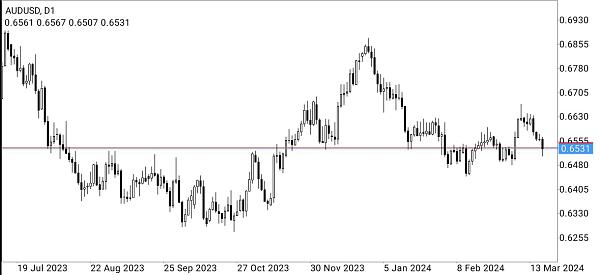

AUD/USD pair mein ek ahem neeche ki taraf ki harkat hui, 0.6535 ke horizontal resistance level ko tor kar. Ye harkat market ki jazbat mein tabdili ko darust karti hai aur Australian dollar aur US dollar ko mutasir karne wale mukhtalif factors ki wajah se ho sakti hai. Is neeche ki harkat ka ek aham sabab Reserve Bank of Australia (RBA) ki maali policy mein tabdeeliyan ho sakti hain. Central banks aksar maali satah ko control karne ke liye interest rates ko adjust karte hain. Agar RBA ko interest rates kam karne ka faisla karna pade ya wo ek dovish stance apnaye, to is se Australian dollar ko US dollar ke muqablay mein kamzor kar sakta hai, jo AUD/USD pair par neeche ki dabao daal sakta hai. Is ke ilawa, maeeshat ke pehloo jaise GDP ki nashonuma, rozgar ke data, aur mahangi ki figures currency pairs ko mutasir kar sakti hain. Agar Australia se kamzor maeeshati data aaye, jaise ke GDP ki growth ka taqreeban ummeed se kam hona ya rozgar mein izafa, to ye Australian dollar ko kamzor kar sakta hai aur iska asar AUD/USD pair par ho sakta hai.

Aalmi siyasati aur maeeshati trends bhi currency ki harkatain par bohot asar daalti hain. US aur China ke darmiyan trade tanazaat, misaal ke tor par, Australia ke trade talluqat par asar daal sakte hain, jo ke Australia ka sab se bara trade partner hai. Agar trade tanazaat barh jayein to investors ke darmiyan risk se bachne ke liye safe-haven assets jaise US dollar ki taraf tawajjo barh sakti hai, jis se AUD/USD pair par neeche ki dabao aayega. Is ke ilawa, key exports jaise ke loha aur coal ke saman keeemat, Australian dollar ki qeemat ko bhaari tor par mutasir karti hain. Agar samaan ki keemat mein kami aaye, to is se Australia ke trade conditions par asar par sakta hai aur currency ko kamzor kar sakta hai.

Technical factors bhi market ki harkatain par asar daalte hain. Traders aksar support aur resistance levels ka istemal karte hain, jaise ke 0.6535 par wala level, trading decisions banane ke liye. Aise level ki tootne se traders selling pressure ka shikaar ho sakte hain jab wo long positions se nikalte hain ya short positions mein dakhil hote hain, jo currency pair ki neeche ki harkat ko barhava de sakta hai. Market jazbat aur tajweezati trading bhi dono simat mein price ki harkatain ko izhar kar sakte hain. Australian economy ya siyasi bechaini ke baare mein negative khabrein ya afwahen traders ko Australian dollar bechna majboor kar sakti hain, jo currency ki qeemat ko US dollar ke muqablay mein neeche kar sakti hai.

Aalmi siyasati aur maeeshati trends bhi currency ki harkatain par bohot asar daalti hain. US aur China ke darmiyan trade tanazaat, misaal ke tor par, Australia ke trade talluqat par asar daal sakte hain, jo ke Australia ka sab se bara trade partner hai. Agar trade tanazaat barh jayein to investors ke darmiyan risk se bachne ke liye safe-haven assets jaise US dollar ki taraf tawajjo barh sakti hai, jis se AUD/USD pair par neeche ki dabao aayega. Is ke ilawa, key exports jaise ke loha aur coal ke saman keeemat, Australian dollar ki qeemat ko bhaari tor par mutasir karti hain. Agar samaan ki keemat mein kami aaye, to is se Australia ke trade conditions par asar par sakta hai aur currency ko kamzor kar sakta hai.

Technical factors bhi market ki harkatain par asar daalte hain. Traders aksar support aur resistance levels ka istemal karte hain, jaise ke 0.6535 par wala level, trading decisions banane ke liye. Aise level ki tootne se traders selling pressure ka shikaar ho sakte hain jab wo long positions se nikalte hain ya short positions mein dakhil hote hain, jo currency pair ki neeche ki harkat ko barhava de sakta hai. Market jazbat aur tajweezati trading bhi dono simat mein price ki harkatain ko izhar kar sakte hain. Australian economy ya siyasi bechaini ke baare mein negative khabrein ya afwahen traders ko Australian dollar bechna majboor kar sakti hain, jo currency ki qeemat ko US dollar ke muqablay mein neeche kar sakti hai.

تبصرہ

Расширенный режим Обычный режим