Wolfe Wave Pattern ek technical analysis pattern hai jo traders istemal karte hain taake market mein potential price reversals ka andaza lagaya ja sake. Ye pattern Bill Wolfe ne develop kiya tha aur iska concept ye hai ke markets waves mein move karte hain, jahan pe expansion aur contraction ke cycles hote hain. Wolfe Wave pattern khaas taur pe market mein potential entry aur exit points ko identify karne ke liye istemal hota hai, jisse ye traders ke darmiyan ek popular tool ban gaya hai.

Wolfe Wave Pattern ki Tashreeh

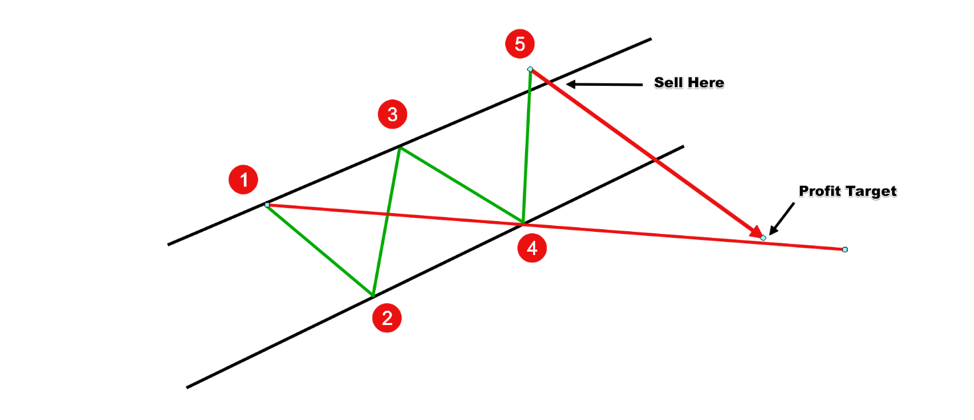

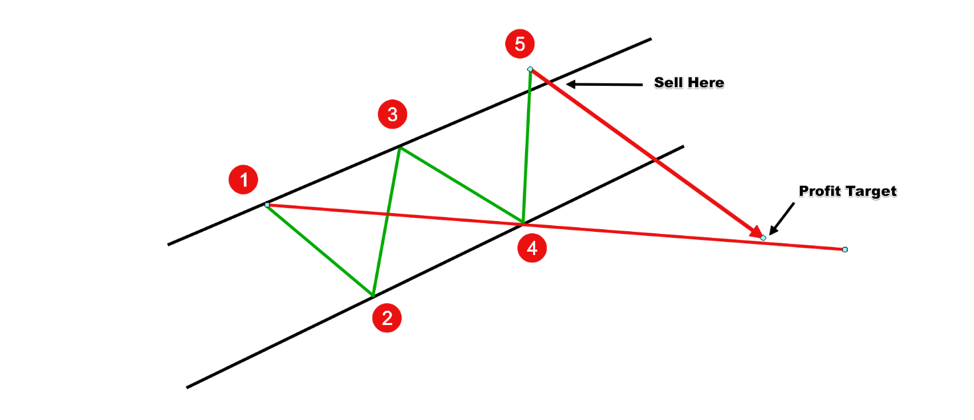

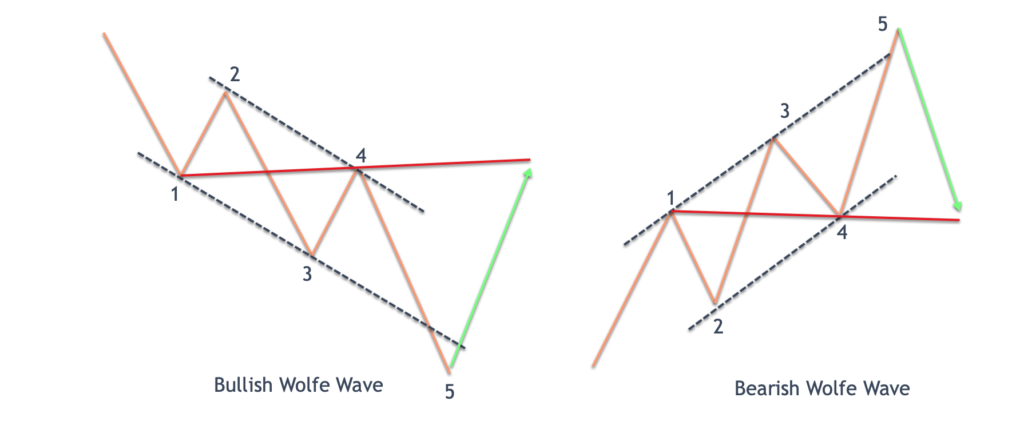

Wolfe Wave pattern paanch waves se bana hota hai, jinhein 1, 2, 3, 4 aur 5 ke roop mein label kiya jata hai. Ye waves ek khaas geometric shape banate hain, jo ke ek wedge ya channel ko resemble karte hain, aur khaas price aur time relationships ke sath hota hai. Yahan har wave ki details hain:

Wolfe Wave Pattern Identifications ke Rules

Ek Wolfe Wave pattern ko sahi taur pe identify karne ke liye, traders kuch khaas rules follow karte hain jinmein se kuch hain:

Wolfe Wave Patterns ke Saath Trading Strategies

Traders Wolfe Wave patterns ko alag alag tareeqon se istemal karte hain trades mein enter aur exit karne ke liye. Kuch common strategies include:

Wolfe Wave patterns traders ko kuch fawaid offer karte hain:

Magar, kuch limitations bhi hain:

Wolfe Wave Pattern ki Tashreeh

Wolfe Wave pattern paanch waves se bana hota hai, jinhein 1, 2, 3, 4 aur 5 ke roop mein label kiya jata hai. Ye waves ek khaas geometric shape banate hain, jo ke ek wedge ya channel ko resemble karte hain, aur khaas price aur time relationships ke sath hota hai. Yahan har wave ki details hain:

