Candlestick Pattern In Forex

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Candlestick Pattern In Forex -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

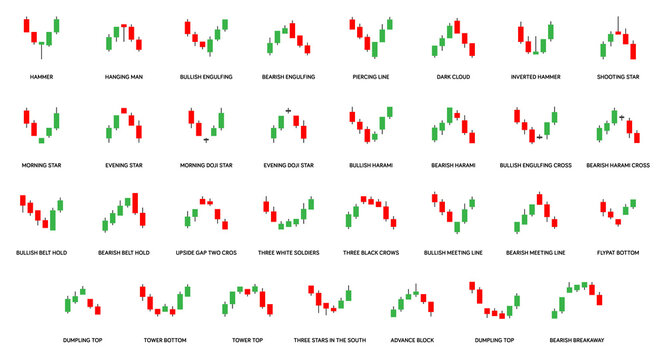

Candlestick patterns forex mein ek mashhoor technical analysis tool hain jo traders istemal karte hain taakay woh market ke reversals, continuations aur trend formations ko pehchanein. Ye patterns price movements ko visual form mein zahir kerte hain jahan aam taur par ek rectangle candle hoti hai jiske oopar aur neeche ek patli vertical line hoti hai, jise wick ya shadow kehte hain. Candlestick ki body us currency pair ke opening aur closing prices ko darshaati hai jo analyze kiye jaa rahe hote hain. In patterns ko study karke traders market ki sentiment samajhna aur informed trading decisions lena chahte hain. Candlestick patterns 18th century mein Japan mein shuru hue aur rice traders ne inko analyze karne ke liye develop kiya. Ye patterns 1990s mein pashchimi duniya mein mashhoor hue aur tab se ye forex jaise alag alag financial markets mein technical analysis ka ahem hissa ban gaye hain. Doji Doji pattern tab banta hai jab candle ki opening price aur closing price ekdum barabar ya bohot qareeb hoti hain. Doji pattern market mein indecision ko darshaata hai, jahan buyers aur sellers ke beech equilibrium bana rehta hai. Is pattern ki tafsir location aur surrounding price action par depend karti hai. Agar doji uptrend ke baad aata hai, to yeh bearish reversal ka sanket ho sakta hai. Lekin agar doji downtrend ke baad aata hai, toh iska bullish reversal potential ho sakta hai. Hammer aur Hanging Man Hammer aur Hanging Man patterns ko single candlestick patterns kaha jata hai. Hammer pattern ek downtrend ke baad aata hai. Is pattern mein candle ki body neeche wick ke beech mein hoti hai aur upper wick lambi hoti hai. Hammer bullish reversal signal ho sakta hai, jahan price neeche girne ke baad wapas upar ja sakta hai. Hanging Man pattern ek uptrend ke baad aata hai. Is pattern mein candle ki body upar wick ke beech hoti hai aur lower wick lambi hoti hai. Hanging Man bearish reversal signal ho sakta hai, jahan price upar jaane ke baad neeche gir sakta hai. Engulfing Pattern Engulfing pattern do candlesticks se banta hai. Bullish engulfing pattern ek downtrend ke baad aata hai. Is pattern mein pehli candle bearish hoti hai, matlab uski closing price opening price se neeche hoti hai. Dusri candle, jise engulfing candle kehte hain, pehli candle ki body ko poori tarah engulf karti hai aur bullish hoti hai. Yeh pattern bullish reversal ka indication hai. Bearish engulfing pattern ek uptrend ke baad aata hai. Pehli candle bullish hoti hai aur dusri candle pehli candle ki body ko engulf karti hai. Is pattern ka matlab hai ki market bearish direction mein move kar sakta hai aur bearish reversal ka possibility hai. Candlestick patterns forex traders ko price action ko samajhne aur market trends ko predict karne mein madad karte hain. Lekin sirf candlestick patterns par bharosa karke trading karna sahi nahi hai. Iske saath sahi risk management aur dusre technical indicators ka istemal karna bhi zaroori hai. Traders ko candlestick patterns ko samajhne ke liye practice aur experience ki zaroorat hoti hai.

Doji Doji pattern tab banta hai jab candle ki opening price aur closing price ekdum barabar ya bohot qareeb hoti hain. Doji pattern market mein indecision ko darshaata hai, jahan buyers aur sellers ke beech equilibrium bana rehta hai. Is pattern ki tafsir location aur surrounding price action par depend karti hai. Agar doji uptrend ke baad aata hai, to yeh bearish reversal ka sanket ho sakta hai. Lekin agar doji downtrend ke baad aata hai, toh iska bullish reversal potential ho sakta hai. Hammer aur Hanging Man Hammer aur Hanging Man patterns ko single candlestick patterns kaha jata hai. Hammer pattern ek downtrend ke baad aata hai. Is pattern mein candle ki body neeche wick ke beech mein hoti hai aur upper wick lambi hoti hai. Hammer bullish reversal signal ho sakta hai, jahan price neeche girne ke baad wapas upar ja sakta hai. Hanging Man pattern ek uptrend ke baad aata hai. Is pattern mein candle ki body upar wick ke beech hoti hai aur lower wick lambi hoti hai. Hanging Man bearish reversal signal ho sakta hai, jahan price upar jaane ke baad neeche gir sakta hai. Engulfing Pattern Engulfing pattern do candlesticks se banta hai. Bullish engulfing pattern ek downtrend ke baad aata hai. Is pattern mein pehli candle bearish hoti hai, matlab uski closing price opening price se neeche hoti hai. Dusri candle, jise engulfing candle kehte hain, pehli candle ki body ko poori tarah engulf karti hai aur bullish hoti hai. Yeh pattern bullish reversal ka indication hai. Bearish engulfing pattern ek uptrend ke baad aata hai. Pehli candle bullish hoti hai aur dusri candle pehli candle ki body ko engulf karti hai. Is pattern ka matlab hai ki market bearish direction mein move kar sakta hai aur bearish reversal ka possibility hai. Candlestick patterns forex traders ko price action ko samajhne aur market trends ko predict karne mein madad karte hain. Lekin sirf candlestick patterns par bharosa karke trading karna sahi nahi hai. Iske saath sahi risk management aur dusre technical indicators ka istemal karna bhi zaroori hai. Traders ko candlestick patterns ko samajhne ke liye practice aur experience ki zaroorat hoti hai.  Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 08:47 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим