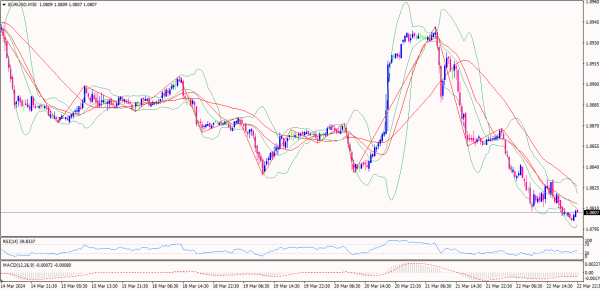

Bohot subha bakhair doston. Chalo ham EUR/USD ke keemat ki raftar par ghaur karte hain. Likhtay waqt EUR/USD 1.0807 par trade ho raha hai. EUR/USD market ek musbat rukh mein hai kyun ke US dollar index ghatakar kheta hai, jisse darasl ye saabit hota hai ke US currency ke maqool. Is doran EUR/USD lambay doran ke liye ek bullish market hai. Chart dikhata hai ke Relative Strength Index (RSI) 64.5736 par hai, isliye Relative Strength Index (RSI)-14 indicator ek kharidne ka signal de raha hai. Ussi waqt, technical indicator jise moving average convergence divergence (MACD) kehte hain, manfi zone se door ja raha hai aur rukhward zone ki taraf ja raha hai. Main samajhta hoon ke izafa halaat se jari rahega. Moving averages, EUR/USD ke liye ek bullish trend ka mojud honay ka zahir kar rahe hain. EUR/USD pair sirf 20 dinon ka exponential moving average ke upar trade ho raha hai. Usi waqt, 44 dinon ka dramatic moving average bhi halq mein hai jo haal hi ke EUR/USD ke keemat ke neeche hai, jo ek bullish nishaan dikhata hai. Upar ke taraf, qareebi resistance 1.0988 ke darja hai. Agar EUR/USD 1.0988 ke support ko paar karta hai, to yeh mazeed taqat hasil kar sakta hai. Us ke baad, agar is waqt EUR/USD 1.1078 ke muqablay mein tute, to EUR/USD mazid taqat hasil kar sakta hai aur 1.1173 tak ja sakta hai. Dosri taraf, neeche ke taraf, qareebi madad 1.0702 ke darja hai. Magar agar EUR/USD ke neeche 1.0533 ke support ko tod diya jata hai, to EUR/USD kamzor ho sakta hai aur gir sakta hai. Is ke baad, EUR/USD pair girte hue rukhta jayega, jo ke teesre madad ke darja 1.0467 tak ka nishana banata hai. Main umeed karta hoon ke market keemat yahan se upar ja sakti hai. Is haftay kharidaroon ke dabao ne EUR/USD par barhawa diya. Isliye, main yakeen karta hoon ke EUR/USD keemat resistance tak pohanchay gi.

No announcement yet.

X

Collapse

new posts

-

#1741 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#1742 Collapse

AUD/USD Jodi Ka Tareekhi Manzar

AUDUSD jodi ki keemat ka tajurba aik naya phase shuru hone ki taraf ishara karta hai. Haal hi mein, price 0.6648 ke oopar ek naya higher high banane mein kamiyab nahin hui. Asal mein, price ne bohot hi jaldi ghatne ka tajurba kiya jis se weekend market aaj tak qareeb 0.6512 ke qareeb band hua. Waise to death cross signal abhi tak zahir nahin hua hai kyunki EMA 50 aur SMA 200 abhi tak cross nahin hui hain, isliye keemat mein mazeed izafa hone ka imkaan hai. Lekin, agar price 200 SMA ke neeche kaam karna jaari rakhta hai to 0.6494 - 0.6480 demand area ki taraf zyada imkaan hai agar woh trendline ko guzar jaati hai.

Dusray janib, Stochastic indicator ke parameters oversold zone mein cross kar gaye hain, jisse yeh zahir hota hai ke neeche ki rally khatam ho chuki hai. Yeh yani ke keemat ka uthaal-puthal pehle upar ki taraf dorost ho sakta hai taake base ki shakl mein badal sake. Yeh ho sakta hai ke price SMA 200 ki taraf jaaye phir neeche jaakar 0.6494 - 0.6480 demand area ko test kare phir 0.6460 - 0.6444 ke neeche aur jaaye. Jab pehla demand area kamiyab ho jaaye, to structure mein tabdeeli aati hai jo ke ek lower low ko darust karti hai, yani agle price direction ke liye tendenti neeche ki taraf muntazir hai.

