights to our fellow traders.To achieve this, it is crucial that we invest our efforts in thorough analysis and dedicated practice. The more effort and practice we put into understanding these patterns, the higher the chances of reaping benefits from the market. Therefore, it is essential for us to practice diligently and develop a strong grasp of these patterns, as it will ultimately lead us to profitable trades and successful outcomes.traders bullish reversal ki expectation rakhte hain. Jab yeh pattern confirm hojata hai, traders long positions lete hain ya existing short positions ko cover karte hain.Agar aap ek trader hain aur aapko Homing Pigeon pattern ka estemaal karna hai, toh aapko kuch cheezein dhyan mein rakhni chahiye:Is pattern ki pehchan sahi karna zaroori hai. Iske liye aapko candlestick charts ko observe karna hoga.Confirmatory signals ke liye aapko dusre technical indicators ya price patterns ka bhi estemaal kar sakte hain.Risk management ko hamesha dhyan mein rakhein. Stop-loss orders ka istemaal karke apni positions ko protect karna zaroori hai.Is pattern ka estemaal karne se pehle, apne broker ya financial advisor se salah lena faidemand ho sakta hai.Yeh candlestick pattern market conditions aur dusre factors ke saath juda hua hota hai, isliye har trade ki guarantee nahi hoti hai. Hamesha apne analysis aur research ko poori tarah se karne ke baad hi trading decisions lena zaroori ha Dear member ascending triangle pattern mein upper trend line flat pattern mein hoty hy or down ke trend line increase hoti rehti hy or yeh pattern es baat ko indicate krta hy buyer seller k against mein zyada ja rhy hoty hain.kun k price high kam hoty ja rhy hy price flat or trend line k ponch jaty hy ap es pattern ko achi trha sy Jab identify krti hain or es k according ap Koi trade lty Hain To es mein ap ko bht zyada faidah mil raha hota hy es liye ap es trha sy kam krna ho ga Taky ap es pattern mein zyada sy zyada trade lag Acha profit bna saky ,or es ke zyada es k finally opar ke traf break honay ka zyada chance hota hy. -

#174 Collapse

Forex market mein Inverse strategy ek trading approach hai jo price movements aur trend reversals par focus karta hai. Ye strategy traders ke liye ek tool hai jisse woh potential trading opportunities identify kar sakte hai jab market normal trend se reverse hone ke chances hote hai. Inverse strategy ka mukhya concept hai ki market trends ka reversal hota hai. Jab market normal trend se reverse hota hai, traders is strategy ka use karke profits generate kar sakte hai. Inverse strategy ko samajhne ke liye, hamein pehle market trends aur trend reversal ke concept ko samajhna hoga. Forex market mein do tarah ke trends hote hai: uptrend aur downtrend. Uptrend mein, price higher highs aur higher lows banata hai, yani price consistently badhta hai. Downtrend mein, price lower lows aur lower highs banata hai, yani price consistently girta hai. Jab market trends change hote hai, trend reversal hota hai. Inverse strategy mein traders market trend reversal ke opportunities ke liye alert rehte hai. Jab market normal trend se reverse hone ke indications dikhte hai, woh trade entries aur exits plan karte hai. Is strategy mein traders bearish aur bullish indicators ka use karte hai, jaise ki technical indicators, price patterns, aur price action analysis. Inverse strategy ke liye kuch important tools hai jo traders use karte hai. Kuch popular tools aur techniques diye gaye hai

Inverse strategy mein traders market trend reversal ke opportunities ke liye alert rehte hai. Jab market normal trend se reverse hone ke indications dikhte hai, woh trade entries aur exits plan karte hai. Is strategy mein traders bearish aur bullish indicators ka use karte hai, jaise ki technical indicators, price patterns, aur price action analysis. Inverse strategy ke liye kuch important tools hai jo traders use karte hai. Kuch popular tools aur techniques diye gaye hai- Technical Indicators: Traders technical indicators ka use karte hai reversal signals identify karne ke liye. Kuch common reversal indicators hain RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), aur Stochastic Oscillator. Inverse strategy mein, jab indicators overbought ya oversold territories mein jaate hai, ya phir divergences dikhate hai, tab traders trend reversals ke possibilities ko samajhte hai.

- Support aur Resistance Levels: Support aur resistance levels bhi trend reversals ke liye important hai. Jab price support level se rebound karta hai, ya phir resistance level ko break karke upar jaata hai, tab trend reversal ka potential hota hai. Traders support aur resistance levels ke breakout aur reversal ko monitor karte hai.

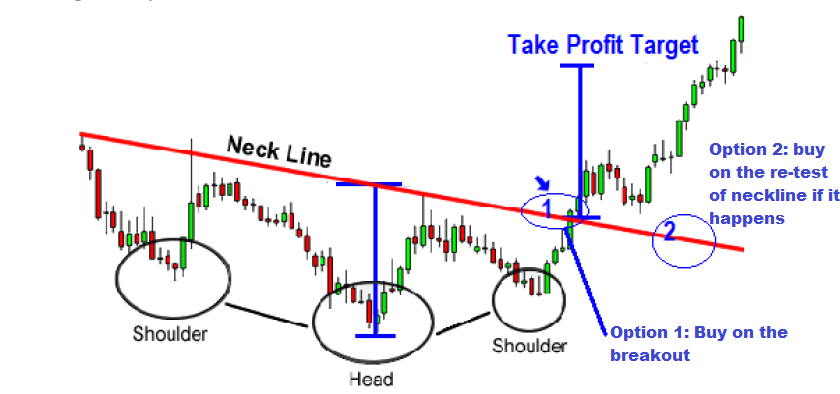

- Price Patterns: Price patterns, jaise ki double tops, double bottoms, aur head and shoulders, trend reversals ke indicators hote hai. Inverse strategy mein traders in patterns ko identify karke trading decisions lete hai. Jab aise patterns form hote hai, woh buy ya sell positions enter karte hai.

- Reversal Candlestick Patterns: Candlestick patterns, jaise ki dojis, hammers, aur shooting stars, trend reversals ke indication provide karte hai. Inverse strategy mein traders in candlestick patterns ka use karte hai aur jab aise patterns form hote hai, woh trading decisions lete hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

- Mentions 0

-

سا0 like

-

#175 Collapse

Definition... ulta lain deen is waqt hota hai jab koi shakhs kisi kavntr party ke sath tijarat karta hai, jis ki position mukhalif hoti hai aur isi tijarat ke sath apni position bhi band kar deti hai . makoos lain deen ki istilaah aksar aik hi qeemat ki tareekh ke sath frwd ya aapshnz ke muahiday ko band karne ke tanazur mein istemaal hoti hai. yeh sarmaya car ko poooray lain deen ke naffa ya nuqsaan ka andaza laganay ki ijazat deta hai .... Explanation... aik ulta lain deen woh hota hai jis ka istemaal isi lain deen ki tafseelaat ke sath kisi sarmaya car ke zareya pehlay ki gayi doosri lain deen ko kaladam ya aafsit karne ke liye kya jata hai. ulta lain deen aam tor par ikhtiyarat aur farordz ke sath istemaal hotay hain. yeh lain deen band honay par sarmaya car ko aik muqarara faida ya nuqsaan ke sath chore deta hai .... jo sarmaya car farordz kharedtay hain woh meyaad khatam honay ke waqt bunyadi asasa, jaisay currency, par qabza karne ka intikhab kar satke hain ya woh meyaad khatam honay ki tareekh tak pounchanay se pehlay moahida band kar satke hain. position ko band karne ke liye, sarmaya car ko of setting tranzikshn khareedna ya bechna chahiye.... Example of inverse strategy... yahan aik farzi misaal hai ke ulta lain deen kaisay kaam karta hai. farz karen ke aik Amrici company €150, 000 frwd contract ko June mein lain deen ke liye April mein $ 1. 20 fi aik euro ki makhsoos qeemat par kharidte hai. yeh 150, 000 € farokht kar ke aik ulta lain deen kar sakta hai isi meyaad khatam honay ki tareekh ke sath jo is ne April mein khareeda tha . aisa karne se, company ne munafe ya nuqsaan mein band kar diya hai. yeh euro baichnay ke liye masool honay wali raqam ki raqam hogi jo frwd contract ke sath euro ki kharidari ke liye ada ki gayi raqam se kam hogi. agar kharidari ke baad se euro ki qader mein izafah hota hai, to khredar agay aata hai . farz karen ke dono fariqain $ 1. 20 eur / usd ki sharah mubadla par mutfiq hain, lehaza agar qeemat $ 1. 25 tak barh jati hai, to woh $ 1. 20 par khareedna behtar hai. doosri taraf, agar euro $ 1. 15 par girta hai, to woh badter hain kyunkay woh muahiday ke tehat $ 1. 20 par lain deen karne ke paband hain . companian mustaqbil mein darkaar funds par rate un lock karne ke liye farordz ka istemaal karti hain aur mumkina qeemat ke utaar charhao ke bajaye yeh jan-nay ke liye ziyada fikar mand hoti hain ke un ke mustaqbil mein cash infloz aur out flow kya hon ge . -

#176 Collapse

Dear jab pattern mai ap ko 2 values up or down mai same same milti hai tu ap woh us ki base pay hoti hai. Ap ko cheye kay jab be ap trading karain tu pattern woh he find karian is ka ap ko pata ho or ap asani sy us pattern mai trend ko find kar sakain. Ap ka trend find karnay kay leye zarori nahi hai kay ap inverse strategy ko he use karain. Ap apni strategy ko use karny kay leye koi be acha pattern find kar kay trading kar sakty hain. -

#177 Collapse

The Forex market Trading Mein Ulta Tareeqa (Inverse Strategy) Ki Tafseel : Forex trading ek tijarat hai jahan par dunya bhar ke mulkoon ki currencies (maal) khareed kar bechi jati hain. Is tijarat mein kamyabi hasil karne ke liye, investors mukhtalif tareeqon ka istemal karte hain, jinmein se ek tareeqa hai "Inverse Strategy" ya "Ulta Tareeqa." Is tareeqe ka maqsad maqbulat se behtareen fawaid hasil karne ka hai jab marketplace ki taraqqi ya kamzori ko pehchanna hota hai.Inverse strategy, jaise naam se zahir hai, marketplace ke mukhalif ya ulta raaste par chalne ka tareeqa hai. Iska matlab hai ke dealer us waqt bechne ka faisla karta hai jab aam taur par log khareed rahe hote hain, aur khareedne ka faisla karta hai jab log bech rahe hote hain. Yani, jab marketplace khareed rahe ho, trader bechta hai aur jab marketplace bech rahe ho, trader khareedta hai. Is tareeqe ka mukhya maqsad market ki rukawat ya ummid se mukhalif raaste par tajwezat dena hai.Inverse strategy ka istemal karne se traders market ke fashion ki pehchan karte hain aur isse unko marketplace ki motion ke naked mein achi samajh milti hai. Agar marketplace mein taraqqi ho rahi hai to yeh approach investors ko market ke khilaf buying and selling se bachane mein madadgar hoti hai. Isi tarah, agar marketplace mein kami ho rahi hai to yeh method unko market ke fayde uthane mein madad deti hai. Ulta Tareeqa: Market Ke Mukhalif Raaste Par Chalne Ki the Forex market Trading Strateji : Inverse approach istemal karne ke liye buyers ko marketplace ke indicators ko samajhna aur unpar amal karna zaroori hota hai. Is mein technical aur essential evaluation ka bhi ahem kirdar hota hai. Technical analysis mein charts, graphs aur beyond performance ki madad se marketplace ki motion ka pata lagaya jata hai. Wahi fundamental evaluation mein monetary indicators, news aur geopolitical occasions ki tafseelati tafseelat se marketplace ke hawale se faislay liye jate hain.Inverse method ka istemal karne se buyers ko apne faislay ko samajhne aur justify karne ki zaroorat hoti hai. Yeh method gambhir soch aur tafseelati research ko zaroori banati hai, kyunke bina tafseelati evaluation ke faislay nuqsaan ka bais ban sakte hain.Mukhtasar taur par kaha jaye to, inverse strategy foreign exchange buying and selling mein ek ahem tareeqa hai jo investors ko marketplace ke fashion ko samajhne aur us trend ke mukhalif faislay lene mein madad deta hai. Is approach ka istemal karne se traders ko market ke hawale se behtar samajh hasil hoti hai aur unka nuqsaan kam ho sakta hai. Lekin yad rahe ke foreign exchange trading ek unstable shoba hai aur har tareeqa apni tafseelati tehqiqat aur samajh se istemal karna chahiye.

Ulta Tareeqa: Market Ke Mukhalif Raaste Par Chalne Ki the Forex market Trading Strateji : Inverse approach istemal karne ke liye buyers ko marketplace ke indicators ko samajhna aur unpar amal karna zaroori hota hai. Is mein technical aur essential evaluation ka bhi ahem kirdar hota hai. Technical analysis mein charts, graphs aur beyond performance ki madad se marketplace ki motion ka pata lagaya jata hai. Wahi fundamental evaluation mein monetary indicators, news aur geopolitical occasions ki tafseelati tafseelat se marketplace ke hawale se faislay liye jate hain.Inverse method ka istemal karne se buyers ko apne faislay ko samajhne aur justify karne ki zaroorat hoti hai. Yeh method gambhir soch aur tafseelati research ko zaroori banati hai, kyunke bina tafseelati evaluation ke faislay nuqsaan ka bais ban sakte hain.Mukhtasar taur par kaha jaye to, inverse strategy foreign exchange buying and selling mein ek ahem tareeqa hai jo investors ko marketplace ke fashion ko samajhne aur us trend ke mukhalif faislay lene mein madad deta hai. Is approach ka istemal karne se traders ko market ke hawale se behtar samajh hasil hoti hai aur unka nuqsaan kam ho sakta hai. Lekin yad rahe ke foreign exchange trading ek unstable shoba hai aur har tareeqa apni tafseelati tehqiqat aur samajh se istemal karna chahiye.

-

#178 Collapse

INVERSE STRATEGY IN FOREX

Introduction: Forex trading, or foreign exchange trading, involves buying and selling currencies with the aim of making profits. Inverse strategy is a unique approach in forex trading where traders take positions opposite to the prevailing market trend. This strategy requires careful analysis and understanding of market dynamics.

1. Understanding Inverse Strategy:- In inverse strategy, traders go against the current market trend.

- Instead of following the crowd, they take positions that oppose the majority sentiment.

- This strategy is based on the assumption that the market will eventually reverse its direction.

2. Contrarian Approach:- Inverse strategy is a contrarian approach to trading.

- Contrarian traders believe that the crowd is often wrong and that market reversals can be profitable opportunities.

- By going against the trend, contrarian traders aim to capitalize on market overreactions and corrections.

3. Key Principles:- Patience: Inverse strategy requires patience as market reversals may take time to materialize.

- Risk Management: Proper risk management is essential to mitigate losses when trading against the trend.

- Technical Analysis: Traders use technical indicators to identify potential reversal points in the market.

4. Identifying Reversal Signals:- Candlestick Patterns: Reversal candlestick patterns such as hammer, shooting star, and engulfing patterns can signal potential market reversals.

- Divergence: Divergence between price and momentum indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) can indicate weakening trend momentum.

- Support and Resistance Levels: Significant support and resistance levels can act as reversal points in the market.

5. Risks Associated:- False Reversals: Market reversals are not guaranteed, and false signals can lead to losses.

- Emotional Challenges: Going against the crowd can be emotionally challenging, especially during prolonged trends.

- High Volatility: Inverse trading can be risky during periods of high market volatility, as reversals may be more unpredictable.

6. Advantages of Inverse Strategy:- Profit Potential: Successful reversal trades can yield significant profits, especially during major trend changes.

- Diversification: Inverse strategy offers diversification benefits as it provides opportunities in both trending and ranging markets.

- Psychological Edge: Contrarian traders often develop a psychological edge by going against the crowd and maintaining discipline in their approach.

