Introduction to Bollinger Bands

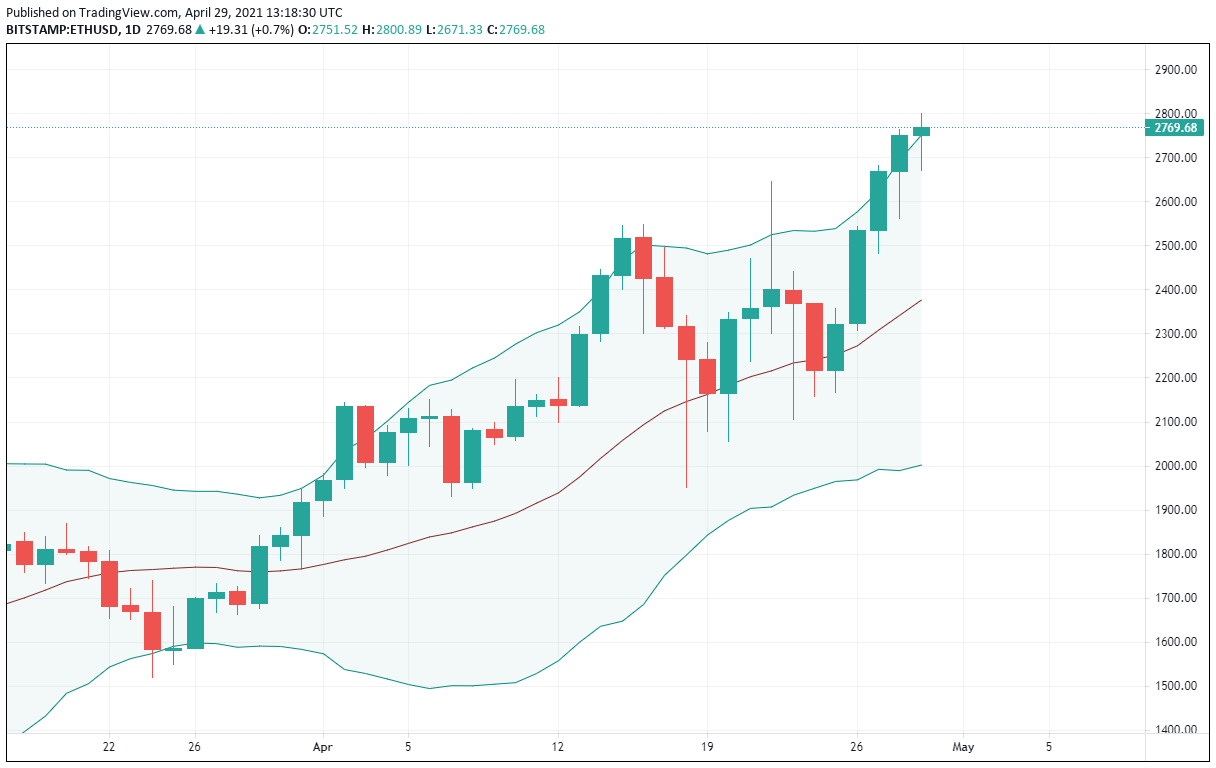

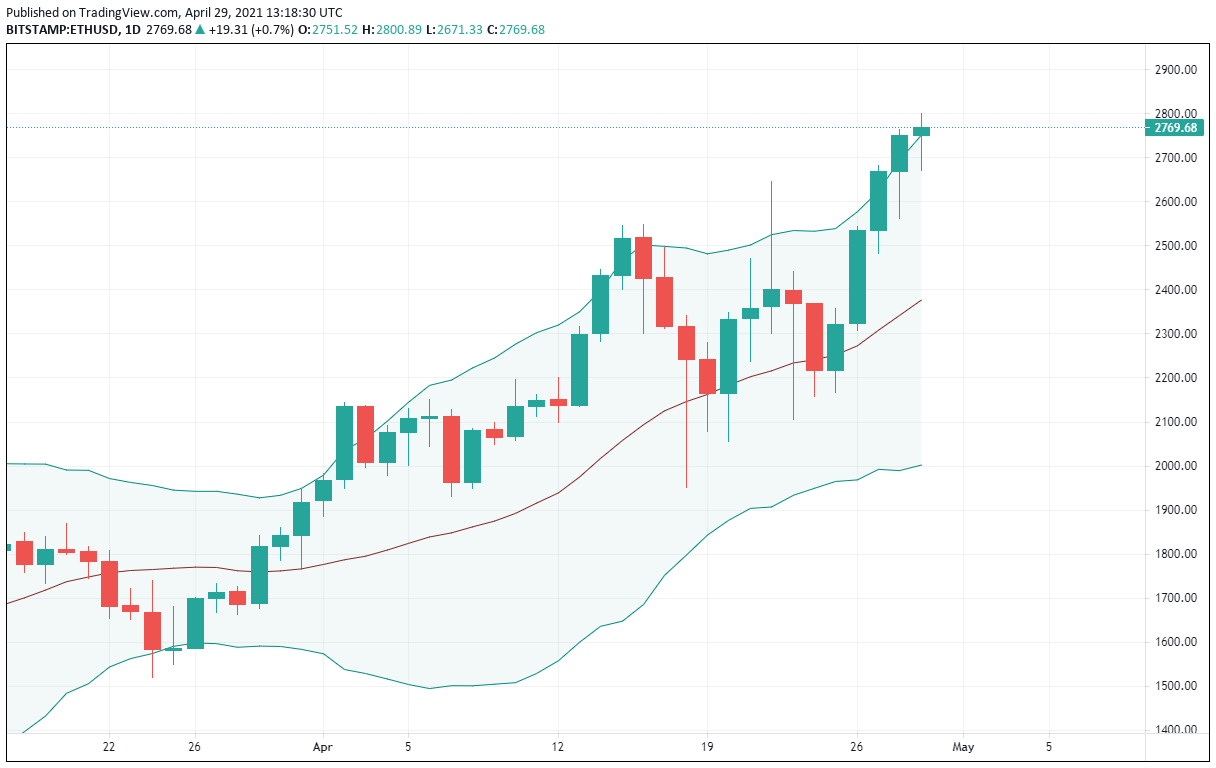

Bollinger Bands aik bohot mashhoor technical analysis tool hai trading ke duniya mein. Isay 1980s mein John Bollinger ne banaya tha aur ye volatility aur standard deviations par mabni hai. Bollinger Bands ke main components hain simple moving average SMA, upper band Upper Bollinger Band, aur lower band Lower Bollinger Band. SMA baseline ka kaam karta hai, price fluctuations ko smoothen karta hai ek mukarrar period mein, jo aam tor par 20 din hota hai. Upper band ko calculate kia jata hai by adding two standard deviations to the SMA, representing the upper boundary of price movement, jabke lower band ko calculate kia jata hai by subtracting two standard deviations from the SMA, indicating the lower boundary.

Components of Bollinger Bands

Bollinger Bands ka aik primary use market volatility ka assessment karna hai. Jab bands widen hoti hain, ye high volatility ko darust karta hai market mein, suggesting potential large price movements. Ulta narrow bands indicate low volatility and a period of price consolidation. Traders is information ko istemal karte hain to gauge the strength of a trend or anticipate potential breakouts or reversals.

Interpretation of Bollinger Bands

Bollinger Bands ka ek aur aspect hai identifying overbought and oversold conditions. Jab price upper band ko touch karta hai ya exceed karta hai, it may signal that the asset is overbought, meaning it has been driven to a high price level and could potentially experience a pullback. On the other hand, jab price touches or falls below the lower band, it may indicate that the asset is oversold, suggesting it may be undervalued and could see a rebound in price.

Uses of Bollinger Bands

Traders Bollinger Bands ko mukhtalif tareeqon se istemal kar saktay hain taake trading decisions mein asani ho. Aik common strategy hai the Bollinger Bands Squeeze. Ye strategy bands ko contract hone ka wait karti hai, indicating low volatility, aur anticipate karta hai a breakout when the bands expand again, signaling a potential strong price movement. Traders may use additional indicators or chart patterns to confirm signals generated by Bollinger Bands.

Bollinger Bands foolproof nahi hain aur unhe doosre technical analysis tools aur risk management strategies ke saath istemal karna chahiye. False signals aa saktay hain, khaaskar jab market mein low volatility ya choppy price action ka waqt hota hai. Traders ko overall market environment, news events, aur fundamental analysis factors ko bhi mad-e-nazar rakhna chahiye jab wo Bollinger Bands ko apne trading decisions mein shaamil karte hain.

Bollinger Bands traders ke liye ek qeemti tool hain jo market ki volatility ka tajziya karne, potential entry aur exit points ko pehchanna, aur overbought aur oversold conditions ka jaiza lene mein madadgar hai. Bollinger Bands ke components ko samajhne aur unhe kaise interpret karna hai, traders apne trading strategies ko behtar bana saktay hain aur maaliyat ke dynamic duniya mein zyada maloomati faislay kar saktay hain.

Ab, chaliye gehri tor par baat karte hain har component ke Bollinger Bands ke aur kaise traders is strategy ko effectively utilize kar sakte hain apne trading activities mein.

Common Trading Strategies

Iske Traders ko consider karna chahiye fundamental analysis factors, market sentiment, economic events, and geopolitical developments when making trading decisions. Bollinger Bands market ki volatility aur price levels mein qeemti wazeh raahnumai faraham karte hain, lekin unhe ek mukammal trading strategy ka hissa ke taur par istemal karna chahiye jo kay mukhtalif nazariyon aur maloomat ke sources ko shaamil karta hai.

Bollinger Bands ek jaded aur taqatwar technical analysis tool hain jo traders ko market ki volatility ka tajziya karne mein madad faraham kar sakta hai, potential entry aur exit points ko pehchanna, aur overbought aur oversold conditions ka jaiza laga saktay hain. Bollinger Bands ke ahem components ko samajh kar, signals ka tawilat se faraham karne ke saath sahi trading strategies ko lagoo karne se, traders apne faisla kun process mein behtar hone mein madad milegi aur wo maaliyat ke markets mein behtarin nataij hasil kar saktay hain.

Bollinger Bands aik bohot mashhoor technical analysis tool hai trading ke duniya mein. Isay 1980s mein John Bollinger ne banaya tha aur ye volatility aur standard deviations par mabni hai. Bollinger Bands ke main components hain simple moving average SMA, upper band Upper Bollinger Band, aur lower band Lower Bollinger Band. SMA baseline ka kaam karta hai, price fluctuations ko smoothen karta hai ek mukarrar period mein, jo aam tor par 20 din hota hai. Upper band ko calculate kia jata hai by adding two standard deviations to the SMA, representing the upper boundary of price movement, jabke lower band ko calculate kia jata hai by subtracting two standard deviations from the SMA, indicating the lower boundary.

Components of Bollinger Bands

Bollinger Bands ka aik primary use market volatility ka assessment karna hai. Jab bands widen hoti hain, ye high volatility ko darust karta hai market mein, suggesting potential large price movements. Ulta narrow bands indicate low volatility and a period of price consolidation. Traders is information ko istemal karte hain to gauge the strength of a trend or anticipate potential breakouts or reversals.

Interpretation of Bollinger Bands

Bollinger Bands ka ek aur aspect hai identifying overbought and oversold conditions. Jab price upper band ko touch karta hai ya exceed karta hai, it may signal that the asset is overbought, meaning it has been driven to a high price level and could potentially experience a pullback. On the other hand, jab price touches or falls below the lower band, it may indicate that the asset is oversold, suggesting it may be undervalued and could see a rebound in price.

Uses of Bollinger Bands

Traders Bollinger Bands ko mukhtalif tareeqon se istemal kar saktay hain taake trading decisions mein asani ho. Aik common strategy hai the Bollinger Bands Squeeze. Ye strategy bands ko contract hone ka wait karti hai, indicating low volatility, aur anticipate karta hai a breakout when the bands expand again, signaling a potential strong price movement. Traders may use additional indicators or chart patterns to confirm signals generated by Bollinger Bands.

Bollinger Bands foolproof nahi hain aur unhe doosre technical analysis tools aur risk management strategies ke saath istemal karna chahiye. False signals aa saktay hain, khaaskar jab market mein low volatility ya choppy price action ka waqt hota hai. Traders ko overall market environment, news events, aur fundamental analysis factors ko bhi mad-e-nazar rakhna chahiye jab wo Bollinger Bands ko apne trading decisions mein shaamil karte hain.

Bollinger Bands traders ke liye ek qeemti tool hain jo market ki volatility ka tajziya karne, potential entry aur exit points ko pehchanna, aur overbought aur oversold conditions ka jaiza lene mein madadgar hai. Bollinger Bands ke components ko samajhne aur unhe kaise interpret karna hai, traders apne trading strategies ko behtar bana saktay hain aur maaliyat ke dynamic duniya mein zyada maloomati faislay kar saktay hain.

Ab, chaliye gehri tor par baat karte hain har component ke Bollinger Bands ke aur kaise traders is strategy ko effectively utilize kar sakte hain apne trading activities mein.

- Simple Moving Average SMA: SMA Bollinger Bands ka foundation hai. Ye ek specified period, commonly 20 days, ke doran ek asset ka average price calculate karta hai, taake price fluctuations ko smooth out kare aur ek clear trend direction provide kare. Traders aksar SMA ko overall market trend ka reference point ke taur par istemal karte hain, jahan price SMA ke upar hone par ek uptrend ko indicate kar sakta hai, jabki price SMA ke neeche hone par ek downtrend ko suggest karta hai.

- UpperBollinger Band: Upper band ko calculate karne ke liye, do standard deviations ko SMA mein add kiya jata hai. Standard deviation volatility ka ek statistical measure hai, jo indicate karta hai ke price average se kitna deviate hota hai. Do standard deviations ko SMA mein add karne se, upper band ek potential resistance zone ko represent karta hai. Jab price upper band ko touch karta hai ya usse exceed karta hai, ye asset overbought hone ka signal ho sakta hai, aur traders ko selling ya profits lene ka faisla karne ke liye majboor kar sakta hai.

- Lower Band Bollinger Band: Lower band ko calculate karne ke liye, do standard deviations ko SMA se subtract kiya jata hai. Upper band ki tarah, lower band ek potential support zone ko represent karta hai. Jab price lower band ko touch karta hai ya usse neeche gir jata hai, ye asset oversold hone ka signal ho sakta hai, aur traders ko buying ya long positions mein dakhil hone ka faisla karne ke liye majboor kar sakta hai.

- Bollinger Band Width: Bollinger Band Width ek technical indicator hai jo Bollinger Bands se derive hota hai. Ye upper aur lower bands ke darmiyan farq ko measure karta hai, jo market volatility mein wazehi faraham karta hai. Ek widening Bollinger Band Width increasing volatility ko suggest karta hai, jabki ek narrowing Band Width decreasing volatility aur ek potential price breakout ya breakdown ko indicate karta hai.

Common Trading Strategies

- Bollinger Bands Squeeze: Bollinger Bands Squeeze strategy ka istemal hota hai taake low volatility periods ko identify kiya ja sake followed by potential high volatility aur strong price movements. Traders bands ke contraction ka intezaar karte hain, indicating low volatility, aur breakout ka intezaar karte hain jab bands phir se expand hote hain. Breakout ka direction up ya down often confirm hota hai by other technical indicators or chart patterns.

- Bollinger Bands Breakout: Traders Bollinger Bands ka istemal kar sakte hain to trade breakouts above the upper band ya below the lower band. A breakout above the upper band bullish trend continuation ko signal kar sakta hai, jabki a breakout below the lower band bearish trend continuation ko indicate kar sakta hai. Traders often volume aur other technical indicators se confirmation ko dekhte hain to validate the breakout signal.

- Bollinger Bands Reversal: Bollinger Bands ka use kiya ja sakta hai to identify potential trend reversals. Jab price upper band ko touch karta hai ya exceed karta hai aur phir wapas band ke neeche retreat karta hai, ye potential reversal from overbought conditions ko signal kar sakta hai. Similarly, jab price lower band ko touch karta hai ya falls below it aur phir wapas rebound back above the band, ye potential reversal from oversold conditions ko indicate kar sakta hai.

- Bollinger Bands Divergence: Traders divergences dhoondhne ke liye kar sakte hain between price action aur Bollinger Bands, to identify potential trading opportunities. For example, agar price makes a higher high while the upper band makes a lower high bearish divergence, ye potential trend reversal to the downside ko signal kar sakta hai. Conversely, a lower low in price with a higher low in the lower band bullish divergence ye potential trend reversal to the upside ko indicate kar sakta hai.

Iske Traders ko consider karna chahiye fundamental analysis factors, market sentiment, economic events, and geopolitical developments when making trading decisions. Bollinger Bands market ki volatility aur price levels mein qeemti wazeh raahnumai faraham karte hain, lekin unhe ek mukammal trading strategy ka hissa ke taur par istemal karna chahiye jo kay mukhtalif nazariyon aur maloomat ke sources ko shaamil karta hai.

Bollinger Bands ek jaded aur taqatwar technical analysis tool hain jo traders ko market ki volatility ka tajziya karne mein madad faraham kar sakta hai, potential entry aur exit points ko pehchanna, aur overbought aur oversold conditions ka jaiza laga saktay hain. Bollinger Bands ke ahem components ko samajh kar, signals ka tawilat se faraham karne ke saath sahi trading strategies ko lagoo karne se, traders apne faisla kun process mein behtar hone mein madad milegi aur wo maaliyat ke markets mein behtarin nataij hasil kar saktay hain.

تبصرہ

Расширенный режим Обычный режим