Trading options mein, aap SELL position le sakte hain jab price 0.6494 - 0.6480 demand area tak pouchta hai aur phir upar trendline ki taraf correct hota hai. To entry point trendline ke aas paas hota hai jab price re-test hoti hai. Tasdiq ke liye, aap Stochastic indicator ke parameters ke cross ka intezaar kar sakte hain jo ke overbought zone ya level 50 par hota hai. Take profit ke liye 0.6460 - 0.6444 demand area aur stop loss ke liye do Moving Average lines ke darmiyan ka faasla.

The heart has reasons that reason does not understand."

- AUDUSD

- Mentions 0

-

سا0 like

-

#1743 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

AUD/USD H4 TAJZIYA

AUD ko mazeed upri raftar ke liye taiyar dekha ja raha hai, jahan 0.65265 ka nafsiyati level aik ahem nukta-e-tawajju hai. Agar currency is rukawat ko tor sakay, to yeh AUD ko mazboot kar sakta hai, jise mukhtalif levels tak pohanch sakti hain aur haftawar ke uchchayiyon ki taraf tawajju surkhya kar sakti hai. Ulti taraf, is nishan se upar se guzarna is tarah ke upri raftar ko jhatka dene ki salahiyat rakh sakta hai. Iske ilawa, agar raftar jari rahe, to AUD apne March ki unchiyon se guzar kar aur baad mein 2024 ke December mein dekhe gaye muqablay ke levels par bhi challenge kar sakta hai, khaaskar at. Inn levels ke paray, AUD December ki unchi par apna aakhri imtehan ka saamna kar sakta hai. Lekin, AUD ka rukh ghumti hui hai, kyun ke yeh bhaari tarah se mukhtalif ma'ashiyati factors aur market jazbat par mabni hai. Anay wale hafton mein ahem honge jab investors aane wale ma'ashiyati data aur geopoliyati tajawuzat ka tajziya karenge, jo currency ke rukh ko nazdeek ki muddat mein tameer karenge.

Mukadma:

Mausam-e-karobaar ki haalat abhi ek complex set of factors ka samandar hai, jahan ma'ashiyati mandi ke mauzooda pehlu se lekar mukhtalif taslehat ke asaratakmeel hai. Jab Manufacturing PMI sudhar dikhata hai, to Services PMI mein thora sa kami aati hai. Lekin, kamzi jobless claims ki qowwat, jo kam tawaqqa ke mukhalif hain, ma'ashiyati sangeenai ke liye acha tasawur hai. Inn dynamics aur unke asar ko samajhna policymaker, karobari afraad aur investors ke liye zaroori hai taake woh hamesha taaza rahen aur karobari aur ma'ashiyati duniya ke daimi tagayyur mein munafa utha sakein. Maloomat ko musalsal rehne aur tabdeel hone wale trends ka jawab dena, stakeholders ko karobari aur ma'ashiyati duniya ke dynamic duniya mein maujooda mouke par pohanchne aur khatron ko kam karne mein behtar shakhsiyat mein rakh sakti hai.

-

#1744 Collapse

AUD/USD Price Action Overview:

Mujhe Aussie par takneeki tajziya kiya hai, aur lagbhag sab timeframes par short janae ke signals mil rahe hain, magar haftay ka timeframe thora alag hai. Main ab 5 ghanton ka timeframe par tajziya kar raha hoon taake meri analysis sahi ho. Main yeh bhi highlight karna chahta hoon ke price ka formation ka pattern hai, jise head and shoulders pattern kehte hain. Agar hum patterns par analysis karte hain, toh hum bearish disha mein confidently trade kar sakte hain, kyun ke agla izafa taqwiyati hoga. Yahan, toh ye nahi pata ke impulse kitna lamba chalega, magar mujhe lagta hai ke ye zyada lamba nahi chalega. Isliye, 5 ghanton ke timeframe par sell position kholne ki kekevt hai. Abhi ke liye itna hi, trading mein kamiyabi ki duaen! AUD/USD 1D Rozana ka timeframe thora uljhan mein hai, lagta hai ke price ne resistance level ko tor kar majbooti hasil ki hai, magar Williams ke mutabiq, humein downtrend ki taraf divergence nazar aata hai, aur candle mein volume kaafi kam hai, isliye main yahan par bhi short position lena behtar samajhta hoon. Hamara mukhya Aussie nishana 1.6565 range mein hone ki umeed hai, mukhtasaran, humein pehle is range ko guzarna hoga, aur uske baad hum 1.6575 range ko dekhein ge. Zayada thos tasdeeq ke liye, humein is range ke upar qayam karna chahiye, phir hi bechna ki surat mein ghor karna chahiye.

