PAMM account in forex trading

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

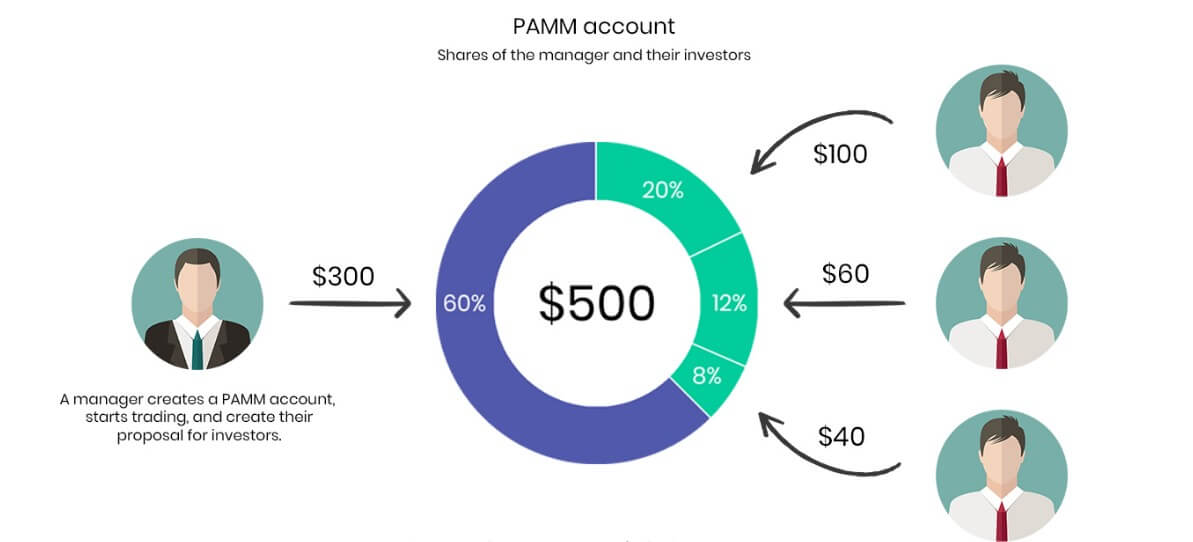

what is PAMM account PAMM account percentage allocation management module bhe kaha jata hey or es ko percentage allocation money management bhe kaha jata hey jama shodah raqam forex trading kay ley aik shape hote hey investor ko apni raqam matloba tor par apni pasand ke ratio qualified trader ko mony management mokhtas karne parte hey yeh trader or manager profit hasell karnay kay ley apnay maksad kay sath investment kartay hein or es tarah jama shodah rakam ka estamal kartay hein or kai forex trading ko management kar saktay hein PAMM kay account kay set up mein shamel forex broker/ forex brokerage firm trader money manager investor investor forex trading say profit hasell karnay mein dilchaspe rakhtay hein laken on kay pass trading activity kay ley time nahe hota hey ya phir forex trading kay ley knowledge nahi hota hey professional trader money management karen gay jo keh aik individual trader investor kay sath dosray logon kay paisay trade or investment karnay ke skil rakhtay hein forex trading kay marcs or mathew ko dosray trader money management kay tor par sign par kartay hein investr bhe limited power of attorney kay sath sign up karta hein aik signed agreement hota hey risk laynay par raze hotay hein apna investment apnay choose kardah manager ko day daytay hein jo jama shodah rakam ko apni trading andaz mein estamal kartay hein or forex trader es ko trading kay ley estamal karay ga woh yeh batata hey keh manager es service kay ley kitni raqam paish kar sakta hey investor money management ko kaisay estamal kartay hein Brokerage firm or investor news ko choose kar kay kai tareekay paish key jatay hein bayshamol tafsele CVs qualification or return kay lahaz say maze ke performance monazam raqam ke raqam , investor ke tadad or apnay trader ke money management kay baray mein positive or negative kay jaizay waghaira es kay elawah bahar ke darja bande kay nazam majod hotay hein nechay aik PAMM accont ke ration system deya geya hey PAMM account afrad kay ley forex trading kay ley apnay management ko chonanay or apnay manager ko select karnay kay ley aik simple preshane ka treka hota hey investor kam say kam shamoleyat say faida hasel kartay hein tahum money manager ke preshani say pak tareka hota hey en accont kay sath investor kam say kam shamoleyat profit say faida hasel kartay hein tahm money manager ke performance ke base par PAMM account par loss kay risk bhe hotay hein or apna matloba salehat or risk say bachnay kay faiday bhe hotay hein afrad ko PAMM account or broker or money manager ay intakhab mein mostaade say kam laytay hein

bhali kay badlay bhali

bhali kay badlay bhali

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Forex trading mein PAMM (Percent Allocation Management Module) account ek popular investment vehicle hai, jo kay traders aur investors kay darmiyan ka aik contract hai. PAMM account mein, traders apni trading strategies ko share kar kay investors ko apni trades mein invest karne ka mouqa detay hain. Is kay sath hi, investors ko profit ki aik hissa milta hai, jo kay un kay investment amount kay hisaab say hota hai. PAMM account aik aisi platform hai jahan traders aur investors ek dusre se interact karte hain aur trading ki performance ke hisaab se profits share karte hain. Jab koi trader PAMM account ke zariye trading karta hai, to wo apni trades aur portfolio ko public view mein rakhta hai. Investors PAMM account mein invest karte hain aur unki investment amount trader ke trades aur portfolio mein allocate ki jati hai. PAMM account ke zariye investors ki investments ka distribution ek fix percentage ke hisaab se hota hai, jise trader khud fix karta hai. Agar trader PAMM account mein successful trading kar raha hai to unke profits ko investors ke investments ke hisaab se distribute kiya jata hai, jabki losses bhi investors ke investments ke hisaab se divide kiye jate hain. PAMM account mein investor ke paas complete control hota hai apne investments ko track karne ke liye. Investor apne PAMM account ko manage kar sakta hai, apne funds ko deposit aur withdraw kar sakta hai, aur apni investment performance ko monitor kar sakta hai. PAMM account ka concept: PAMM account mein, trader apni trading strategies ko share karta hai aur investor apni investment kay sath is mein invest karta hai. Is mein trader apni trades ko execute karta hai aur profit ya loss apni trades kay result kay hisaab say distribute karta hai. Is kay sath hi, profit sharing kay taur par, trader ko bhi apni trading strategies kay hisaab say aik hissa milta hai. PAMM account kay advantages:

PAMM account ka concept: PAMM account mein, trader apni trading strategies ko share karta hai aur investor apni investment kay sath is mein invest karta hai. Is mein trader apni trades ko execute karta hai aur profit ya loss apni trades kay result kay hisaab say distribute karta hai. Is kay sath hi, profit sharing kay taur par, trader ko bhi apni trading strategies kay hisaab say aik hissa milta hai. PAMM account kay advantages:- Passive income source: PAMM account say investors ko passive income ki aik achi source milti hai, kyunki yahan kay traders apni trading skills ko share kartay hain aur investors un kay trades mein invest kartay hain.

- Professional traders kay kaam ka dekhaal: PAMM account mein investors ko professional traders kay kaam ka dekhaal milti hai. Yahan par traders kay track record, trading strategies, performance kay sath sath risk management techniques kay bare mein bhi information milta hai.

- Diversification: PAMM account kay zariye, investors apnay portfolio ko diversify kar saktay hain aur apni investment ko different trading strategies mein invest kar kay apnay risk ko spread kar saktay hain.

- Low minimum investment: PAMM account mein, investors ko minimum investment amount kay zariye bhi invest karnay ka mouqa milta hai. Is kay sath hi, investors ko trading kay experts kay kaam ka dekhaal bhi milta hai.

- Risk of loss: Jaisa kay forex trading mein hota hai, PAMM account mein bhi investors ko risk of loss ka samna karna parta hai. Traders ki trades kay performance aur market kay fluctuations say investors kay investment amount kaafi affect ho sakta hai.

