Assalamu Alaikum Dosto!

Forex Price Chart

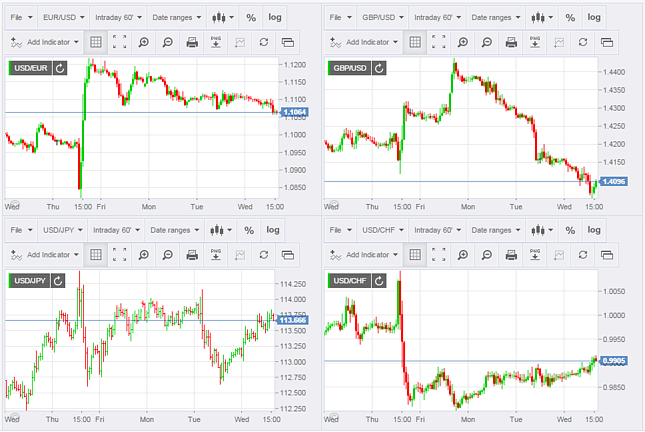

Forex trading mein price chart ka aik strong aur behtar role hai, jiss ko kabhi bhi nazar andaz nahi kia ja sakta. Forex trading charts future markets mein technical analysis ke liye zaroori hen, q k yeh market k past ka mutalea ki bunyaad faraham karte hen. Yeh prices ki movements ko visual andaaz mein dekhnay aur trade karne ka aik zareya hen, jis par analyst mukhtalif qisam k indicators k istemal karte howe market ki current situation k mutabiq apne planing tarteeb deta hai.

Traders mukhtalif timeframes aur mukhtalif visual andaaz mein dikhane k liye chart tarteeb dete hen. Trading ke liye traders ke muntakhib karda timeframe par munhasir hai, k wo mukhtalif timeframes ko dikhane walay mukhtalif charts ko dekhnay ka intikhab kar satke hain. Aik long term trader weekly ya monthly chart par qeemat ka pata lagane ki koshash karta hai, jab keh aik short term ka trader 60 minute ya 5 minute ke chart ka istemaal karta hai.

Charts ko tarteeb daine aur inn charts par visual price numaindagi ke bohat se tareeqay hen. Chart ki sab se aam aqsam candlestick, bar charts aur line charts hain. Iss se qata nazar ke price k trader kis qisam ki visual numaindagi ka istemaal karte hain, candlestick, bar chart aur line chart shanakht karne ke liye rasta talaash karne mein madad karte hen:

- K aya market trend main trade kar raha hai.

- Market k top ya bottom main trend reversal hone wala hai.

- Market k consolidation ya istehkam ka time-peroid.

Forex Price Charts ke Fawaid

Agar forex trader ke paas price charts na hon, to woh kahan hoga? Ye sab se ahem tools hain jo currency pairs ke amal par har qisam ki market analysis karne ke liye istemal hoti hain. Trader inhein istemal karte hain taake currency rate ka tareekhi data dekhein aur mustaqbil ke currency price movements par mukhtasir tehqiqat karein. Aik aam sawal ye hota hai ke kaunsa khaas forex charting software behtareen hai.

Jawab afsoos ke sath itna saaf aur wazeh nahi hai. Ye is liye hai ke har ek forex trader ka apna khas trading andaz hota hai aur is liye, usay behtareen trading mauqay ko pehchanne ke liye khas tools ki zaroorat hoti hai. Har qisam ke trading andaz ke liye bohot se mukhtalif qisam ke forex price charts mojood hain. In charts se kuch fawaid umeed kiye ja sakte hain:

- Ye duniyawi currency exchange market ka mahol haqeeqi aur realtime tasawwur karne mein madadgar hotay hain.

- Ye market patterns aur rawayyon ko pehchanne mein madad karte hain.

- Ye technical aur fundamental forex market analysis dono ke liye bunyadi tools hain.

Forex technical analyst forex price charts ka istemal karke haqeeqi waqiaat aur price movement ke maqrooz patterns par tawajjo dete hain.

Doosri taraf, fundamental forex market analyst price charts par nazar daal kar price trends ki tajziyat karte hain aur unka macro events se talluq jaanchte hain. Ye events maqrooz siyasi aur maali taqazaat aur policies ki tabdeeliyan shamil hain.

Forex Price Charts ka Istemal Kaise Karein

Forex price charts ka istemal se faida uthane ke liye, kuch ahem points par kisi bhi trader ya market analyst ka tawajjo dena zaroori hai.

- Durust tajziyat ke liye, support aur resistance price levels ka acha ilm hona zaroori hai.

- Ek forex trader ko samajhna zaroori hai ke kaun se market indicators aise hote hain jo dikhate hain ke khas price level qaim rahega ya tootega.

Agar ek forex trader in do points ko behtar taur par istemal karna seekh le, to woh aasani se kuch hi arsay mein jeetne wali forex trading strategy bana sakta hai. Aur behtar aur tezi se nataij ke liye, mashwara diya jata hai ke ek professional service mein shamil ho jaye jo haqeeqi waqt par online forex charts, indicators aur market analysis faraham karte hain.

Candlestick Charts

Candlesticks charts price ki aik visual numaindagi ka istemaal karte hai, jo do ahem hisson, body aur wick mein taqseem hotay hen. Ye hissey aik aisay andaaz mein melte hen, jo aik candle ki terhan nazar atay hain, jiss ki waja se iss chart ka naam candlestick chart rakha gaya hai.

Wick, body ke oopar aur neechay aik patli lakeer se zahir hota hai, jo aik timeframe ke douran trade ki gayi sab se ziyada aur sab se kam qeematon ko dekhata hai. Candle ki body, moti aur darmiyana hissa, aik timeframe ke douran open aur close honay wali qeematon ko zahir karta hai.

Agar aik candle main open price close se kam hota hai, to candle ka color aam tor par green ya white hoga, lekin ye trader ke software k color ki aqsaam par munhasir hai. Agar close price open price se kam hoti hai, to candle ka bar aam tor par red ya black ho jaye ga, lekin ye bhi trader k software aur uss main maojod color k intekhab par munhasir hai.

Sab se pehlay candle ki real body ka size khareed-o-farokht ki shiddat ki nishan-dahi karti hai. Candle ki real body jitni lambi hogi, iss candlestick ke waqat ke douran itni hi ziyada price barhay gi. Candle k short real body ka matlab yeh hai, keh open aur close honay wali qeematein bohat millti jalti hen, jiss ka matlab yeh hai keh muntakhib karda timeframe main price ziada taaqat main nahi hai.

Dosra, real ke nisbat shadow ya wick ka size bhi ahem hai. Small ya baghair shadow wali candles ka matlab hai, k close price timeframe k dowran ziada mazbot hai, agar ye green hai, to iss ka matlab hai, k buyers market ko apne control main leye howe hen aur agar ye red hai, to market ka control sellers k pass hai.

Agar candle k shadow ya wick ki lambay main ziada ho to prices ka aik bara range hota hai, jiss ka matlab hai k market buyers buyers aur sellers walay dono ke control mein hai.

Candles traders ko yeh bhi dikha sakti hen, keh real body k close honay par kon control mein hai. Agar candle ke nichale hissay ke qareeb aik chhota si real body hai, to is ka matlab hai ke timeframe ke aakhir mein sellers ne buyers se control hasil kar liya hai, jo real body ke open hissay mein mazboot they.

Lekin agar aik timeframe main small real body top par banti hai, aur nechle hissey main candle ka aik lamba shadow ya wick hai, to iss ka matlab hai, k matloba timeframe main buyers ne sellers se control hasil kar leye hai, jo aghaz main market par hawee they. Forex candlestick chart ke kuch ahem features shamil hain:

- Candlestick Structure: Har candlestick ka ek "body" hota hai jo ke open aur close prices ke darmiyan farq ko darust karta hai. Body bhari hoti hai (aam tor par siyaah ya surkh rang mein) jab close open se kam hota hai, ye ek bearish doraan ko darust karta hai. Body khali hoti hai (aam tor par safed ya sabz rang mein) jab close open se zyada hota hai, ye ek bullish doraan ko darust karta hai.

- Wicks/Shadows: Patli lines body ke ooper aur neeche ko "wicks" ya "shadows" kehte hain aur ye high aur low prices ko us waqt ke doran darust karte hain. Wicks ki lambai market ki volatility ke baare mein maloomat faraham kar sakti hai.

- Time Frames: Candlestick charts ko mukhtalif time frames mein dikhaya ja sakta hai, 1 minute se lekar mahinay ya saal ke liye. Traders ko alag alag darajat par price action ka tajziya karne ke liye timeframe ka intekhab karne ki ijaazat hai.

- Candlestick Patterns: Khaas candlesticks ke formations, jo ke candlestick patterns kehlate hain, potential market trends ya reversals ko signal kar sakte hain. Misal ke tor par, bullish "Three White Soldiers" aur bearish "Evening Star" patterns.

- Visual Representation: Candlestick charts traditional bar charts ya line charts ke muqable mein zyada intehai aur visual representation faraham karte hain, jisse traders ko market trends aur patterns ko pehchanne aur samajhne mein asani hoti hai.

Forex traders candlestick charts ko market ki sentiment ka tajziya karne, trading opportunities ko pehchanne, aur currency markets mein apne positions ko dakhil, nikalne, ya manage karne ke mutaliq agahi hasil karne ke liye istemal karte hain.

Bar Chart

Bar chart, ya OHLC chart, kaafi had tak candlestick chart se hososeyat mein melta julta hai, lekin is mein kuch visual differences hen. Candlesticks chart ki terhan, bar chart har waqat ke liye data ke chaar hessey faraham karta hai : open, high, low aur close.

