Re: Aud/jpy

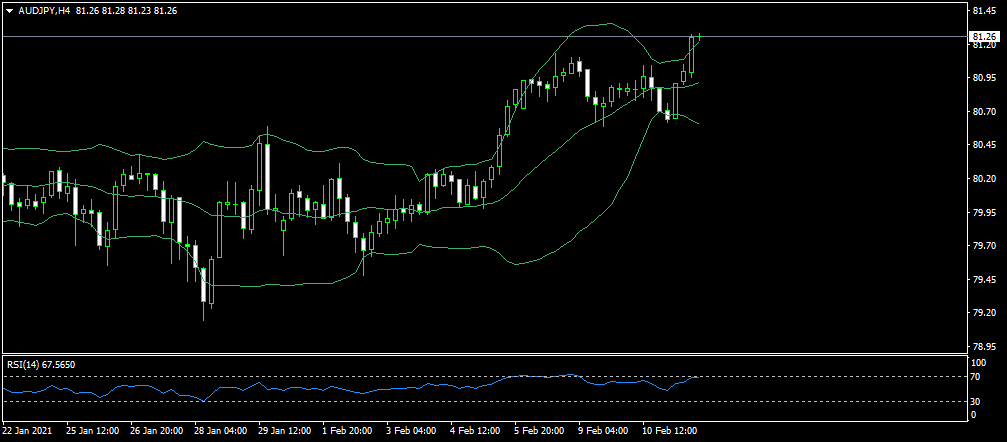

AUD/JPY ki qeemat is waqt 81.26 hai, 4H chart ke mutabiq is ka up trend hai aur ye is ko continue rakh sakta per jese ke price bollinger band ke upper wale band ko touch kar rahi hai aur ye kuch ziyada hi buy ho chuka hai aur abhi mazeed upper jana band kar sakta hai lihaza jinho ne ko buy kia hua hai wo muhtat ho jae aur apni trades ka khayal rakhe.

AUD/JPY ki qeemat is waqt 81.26 hai, 4H chart ke mutabiq is ka up trend hai aur ye is ko continue rakh sakta per jese ke price bollinger band ke upper wale band ko touch kar rahi hai aur ye kuch ziyada hi buy ho chuka hai aur abhi mazeed upper jana band kar sakta hai lihaza jinho ne ko buy kia hua hai wo muhtat ho jae aur apni trades ka khayal rakhe.

تبصرہ

Расширенный режим Обычный режим