- Dependence on trader's skills: PAMM account mein investors ka profit aur loss traders kay trading skills kay hisaab say hota hai. Agar trader ki performance acchi nahin hai, to investors kay investment kay sath loss ka risk bhi barh jata hai.

- Limited control: PAMM account mein, investors ki control kay limits hotay hain. Is kay sath hi, traders apni trading strategies kay hisaab say trades ko execute kartay hain, jis say investors ko limited control milta hai.

PAMM account kay liye important tips:

PAMM account kay liye important tips:- Research: PAMM account mein invest karnay say pehlay, investors ko traders kay track record, performance aur risk management techniques kay bare mein thorough research karna chahiye.

- Diversification: PAMM account mein invest karnay say pehlay, investors ko apnay portfolio ko diversify karne kay liye different traders aur different trading strategies mein invest karna chahiye.

- Risk management: PAMM account mein invest karnay say pehlay, investors ko apnay risk management strategies kay hisaab say apni investment kay size ko decide karna chahiye. Is kay sath hi, stop-loss aur take-profit levels ko set karna bhi important hai.

- Communication: PAMM account mein, investors ko apnay traders kay sath regular communication maintain karna chahiye, takay unko traders ki trades aur performance kay bare mein regular updates mil saken.

- Select reputable brokers: PAMM account mein invest karnay say pehlay, investors ko reputable brokers ko select karna chahiye, jo kay reliable trading platform aur accha customer support provide karte hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#4 Collapse

Pamm Account Forex Trading

1. Introduction:- Forex mein trading karne ka ek aham tareeqa PAMM accounts hain.

- Ye accounts investors ke liye mufeed hotay hain jo forex trading mein shamil hona chahte hain lekin trading ke technical aspects ko nahi samajhte.

2. PAMM ka Matlab:- PAMM ka matlab hai "Percentage Allocation Management Module."

- Ye ek aise system hai jisme ek trader apne trading account ko multiple investors ke saath share karta hai.

3. Kaise Kaam Karta Hai:- Ek trader PAMM account kholta hai aur usme funds invest karta hai.

- Fir, wo apne trading decisions ke through funds ko manage karta hai.

- Investors apna investment PAMM account mein daal kar trader ki trading activities mein participate karte hain.

- Har investor ka share trader ki performance ke hisaab se badalta hai.

4. Benefits for Investors:- Investors ko trading ke liye kisi bhi tarah ki technical knowledge ki zarurat nahi hoti.

- Unhe apne funds ko professional trader ke through manage karwane ka mauqa milta hai.

- Risks ko spread karna aasan ho jata hai kyunki funds alag-alag traders ke beech taqseem kiye jate hain.

5. Benefits for Traders:- Traders ko apne trading skills ko showcase karne ka mauqa milta hai.

- Unhe additional income generate karne ka mauqa milta hai investors ke through.

- PAMM accounts ke zariye unke liye funds manage karna asaan ho jata hai.

6. Risks Involved:- Jaise har investment mein, PAMM accounts mein bhi kuch risk hote hain.

- Agar trader ki performance achhi nahi hai, to investors ko nuksan ho sakta hai.

- Volatile market conditions mein, losses hone ka khatra zyada hota hai.

7. Kaise Shuru Karein:- PAMM account shuru karne ke liye kisi bhi reputed forex broker se contact karein.

- Account opening process ko samajhne ke liye broker ki website par available resources ka istemal karein.

- Account open karne ke baad, apne investment ko carefully allocate karein aur trader ko chunein jiska performance consistent ho.

8. Best Practices:- PAMM account choose karte waqt trader ki performance, track record, aur risk management capabilities ko dhyan mein rakhein.

- Apna investment spread karein multiple traders ke beech taaki risk kam ho.

- Regularly apne investments ki performance ko monitor karein aur zarurat padne par adjustments karein.

9. Conclusion:- PAMM accounts forex trading ke liye ek effective aur accessible tareeqa hain.

- Investors ko professional traders ke through apne funds ko manage karwane ka mauqa milta hai, jabki traders ko additional income generate karne ka mauqa milta hai.