0.6566 se 0.64514 tak girne ke baad, ye maali sazish apna niche girne ka andaza rakhta hai aur dheere dheere uthne lagta hai. Ab isne 0.65545 ke level tak pohancha hai. Bazaar ke dynamics ka tajziya kar ke, ek price izafa ki umeed hai, shayad ek mabain muddat ke muddat ke sath. Ye pattern bazaar mein ek mukhtalif trend ki mumkin umeed dikhata hai. Haal hi ke is instrument ki harkatein kaafi numaya hain, jo daldal ke baad sakhti dikhate hain. Dheere dheere oopar ki taraf ki trajectory mein tabdili ka andaza hai, bazaar ke shirkat daron mein izafa ke sath is instrument ki qeemat par barhne wale itminan ko darust karte hue. Iske ilawa, mojooda darajat par qeemat ka mustiqil qaim rehna mabain muddat mein izafa ki mumkin umeed dikhata hai. -

#1745 Collapse

Maine dekha ke AUDUSD H4 timeframe par 0.6513 se lekar 0.6637 tak base area mein dilchasp izafa hua hai. Ye izafa taqatwar khareedari ke dabaav ka aik signal hai ke currency pair par qabza karna chahte hain. Magar yeh harkat us darje tak ruk gayi hai, jis ne darust karte hue is area mein mazeed intehai rukawat ka ishara diya. Supply area mein mehdood kiye ja rahe hain 0.6513 se lekar 0.6637 tak. Ye area pehle bhi rukawat ki taqat dikhata hai, is liye ye ek ahem nishaan ho sakta hai potential clear price reversal ka.

H1 timeframe par price action ko zyada wazeh dekhne ke liye acha khayal hai. Minor trend ke lehaaz se, yeh ab bhi bearish rukh mein hai, is liye moomkin hai ke ye mustaqbil mein mazeed nichle ja sakta hai. Buyer signal ko durust sabit karne ke liye, AUDUSD price ko trendline resistance line ke oopar safal tor par buland honay ka intezar karna behtar hai. Us ke baad, main ek khareedari order le lunga umeed hai ke AUDUSD price foran aage barh kar ek ziada resistance level ko hasal karne ke liye, ya'ni price range 0.66664 hai. Halanki ek dilchasp izafa tha, amomi trend ab bhi bearish rukh mein hai H4 timeframe par. Ye is baat ko taqat deta hai ke 50 EMA aur 100 EMA lines ab shuru mein mil rahe hain, jis se neeche ki momentum ab bhi kaafi taqatwar hai. Mera mumkin tajurba yeh hai ke is izafe ka mazeed tasdeeq ka intezar karna hai. 0.65504 se lekar 0.65605 ke range mein baray supply area hone ke bawajood, main is area ke aas paas price ke reaction ka nazar rakhunga. Ziyada tar, agar price us area tak pohanchti hai aur wahan radd ya ulta hone ki alaamaat dikhata hai, to ye aik taqatwar signal ho sakta hai ek farokht mauqay ko dhoondhne ka.

-

#1746 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

AUDUSD Pair ke liye Trading Strategy:

Jab hum AUDUSD pair ke price movement ko predict karne mein utarte hain, to chart ka dhyanpoorn janch humein samjhauta karne ke liye karta hai ki yah instrument bechna ka avsar dhyan mein rakha jana chahiye. Market mein pravesh ke liye mahatvapurn point 0.6560 ke price level par dikhai deta hai, jahan ek spasht resistance dikhayi deta hai. Is nirnay ke piche ka karan yah hai ki hume ummid hai ki pair apne niche ki disha mein aage badhta rahega, aur sambhavna hai ki yah 0.6510 ke level tak pahunch sakta hai. Is nishchit sthal ko nishchit labh lena hai trade se, agar ummid mein rahe hue gati sakar hoti hai. Phir bhi, mahatvapurn hai ki hum market dynamics mein kisi bhi parivartan ko dekhte rahen aur turant karyanvayan kar saken. Agar sthapit samrachana ko chhed diya jata hai, jise ek sambhavna pratikriya darshata hai, to humare lie zaroori ho jata hai ki 0.6600 ke price par nuksan ko khatm kar dena. Yeh pehle se hi tayyari karta hai ki hum turant yah vishwas kar saken ki avashyakta ke anusar instrument ko kharidna chahiye.

Iske atirikt, agar 0.6560 ke resistance level ko tod diya jata hai, to yah market dynamics mein ek mahatvapurn vikas ka sanket ho sakta hai. Aise paristhiti mein, yah sthal ek samarthan kshetra mein parivartit ho sakta hai, jo ek lambe samay ke liye pravesh karne ka ek sunishchit avasar pradan karta hai. Yah rajnaitik pratikriya bazar ke vyavhar aur moolak takneek sanketon ki ek dhyanpoorn janch par adharit hai. Mahatvapurn pravesh aur nikelne ke points ko pehchankar, vyapari apne risk exposure ko prabhavit roop se prabandhit kar sakte hain jabki labh ke avasaron ka faida utha sakte hain. Sansar, AUDUSD pair ke liye sujhav di gayi trading strategy neembejan mein price dynamics ka ek samajhdar gyan aur bazar ke vikasikaran par ek proactive pratikriya par adharit hai.

-

#1747 Collapse

Agar h1 timeframe se tajziya kiya jaye, toh bohot gehri girawat ke baad, 1.2669 ke daam par h1 support tor diya gaya hai. Ye darust karta hai ke trend ab bhi mazboot bearish hai. Mauqa shayad ab bhi mojood ho. Lekin dekhte hain ke oopar jane ka mauqa haqeeqatan bara ho raha hai kyunki girawat ke baad koi tajweez hi nahi hui hai. 1.2599 ke daam par candle shoulder area mein qaim hai, yeh shayad currency pair ke palatne ka sahi waqt ho. Saa ka kehna hai ke naye support ka formation hoga jo gbpusd ko ubharnay ke liye istemal kiya jayega.

Agar Ichimoku indicator ka istemal kiya jaye, toh candle ka maqam ab bhi tenkan sen aur kijun sen lines ke neeche hai. Kumo cloud bhi abhi tak tora nahi ja sakta kyunki is ka maqam ab bhi neeche hai. Is doran, ye indicator abhi tak bullish signal nahi diya hai. Lekin, do lines ek doosre ke qareeb ja rahe hain, iska matlab hai ke qareebi mustaqbil mein ek naya intersection ho sakta hai.

Intehaiyat se, stochastic indicator se yeh wazeh hai ke line ne level 20 ko kamiyabi se tor diya hai. Iska matlab hai ke halat waqai oversold hain. Main samajhta hoon ke yeh mamooli hai kyunki pichle kuch dinon mein girawat mein qarib pips daeenge. Halankeh, bechne ki halat ho chuki hai, lekin GBPUSD ab bhi upar jane ka irada nahi rakhta. Asal mein, aaj mujhe ek mukhtalif pattern mila hai jo ek palatne ka ishara hai.

Toh aaj ke tajziye ka ikhtitam yeh hai ke currency pair ke upar jane ka mauqa hai kyunki candle abhi tak shoulder area mein qaid hai. Iske ilawa, girawat ke baad abhi tak koi tajweez hi nahi hui hai. Isliye aaj main doston ko mashwara doon ga ke sirf khareedne ka position kholne ki koshish karein kyunki faida kamane ka mauqa kafi hai. Take profit maqsad ko mamooli tor par nazdeeki madda par rakh sakte hain jo ke ab 1.2664 ke daam par hai. Intehaiyat se, stop loss ko 1.2564 par rakh sakte hain.

Technical Reference: 1.25700 ke neeche kharidain

Resistance 1: 1.26350

Resistance 2: 1.26700

Support 1: 1.25700

Support 2: 1.25450

1 ghante ke chart par, GBPUSD ek mumkin palatne ka nishaan dikhata hai jab Doji candlestick zahir hoti hai. Neeche ki taraf girawat ke doran, Doji ka zahir hona ek ishara ho sakta hai ke qeematain palatengi. Iske ilawa, Stochastic indicator bhi oversold area se oopar chala gaya hai.

15 minute ke chart par, nazdeeki support taqreeban 1.25700 ke aas paas hai. Jab tak yeh hadood neeche nahi jati, GBPUSD ko 1.26350 tak ubharnay ka imkan hai.

