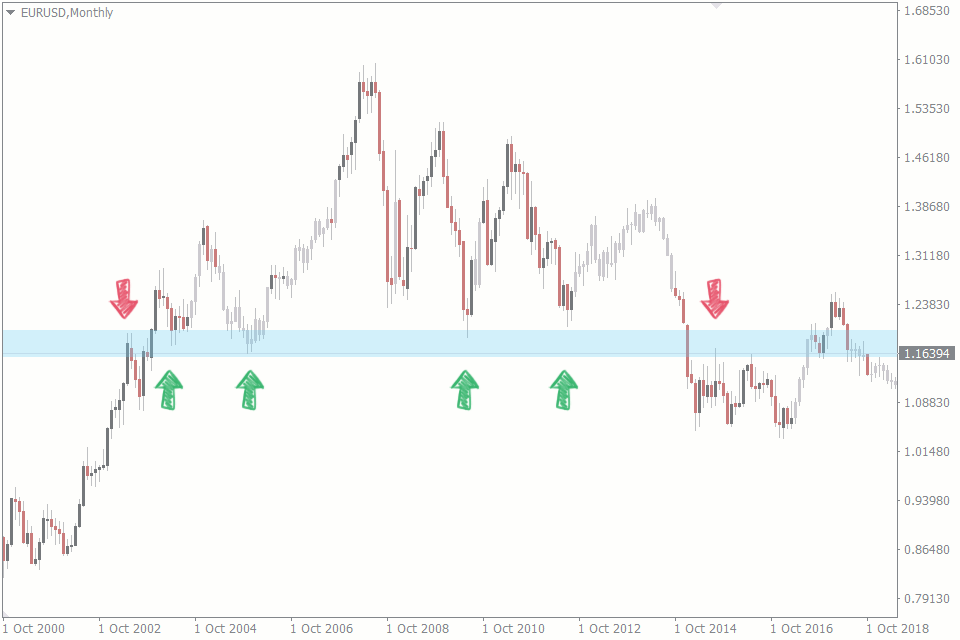

"Forex Trading from Levels" ek tajwezati program hai jo traders ko market ke mukhtalif darajat par trading karna aur levels ka istemal karne ka tareeqa sikhata hai. Is program mein traders ko market ke mukhtalif levels jaise support aur resistance, Fibonacci retracement levels, pivot points, aur trend lines ke bare mein samjhaya jata hai. Traders ko yeh tajwezat faraham kiye jate hain ke kaise in levels ka istemal karke trading strategies tay ki ja sakti hain aur kis tarah se in levels se entry aur exit points tay kiye ja sakte hain. Is tareeqe se, traders ko market ke mukhtalif phases aur price action ko samajhne mein madad milti hai aur unhein behtar trading decisions lene mein sahayata milti hai.

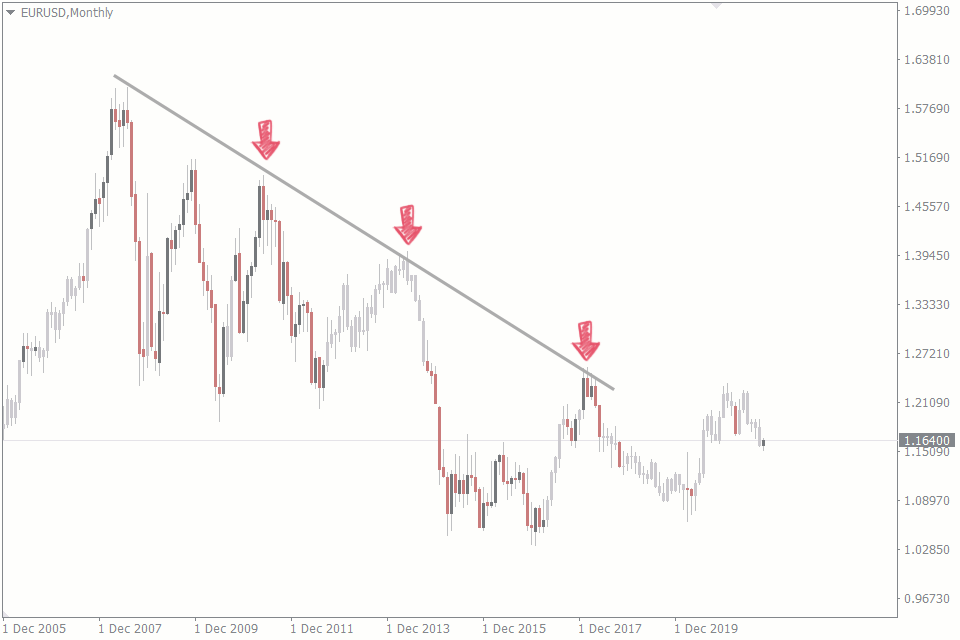

"Mastering Forex Market Dynamics" ek tajwezati program hai jo traders ko forex market ke dynamics ko samajhne aur un par hukumat hasil karne mein madad deta hai. Is program mein traders ko market ke mukhtalif factors, jaise supply aur demand, economic indicators, geopolitical events, aur market sentiment ke bare mein tafseel se samjhaya jata hai. Iske saath hi, traders ko price action aur chart patterns ka istemal karke market ki gati aur trends ko samajhne ka tareeqa bhi sikhaya jata hai. Is tareeqe se, traders ko market ke mukhtalif phases aur movements ko samajhne mein madad milti hai aur unhein behtar trading decisions lene mein sahayata milti hai.

"Mastering Forex Market Dynamics" ek tajwezati program hai jo traders ko forex market ke dynamics ko samajhne aur un par hukumat hasil karne mein madad deta hai. Is program mein traders ko market ke mukhtalif factors, jaise supply aur demand, economic indicators, geopolitical events, aur market sentiment ke bare mein tafseel se samjhaya jata hai. Iske saath hi, traders ko price action aur chart patterns ka istemal karke market ki gati aur trends ko samajhne ka tareeqa bhi sikhaya jata hai. Is tareeqe se, traders ko market ke mukhtalif phases aur movements ko samajhne mein madad milti hai aur unhein behtar trading decisions lene mein sahayata milti hai.

تبصرہ

Расширенный режим Обычный режим