GBP/JPY Jodi: An Overview and Analysis

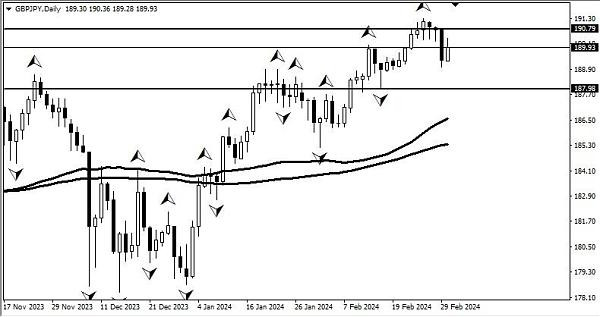

GBP/JPY jodi ne peechle nuqsanat se aaghaz kiya aur daily timeframe par mojooda uncha darja 190.80 ko tor diya. Lekin, yeh dynamic SMA5 aur SMA10 indicators se rukawat ka samna kar rahi hai, jis se mazeed urooj ki maumkin tajawuzat ka inkaar ho sakta hai. Agar jodi is rukawat darjy ke neeche rahe, to 187.98 ke sahara ki taraf wapas ka imkan hai, khas tor par agar woh 187.82 ke rukawat darjy ko torne mein nakam rahe.

Dor-e-Guzashta ki Rujhanat:

GBP/JPY jodi ki dor-e-guzashta ki rujhanat ko samajhne ke liye, humein pichli karwaiyon aur muddaton ki kimat ka jayeza lena hoga. Is doran, yeh jodi 190.80 ke uncha darja ko tor kar agay badhi, jo ke aik ahem rukawat darja hai. Lekin, is uncha darje se guzarnay mein jodi ko kisi bhi had tak mushkilat ka samna karna para, khas tor par dynamic SMA5 aur SMA10 indicators ke rad-e-amal ki wajah se. Yeh indicators mojooda market halat ko samajhne aur tezi se faeslon par amal karne mein madadgar hote hain.

Trend ki Tabeer:

Halqumandi ki nazar mein, mojooda trend taraf se tasalsul par hai, lekin qeemat ke harkat is downward trend ko saabit karti hai. Is haftay mein sellers ne 0.6090 ke sahara ko test kiya jo ke 0.6210 ilaqe se shuru hone wale izafay ko mita diya. Aur mojooda sorat-e-hal mein, buyers ko bullish dabao dene ki koshish ho rahi hai lekin harkat intehai eham nahi hai. Aur chand ghati tak volatility kaafi kam hai, is liye qeemat ki harkat abhi bhi supply aur demand ke darmiyan mozu hai.

Trading Signal:

Main ek sell position kholonga jab qeemat 0.6170 ke safarash par mazeed oopar uthaye gi. Phir, agar sellers bearish dabao daal sakte hain to rejection ka jazb kiya jaye ga, hum qeemat ka target giraawat ke liye 0.6030 ke darje par rakh sakte hain. Phir, agar qeemat 2 dino ke andar us ilaqe mein baith jaye, to main aik averaging sell karne ka mansoobah banaonga kyun ke seller se tasdiq ka tajurba hota hai ke mukhfi ka reversal ho sakta hai. Aur doosre sell position ke liye TP target ko 0.5850 ke ilaqe mein rakh sakte hain.

Halqumandi:

Aakhri tor par, jodi ko dobara se downtrend mein jari rakhne ka muntazir hoon aur qareebi sahara darjaton ke nazdeek, mojooda global uttari trend ko mad-e-nazar rakhte hue, main uptrend ka dobara jari honay ka intezar karta hoon. Yah ek tezabi jazoobati masla hai jisme karkunon ko imtiaz aur tehqiqati jazbat se samajhne ki zarurat hoti hai taake woh munafa haasil kar sakein.

GBP/JPY jodi ne peechle nuqsanat se aaghaz kiya aur daily timeframe par mojooda uncha darja 190.80 ko tor diya. Lekin, yeh dynamic SMA5 aur SMA10 indicators se rukawat ka samna kar rahi hai, jis se mazeed urooj ki maumkin tajawuzat ka inkaar ho sakta hai. Agar jodi is rukawat darjy ke neeche rahe, to 187.98 ke sahara ki taraf wapas ka imkan hai, khas tor par agar woh 187.82 ke rukawat darjy ko torne mein nakam rahe.

Dor-e-Guzashta ki Rujhanat:

GBP/JPY jodi ki dor-e-guzashta ki rujhanat ko samajhne ke liye, humein pichli karwaiyon aur muddaton ki kimat ka jayeza lena hoga. Is doran, yeh jodi 190.80 ke uncha darja ko tor kar agay badhi, jo ke aik ahem rukawat darja hai. Lekin, is uncha darje se guzarnay mein jodi ko kisi bhi had tak mushkilat ka samna karna para, khas tor par dynamic SMA5 aur SMA10 indicators ke rad-e-amal ki wajah se. Yeh indicators mojooda market halat ko samajhne aur tezi se faeslon par amal karne mein madadgar hote hain.

Trend ki Tabeer:

Halqumandi ki nazar mein, mojooda trend taraf se tasalsul par hai, lekin qeemat ke harkat is downward trend ko saabit karti hai. Is haftay mein sellers ne 0.6090 ke sahara ko test kiya jo ke 0.6210 ilaqe se shuru hone wale izafay ko mita diya. Aur mojooda sorat-e-hal mein, buyers ko bullish dabao dene ki koshish ho rahi hai lekin harkat intehai eham nahi hai. Aur chand ghati tak volatility kaafi kam hai, is liye qeemat ki harkat abhi bhi supply aur demand ke darmiyan mozu hai.

Trading Signal:

Main ek sell position kholonga jab qeemat 0.6170 ke safarash par mazeed oopar uthaye gi. Phir, agar sellers bearish dabao daal sakte hain to rejection ka jazb kiya jaye ga, hum qeemat ka target giraawat ke liye 0.6030 ke darje par rakh sakte hain. Phir, agar qeemat 2 dino ke andar us ilaqe mein baith jaye, to main aik averaging sell karne ka mansoobah banaonga kyun ke seller se tasdiq ka tajurba hota hai ke mukhfi ka reversal ho sakta hai. Aur doosre sell position ke liye TP target ko 0.5850 ke ilaqe mein rakh sakte hain.

Halqumandi:

Aakhri tor par, jodi ko dobara se downtrend mein jari rakhne ka muntazir hoon aur qareebi sahara darjaton ke nazdeek, mojooda global uttari trend ko mad-e-nazar rakhte hue, main uptrend ka dobara jari honay ka intezar karta hoon. Yah ek tezabi jazoobati masla hai jisme karkunon ko imtiaz aur tehqiqati jazbat se samajhne ki zarurat hoti hai taake woh munafa haasil kar sakein.

تبصرہ

Расширенный режим Обычный режим