-

#1748 Collapse

Assalam-o-Alaikum sab ko, jo ab invest social forums mein mojood hain, duniya bhar mein ek bara forum hai jo posting campaign ke liye bohot bade contests aur bonus provide karta hai. Ye ab tak das saal se chal raha hai aur hum is forum par bharosa karte hain sath mein instaforex company ke saath, jo duniya ka behtareen forex broker hai. Is tarah ke campaign aur contests purane aur naye members ko encourage karte hain ke wo zyada se zyada faydemand topics aur mukhtalif technical analysis publish karein taake bahar se visit karne wale jo information aur technical analysis ki talash mein hain, unhe attract kiya ja sake.

Aaj, 23 March 2024, ke liye aud usd pair ke technical analysis daily time frame charts par:

Hum abhi bhi lambi arse ke liye down trend mein hain jaisa ke price 0.8023 se shuru hua trend abhi tak khatam nahi hua hai, is waqt tak humein bechnay ke liye jagah dhoondni chahiye. Main yeh dekh raha hoon ke 0.6273 se 0.6874 tak shuru hui up wave ek retracement wave hai aur iski inteha yeh high pe khatam hoti hai, is liye hum ab is pair ko bechenge har uthaane par. Pair daily time frame par bohot ahem resistance ka samna karta hai jab woh legacy trade resistance pe price 0.6630 par touch karta hai, isi tarah se agar woh daily candle legacy trade indicator ke upar close nahi kar pata toh hum ise bechenge.

Aaj ke liye aud usd pair ke technical analysis 23 March 2024 ke saath, chaar ghanton ka time frame analysis:

Pair bohot tezi se neeche gir raha hai ek tez wave ke saath jo price 0.6632 se shuru hua hai aur abhi tak jaari hai, lekin is neeche ke wave mein pair ne koi resistance test nahi kiya hai lekin abhi pehli resistance face karta hai jab woh bolinger stop indicator se milta hai. Meri umeed hai ke yeh stable nahi rahega aur is resistance ke upar chaar ghanton ka candle close nahi karega aur jab isko touch karega toh pair 100 pips ke target ke liye neeche gir jaayega.

-

#1749 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

AUD-USD currency pair ka tajziya:

Daily chart par:

AUDUSD mein, zahir hai ke ek rollback neeche ki taraf hone ki sambhavna hai. Keemat barhi aur tees martaba mazboot darja 0.6515 tak pohanchi lekin issay torh kar aur ooper nahi ja saki. Keemat ooper nahi ja sakti; yeh wazeh hai. Is ke ilawa, teer aur basement indicators tasdeeq karte hain ke level se bechne ke liye dakhil ho sakte hain. Is ke alawa, average haftawarana barhawar ka rukh khatam ho chuka hai, jo ke ek rollback ko neeche ki taraf darust karta hai, aur resistances ke sath level ko mazbooti dete hain, jo ke phir se neeche ki taraf rollover ko darust karte hain. Bechnay ki aur rollback neeche ki tehqeeq achi lagti hai. Munafa weekly support level par 0.6480 par band kiya ja sakta hai, jo ke aik shuruat ki achi jagah hai. Agar keemat is level se ooper uth jaye, to trend ke sath kharidne ka bhi acha khayal ho sakta hai.

H1 Time Frame

Neeche ke levelon ki tajziya mumkin hai, aur yeh kar saktay hain. Iss surat mein, agar keemat market ke opening se chalne lagti hai, to hum shuru mein neeche ja sakte hain jo ke Asia ki raat ke doosray din 0.6540 par surakshit zone ke upper border tak ja sakte hain. Agar keemat apni mojooda minimum se neeche na gir sake, to yeh jodi ki keemat 0.6525 tak barh sakti hai. Agar keemat mojooda minimum ko torh nahi sakti, to keemat barh sakti hai. Iss surat mein 0.6575 par muqabla support ban jaye ga, kyun ke hum dekh sakte hain ke muqabla support ban sakta hai.

-

#1750 Collapse

AUD/USD Technical Analysis:

H4 timeframe mein, AUDUSD jodi ne 0.64920 se 0.65065 tak ek qabil-e-zikar uroojati durusti ka samna kiya, jo ke market ko domine karne ki koshish karne wale kharidaron ka mazboot influx ka ishaara hai. Magar, yeh chadhao us level ke aas-paas rok di gayi, jo ke us zone mein mazboot rukawat ka ishaara hai. Mazeed uroojati momentum ki tawaqo ki satah, 0.65504 se 0.65605 tak ke supply area ki mojudgi ke wajah se mehdood hai. Yeh khaas ilaqa pehle bhi numaya rukawat ka muzahira kar chuka hai, jis ne isay ek aham nukta banaya hai taqreeban sabit qeemat ka ulta ho sakta hai.

Aage dekhte hue, mazboot bullish momentum ke liye aage ka manzar ko 0.65504 se 0.65605 tak ke qabil-e-tawaja supply area ki mojudgi se mukhtalif honay ki tawaqo hai. Tareekhi data yeh darust karta hai ke yeh zone pehle bhi upri keemat ke harkat ko rukne wala sangeen rukawat ka kaam karta hai, jis ne isay ek ahem rukne ka nishana banaya hai taqreeban sabit qeemat mein ulat jaane ke lehaz se.

Mukhtasir mein, hal hi mein AUDUSD jodi mein uroojati durusti ne kharidaron ke dilchaspi ka saboot diya hai, magar mukhtalif rukawat ke levels ki mojudgi, khaas kar 0.65504 se 0.65605 tak ke darmiyan, ek ihtiyaat bhari taur par zaroori lagta hai. In levels ke ird-gird ke qeemat ke aamal ka nigaarish, jodi ke masail ka tehqiq karna, aur market ke jazbati dor mein ek zahir taur par tabdeel hote hue nikaat ka pata lagana, sangeen ghaur aur hoshiyari ki zaroorat hai.

- AUDUSD

- Mentions 0

-

سا0 like

-

#1751 Collapse

AUD/USD H4 Timeframe

H4 timeframe mein, AUDUSD pair ne 0.64920 se lekar 0.65065 tak ek ahem upri sudhar ka samna kiya, jo market ko qabu karne ke liye kharidaroun ka mazboot dakhil honay ka ishara tha. Halaanki, yeh chadhav us level ke aas paas rok diya gaya, jo is ilaake mein mazboot rukawat ka ishara deta hai. Mazeed upri momentum ke imkanat ko aik supply area se mehdood kiya gaya hai jo 0.65504 se lekar 0.65605 tak phaila hua hai. Yeh khaas ilaqa pehle se hi mazboot rukawat ka saboot deta hai, iska taluq mukhtalif mawaqay par zahir ho chuka hai, jo aik mabain juncture ke tor par ehem hai taake kisi taslees ke potential aamad ka jaiza liya ja sake.

Aage dekhte hue, mazeed bullish momentum ke liye tasawwur ko ek mazboot supply area ke mojoodgi se mayaari milti hai jo 0.65504 se lekar 0.65605 tak phaila hua hai. Tareekhi data yeh darust karta hai ke yeh ilaqa pehle se hi upri price movements ke liye mazboot rukawat ka kaam karta raha hai, iska taluq mukhtalif mawaqay par zahir ho chuka hai, jo iska ehemiyat ko markazi satah par darust karta hai taake potential taslees ke zahir hone ka ehtimal samjha ja sake.

Ikhtisar mein, haal hi mein AUDUSD pair mein upri sudhar ko kharidar ki dilchasp dilchaspi ki taseer ko darust karta hai, mazboot rukawat levels ki mojoodgi, khaaskar 0.65504 se lekar 0.65605 tak ke andar, ek ehtiyaat bhara nazariya samajh sakti hai. In levels ke atraaf ke price action ka nigrani karna market pair ke mustaqbil ki makhsoosiyat aur market jazbaat mein ek zahir aur nazar andaz tabdeeli ka asal pata lagane mein ahem ho sakta hai.

-

#1752 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

AUD/USD

Australian dollar ki farokht ab tak achi hain, aur sab se ahem baat yeh hai ke humein gadhaani ka intezar karna hai jab bulls se bears ki taraf tawajjo badal jaye. Yeh hareef wave ke doran chal raha hai jo 0.6525 ke darje tak upar hoga, aur is tezabiat ka natija hamare manzil ki mustaqbil ki raah ka faisla karega. Agar hum support ko tor kar 0.6545 ke darje tak aur bhi aage barh jaate hain, to hum maqami minimum ko taaza kar sakte hain, ya agar hum rebound karte hain aur 0.6590 ke resistance ke darje tak gehra izaafa hota hai, to hum aur gehri baarish ko dekh sakte hain. Transaction ki raah par mati baandhne ki koshish ki jaati hai, lekin yeh sahi raah par hai, is liye mujhe neeche jaana hai.

Rozana waqt ka frame

Bawajood girawat ke ek dauran se, Australian currency girawat ke ek dauran ke baad ek aur bullish dauran dekh sakti hai. Girawat ke doran, neeche ki hadood ke qareeb aik ilaqa hai, is liye agar aap chaurha ascend channel se khareedte hain, to aap ko channel ke bahar rok lagane chahiye, is tarah agar aap wahan se khareedte hain to ye mehfooz hoga. Bullon ke liye, maqsood 0.6480-0.6530 hai, lekin yeh urooj ko darust nahi karta, is liye hum upar tak 0.6460-0.6525 tak chal sakte hain. Hum daam ko daam par rakhte hain taake agar ye 0.6540-0.6570 tak gir jaaye, to hume 0.6510-0.6595 tak oopar uthne ka imkaan nahi reh jaye. Halaanki, mein hamesha khareedaron ko pehlii shaadi per rakhta hoon. Kamiyabi ke liye dua hai.

Dair se girawat ki ek lehar ke bawajood, Australian currency ek aur bullish lehar dekh sakti hai girawat ke baad. Thapthapane ke doran, neechay ke border ke qareeb aik ilaqa hai, is liye agar aap ek wide ascending channel se khareedte hain, to aap stops ko channel ke bahar rakh sakte hain, is tarah se agar aap wahan se khareedte hain to yeh mehfooz hoga. Bulls ke liye, maqsad 0.6480-0.6530 hai, lekin yeh aakhri had nahi hai, is liye hum 0.6460-0.6525 tak chal sakte hain. Hum daamon ko keemat par rakhte hain taake agar yeh 0.6540-0.6570 tak gir jaata hai, to humein yeh umeed nahi ke hum 0.6510-0.6595 tak chadha sakte hain. Magar, main hamesha kharidaar ko pehle darja par rakhta hoon. Khush kismati.

-

#1753 Collapse

AUD/USD Technical Analysis.

AUD/USD currency bear is support zone ka jhoota breakthrough karega phir uttar, ya phir consolidation ke darmiyan kuch hoga pehle se barhne ke liye. Bechnay ki jagah, aap 0.6580 ki resistance level ko mad e nazar rakhsakte hain, jahan se mujhe umeed hai ke ek rebound hoga. Main pair ko kareeb 0.6560 ke level tak giraane ka iraada karta hoon, jahan se faida uthana zaroori hoga. Agar ek reversal signal aur structure toot gaya, toh aapko nuqsan 0.6620 ke liye uthana hoga aur unko kharidna hoga. Jab 0.6580 ka level toot jaye ga, toh ye pehle se hi support ke tor par kaam karega jahan se kharidari ki ja sakti hai. Pichle Jumma ko, AUD/USD pair ke liye, bears ne actively support level ko 0.6557 par test kiya lekin ise torne mein nakam rahe, halan ke volumes iss level ka test karte waqt dheere dheere barh gaye, jo ke further decline ki kami mein, bears ki taraf se kuch weakness ka aik nishaan lagta hai. Magar, is kaam mein hone ke bawajood humne designated support level se rebound nahi dekha, balke keemat mazeed qareeb aur qareeb barhti gayi, aur ye ek wazi shaa'ur hai aik qareebi breakdown ke tayyari ka designated support level 0.6557, khas tor par jab dollar ka moqam ab kaafi strong hai jis se ziada assets se taluq hai.

Keemat local levels ke area mein hai 0.6520, jab aik reversal formation is range ke qareeb banega, aur moving averages ke interweaving ki tasdeeq ke saath, ye ek khareedari signal dega. Target kaam karne ka hoga maximum 0.6520, jahan se price history mein gir chuki hai. Main ye bhi nahi nafees kar raha hoon ke price mazeed girne ke silsile mein jaye, important minimum 0.6550 ko torne ke saath, is maamle mein moving average indicator ko nichle dynamics ki tasdeeq karni chahiye, jis se market ek naye nichli trend mein palat jata hai. Toh haan, theoryati analysis ke mutabiq, hum ek girawat ka jari rakhna umeed karte hain support level ke 0.6521 ke taraf, phir sawalon ka silsila hota hai. Halan ke woh round mark 0.6500 ki taraf nishaan rakh sakte hain ise hasil karne ke liye, ye shayad sab kuch hai. Agar trading operations kaam liye jayein, toh woh lagbhag khali hain jab se maine is AUD/USD trading instrument mein sirf Thursday ko bechne ke rukh mein shuru kiya hai.

- AUDUSD

- Mentions 0

-

سا3 likes

-

#1754 Collapse

Daily Timeframe Analysis

AUD/USD doosre seedha suraj ka red candle pe hai, jo September 6 ke record lows ke kareeb se shuru hua hai. Is liye, sabhi nigaahen ab momentum indicator par hain taake pair ka agla kadam kya hoga iska pata chale. Mazeed tafseel se, RSI ab apne 50 ke equilibrium level ke neeche girte ja raha hai aur ab neeche ki taraf ja raha hai. Stochastic abhi moving averages ke khilaf ladh raha hai, aur is jung ka nateeja pair ke agle kadam ko tay karne mein bada kirdar play kar sakta hai. Average Directional Movement Index, doosri taraf, haal hi ke price action ko ignore kar raha hai aur 25 ke level ke neeche atka hua hai.

Weekly Timeframe Analysis

Technical tor par, ek ulta sar aur kandho ka pattern banne ki seema hai, jiska gardan 0.6521 par hai. Lekin, is bullish pattern ke liye, is level ke oopar ek bounce zaroori hai. Agar buyers mojooda pullback se ladhne ka faisla karte hain, toh wo 0.6446 ke neeche girne ki taraf dekhenge aur phir 0.6669 area ka nishaana banayenge. Khaas taur par, yeh area downtrend ke 61.8% Fibonacci retracement ke andar hai, jo rectangular pattern ka neeche ka hissa hai aur 50-day simple moving average bhi hai. Is area ke oopar, 200-day simple moving average 0.6517 par hai.

Warna, sellers mojooda move ka faida utha sakte hain aur 0.6376 ke low ko test kar sakte hain. Mukhtasar tor par, zyadatar momentum indicators ke support mein naye downside move ko behtar bana raha hai, lekin AUD/USD ka agla price action do trends ke darmiyan hone wale move par mabni hai, aur jang jaari hai. Neeche di gayi chart dekhein:

- AUDUSD

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#1755 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

AUD/USD Technical Analysis:

Mausam ka haal dekhnay par aisa lagta hai ke AUDUSD chart mein taqatwar bullish jazba hai, or umeed hai ke aglay dino mein mazeed bulandi ka intezar hai, jaise ke directional arrows se zahir hai. H4 chart ko qareeb se dekhnay par dekha gaya hai ke bullish control ka dhire dhire izafa ho raha hai, jo ek mazboot bullish trend ki alamat hai. Ek ahem imkaan hai ke pair 0.6610 ke qeemat tak chadhe ga, jo ke barhte hue bullish momentum se farogh pa raha hai. Jabke yeh level pehle support ke tor par kaam karta tha, lekin ab yeh resistance level ke tor par kaam kare ga jab tak foran breakeout na ho. 0.6635 tak pohnchnay par, ek correction ki umeed hai rally mein, jo ek potential trading opportunity paish kare gi. Yeh correction muntazir hai ke yeh bearish retracement ko lead kare ga, jo ke 0.6655 ke qeemat tak girne ki umeed hai, jahan se support ki intezar hai ek rebound ke liye peechlay swing highs ki taraf 0.6685 ke qareeb. Trading karne walo ke liye yeh yaad rakhna ahem hai ke, kyunke retracement level ahem samjha jata hai, to woh bounce ka intezar kar saktay hain jab tak ke price daily chart pe peechlay swing high tak na pohunchay. Yeh dauray daraz harkat rozmarra ke traders aur scalpers dono ke liye munafa deh hote hain, jo upar aur niche ke chatan chhant saktay hain. In mawazun fawaaid hasil karne ke liye, traders ko chaukanna rehna chahiye aur unko highlight kiye gaye maqamat ka khayal rakhna chahiye potential buy ya sell positions ke liye. In maqamat par daakhil aur nikalne ke moqaat ke aqwam waqt par shahkaar hone se azeem munafa hasil ho sakta hai AUDUSD ke mojooda market mahol mein. Ikhtisar mein, mojooda AUDUSD price action bullish momentum ke liye nazuk manzarein pesh karti hai qareebi muddat ke liye, jahan potential corrections mazeed trading opportunities faraham kar sakti hain. Ahem levels ko qareeb se nazar andaz karke aur hushyar risk management strategies istemal karke, traders khud ko market ki yeh harkatain mufeed taur par haasil karne ke liye qabil-e-maqam banwa saktay hain

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:17 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим