NZD USD

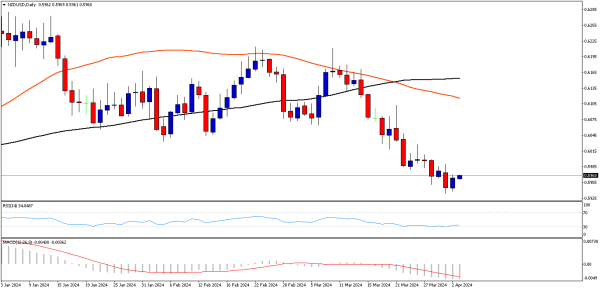

NZD/USD Fundamental & Takneeki Vishleshan: Jaise hum NZD/USD currency pair mein dekhte hain, bechne waale mazboot qabza banaye rakh rahe hain, jabki alag-alag suchak oversold sthitiyon ke nazdeek pahunch rahe hain. Ye trend, daily chart par spasht hai, aur beech beech ke badlavon ke bawajood bana hai, jo lagataar giraawat ki bhavna ko darshata hai. Jab bechne waale apna prabhav banaye rakh rahe hain, toh nazar andar hone waale bhavishya mein sambhav giraawat ko darshata hai. In bazaar gatiyon ke beech, ghanto ke Relative Strength Index (RSI) se ek moolyankan samaksh aham vikas saamne aata hai, jo sudhar ke sanket dikhata hai. Majboot punarpratishodh ke saath, RSI ne sakaratmak zone mein gehri tezi se badhav kiya hai, jo kharidne waalon ke liye ek samayik punarjagran darshata hai. Ghante ke samay frame par momentum mein is parivartan ne chhoti avdhi ke liye kuchh ummeed ki kirnon ko pesh karta hai.

Halaanki, in badlavon ke beech, satarkta ka abhyas vyapar mein mahatvapurn bearish crossover ko 0.6070 ke mahatvapurn star par dekha gaya hai. Ye ghatna ek mazboot bearish dhruvav ko darshata hai, jo agle samay ke liye neeche ki disha ko mazboot kar sakta hai. Vyapariyon ko is vikas ko dhaara mein lena chahiye kyun ki yah bazar mein neeche ki dabav ko darshane ki sambhavna ko darshata hai. In bazaar gatiyon ko samajhne ke liye satarkta aur stratgeek faisle lene ki aavashyakta hai. Jabki ghante ka RSI punarpratishodh kharidne waalon ke liye samayik rahat pradaan kar sakta hai, toh adhikansh trend yah darshata hai ki bechne waale mazbooti se prabhavit rahte hain. Suchakon ko kareeb se monitor karna aur bazar vikas ke baare mein jaankari prapt karna vyapariyon ke liye jaroori hoga jo in parivartanakari sthitiyon ko prabhavshali tarike se samajhna chahte hain.

Halaanki, agar keemat 0.5940 ke star ke neeche girti hai, toh yah bearon ko keemat ko 0.5900 ke sthaaniya samarthan tak dhakelne ke liye aur momentum pradaan kar sakti hai. Vyapari in staron ko dhyaan se monitor kar rahe hain taki sambhav bazar disha ko mapne aur soojh-boojh ke saath vyaparik faisle lene mein saksham ho sakein.

NZD/USD Fundamental & Takneeki Vishleshan: Jaise hum NZD/USD currency pair mein dekhte hain, bechne waale mazboot qabza banaye rakh rahe hain, jabki alag-alag suchak oversold sthitiyon ke nazdeek pahunch rahe hain. Ye trend, daily chart par spasht hai, aur beech beech ke badlavon ke bawajood bana hai, jo lagataar giraawat ki bhavna ko darshata hai. Jab bechne waale apna prabhav banaye rakh rahe hain, toh nazar andar hone waale bhavishya mein sambhav giraawat ko darshata hai. In bazaar gatiyon ke beech, ghanto ke Relative Strength Index (RSI) se ek moolyankan samaksh aham vikas saamne aata hai, jo sudhar ke sanket dikhata hai. Majboot punarpratishodh ke saath, RSI ne sakaratmak zone mein gehri tezi se badhav kiya hai, jo kharidne waalon ke liye ek samayik punarjagran darshata hai. Ghante ke samay frame par momentum mein is parivartan ne chhoti avdhi ke liye kuchh ummeed ki kirnon ko pesh karta hai.

Halaanki, in badlavon ke beech, satarkta ka abhyas vyapar mein mahatvapurn bearish crossover ko 0.6070 ke mahatvapurn star par dekha gaya hai. Ye ghatna ek mazboot bearish dhruvav ko darshata hai, jo agle samay ke liye neeche ki disha ko mazboot kar sakta hai. Vyapariyon ko is vikas ko dhaara mein lena chahiye kyun ki yah bazar mein neeche ki dabav ko darshane ki sambhavna ko darshata hai. In bazaar gatiyon ko samajhne ke liye satarkta aur stratgeek faisle lene ki aavashyakta hai. Jabki ghante ka RSI punarpratishodh kharidne waalon ke liye samayik rahat pradaan kar sakta hai, toh adhikansh trend yah darshata hai ki bechne waale mazbooti se prabhavit rahte hain. Suchakon ko kareeb se monitor karna aur bazar vikas ke baare mein jaankari prapt karna vyapariyon ke liye jaroori hoga jo in parivartanakari sthitiyon ko prabhavshali tarike se samajhna chahte hain.

Halaanki, agar keemat 0.5940 ke star ke neeche girti hai, toh yah bearon ko keemat ko 0.5900 ke sthaaniya samarthan tak dhakelne ke liye aur momentum pradaan kar sakti hai. Vyapari in staron ko dhyaan se monitor kar rahe hain taki sambhav bazar disha ko mapne aur soojh-boojh ke saath vyaparik faisle lene mein saksham ho sakein.

تبصرہ

Расширенный режим Обычный режим