- Wave 1: Ye pattern ka pehla wave hota hai aur typically ek sharp move hota hai price mein, ya toh upar ya neeche.

- Wave 2: Wave 1 ke baad, ek corrective wave aati hai, jo ke Wave 2 ke roop mein label kiya jata hai, jo ke Wave 1 ki movement ka kuch hissa retrace karta hai.

- Wave 3: Wave 3 pattern ka sabse lamba aur strong wave hota hai, jisse Wave 1 ke high ya low ko cross karta hai.

- Wave 4: Wave 3 ke baad, ek aur corrective wave aati hai, Wave 4 ke roop mein, jo ke Wave 3 ki movement ka kuch hissa retrace karta hai.

- Wave 5: Pattern ka aakhri wave hota hai Wave 5, jo ke Wave 3 ke opposite direction mein move karta hai lekin usually Wave 3 ke high ya low ko nahi cross karta.

Wolfe Wave Pattern Identifications ke Rules

Ek Wolfe Wave pattern ko sahi taur pe identify karne ke liye, traders kuch khaas rules follow karte hain jinmein se kuch hain:

- Wave Relationships: Wave 3 sabse lamba aur strong wave hona chahiye, jo ke Wave 1 ke high ya low ko cross karta hai.

- Wave 4 Channel: Waves 2 aur 4 ek channel banate hain, jahan Wave 4 typically Wave 1 aur Waves 2 aur 3 ko connect karne wale trendline ke beech mein rehta hai.

- Wave 5 Projection: Traders often Fibonacci extensions ya doosre projection techniques ka istemal karte hain Wave 5 ke liye, based on Wave 1 ki length aur Wave 3 aur 4 ke relationship pe.

- Time Relationships: Waves ke beech kuch specific time relationships hote hain, jahan Wave 4 typically Wave 1 aur Wave 3 ke high ya low points ke around complete hota hai.

Wolfe Wave Patterns ke Saath Trading Strategies

Traders Wolfe Wave patterns ko alag alag tareeqon se istemal karte hain trades mein enter aur exit karne ke liye. Kuch common strategies include:

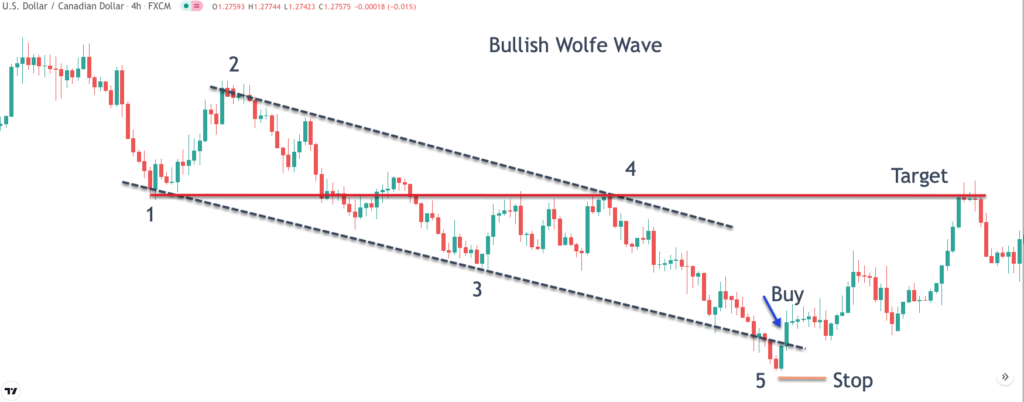

- Entry Points: Traders ek trade mein enter kar sakte hain jab Wolfe Wave pattern confirm ho jaye, usually Wave 5 complete hone ke baad aur price reverse hone lagta hai.

- Stop Loss aur Take Profit: Stop loss levels typically Wave 4 ke low ke neeche rakhe jate hain bullish Wolfe Wave pattern mein aur Wave 4 ke high ke upar bearish pattern mein. Take profit levels Fibonacci extensions ya doosre technical analysis tools ke basis pe set kiye ja sakte hain.

- Confirmation Indicators: Traders often additional technical indicators ya price action signals ka istemal karte hain Wolfe Wave patterns ko confirm karne ke liye, jaise divergences, candlestick patterns, ya trendline breaks.

- Risk Management: Sahi risk management zaroori hai jab Wolfe Wave patterns ko trade kia jaye, jaise ke kisi bhi trading strategy mein. Traders ko apni positions ko sahi taur pe size karna chahiye aur stop loss orders ka istemal karna chahiye takay potential losses ko limit kiya ja sake.

Wolfe Wave patterns traders ko kuch fawaid offer karte hain:

- Clear Entry aur Exit Points: Pattern clear guidelines provide karta hai entry aur exit points ke liye, jo ke traders ko unke trades plan karne mein madad karta hai.

- Objective Criteria: Traders objective criteria ka istemal kar sakte hain, jaise wave relationships aur channel formations, Wolfe Wave patterns ko identify karne ke liye, jo ke trading decisions mein subjectivity ko kam karta hai.

- Potential for High Reward: Agar sahi taur pe trade kiya jaye, Wolfe Wave patterns high reward-to-risk ratios offer kar sakte hain, especially jab sahi risk management techniques ke saath combine kiye jayein.

Magar, kuch limitations bhi hain:

- Subjectivity in Identification: Jab Wolfe Wave patterns ko identify karte waqt, thori si subjectivity ho sakti hai interpretation mein, jo ke false signals ka potential create kar sakta hai.

- Market Conditions: Wolfe Wave patterns sabhi market conditions mein perform nahi karte hain, aur traders ko is pattern ka istemal karte waqt broader market context ko consider karna chahiye.

- Complexity: Novice traders ke liye, Wolfe Wave patterns samajhna aur apply karna zyada complex ho sakta hai simple technical analysis tools ke mukable mein.

- Bullish Wolfe Wave Pattern: Ek bullish Wolfe Wave pattern mein, prices Waves 1 se 5 tak form karte hain, jahan Wave 3 sabse lamba aur strong hota hai. Traders Wave 5 complete hone ke baad long position enter kar sakte hain aur price reverse hone lagta hai, Fibonacci extensions ya previous resistance levels ko target karke potential profit banane ke liye.

- Bearish Wolfe Wave Pattern: Ek bearish Wolfe Wave pattern mein, prices Waves 1 se 5 tak form karte hain, jahan Wave 3 sabse lamba aur strong hota hai lekin opposite direction mein. Traders Wave 5 complete hone ke baad short position enter kar sakte hain aur price reverse hone lagta hai, Fibonacci extensions ya previous support levels ko target karke potential profit banane ke liye.

تبصرہ

Расширенный режим Обычный режим