XAU/USD KA ANALYSIS:-

1. Maujooda Qeemat (Current Price): Aaj ke doran sonay ki qeemat mein ki gayi tabdeeli ka pehla nazar aata hai. Aapko yaad rahe ke sonay ka qeemat har ghante ya har minute mein tabdeel ho sakta hai, is liye is tafseelat ko waktan-fa-waqt update karna zaroori hai.

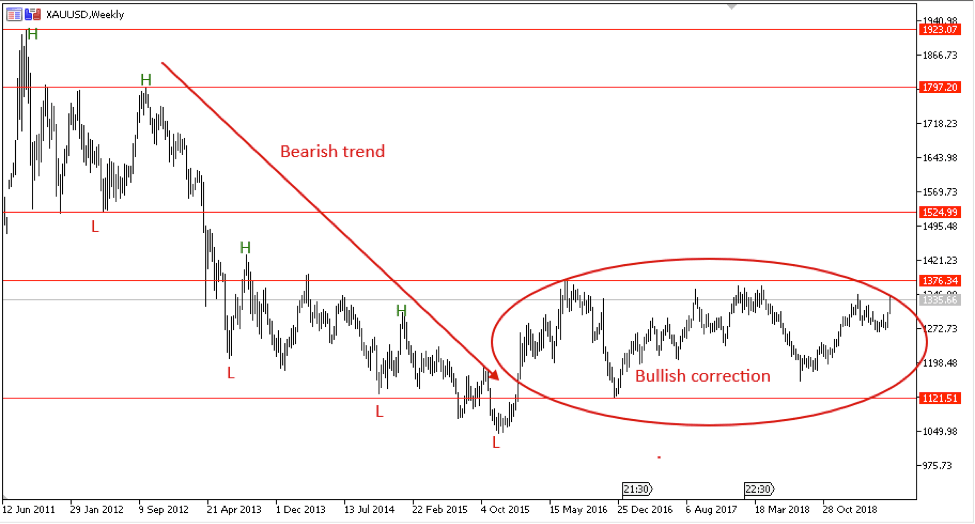

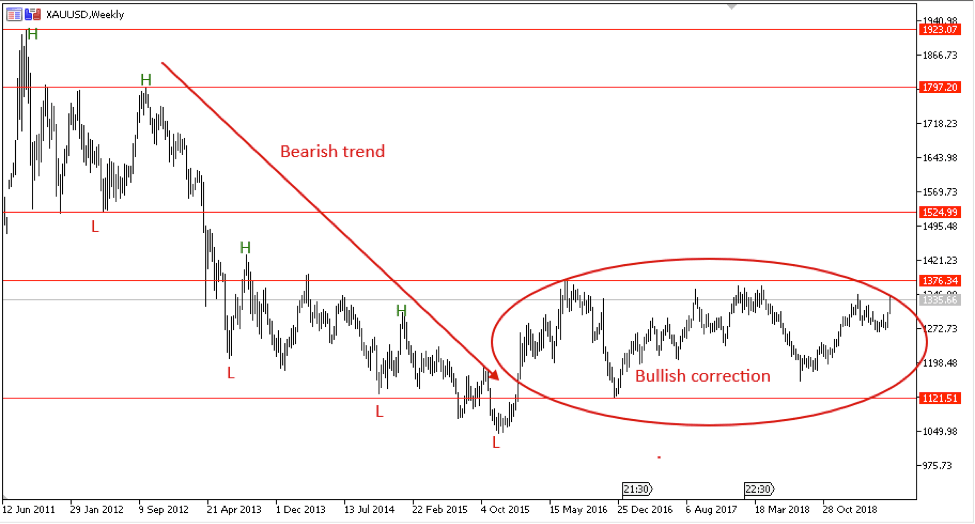

2. Technical Analysis (Techneeqi Tahlil): Sonay ke qeemat mein tabdeeli ko samajhne ke liye techneeqi tahlil ka istemal karna ahem hai. Is mein sonay ke tareekh ki graph ko samajhne ke liye tools aur indicators ka istemal hota hai. Moving averages, RSI, aur Fibonacci retracements jaise tools ki madad se aap ko trends aur price levels ka andaza ho sakta hai.

3. Support Aur Resistance Levels (Madad Aur Rukawat Ke Level): Tahlil mein support aur resistance levels ka pata lagana bhi zaroori hai. Support levels woh qeematein hoti hain jahan se sonay ki qeemat gir kar rukti hai aur phir se upar uthne lagti hai. Resistance levels woh qeematein hoti hain jahan se sonay ki qeemat barh kar rukti hai. In levels se aap ko price movement ka andaza hota hai.

4. News Aur Geopolitical Events (Khabarain Aur Siyasi Waqiat): Sonay ki qeemat par asar daalti hain khabarain aur siyasi waqiat bhi. Economic indicators, central bank decisions, aur geopolitical tensions sonay ke qeemat mein tabdeeli paida kar sakte hain. Aaj ke din kisi bhi qisam ki important khabar ko note karna zaroori hai.

5. Global Economic Conditions (Dunyawi Maashi Haalat): Global economic conditions bhi sonay ke qeemat par asar daalte hain. Dollar ki qeemat, interest rates, inflation, aur trade tensions sonay ki qeemat ko prabhavit kar sakte hain.

6. Technical Patterns (Techneeqi Patterns): Graph par dikhne wale technical patterns bhi sonay ke analysis mein istemal hote hain. Is mein double tops, head and shoulders, aur saaf trends ka pata lagana shamil hain.

7. Long-Term Aur Short-Term Trends (Lambi Aur Choti Muddat Ke Rujhanat): Sonay ke analysis mein lambi aur choti muddat ke rujhanat ko bhi samajhna zaroori hai. Kuch waqt ke liye sonay ki qeemat barh sakti hai lekin lambi muddat mein girne ka khadsha bhi hota hai.

8. Trading Strategy (Tijarat Ka Tareeqa): In tamam tafseelat ko samajh kar, aap apni trading strategy tayyar kar sakte hain. Kya aap long (khareedne) ya short (farokht karne) mein jana pasand karenge? Stop-loss aur take-profit levels kya honge? Ye sab tafseelat tijarat ka hissa hote hain.

Yad rahe ke sonay ka market hamesha tabdeeli ka shikar hota hai. Is liye apni tafseelat ko taaza rakhein aur hamesha zaroori siyasi aur maashi khabar ko dekhte rahein.

GOLD Specialized ANYLSIS H2 TIMES Edges OVERVIEW..&& Aging ESS Gold anylsis say chay American greenback ke tawaqqa hai, mazboot rehne ki. I found comfort at the marketplace, kami ki wajah. If the price of gold goes below $ 1800 per ounce, then the steady prices of $ 1750 and $ 1700 per ounce will continue to be in effect. Doosri taraf, if yeh 50-racket se tajawaz kar jata hai. Jo aik ahem muzahmati nuqta hai, yeh $ 1900 ki satah tak pahonch sakta hai, ema. $ 1850 ki satah ke qareeb. Is there a commercial center with a tajurbah that complies with satah standard maazi? Khulasa peak standard, Sony ki Commercial Center, and Tajir Oversight Inclusion Ke Mustaqbil Ke Baray Mein Ghair Yakeeni Hain. Markazi bankon sonay ki musalsal kharidari goods ki maang peda karti, market ko $ 1800 aur $ 1850 ki standard numaya muzahmat ka saamna hai. Congress ki samaat ke douran jerum Powell ke bayanaat commercial center ke biyany o mutasir kar satke hain, taajiron ko earzi solace ka saamna karna standard sakta hai.Good day, friends.Rasistenc Mn Ess Gold ki Great day, laken meray idea kay motabaq gold nay or bhe up jana whats up gold ka target 2040$ or 20545$ he ho sakta hy, abhi tak jo obstacle degree he Unfamiliar commerce and commercial center mein brief explanation hi gold ke cost

GOLD Specialized ANYLSIS H2 TIMES Edges OVERVIEW..&& Aging ESS Gold anylsis say chay American greenback ke tawaqqa hai, mazboot rehne ki. I found comfort at the marketplace, kami ki wajah. If the price of gold goes below $ 1800 per ounce, then the steady prices of $ 1750 and $ 1700 per ounce will continue to be in effect. Doosri taraf, if yeh 50-racket se tajawaz kar jata hai. Jo aik ahem muzahmati nuqta hai, yeh $ 1900 ki satah tak pahonch sakta hai, ema. $ 1850 ki satah ke qareeb. Is there a commercial center with a tajurbah that complies with satah standard maazi? Khulasa peak standard, Sony ki Commercial Center, and Tajir Oversight Inclusion Ke Mustaqbil Ke Baray Mein Ghair Yakeeni Hain. Markazi bankon sonay ki musalsal kharidari goods ki maang peda karti, market ko $ 1800 aur $ 1850 ki standard numaya muzahmat ka saamna hai. Congress ki samaat ke douran jerum Powell ke bayanaat commercial center ke biyany o mutasir kar satke hain, taajiron ko earzi solace ka saamna karna standard sakta hai.Good day, friends.Rasistenc Mn Ess Gold ki Great day, laken meray idea kay motabaq gold nay or bhe up jana whats up gold ka target 2040$ or 20545$ he ho sakta hy, abhi tak jo obstacle degree he Unfamiliar commerce and commercial center mein brief explanation hi gold ke cost

Yad rahe ke sonay ka market hamesha tabdeeli ka shikar hota hai. Is liye apni tafseelat ko taaza rakhein aur hamesha zaroori siyasi aur maashi khabar ko dekhte rahein.

Yad rahe ke sonay ka market hamesha tabdeeli ka shikar hota hai. Is liye apni tafseelat ko taaza rakhein aur hamesha zaroori siyasi aur maashi khabar ko dekhte rahein.