Open price bar k bayen taraf aik choti horizontal line se zahir hoti hai, jab k close price horizontal line se dayen taraf hoti hai. Timeframe ka High aur low price bar ki vertical line se zahir hoti hen. Aik bar mein trader dekh satka hai, keh price kahan se shoro hui, price kahan khatam hui aur qeemat ki trading ki had kia thi. Aik trader ke tor par, aap ko timeframe par mabni approach ya trade par mabni approach ka istemaal karte hue yeh set karna hoga, keh aap ke chart par kitni bar koi nai candlestick ya baar zahir hota hai.

Misaal ke tor par, agar koi trader 5 minute ke chart par bars ka aik silsila muntakhib karta hai, jahan open aur high pichlle bar ki high se oopar hen, to woh is nateejay par pahonch satka hai, ke market ka trend upward ya bullish hai. Forex bar charts ke baray mein ahem points shamil hain:

- Bar ke Components: Aik forex bar chart par aik single bar vertical line hoti hai jo ke high aur low prices ko darust karti hai, sath mein daen aur baen taraf lambi lines hoti hain jo ke period ke open aur close prices ko darust karti hai.

- OHLC Format: OHLC (Open, High, Low, Close) format bar charts mein aam tor par istemal hota hai taake comprehensive taur par price action ko darust kare. Ye format traders ko market trends ko tajziya karne aur trading decisions banane ke liye zaroori data points faraham karta hai.

- Timeframes: Forex bar charts ko mukhtalif timeframes par display kiya ja sakta hai, masalan 15-minute, 1-hour, 4-hour, aur daily bars. Traders apni trading strategy aur analysis ke zaroorat ke mutabiq timeframe ka intekhab kar sakte hain.

- Technical Analysis Tool: Bar charts technical analysis mein bunyadi tools hote hain, jo ke price movements aur patterns ko waqt ke sath wazeh taur par tasawwur faraham karte hain. Ye forex traders ke darmiyan trends, support aur resistance levels, aur potential dakhil ya nikalne ke points ko pehchanne mein istemal hotay hain.

- Candlestick Charts ke Sath Muqabla: Jabke bar charts zaroori price information faraham karte hain, kuch traders candlestick charts ko unki visual appeal aur samajhne ki aasan tasweer ke liye pasand karte hain. Candlestick charts bar charts ke data ko faraham karte hain lekin bullish aur bearish sentiment ke liye rangon ka istemal karte hain.

Forex bar charts forex traders ke liye price movements ko tajziya karne, patterns ko pehchanne, aur dynamic foreign exchange market mein inform trading decisions banane ke liye zaroori tools hain.

Line Chart

Line chart basic price ko dekhnay ka aik aur tareeqa hai, lekin candlestick ya bar ke bar-aks, jo trader ko qeematon ke behtar nakaat ki analysis karne ki ijazat deta hai, aik line chart long term trend ko dekhnay ka aik behtar tareeqa faraham karta hai.

Aik line chart is baat ki numaindagi karta hai ke qeemat maazi mein kahan rahi hai aur aik makhsoos peroid k dowran band honay wali price ko zahir karti hai.

Ek line chart pattern ek grafical tasawwur hai jo data points ko seedha rekhta jo ke waqt ke sath trends aur patterns ko dikhane ke liye istemal hota hai. Ek line chart mein, data sets ko points ke siraay se plot kiya jata hai, har point ek khaas qeemat ko ek khaas lamha par darust karta hai. Phir ye points seedhe rekhton se jura jate hain taake ek musalsal rekhta banayein jo data ka trend ya pattern waqt ke sath dikhata hai. Line charts aam tor par mukhtalif metrics ke tabdeeliyon ko waqt ke sath dekhne ke liye istemal kiye jate hain, jaise ke stock prices, temperature, abaadi ki barhao, aur company ka karobaar. Ye mukhtalif fields aur industries mein data ko ek asan aur grafical andaz mein tasawwur karne ke liye qeemti tools hain. Line chart pattern ke kuch ahem features shamil hain:

- Data ka Tasawwur: Data points ko graph par plot kiya jata hai jahan X-axis waqt ke waqfay aur Y-axis quantity ko darust karta hai.

- Trend Analysis: Chart mein line ki curve khaas data ka trend darust karta hai, ye dikhata hai ke values waqt ke sath barh rahe hain, ghat rahe hain ya mustaqil hain.

- Muqabla: Line charts mukhtalif data sets ke tabdeeliyon ka muqabla ek hi waqt ke doraan kar sakte hain, jisse trends aur patterns ko asani se tasawwur kiya ja sake.

- Tareekhi Irtiqa: Line charts 18th century mein shuru huye aur ilm e kaiyat mein istemal hotay aye hain taake data trends ko darust karne ke liye.

- Istemal: Line charts rozana stock prices, karobar ki farokht, aur dosri metrics ke mutalik tabdeelion ko dekhne ke liye intehai wabasta hain.

Line chart patterns data trends aur patterns ko tasawwur karne ke liye bunyadi tools hain, jinhe waqt ke sath mukhtalif metrics ke tabdeelion ko tajziyat aur samajhne ke liye zaroori samjha jata hai.

تبصرہ

Расширенный режим Обычный режим