"Forex Long-Range Wave Analysis Charting the Future of Forex" ka tasawwur aik mukammal rehnuma ya tajruba ho sakta hai jis mein foreign exchange (forex) market mein lambi dora (long-term) trends ka tajziya aur strategy shamil ho. Halankeh yeh aik khayali kitab ka title lagta hai, lekin mein aapko yeh bata sakta hoon ke aisey guide mein kya kya shaamil ho sakta hai.

Mukhtasir tor par, "Forex Long-Range Wave Analysis Charting the Future of Forex" naam ka guide lambi dora trends ko analyze karne ke liye aik mukammal framework faraham kar sakta hai, jismein technical analysis, bunyadi factors, risk management, aur trading ki psyhological pehlu shaamil hoti hai.

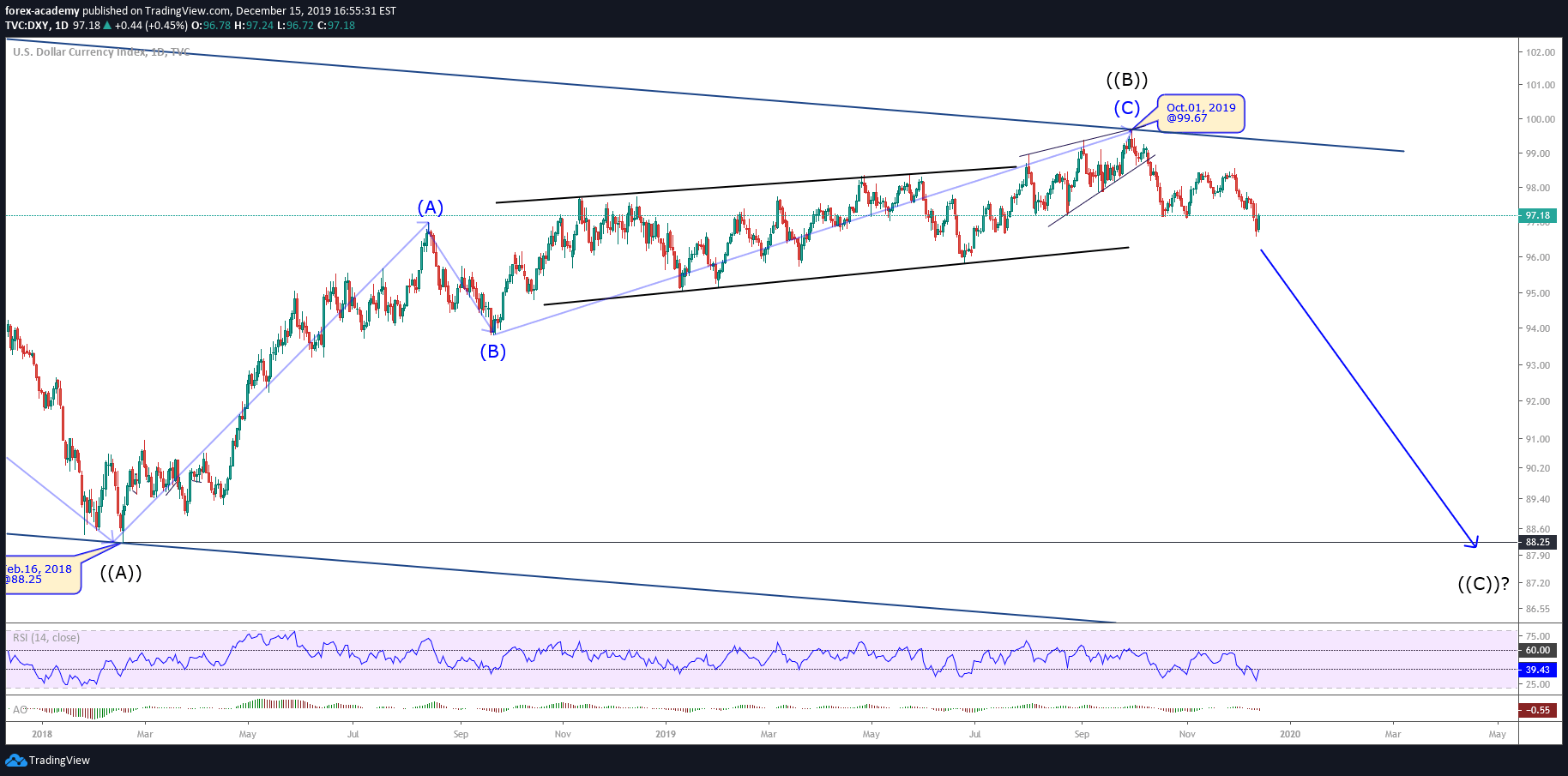

- Lehar (Wave) Tahlil: Yeh shayad Elliott Wave Theory ko refer karta hai, jo ke technical analysis ka aik tareeqa hai jo market data mein dohraata patterns (waves) ko pehchan kar future price movements ko predict karne ki koshish karta hai. Yeh theory yeh samjhati hai ke markets optimism (bullish waves) aur pessimism (bearish waves) ke cycles mein chalte hain.

- Lambi Dora Nazriya (Long-Range Perspective): Chhoti dora (short-term) trading strategies ke mukabil, lambi dora analysis weeks, months, ya saaloon ke trends ko dekhta hai. Yeh bada manzar dekhne ki koshish karta hai takay market ke dynamics ko samjha ja sake aur woh trends pehchan sakte hain jo khaas faida de sakte hain.

- Charting Techniques: Guide various charting techniques aur tools ko cover kar sakta hai jo forex analysis mein istemaal hotey hain, jaise ke candlestick patterns, trendlines, support aur resistance levels, aur technical indicators jaise ke moving averages, MACD (Moving Average Convergence Divergence), aur RSI (Relative Strength Index).

- Bunyadi Fators (Fundamental Factors): Lambi dora forex analysis mein currency values ko influence karne wale bunyadi factors ko bhi mad e nazar rakha jata hai, jaise ke economic indicators (GDP growth, inflation, employment), central bank policies, geopolitical events, aur market sentiment.

- Risk Management: Koi bhi moassar trading strategy, khaaskar lambi dora analysis ke liye, risk management par zor deta hai. Yeh include karta hai stop-loss orders set karna takay potential nuqsaan ko limit kya ja sake, position sizing takay risk exposure ko manage kiya ja sake, aur alag alag currency pairs mein diversification.

- Trading Ki Psyhology: Trading ke psyhological pehluon ko samajhna lambi dora kamyabi ke liye ahem hai. Ismein shamil hai emotions jaise ke greed aur fear ko control karna, trading plan ko follow karne mein discipline, aur market volatility ya consolidation ke doran sabr karna.

- Adaptability aur Continual Learning: Forex market hamesha tabdeel hoti hai, isliye traders ko apni strategies ko mutabiq karna hota hai. Guide zaroorat hai ke continuous learning, market developments par updated rehna, aur feedback aur experience ke mutabiq trading techniques ko refine karna.

Mukhtasir tor par, "Forex Long-Range Wave Analysis Charting the Future of Forex" naam ka guide lambi dora trends ko analyze karne ke liye aik mukammal framework faraham kar sakta hai, jismein technical analysis, bunyadi factors, risk management, aur trading ki psyhological pehlu shaamil hoti hai.

تبصرہ

Расширенный режим Обычный режим