USD Vs Other Currency

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

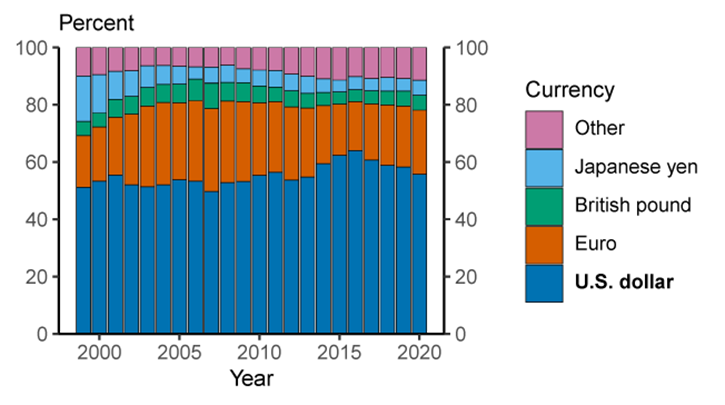

Forex ya foreign exchange market dunya ka sab se bara finance ka market hai jahan currencies ko tijarat kiya jata hai. Is market mein aik ahem kirdar ada karne wali currency United States dollar (USD) hai. USD dunya mein sab se bara reserve currency hai jis ki wajah se iska qadeemati asar global iqtisadiyon aur finance market par hota hai. The Role of the US Dollar USD kuch wajohat ki global trading aur finance mein ahem kirdar ada karta hai: Reserve Currency Status: USD ko dunya bhar ke central banks reserve currency ki hesiyat se qabool karte hain. Yeh international lehaz se tabadla ka zariya aur qeemat rakhne ka aik waseela hai. Global Trade: USD aalmi tijarat mein sab se zyada qabool ki jane wali currency hai, jis ki wajah se yeh mukhtalif industries mein transactions ke liye sab se aham currency hai. Commodity Pricing: Kai commodities jaise oil aur sone ki keemat USD mein muayana aur usi currency mein tijarat hoti hai. Yeh is currency ki asar ko global market mein mazboot banati hai. Factors Affecting the USD's Value Macroeconomic Indicators: GDP growth, inflation, employment reports, aur interest rates jaise finance se mutaliq data USD ki qeemat par sakht asar dalte hain. Musbat finance se mutaliq indicators currency ko mazboot kar dete hain, jabkay manfi data uski qeemat ko kam kar sakte hain. Monetary Policy: United States ki central bank, Federal Reserve (Fed), ke faislay USD par bade asar rakhte hain. Sood ki dar mein tabdeel, quantitative easing programs aur monetary policy ke tabdeel currency ki qeemat par asar andaz ho sakte hain. Political Stability: United States mein siyasi waqiat aur sidha USD par asar dal sakte hain. Intikhabat hukumat ki policies aur almi tanao jaise factors currency par shadeed hawadari aur asar dalte hain. Safe-Haven Status: Aalmi tanazur aur market ki badhaawar ke doran investors USD ko aik safe-haven asset ke tor par istemal karte hain. Yeh izafa hui demand currency ki qeemat ko mazboot kar sakti hai.

Factors Affecting the USD's Value Macroeconomic Indicators: GDP growth, inflation, employment reports, aur interest rates jaise finance se mutaliq data USD ki qeemat par sakht asar dalte hain. Musbat finance se mutaliq indicators currency ko mazboot kar dete hain, jabkay manfi data uski qeemat ko kam kar sakte hain. Monetary Policy: United States ki central bank, Federal Reserve (Fed), ke faislay USD par bade asar rakhte hain. Sood ki dar mein tabdeel, quantitative easing programs aur monetary policy ke tabdeel currency ki qeemat par asar andaz ho sakte hain. Political Stability: United States mein siyasi waqiat aur sidha USD par asar dal sakte hain. Intikhabat hukumat ki policies aur almi tanao jaise factors currency par shadeed hawadari aur asar dalte hain. Safe-Haven Status: Aalmi tanazur aur market ki badhaawar ke doran investors USD ko aik safe-haven asset ke tor par istemal karte hain. Yeh izafa hui demand currency ki qeemat ko mazboot kar sakti hai.  The Impact on Forex Trading Major Currency Pairs: USD sab se bari currency pairs jaise EUR/USD, GBP/USD, aur USD/JPY mein shamil hota hai. Tajirin USD ke performance ko doosri currencies ke sath muqabla kar ke tijarat ke mauqay aur faisle karte hain. Volatility and Liquidity: USD ka dominion Forex mein asani se hawadari aur tijarat ki volume ko mazboot karta hai. Currency ki hawadari tajirin ko spekulative tijarat aur hedging strategies ke zariye munafa hasil karne ka mauqa deta hai. Cross-Currency Relationships: USD ki harkatein doosri currencies par asar dal sakti hain, jis se currency pairs ke darmiyan correlation aur interdependence ban jata hai. Tajirin ko market trends ka analysis karte waqt in relationships ko samjhna zaroori hota hai. Economic News aur Events: USD se mutaliq khabarain, central bank ki announcements aur maaliyat se mutaliq indicators Forex markets par shadeed asar dalte hain. Tajirin in waqiat aur events ko closely monitor kar ke market ki harkatein samajhne aur apni tijarat ke position ko tawazun mein rakhne ki koshish karte hain. USD ka effect forex trading mein major currency pairs, market ki liqudity, cross-currency relationships aur liquidity ki wajah se paida hone wali volatility tak phailta hai. Malumat aur samajhdaari se traders forex market mein kamiyabi hasil kar sakte hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

The Impact on Forex Trading Major Currency Pairs: USD sab se bari currency pairs jaise EUR/USD, GBP/USD, aur USD/JPY mein shamil hota hai. Tajirin USD ke performance ko doosri currencies ke sath muqabla kar ke tijarat ke mauqay aur faisle karte hain. Volatility and Liquidity: USD ka dominion Forex mein asani se hawadari aur tijarat ki volume ko mazboot karta hai. Currency ki hawadari tajirin ko spekulative tijarat aur hedging strategies ke zariye munafa hasil karne ka mauqa deta hai. Cross-Currency Relationships: USD ki harkatein doosri currencies par asar dal sakti hain, jis se currency pairs ke darmiyan correlation aur interdependence ban jata hai. Tajirin ko market trends ka analysis karte waqt in relationships ko samjhna zaroori hota hai. Economic News aur Events: USD se mutaliq khabarain, central bank ki announcements aur maaliyat se mutaliq indicators Forex markets par shadeed asar dalte hain. Tajirin in waqiat aur events ko closely monitor kar ke market ki harkatein samajhne aur apni tijarat ke position ko tawazun mein rakhne ki koshish karte hain. USD ka effect forex trading mein major currency pairs, market ki liqudity, cross-currency relationships aur liquidity ki wajah se paida hone wali volatility tak phailta hai. Malumat aur samajhdaari se traders forex market mein kamiyabi hasil kar sakte hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:48 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим