GBP/JPY price analysis:

1-hour time frame:

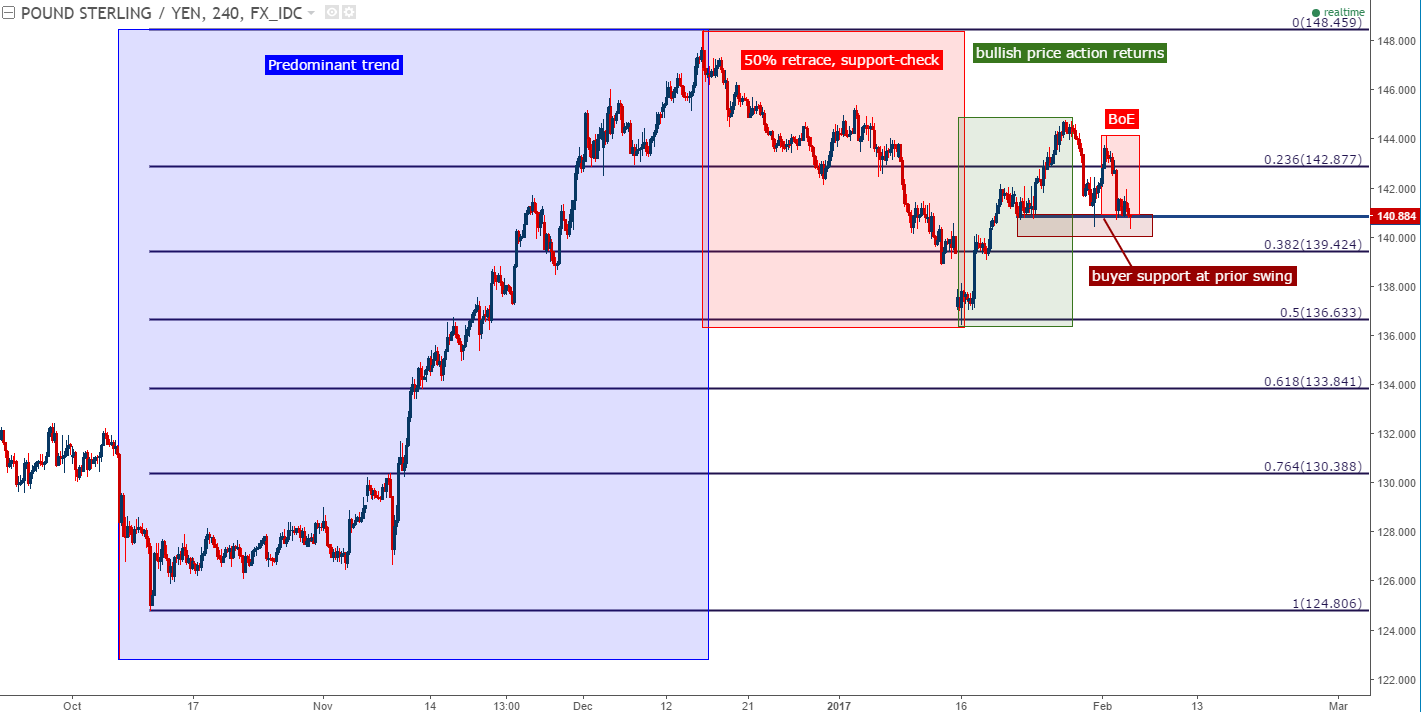

GBP/JPY ko Four Hour's ka Times Frames par Analysis kiya jay to is GBP/JPY ka Four Hour's ka Time Frame par jo supporting level ha ya lowered ke traf 180.08 par ha or jo is GBP/JPY ka four Hour's ka Time Frame par resistance level ha ya 182.08 par ha or agar is GBP/JPY ki price is ka Four hour's wala time frame ma lowered ke traf supporting level 180.08 ke janab jati ha or jo four hours ke candel ha is GBP/JPY ki ya is supporting level 180.08 ka level ko hit kar ka high ma closed hoti ha to Trader's is making buyer's ke janab ki trade ko enter karay ga

or is trade ka jo profit Target ho ga is ko higher ke traf 100 points par place karay ga or agar is gbp/jpy ki Price Lowered jana ka bajai higher ke traf jati ha or GBP/JPY ki jo four hours ke Candlesticks ha ya high ma jo resistance level ha 182.08 ka is resistance level ko hit kar ka is GBP/JPY ki four hours ke candel lower ma hi close ho jati ha to is ma traders ko GBP/JPY ki Price ka downward jana ka signal mila ga or traders is gbp/jpy ma sell ke trade ko enter karay ga Tu Trad Ho gy.GBP/JPY currency pair se nazar andaz ki gayi numaya ubhaar dikha diya hai; aaj ke upar ki harkats ne 184.40 ki ahem rukawat par dobara zor diya hai. Is rukawat ko saf karne wala ek qaabil-e-faisla toot jaane ki soorat mein yeh darsata hai ke 188.60 ke oonchey se haal hi mein hoti hui. Tu hi Trad Mein take profit Use karein gy.

GBP/JPY ko one Hour's ka time Frame par Analysis karay to is GBP/JPY ka one Hour's ka time Frame par ak long uptrending ban raha ha or jo GBP/JPY ha ya is ko is time par price ha ya 181.16 par move kar rahi ha or is time par koi signal ni mil raha traders is ma GBP/JPY ki one hour's ke candle ka support ya resistance level ka nearly ma jana ka wait karay ga jo is GBP/JPY ka one hour wala time Frame ma jo resistance level ha ya higher ke janab 181.57 par ha or jo support level ha 180.58 par ha or agar is GBP/JPY ku price high ke jaanb moge karti joi jati ha

or high ma jo resistances level ha 181.58 ka 8s ko hit Karti ha ot lowered ma hi isMutabiq market analysis, It is clear that the GBP/JPY currency pair is currently trending (BEARISH). Currently H4 time frame mein dekhi gayi Movement mein kam az kam ye Nazar aata hai ke keemat Simple Movings (AVERAGE) indicators 60 aur 150 ke Neechy ghus sakta hai, jise reference ke taur par liya ja sakta hai ke Market abhi bhi niche jaane ka potenital rakhta hai, is liye agar is haftay mein keemat aur Neeche ja sake toh girawat ko jari rakhne ka aur bhi mauka hai. Pichle haftay mein, is currency pair ne apne Bearish Trending ko jari rakhne mein kamyabi haasil ki thi. Tu GBP/JPY pair pe Trad Say profit len.GBP/JPY pair price h4 chart pay 185.70 Pivot points are running. Chart pay stochastic Indicator 20 levels k ooper crossed over, sath down ka signal show kar raha hai. OSMA Indicator bhi chart pay confirmations k sath sell ka signal show karta hai. If the current bullish movement continues, the chart pay price will reach 183.91, and the usk bad price will test the 183.39 support level.

agar current cost h4 time frame pay bounced hoty hai, aur sath central point line k buy main breakout karty hai, to chart pay price ki upward movements open honay k chances ban saktay hain, jiska target ooper 186.57 aur usk bad price mazeed 187.09 resistance zones ho saktay hain. Mairy's personal predictions are that if the price moves above the central point line in the last week, there are chances that the price will reach its target resistance sectors.

4-hour time frame:

The price of the GBP/JPY pair on the h1 chart is 185.30. Pivot point areas are running. The chart pay stochastic Indicator has crossed 20 levels, indicating a buy signal. OSMA Indicator bhi chart pay confirmations k sath sell ka signal show karta hai. If current bullish movements continue, chart pay price ka target ooper 187.16 aur usk bad price mazeed 187.70 resistance levels will be tested.

agar current cost hourly time frame pay reversed hoty hai, aur sath central point line k sell main breakout karty hai to chart pay price ki downward movements open honay k chances ban saktay hain jiska target neechay 184.38 aur usk bad price mazeed 183.84 support zones ho saktay hain. Mairy's personal predictions are that if the price moves above the central point line in the last week, there are chances that the price will reach its target resistance sectors.

h4 chart pay GBP/JPY pair price 185.30 Pivot points are currently running. The chart pay stochastic Indicator has crossed 20 levels, indicating a buy signal. OSMA Indicator bhi chart pay confirmations k sath sell ka signal show karta hai. If current bullish movements continue, chart pay price ka target ooper 187.16 aur usk bad price mazeed 187.70 resistance levels will be tested.

agar current cost h4 time frame pay reversed hoty hai, aur sath central point line k sell main breakout karty hai, to chart pay price ki downward movements open honay k chances ban saktay hain, jiska target neechay 184.38 aur phir usk bad price mazeed 183.84 support zones ho saktay hain. Mairy's personal predictions are that if the price moves above the central point line in the last week, there are chances that the price will reach its target resistance sectors.

GBP/JPY pair price h4 chart pay 187.39 Pivot points are currently running. The chart pay stochastic Indicator has crossed 20 levels, indicating a buy signal. OSMA Indicator bhi chart pay confirmations k sath sell ka signal show karta hai. If current bullish movements continue, then chart pay price ka target ooper 189.32 aur usk bad price mazeed 189.87 resistance levels will be tested.

agar current cost h4 time frame pay reversed hoty hai, aur sath central point line k sell main breakout karty hai to chart pay price ki downward movements open honay k chances ban saktay hain, jiska target neechay 186.47 aur phir usk bad price mazeed 185.91 support zones ho saktay hain. Mairy's personal predictions are that if the price moves above the central point line in the last week, there are chances that the price will reach its target resistance sectors.

The daily chart of the GBP/JPY pair shows a price of 187.39. Pivot point areas are currently active. The chart pay stochastic Indicator has crossed 20 levels, indicating a buy signal. OSMA Indicator bhi chart pay confirmations k sath sell ka signal show karta hai. If current bullish movements continue, then chart pay price ka target ooper 189.32 aur usk bad price mazeed 189.87 resistance levels will be tested.

agar current cost daily time frame pay reversed hoty hai, aur sath central point line k sell main breakout karty hai to chart pay price ki downward movements open honay k chances ban saktay hain jiska target neechay 186.47 aur usk bad price mazeed 185.91 support zones ho saktay hain. Mairy's personal predictions are that if the price moves above the central point line in the last week, there are chances that the price will reach its target resistance sectors.

1-hour time frame:

GBP/JPY ko Four Hour's ka Times Frames par Analysis kiya jay to is GBP/JPY ka Four Hour's ka Time Frame par jo supporting level ha ya lowered ke traf 180.08 par ha or jo is GBP/JPY ka four Hour's ka Time Frame par resistance level ha ya 182.08 par ha or agar is GBP/JPY ki price is ka Four hour's wala time frame ma lowered ke traf supporting level 180.08 ke janab jati ha or jo four hours ke candel ha is GBP/JPY ki ya is supporting level 180.08 ka level ko hit kar ka high ma closed hoti ha to Trader's is making buyer's ke janab ki trade ko enter karay ga

or is trade ka jo profit Target ho ga is ko higher ke traf 100 points par place karay ga or agar is gbp/jpy ki Price Lowered jana ka bajai higher ke traf jati ha or GBP/JPY ki jo four hours ke Candlesticks ha ya high ma jo resistance level ha 182.08 ka is resistance level ko hit kar ka is GBP/JPY ki four hours ke candel lower ma hi close ho jati ha to is ma traders ko GBP/JPY ki Price ka downward jana ka signal mila ga or traders is gbp/jpy ma sell ke trade ko enter karay ga Tu Trad Ho gy.GBP/JPY currency pair se nazar andaz ki gayi numaya ubhaar dikha diya hai; aaj ke upar ki harkats ne 184.40 ki ahem rukawat par dobara zor diya hai. Is rukawat ko saf karne wala ek qaabil-e-faisla toot jaane ki soorat mein yeh darsata hai ke 188.60 ke oonchey se haal hi mein hoti hui. Tu hi Trad Mein take profit Use karein gy.

GBP/JPY ko one Hour's ka time Frame par Analysis karay to is GBP/JPY ka one Hour's ka time Frame par ak long uptrending ban raha ha or jo GBP/JPY ha ya is ko is time par price ha ya 181.16 par move kar rahi ha or is time par koi signal ni mil raha traders is ma GBP/JPY ki one hour's ke candle ka support ya resistance level ka nearly ma jana ka wait karay ga jo is GBP/JPY ka one hour wala time Frame ma jo resistance level ha ya higher ke janab 181.57 par ha or jo support level ha 180.58 par ha or agar is GBP/JPY ku price high ke jaanb moge karti joi jati ha

or high ma jo resistances level ha 181.58 ka 8s ko hit Karti ha ot lowered ma hi isMutabiq market analysis, It is clear that the GBP/JPY currency pair is currently trending (BEARISH). Currently H4 time frame mein dekhi gayi Movement mein kam az kam ye Nazar aata hai ke keemat Simple Movings (AVERAGE) indicators 60 aur 150 ke Neechy ghus sakta hai, jise reference ke taur par liya ja sakta hai ke Market abhi bhi niche jaane ka potenital rakhta hai, is liye agar is haftay mein keemat aur Neeche ja sake toh girawat ko jari rakhne ka aur bhi mauka hai. Pichle haftay mein, is currency pair ne apne Bearish Trending ko jari rakhne mein kamyabi haasil ki thi. Tu GBP/JPY pair pe Trad Say profit len.GBP/JPY pair price h4 chart pay 185.70 Pivot points are running. Chart pay stochastic Indicator 20 levels k ooper crossed over, sath down ka signal show kar raha hai. OSMA Indicator bhi chart pay confirmations k sath sell ka signal show karta hai. If the current bullish movement continues, the chart pay price will reach 183.91, and the usk bad price will test the 183.39 support level.

agar current cost h4 time frame pay bounced hoty hai, aur sath central point line k buy main breakout karty hai, to chart pay price ki upward movements open honay k chances ban saktay hain, jiska target ooper 186.57 aur usk bad price mazeed 187.09 resistance zones ho saktay hain. Mairy's personal predictions are that if the price moves above the central point line in the last week, there are chances that the price will reach its target resistance sectors.

4-hour time frame:

The price of the GBP/JPY pair on the h1 chart is 185.30. Pivot point areas are running. The chart pay stochastic Indicator has crossed 20 levels, indicating a buy signal. OSMA Indicator bhi chart pay confirmations k sath sell ka signal show karta hai. If current bullish movements continue, chart pay price ka target ooper 187.16 aur usk bad price mazeed 187.70 resistance levels will be tested.

agar current cost hourly time frame pay reversed hoty hai, aur sath central point line k sell main breakout karty hai to chart pay price ki downward movements open honay k chances ban saktay hain jiska target neechay 184.38 aur usk bad price mazeed 183.84 support zones ho saktay hain. Mairy's personal predictions are that if the price moves above the central point line in the last week, there are chances that the price will reach its target resistance sectors.

h4 chart pay GBP/JPY pair price 185.30 Pivot points are currently running. The chart pay stochastic Indicator has crossed 20 levels, indicating a buy signal. OSMA Indicator bhi chart pay confirmations k sath sell ka signal show karta hai. If current bullish movements continue, chart pay price ka target ooper 187.16 aur usk bad price mazeed 187.70 resistance levels will be tested.

agar current cost h4 time frame pay reversed hoty hai, aur sath central point line k sell main breakout karty hai, to chart pay price ki downward movements open honay k chances ban saktay hain, jiska target neechay 184.38 aur phir usk bad price mazeed 183.84 support zones ho saktay hain. Mairy's personal predictions are that if the price moves above the central point line in the last week, there are chances that the price will reach its target resistance sectors.

GBP/JPY pair price h4 chart pay 187.39 Pivot points are currently running. The chart pay stochastic Indicator has crossed 20 levels, indicating a buy signal. OSMA Indicator bhi chart pay confirmations k sath sell ka signal show karta hai. If current bullish movements continue, then chart pay price ka target ooper 189.32 aur usk bad price mazeed 189.87 resistance levels will be tested.

agar current cost h4 time frame pay reversed hoty hai, aur sath central point line k sell main breakout karty hai to chart pay price ki downward movements open honay k chances ban saktay hain, jiska target neechay 186.47 aur phir usk bad price mazeed 185.91 support zones ho saktay hain. Mairy's personal predictions are that if the price moves above the central point line in the last week, there are chances that the price will reach its target resistance sectors.

The daily chart of the GBP/JPY pair shows a price of 187.39. Pivot point areas are currently active. The chart pay stochastic Indicator has crossed 20 levels, indicating a buy signal. OSMA Indicator bhi chart pay confirmations k sath sell ka signal show karta hai. If current bullish movements continue, then chart pay price ka target ooper 189.32 aur usk bad price mazeed 189.87 resistance levels will be tested.

agar current cost daily time frame pay reversed hoty hai, aur sath central point line k sell main breakout karty hai to chart pay price ki downward movements open honay k chances ban saktay hain jiska target neechay 186.47 aur usk bad price mazeed 185.91 support zones ho saktay hain. Mairy's personal predictions are that if the price moves above the central point line in the last week, there are chances that the price will reach its target resistance sectors.

تبصرہ

Расширенный режим Обычный режим