7. Implementation Tips:- Start Small: Begin with small position sizes when implementing inverse strategy to manage risks effectively.

- Use Stop Loss Orders: Set stop loss orders to limit potential losses in case the market continues to move against the trade.

- Stay Informed: Keep abreast of market news and developments that could impact currency trends.

8. Backtesting and Practice:- Backtesting: Before implementing inverse strategy in live trading, backtest the strategy using historical data to assess its effectiveness.

- Demo Trading: Practice inverse trading in a demo account to gain experience and refine your approach without risking real capital.

- Learn from Mistakes: Analyze past trades to learn from mistakes and continuously improve your trading strategy.

9. Conclusion: Inverse strategy in forex trading offers a unique approach for traders to capitalize on market reversals. By going against the prevailing trend, contrarian traders aim to profit from overreactions and corrections in the market. However, implementing inverse strategy requires careful analysis, patience, and disciplined risk management to navigate the inherent risks associated with trading against the crowd. With proper understanding and practice, inverse strategy can be a valuable addition to a trader's toolkit for navigating dynamic forex markets.

-

#179 Collapse

Aghaaz: Forex mein mukhtalif strategies istemal karna ek zaroori hissa hai. Inverse strategy forex trading mein aik ahem tareeqa hai jo khas tor par risk management aur profit ko maximize karne ke liye istemal hota hai. Is strategy ko samajhna aur istemal karna forex traders ke liye zaroori hai. Is post mein, hum inverse strategy ke baray mein tafseel se baat karenge.

1. Muqaddas Maqsad:- Inverse strategy ka maqsad hai nuksan ko minimize karna aur faida barhane ka tareeqa tajwez karna.

- Yeh strategy traders ko maqsad ke mutabiq trading decisions lenay mein madadgar hoti hai.

2. Mablagh Ki Khidmat:- Inverse strategy ka aik ahem hissa mablagh ki khidmat hai.

- Is strategy mein, traders mablagh ki hissaydar aur tijarat ke pehle mawafiqat ko shamil karte hain.

3. Samajh aur Tehqeeq:- Inverse strategy ko samajhne aur istemal karne ke liye zaroori hai ke traders forex market ko gehraayi se samjhein aur market ki tehqeeq karein.

- Tehqeeqat ke zariye traders market trends aur price movements ko samajh kar behtareen faislay kar sakte hain.

4. Risk Management:- Inverse strategy forex mein risk management ka ek ahem hissa hai.

- Is strategy ke zariye, traders apne nuksan ko minimize karne aur apne positions ko protect karne ke liye tawaja dete hain.

5. Trading ki Shuruaat:- Inverse strategy ko istemal karne se pehle, traders ko apni trading ki shuruaat ke maqsad ko wazeh kar lena chahiye.

- Shuruaati maqsad ko samajh kar, traders apni trading strategy ko inverse tareeqay se customize kar sakte hain.

6. Technical Analysis:- Inverse strategy mein technical analysis ka istemal ahem hota hai.

- Technical indicators aur price charts ke zariye traders market trends ko samajh kar apni trading strategy ko design karte hain.

7. Fundamental Analysis:- Fundamental analysis bhi inverse strategy mein ahem kirdar ada karta hai.

- Economic indicators aur geopolitical events ki tafseel se tajziya kar ke, traders apne positions ko munafa kamane ke liye optimize kar sakte hain.

8. Trading Signals:- Inverse strategy ke mutabiq trading signals ko samajhna traders ke liye zaroori hai.

- Trading signals ko samajh kar, traders apne positions ko sahi waqt par enter aur exit kar sakte hain.

9. Trading Psychology:- Inverse strategy istemal karne mein trading psychology ka bhi bara hissa hota hai.

- Trader ki mindset ko control karna aur emotions ko handle karna, successful trading ke liye zaroori hai.

10. Tijarat ki Shafafiyat:- Inverse strategy forex market mein tijarat ki shafafiyat ko barqarar rakhne mein madadgar hai.

- Is strategy ke zariye, traders transparent aur accountable trading practices ka muzahira karte hain.

11. Case Studies:- Inverse strategy ke istemal ke kuch case studies aur examples ko samajhna traders ke liye faida mand ho sakta hai.

- Case studies ke zariye, traders practical tajziyat aur trading decisions par amal kar sakte hain.

12. Learning Resources:- Inverse strategy ko samajhne aur istemal karne ke liye mukhtalif learning resources available hain.

- Books, online courses, aur forums traders ko inverse strategy ke bare mein mazeed maloomat faraham karte hain.

Nateeja:- Inverse strategy forex trading mein ek ahem aur mufeed tareeqa hai.

- Traders ko is strategy ko samajh kar istemal karna chahiye taake wo apne trading results ko behtar banane mein kamiyab ho sakein.

Ikhtitam: Forex trading mein inverse strategy ka istemal karna trading ki safalta mein ek ahem tareeqa hai. Is post mein humne inverse strategy ke ahem pehluo par roshni dali aur traders ko is tareeqay ko samajhne aur istemal karne ke liye motivate kiya. Amal karke, traders apne trading results ko behtar bana sakte hain aur apni tijarat ko mazeed kamiyabi ki taraf le ja sakte hain.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#180 Collapse

Trading me ulta soch, yaani ke inverse strategy, ek aham tareeqa hai jisse kuch traders apni investments ko protect karte hain aur profits maximise karte hain. Ye tareeqa maamoolan market ki girawat ya samay par istemaal kiya jata hai, jab ki seedhi strategy kamzor ya mushkil halat mein kaam na kare.

Inverse strategy ka maqsad hota hai market ki mukhalif raftar ko shamil karna, yaani jab market down ja rahi ho, inverse strategy ko istemal karke traders apni positions ko barqarar rakh sakte hain ya profits kamayein. Is tareeqe ka istemal karke, traders apne nuqsan ko kam kar sakte hain ya phir mukhtalif assets mein invest karke portfolio ko diversify kar sakte hain.

Ek tareeqa inverse strategy ka istemal karna hai put options ki khareed ya farokht karna. Put options, ek qisam ki financial contract hoti hai jo investor ko ek mukarrar price par muddat tak kisi stock ko farokht karne ya khareedne ka haq deti hai. Jab market down hoti hai, put options ke keemat barh jati hai, jisse traders ko profits milte hain.

Iske alawa, kuch traders apne portfolios mein inverse ETFs (Exchange Traded Funds) shamil karte hain. Inverse ETFs market ki girawat ki taraf munhasir hoti hain, yaani jab market down hoti hai, ye ETFs upar ja sakti hain, jisse investors ko profits milte hain. Ye ETFs normal ETFs ki tarah function karte hain, lekin unka maqsad market ki girawat ko exploit karna hota hai.

Inverse strategy ka istemal karne se pehle, zaroori hai ke traders market ki analysis karein aur samajhne ki koshish karein ke market kis taraf ja rahi hai. Market ki movement ke mutabiq, sahi put options ya inverse ETFs ka chunav kiya ja sakta hai.

Lekin, inverse strategy ka istemal karna bhi apne risk ke saath aata hai. Market ki girawat mein, agar trader galat put options ya inverse ETFs kharid leta hai, to nuqsan ho sakta hai. Isliye, inverse strategy ka istemal karne se pehle, traders ko market ki movement ko samajhna zaroori hai aur sahi tajziya karna chahiye.

Is tareeqe ka istemal karne se pehle, traders ko bhi samajhna zaroori hai ke ye strategy unke investment goals aur risk tolerance ke mutabiq hai ya nahi. Har trader ki apni apni tolerance level hoti hai jab baat aati hai risk ki, isliye har kisi ko ye strategy istemal karne se pehle apne liye appropriate samjha jana chahiye.

To conclude, inverse strategy trading mein ek ahem tareeqa hai jisse traders apni investments ko protect kar sakte hain aur profits maximise kar sakte hain market ki girawat ya samay par. Lekin, is tareeqe ka istemal karne se pehle, zaroori hai ke traders market ki analysis karein aur apne risk tolerance ko samjhein.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:19 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим