Assalamu Alaikum Dosto!

Forex Trading Mein Locking Positions

Locking, ek hi trading account se single assets se mukhtalif ways par positions place kar trade karne ka tareeqa hai. Mojudah dor mein, kai sabit shuda aur kuch tanazzul wale tareeqay mojood hain jo tajaweez trading karne ke liye istemaal hotay hain. Position locking iss doosre - tanazzul wale - qisam mein shaamil kiya ja sakta hai. Is method ka istemaal karne wale trading systems aksar mukhalif reviews hasil karte hain aur technical aur fundamental analysis ke numaindon se mazboot tanqeed ka samna karte hain.

Magar phir bhi, yeh trading methodology bohot arse se mojood hai aur kuch traders ne is par bunyad rakhte hue munafa hasil karne ka tareeqa dhunda hai. Is case mein, locking basically do mukhalif orders ko hold karna hota hai.

Socho ke ek trader ne EUR/USD currency pair par 0.1 lot ka long position (Buy) khol liya hai. Jab EUR/USD currency pair par 0.1 lot ka short position (Sell) kholta hai, toh ek "lock" ban jata hai. Is structure ka naam kisi waja se nahi hai. Ye do positions locked hain. Ab, chahay jo bhi price ka movement ho, ek order ki nuksan ko doosre order ki proportional munafa se block kar diya jayega. Iski nazariye se, ye tab tak mumkin hai jab tak trader lock se bahar nahi nikalta - yaani ke mukhalif orders mein se aik ko band karne ya dono ko band karne ke liye kuch karta hai.

Zyadatar cases mein, locking Stop Loss ki tarah kaam karti hai. Lekin, Stop Loss order ko trigger hone par trading account ki equity aur balance mein tabdili ati hai (nuksan hone par ye dono kam hojati hain). Lekin, mukhalif order kholne ka asar sirf balance par hota hai, sirf doosra parameter kam hota hai.

Is tarah, trader koshish karta hai ke Stop Loss set karne ki bajaye lock bana kar nuksan se bach sake. Aam alfaz mein, locking ko aise define kiya ja sakta hai - ek mojood position ke khilaaf ek mukhalif order kholna, taake trading account par nuksan ko roka ja sake.

Ek haath mein toh yeh trader ke sath ek khuda mazak kar sakti hai. Kyunke agar price ka direction doosri baar galat taur par samjha jaye toh, trader ko teesre order ke sath choutha order, aur phir aisa hee hota jaega, aur isi tarah. Deposit "phula hua" hojaega. Orders ko control karna mushkil hojaega, aur brokerage company position rollover ke liye kuch maqool commission layegi. Is haalat mein, tamam funds ka nuksan (Margin call) lagbhag laazmi hai.

Is haalat mein, ek ahem musbat lamha hai trader ke liye. Aik taraf, stop order ko lock se badalne ki dhoka de kar, doosri taraf, trader is soorat mein zyada pur sukoon aur tawajju hota hai. Deposit abhi bhi mojood hai aur haalat ko sudharne ki koi koshish ho sakti hai. Aaj kal, locking technique kayi qisam ki hoti hai.

Volume aur khuli positions ki tadad ke mutabiq, inhein darust kiya jata hai:

- Full locking:– ye locking position locked position ke volume ke barabar hoti hai;

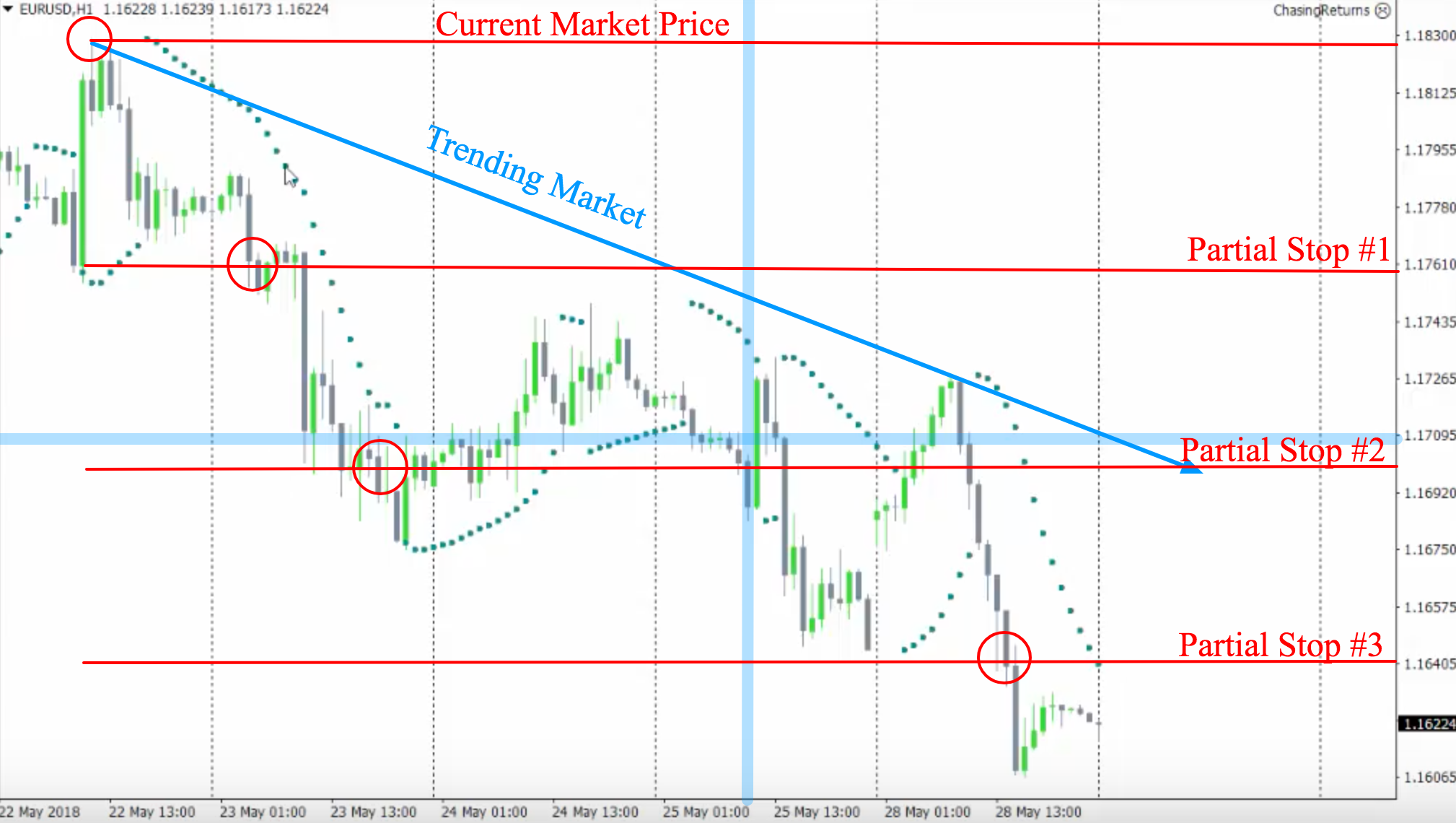

- Partial locking:– locking position ka volume locked position ke volume se kam hota hai;

- Triple locking:– locking order locked position ke volume ko barhata hai, ya locking orders ki tadad ek se zyada hoti hai.

Mukhalif position kholne ke waqt ki darkhaast ke mutabiq, inhein alag alag qisam ke mutabiq tajaweez di ja sakti hai:

- Negative:– ek loss ho raha hota hai jab locking order khula jata hai;

- Positive:– locking order khula jata hai jab locked position mein munafa ho raha hota hai;

- Zero:– locking order lagaya jata hai jab locked order break-even point par hota hai.

Chunne gaye trading strategy aur trading system ke mutabiq, alag alag locking tareeqay istemaal kiye ja sakte hain, ya toh akele ya saath mein.

Locking Strategy Ko Forex Trading Mein Kaise Apply Karein

Bohot saari locking par based trading strategies hain. Lekin har trader ko apni trading system banani parti hai, apni nafsiyati khasusiyat aur trading pasandidgiyon ke mutabiq. Chaliye forex trading mein positive locking ki sabse asaan trading strategy ko dekhte hain.

Trader kisi bhi trading pair ko chunta hai aur trend ke mutabiq market execution ke sath aik position kholta hai. "Main" position kholne ke baad, is zaroori hai ke woh same trading instrument par, price (aur is liye "main" order se) ke bohot qareeb ek mukhalif order pending execution ke sath rakhay.

Agar "main" order mein munafa hota hai, toh locking order ko Trailing Stop ke tor par istemal kia jata hai jab tak position zaroori munafa ke level par nahi le jata. Agar "main" order mein nuksan hota hai, toh pending locking order trigger hota hai, aur ek lock ban jata hai, aur "main" order ke nuksanat mehdood hojatay hain. Trader ab locking order ke sath kaam karna shuru karta hai.

Acha hoga ke jab locking trade mein munafa dikhai de, toh isko Trailing Stop ke sath bandh liya jaye. Price ka movement dubara trend par laut ke, aik naya "reverse" pending order diya jata hai, jo ke asal (main) trade ko hamrah sath chalata hai. Jab deposit ka break-even level pohanch jata hai, toh maamoolan maqami order aur naye lagaye jane wale pending order ke darmiyan fasla dheere dheere barhaya jata hai.

Jab munafa maqarar level tak pohanch jata hai, toh orders ko bandh diya jata hai. Yad rakha jaye ke upar bayan kiye gaye maqam ka hawala, waqaiye mein mukammalat ka idealized hai. Amal mein, lock lagane ke baad halat ke liye bohot se tanazzulat mojood hain.

Locking Position Se Exit Karna

Locking se bahir nikalne ke kai tareeqay hain. Is case mein muddat sirf trades ko bahir nikalne ki nahi hoti, balki unhe munafa ke sath band karne ki salahiyat bhi hoti hai. Chaliye sab se mashhoor tareeqon par nazar daalte hain:

- Agar price locked orders ke darmiyan hai, toh fundamental factors ka faida uthane ka mauka hota hai. Jab ahem khabarat aati hain, toh lock ke sarhad par mojood expected price movement ke rukh mein ek mazeed position kholi jati hai. Taqatwar price movement nuksan ko maat de sakti hai aur munafa banati hai;

- Jab price reversal point tak pohanchta hai, toh munafa wala trade band karain aur doosri order ko break-even hone ki koshish karen. Doosri order ko minimal munafa ke sath band karain ya Stop Loss set karen aur iski movement trade ke munafa ke mutabiq karen;

- Jab pending locking order trigger hota hai, toh iski price ko opening point par wapas anay ka intezar karen aur position ko band karain. Main position munafa banaaye rakhne den;

- Agar locking position ke rukh mein steady price movement mojood hai, toh is position ya iske orders ki tadad ko barhaayein. Aapko trade ko break-even hone ka intezaar karna chahiye aur orders ko band karne dena chahiye. Main position ko bhi band kar sakte hain aur locking positions ki munafa ka intezaar kar sakte hain;

- Jab price opening locus ki values par wapas laut ke, aur price movement is level ke aas paas consolidate hota hai, toh munafa wala position band kar dena chahiye. Agar price movement phir se munafa ke rukh mein hai, toh naye locking position ko kholen, lekin bohot kam volume ke sath. Warna, main order ko break-even hone ka intezaar karen;

- Agar price movement wapas asal rukh mein laut gaya hai, aur quotes locking order se kafi door chale gaye hain, iski kamzori ko kam karne ke liye position ko band karna zaroori hai.

Kia Loss Wali Trades ko Lock Karna Chaheye?

Locking apne trading mein istemaal karne walay mukhtalif categories ke traders hain.

Sab se barri group wo traders hain jo trading mein naye hain. Unka locking istemaal karne ka tareeqa bayan nahi hota, lekin isme trading deposit mein kami ko shorat se bachane ki anjaam shuda koshish, asaas market situations ko bardasht karne ka umeed, aur beshak lock ko munafa ke sath exit karne ka irada shamil hai. Zyadatar cases mein, is tarah se naye market mein aane wale trader ko faida nahi hota. Har bar jab trader lock se bahir nikalta hai, woh ek naye locking order ko locked position se door ek mazeed fasla par kholta hai. Natijatan, jald he jald, account ki equity itni kam hojati hai ke broker ki system position ko lock nahi karne deti. Aage ke price movement mein jo trader ke liye locked position ke rukh mein hota hai, woh trader ko deposit ke baghair chhod deta hai. Is case mein locking ka istemaal bayshak bekaar hota hai.

Doosri category wale traders jo locking positions ka istemaal karte hain, woh professional traders hain. Ye ek relatively choti group hai. Aam taur par, inka locking ko kisi well-developed trading system ke andar doosre trading tareeqon ke saath istemaal kia jata hai. Aise trading systems mein locking ko bahar nikalne ke liye kayi reserve tareeqe hote hain, trading instrument ke liye fundamental analysis hoti hai, aur locking ke liye expert advisers ka istemaal hota hai. Is case mein locking ka istemaal jayaz hai, kyun ke ye trading system ko zyada flexibility aur stability deta hai.

Locking In Forex Trading Ke Advantages aur Disadvantages

Locking, jaise koi bhi trader ke tool, iske apne faiday aur nuksanat hain. Is tareeqe ke Advantages mein shamil hain:

- Psychology Comfort Melta Hai: Jab ek position stop order ke sath band hoti hai, toh deposit ki qeemat kam hoti hai. Kuch nakamiyat wali trades ki soorat mein, deposit aankhon ke saamne ghat jati hai. Is halat mein, trader apni sab se zyada zor-o-shor aur pareshani se guzar raha hota hai. Locking trader ko dobara mauqa deta hai. Nafsiyati kamzori ke bawajood, trading account ki haalat lock se bahir nikalne tak badal nahi ti. Metatrader 4 ke report mein sirf nafa deh trades hone ki wajah se investor ko be shak khushi hoti hai;

- Loss ki Tadad kam Karna. Ye koi raaz nahi hai ke financial markets mein aise moqaat aate hain jab price movements kisi bhi logic ke mutabiq nahi hote. Market noise ki surat mein, Stop Loss trigger hone ki aur bohot se nakamiyat wale positions ane ki zyada sambhavna hoti hai. Locking, trading mein nuksanat ko barhne se bachane ka ek tareeqa hai;

- Decision Making Mein Temporary Advantage: Locking position rakhne se, ek taraf toh aage ke nuksanat ki rok hoti hai, or dosri taraf position khuli rehti hai, jisse investor ko aage ke amal par sochne ka mouqa milta hai.

Lekin locking trading k kuch Disadvantages bhi hain:

- Lock se Exit Hone Mein Mushkil. Shuruwat mein aasani se khuli positions lazmi tor par unko band karne mein mushkilat paida karte hain. Aam taur par, sirf market ko analyse karne wala trader he lock se munafa ke sath bahir nikal sakta hai. Aise traders khuli positions ko analyse ke mutabiq bhi kholte hain, jo position ko band karne ke liye acha mahaul banate hain. Aik beginner trader ke liye lock se bahir nikalna bohot mushkil ho sakta hai;

- Deposit ka Hissa Band Hona. Ye point un traders ke liye khaas eham hai jo apne deposits mein bohot paisa nahi rakhte hain. Walaayat ke bawajood ke deposit quantity lock ke doran kam nahi hoti, nuksanat ko rokne ki koshish mein equity quantity kam hoti hai aur broker ek moqa par trader ko naye positions, including locking positions, khulne nahi deta;

- Locking Volume mein Izafah ka Risk. Ye locking Martingale ki tarah hota hai. Nuksanat ko dhakne ki umeed mein, trader apni main position se zyada locking position khol sakta hai. Natijatan, lock mein orders ki quantity barh jati hai aur aakhir mein trader ka deposit kho jata hai.

- Broker ki Taraf se Order ki Service ka Izafah. Har order ke khulne par, trader broker ko spread ada karta hai. Agar orders nuksan mein band hote hain, toh aise kharch ki miqdaar maamoolan eham ho sakti hai. Position ko lock mein rakhna kabhi din ke liye nahi balki kabhi hafton tak bhi ho sakta hai. Agle trading dour ke liye open position ko transfer ke liye bhi ek fee, yaani swap hoti hai. Agar position ko lamba arsa tak rakha jata hai, toh swap maqdar mein izafah ho sakta hai.

- High Mental Stress. Locking ka aik faida nafsiyati sukoon ka haalat hai. Lekin iska ek dosra pehlu bhi hai. Position ko lock karke, trader thode arsay ke liye masle se door ho jata hai. Lekin lock se bahir nikalne mein mushkilat aur local volumes ko barhane mein der ya pichhdaav aane par usko apne aap ko feel hoga. Trader thak jata hai aur mehsoos karta hai ke woh masla jo lock se bahir nikalne ki koshish se taal gaya tha, woh dobara aur usse bhi zyada taiz ho gaya hai. Aise halat mein, ek tajaweez shuda investor ko mayus kar sakti hai.

Conclusion

Locking ki polity ka mutalaa karna mushkil hai, lekin jab ise ek experienced trader apne achaar mein istemaal karta hai toh iska kuch asar hota hai.

Partial ya triple locking trading system ki flexibility ko barha sakta hai, jo ke stop orders istemaal karte waqt hamesha mumkin nahi hoti.

Kuch nafsiyati traders ke liye, locking nuksanat ko rokne ka acha ikhtiyar ho sakta hai, agar unko is tareeqe ki tabiyat ka pata hai.

Magar, locking ke istemaal ka khatra newbie trader ke liye hai ke woh apna deposit bar bar kho sakte hain.

تبصرہ

Расширенный режим Обычный режим