- Zaruri hai ki investors aur traders apne decisions ko carefully weigh karein aur risks ko samajh kar hi invest karein.

-

#5 Collapse

PAMM ACCOUNT EXPLAIN

PAMM (Percentage Allocation Management Module) account forex trading mein ek innovative aur effective investment solution hai, jo investors aur experienced traders ke liye mutual benefits provide karta hai. PAMM accounts ke through multiple investors apne funds ko ek experienced trader ya money manager ke control mein dete hain, jo collective capital ko manage karke trading activities perform karta hai. Yeh system un investors ke liye specially beneficial hai jo forex market ke complexities ko samajhne mein difficulty mehsoos karte hain ya apna time aur effort directly trading karne mein invest nahi karna chahte. PAMM account structure investors ko passive income generate karne ka mauka deta hai, jabke professional traders apne expertise ke zariye higher returns achieve kar sakte hain.

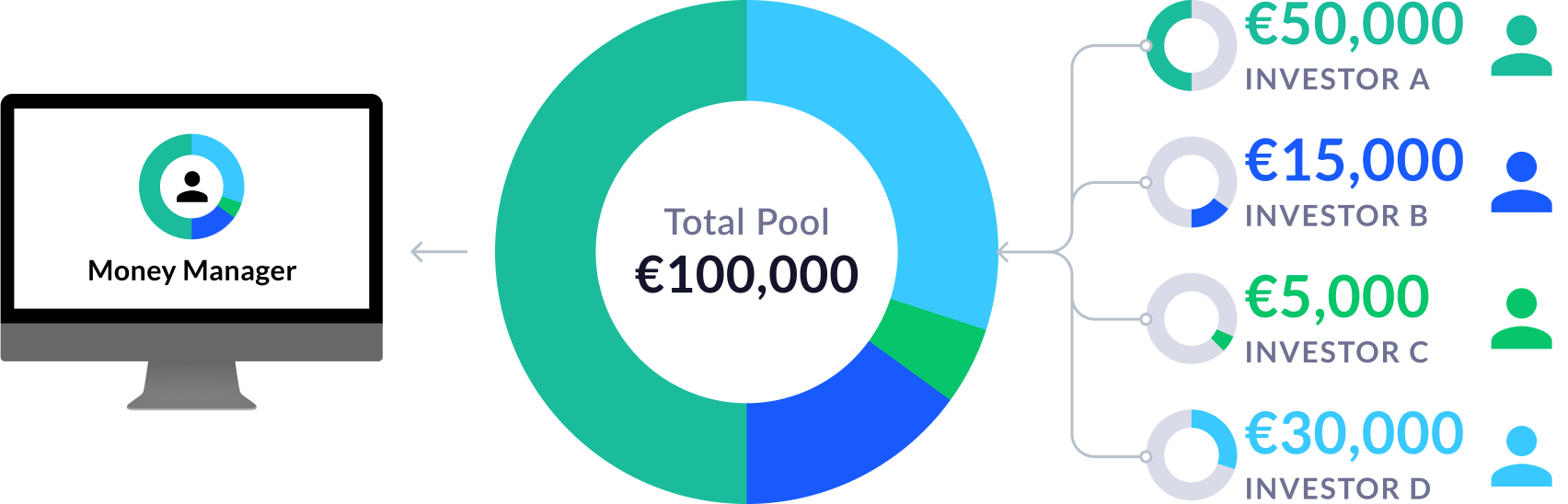

PAMM account ka setup aur functioning bohot systematic hota hai. Investors apne capital ko ek specific PAMM account mein invest karte hain, jahan yeh capital ek pool ke taur par aggregate hota hai. Money manager, jo ke ek experienced trader hota hai, is aggregated capital ko use karke forex market mein trades execute karta hai. Har investor ka profit ya loss uske invested capital ke proportion ke mutabiq distribute hota hai. PAMM account mein transparency aur trust ensure karne ke liye brokerage firms ki taraf se monitoring aur reporting mechanisms implement kiye jate hain. Yeh mechanisms investors ko real-time performance reports aur account status provide karte hain, taake wo apne investments ko effectively track kar sakein.

PAMM accounts ke kuch significant advantages hain. Sabse pehla advantage diversification hai. Investors apna capital multiple PAMM accounts mein distribute kar sakte hain, jisse risk ko diversify karne aur overall portfolio performance ko stabilize karne mein madad milti hai. Doosra advantage professional management ka hai. PAMM accounts ko experienced aur skilled traders manage karte hain, jo ke market trends aur trading strategies ko better samajhte hain. Yeh professionals advanced analytical tools aur techniques ka istemal karke trading decisions lete hain, jo ke typically higher returns aur reduced risk ka sabab bante hain. Teesra advantage transparency aur accountability ka hai. PAMM accounts mein saari trading activities aur fund movements ko accurately record kiya jata hai, jisse investors ko complete visibility milti hai aur wo confidently invest kar sakte hain.

Lekin, PAMM accounts ke sath kuch risks bhi associated hain, jinke baare mein aware hona zaroori hai. Sabse pehla risk market volatility ka hai. Forex market bohot volatile hota hai aur yeh volatility significant losses ka sabab ban sakti hai. Doosra risk money manager ke performance ka hai. Agar money manager ki trading strategies successful nahi hoti, to investors ko losses face karne pad sakte hain. Teesra risk brokerage firm ke credibility ka hai. PAMM accounts ko manage karne wali brokerage firm ka reliable aur regulated hona bohot important hai, taake fraud aur mismanagement ke risks ko mitigate kiya ja sake. Isliye, PAMM accounts mein invest karte waqt thorough research aur due diligence zaroori hai. Investors ko brokerage firm, money manager aur overall market conditions ko achi tarah evaluate karna chahiye taake informed investment decisions le sakein aur apne capital ko secure rakh sakein.

- Mentions 0

-

سا0 like

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

PAMM ACCOUNT EXPLAIN

PAMM (Percentage Allocation Management Module) account forex trading mein ek innovative aur effective investment solution hai, jo investors aur experienced traders ke liye mutual benefits provide karta hai. PAMM accounts ke through multiple investors apne funds ko ek experienced trader ya money manager ke control mein dete hain, jo collective capital ko manage karke trading activities perform karta hai. Yeh system un investors ke liye specially beneficial hai jo forex market ke complexities ko samajhne mein difficulty mehsoos karte hain ya apna time aur effort directly trading karne mein invest nahi karna chahte. PAMM account structure investors ko passive income generate karne ka mauka deta hai, jabke professional traders apne expertise ke zariye higher returns achieve kar sakte hain.

PAMM account ka setup aur functioning bohot systematic hota hai. Investors apne capital ko ek specific PAMM account mein invest karte hain, jahan yeh capital ek pool ke taur par aggregate hota hai. Money manager, jo ke ek experienced trader hota hai, is aggregated capital ko use karke forex market mein trades execute karta hai. Har investor ka profit ya loss uske invested capital ke proportion ke mutabiq distribute hota hai. PAMM account mein transparency aur trust ensure karne ke liye brokerage firms ki taraf se monitoring aur reporting mechanisms implement kiye jate hain. Yeh mechanisms investors ko real-time performance reports aur account status provide karte hain, taake wo apne investments ko effectively track kar sakein.

PAMM accounts ke kuch significant advantages hain. Sabse pehla advantage diversification hai. Investors apna capital multiple PAMM accounts mein distribute kar sakte hain, jisse risk ko diversify karne aur overall portfolio performance ko stabilize karne mein madad milti hai. Doosra advantage professional management ka hai. PAMM accounts ko experienced aur skilled traders manage karte hain, jo ke market trends aur trading strategies ko better samajhte hain. Yeh professionals advanced analytical tools aur techniques ka istemal karke trading decisions lete hain, jo ke typically higher returns aur reduced risk ka sabab bante hain. Teesra advantage transparency aur accountability ka hai. PAMM accounts mein saari trading activities aur fund movements ko accurately record kiya jata hai, jisse investors ko complete visibility milti hai aur wo confidently invest kar sakte hain.

Lekin, PAMM accounts ke sath kuch risks bhi associated hain, jinke baare mein aware hona zaroori hai. Sabse pehla risk market volatility ka hai. Forex market bohot volatile hota hai aur yeh volatility significant losses ka sabab ban sakti hai. Doosra risk money manager ke performance ka hai. Agar money manager ki trading strategies successful nahi hoti, to investors ko losses face karne pad sakte hain. Teesra risk brokerage firm ke credibility ka hai. PAMM accounts ko manage karne wali brokerage firm ka reliable aur regulated hona bohot important hai, taake fraud aur mismanagement ke risks ko mitigate kiya ja sake. Isliye, PAMM accounts mein invest karte waqt thorough research aur due diligence zaroori hai. Investors ko brokerage firm, money manager aur overall market conditions ko achi tarah evaluate karna chahiye taake informed investment decisions le sakein aur apne capital ko secure rakh sakein.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#7 Collapse

PAMM ACCOUNT EXPLAIN

PAMM (Percentage Allocation Management Module) account forex trading mein ek innovative aur effective investment solution hai, jo investors aur experienced traders ke liye mutual benefits provide karta hai. PAMM accounts ke through multiple investors apne funds ko ek experienced trader ya money manager ke control mein dete hain, jo collective capital ko manage karke trading activities perform karta hai. Yeh system un investors ke liye specially beneficial hai jo forex market ke complexities ko samajhne mein difficulty mehsoos karte hain ya apna time aur effort directly trading karne mein invest nahi karna chahte. PAMM account structure investors ko passive income generate karne ka mauka deta hai, jabke professional traders apne expertise ke zariye higher returns achieve kar sakte hain.

PAMM account ka setup aur functioning bohot systematic hota hai. Investors apne capital ko ek specific PAMM account mein invest karte hain, jahan yeh capital ek pool ke taur par aggregate hota hai. Money manager, jo ke ek experienced trader hota hai, is aggregated capital ko use karke forex market mein trades execute karta hai. Har investor ka profit ya loss uske invested capital ke proportion ke mutabiq distribute hota hai. PAMM account mein transparency aur trust ensure karne ke liye brokerage firms ki taraf se monitoring aur reporting mechanisms implement kiye jate hain. Yeh mechanisms investors ko real-time performance reports aur account status provide karte hain, taake wo apne investments ko effectively track kar sakein.

PAMM accounts ke kuch significant advantages hain. Sabse pehla advantage diversification hai. Investors apna capital multiple PAMM accounts mein distribute kar sakte hain, jisse risk ko diversify karne aur overall portfolio performance ko stabilize karne mein madad milti hai. Doosra advantage professional management ka hai. PAMM accounts ko experienced aur skilled traders manage karte hain, jo ke market trends aur trading strategies ko better samajhte hain. Yeh professionals advanced analytical tools aur techniques ka istemal karke trading decisions lete hain, jo ke typically higher returns aur reduced risk ka sabab bante hain. Teesra advantage transparency aur accountability ka hai. PAMM accounts mein saari trading activities aur fund movements ko accurately record kiya jata hai, jisse investors ko complete visibility milti hai aur wo confidently invest kar sakte hain.

Lekin, PAMM accounts ke sath kuch risks bhi associated hain, jinke baare mein aware hona zaroori hai. Sabse pehla risk market volatility ka hai. Forex market bohot volatile hota hai aur yeh volatility significant losses ka sabab ban sakti hai. Doosra risk money manager ke performance ka hai. Agar money manager ki trading strategies successful nahi hoti, to investors ko losses face karne pad sakte hain. Teesra risk brokerage firm ke credibility ka hai. PAMM accounts ko manage karne wali brokerage firm ka reliable aur regulated hona bohot important hai, taake fraud aur mismanagement ke risks ko mitigate kiya ja sake. Isliye, PAMM accounts mein invest karte waqt thorough research aur due diligence zaroori hai. Investors ko brokerage firm, money manager aur overall market conditions ko achi tarah evaluate karna chahiye taake informed investment decisions le sakein aur apne capital ko secure rakh sakein.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 02:04 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим