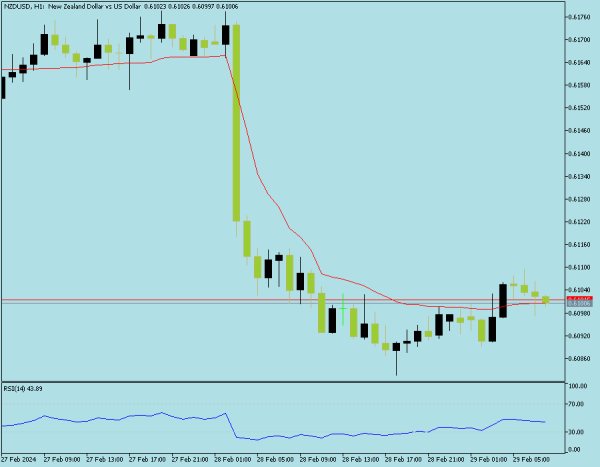

Nzd / Usd Rozana H1 Time Frame Chart:

salam. mukammal mandi wali mom batii ki mojoodgi pehlay ki yomiya had ke kam se neechay aik hamwar settling ka baais bani. jaisa ke pehlay zikar kiya gaya hai, mein is imkaan ko tasleem karta hon ke baichnay walay qeemat ko qareeb tareen nzd / usd rozana h1 time frame chart support level ki taraf barha rahay hain, jis ki nishandahi 0. 6098 par hai. mere nishanaat ki bunyaad par. is support level ke aas paas, do mumkina mnzrname samnay aa satke hain. ibtidayi manzar naame mein is satah ke neechay qeemat ka istehkaam shaamil hai, jo baad mein neechay ki taraf jane ki raah hamwar karta hai. agar yeh manzar nama amli shakal ikhtiyar karta hai to, meri tawaqqa hai ke qeemat is support ki satah ki taraf barhay gi jis par waqay hai. is support level ke qareeb mein, mein sabr ke sath trading set up ki tashkeel ka intzaar karoon ga, agay ki raftaar ke baray mein qeemti baseerat faraham karta hon. mojooda gravt ka rujhan kam honay ke koi assaar nahi dekhata, is manzar naame ko dekhte hue qader mein kami ke sath, aik samajh daar faisla farokht karne ka ho ga, jis mein jald baazi ke iqdamaat ke bajaye pursukoon hisaab kitaab aur sabr ki zaroorat par zor diya jaye ga. satah par wapsi ki tawaqqa karte hue, tawaqqa wazeh hai, jis ki wajah se monitor ki screen sorat e haal ki shiddat se garam ho jati hai. nichale hissay mein aik sazgaar candle stuck patteren ki ahmiyat par zor dete hue, umeed parasti mumkina munafe ke mawaqay ki nishandahi karti hai. is hikmat e amli par qaim rehne ki ahmiyat par aik stap set ke sath wazeh ho jata hai, jo ke tay shuda mansoobay se inhiraf ke mumkina nataij ko tasleem karta hai. jism par mojood nuqta ke zikar se sorat e haal ki shiddat ko mazeed wazeh kya jata hai, jis se tamam harkaat ki nigrani aur tashreeh ki ahmiyat wazeh hoti hai .

market –apne aap ko aik ghair yakeeni haalat mein paati hai, jo ke 0. 6097 par waqay muqami nzd / usd yomiya h1 time frame chart support zone ke qurbat mein mutadid bearish lambi mom btyon ke wujood aur istehkaam ki mojooda haalat se wazeh tor par wazeh hai. khaas tor par, aik humahangi qabil mushahida hai jis ke darmiyan mumkina tor par aik isharay, aur market chart ho sakta hai. yeh hum ahangi aik isharay ke tor par kaam karti hai, jo market ki harkiyaat mein anay wali tabdeeli ke imkaan ki taraf ishara karti hai. h1 chart rujat ka tajzia karne par, yeh wazeh ho jata hai ke baichnay walay mayoosi ke jazbaat ka muzahira karte hue, market mein kami ke liye koshan hain, jabkay taizi ka rujhan barqarar hai. ki hawala kardah qader oopri channel ki had se tajawaz kar jati hai. yeh qiyaas kya jata hai ke farokht knndgan ki taraf se kaafi muzahmat ka saamna karte hue sharah satah tak pahonch sakti hai. is satah tak pounchanay par, hooshiyar karwai mein soorat e haal ka jaiza lainay ya orders ko mehfooz karne ke liye pozishnin band karna shaamil ho sakta hai. aik mutabadil hikmat e amli position ko barqarar rakhna ho sakti hai, rujhan mein tabdeeli ko sun-hwa dainay ke liye, aik fa-aal taizi ki muhim ko farogh dainay ke liye satah ki paish Raft ki tawaqqa karna .

salam. mukammal mandi wali mom batii ki mojoodgi pehlay ki yomiya had ke kam se neechay aik hamwar settling ka baais bani. jaisa ke pehlay zikar kiya gaya hai, mein is imkaan ko tasleem karta hon ke baichnay walay qeemat ko qareeb tareen nzd / usd rozana h1 time frame chart support level ki taraf barha rahay hain, jis ki nishandahi 0. 6098 par hai. mere nishanaat ki bunyaad par. is support level ke aas paas, do mumkina mnzrname samnay aa satke hain. ibtidayi manzar naame mein is satah ke neechay qeemat ka istehkaam shaamil hai, jo baad mein neechay ki taraf jane ki raah hamwar karta hai. agar yeh manzar nama amli shakal ikhtiyar karta hai to, meri tawaqqa hai ke qeemat is support ki satah ki taraf barhay gi jis par waqay hai. is support level ke qareeb mein, mein sabr ke sath trading set up ki tashkeel ka intzaar karoon ga, agay ki raftaar ke baray mein qeemti baseerat faraham karta hon. mojooda gravt ka rujhan kam honay ke koi assaar nahi dekhata, is manzar naame ko dekhte hue qader mein kami ke sath, aik samajh daar faisla farokht karne ka ho ga, jis mein jald baazi ke iqdamaat ke bajaye pursukoon hisaab kitaab aur sabr ki zaroorat par zor diya jaye ga. satah par wapsi ki tawaqqa karte hue, tawaqqa wazeh hai, jis ki wajah se monitor ki screen sorat e haal ki shiddat se garam ho jati hai. nichale hissay mein aik sazgaar candle stuck patteren ki ahmiyat par zor dete hue, umeed parasti mumkina munafe ke mawaqay ki nishandahi karti hai. is hikmat e amli par qaim rehne ki ahmiyat par aik stap set ke sath wazeh ho jata hai, jo ke tay shuda mansoobay se inhiraf ke mumkina nataij ko tasleem karta hai. jism par mojood nuqta ke zikar se sorat e haal ki shiddat ko mazeed wazeh kya jata hai, jis se tamam harkaat ki nigrani aur tashreeh ki ahmiyat wazeh hoti hai .

market –apne aap ko aik ghair yakeeni haalat mein paati hai, jo ke 0. 6097 par waqay muqami nzd / usd yomiya h1 time frame chart support zone ke qurbat mein mutadid bearish lambi mom btyon ke wujood aur istehkaam ki mojooda haalat se wazeh tor par wazeh hai. khaas tor par, aik humahangi qabil mushahida hai jis ke darmiyan mumkina tor par aik isharay, aur market chart ho sakta hai. yeh hum ahangi aik isharay ke tor par kaam karti hai, jo market ki harkiyaat mein anay wali tabdeeli ke imkaan ki taraf ishara karti hai. h1 chart rujat ka tajzia karne par, yeh wazeh ho jata hai ke baichnay walay mayoosi ke jazbaat ka muzahira karte hue, market mein kami ke liye koshan hain, jabkay taizi ka rujhan barqarar hai. ki hawala kardah qader oopri channel ki had se tajawaz kar jati hai. yeh qiyaas kya jata hai ke farokht knndgan ki taraf se kaafi muzahmat ka saamna karte hue sharah satah tak pahonch sakti hai. is satah tak pounchanay par, hooshiyar karwai mein soorat e haal ka jaiza lainay ya orders ko mehfooz karne ke liye pozishnin band karna shaamil ho sakta hai. aik mutabadil hikmat e amli position ko barqarar rakhna ho sakti hai, rujhan mein tabdeeli ko sun-hwa dainay ke liye, aik fa-aal taizi ki muhim ko farogh dainay ke liye satah ki paish Raft ki tawaqqa karna .

تبصرہ

Расширенный режим Обычный режим