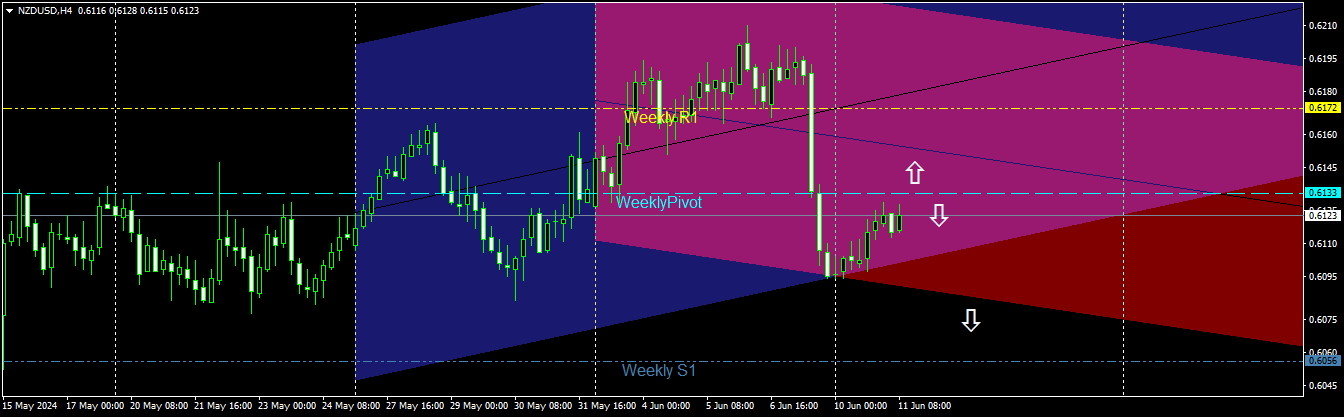

aik acha din ho! Linear regression channel ka dhaalaan H4 graph ke mutabiq ooper hai. Yeh is baat ki nishani hai ke kharidar 0.62067 ke level tak pohanchne ki koshish kar raha hai. Maqsad tak pohanchne par harakat sust ho jaayegi. Kamzori ki wajah se, utar chadhaav mein kami aayegi, bazaar dheema ho jaayega, aur aik correction ke saath dobara taqat ikatthi karna zaroori ho jaayega. Channel ke uper hissa ko khareedari ke tor par na dekha jaaye; aapko 0.61796 tak correction ka intezaar karna hoga. Yahan par aap apni khareedari ka soch sakte hain. Agar yeh 0.61796 ke neeche mazbooti se consolidate hota hai, to bear apne aap ko zahir karega, jo bazaar ko neeche le ja sakta hai. Is liye, is soorat-e-haal mein khareedari dilchaspi nahi rehti. Channel ka konah yeh dikhata hai ke bull kitna active hai; jitna bara konah, utna zyada taqatwar kharidar. Ek mazboot channel konah aksar market news action ka ishara hota hai jo achi harakat ke liye madadgar hota hai.

Bari tasveer dekhne ke liye image par click karein. Title: NZDUSDM15.png Views: 0 Size: 35.4 Kb ID: 36231729. Main linear regression channel H4 par waqe hai, aur mai isay harakaton ka taayun karne ke liye istimaal karta hoon. Channel H4, auxiliary hai, jo ab bullish picture ko mukammal kar raha hai, jo ke barhte hue trend ko highlight karta hai. Channels aik hi direction mein move kar rahe hain; is instrument ke bullish sentiment ko is se characterize kiya ja sakta hai. Agar lower period par signal toot jaaye, to aapko 0.61776 tak girawat ka intezaar karna chahiye. Jahan se aap 0.62204 tak khareedari par ghoor kar sakte hain. Channel ke upper border par, jab bulls wahan hote hain, mai khareedari se door rehta hoon, aur bechne se bhi, jo mere liye abhi kante hain. Mere trading ka asal usool yeh hai ke H4 channel ke movement ke direction mein trade karoon, kyun ke yeh mera main channel hai. Junior channel par entry ko wazeh karna aur strong movements ke doran kaam karna acha hota hai, jab correction minimal ho.aap cost development ko Monday se Wednesday tak dekhte hain to dekhein gay ke kharidaron ke maqami asarain hain. Thori na-mawafiq arzi surat-e-hal bullish patterns ko kam kar sakti hain. Halat ke mutabiq, haftay ke akhir mein keemat 0.6107 hai. Haftay ke exchange mein, shama ne 0.6130 se thori na-mawafiq range ke saath band kiya. Uper diye gaye shiray se wazeh hai ke kharidaron ka asar market par jari hai. Theo ne 0.61070 par rok laga di hai kyunke ye haftay ki khatam hone wali ek waqiya hai. Aglay haftay ke liye hamari trading ka markaz kharid ki position lena hoga kyunke NzdUsd market par kharidaron ka asar ek sab se badi quwwat hai. Jald hi, shama 0.61700 ke qareebi had tak pohanchne ki koshish kar sakti hai, jo aglay bullish safar ka maqsood hai. Jo bullish trend kuch dino pehle shuru hua tha, wo agle haftay jari rahega. Haftay ke ibtedayi dour mein market ka mahol abhi bhi ek nichey ki sudhar mein hai, shayad 0.61070 tak ja sakta hai. Haftay ke darmiyan dakhil hone ke baad, shama ek bullish pattern ka mutabaadil kar sakti hai.Aakhir mein, NzdUsd ki keemat bullish pattern ke mutabiq agay barhti rahi sakti hai takay traders ka maqsood pohanch sake. Aglay haftay mein, keemat ka ek dilchasp mauqa hai ke woh agay ke design ke saath jari rahe, kam az kam is se oopar ki satah ko test karne ka. Chahe keemat ka agla bullish maqsad haasil ho jane ka imkan ho ya na ho, agar ye kaam kamyab hota hai

Bari tasveer dekhne ke liye image par click karein. Title: NZDUSDM15.png Views: 0 Size: 35.4 Kb ID: 36231729. Main linear regression channel H4 par waqe hai, aur mai isay harakaton ka taayun karne ke liye istimaal karta hoon. Channel H4, auxiliary hai, jo ab bullish picture ko mukammal kar raha hai, jo ke barhte hue trend ko highlight karta hai. Channels aik hi direction mein move kar rahe hain; is instrument ke bullish sentiment ko is se characterize kiya ja sakta hai. Agar lower period par signal toot jaaye, to aapko 0.61776 tak girawat ka intezaar karna chahiye. Jahan se aap 0.62204 tak khareedari par ghoor kar sakte hain. Channel ke upper border par, jab bulls wahan hote hain, mai khareedari se door rehta hoon, aur bechne se bhi, jo mere liye abhi kante hain. Mere trading ka asal usool yeh hai ke H4 channel ke movement ke direction mein trade karoon, kyun ke yeh mera main channel hai. Junior channel par entry ko wazeh karna aur strong movements ke doran kaam karna acha hota hai, jab correction minimal ho.aap cost development ko Monday se Wednesday tak dekhte hain to dekhein gay ke kharidaron ke maqami asarain hain. Thori na-mawafiq arzi surat-e-hal bullish patterns ko kam kar sakti hain. Halat ke mutabiq, haftay ke akhir mein keemat 0.6107 hai. Haftay ke exchange mein, shama ne 0.6130 se thori na-mawafiq range ke saath band kiya. Uper diye gaye shiray se wazeh hai ke kharidaron ka asar market par jari hai. Theo ne 0.61070 par rok laga di hai kyunke ye haftay ki khatam hone wali ek waqiya hai. Aglay haftay ke liye hamari trading ka markaz kharid ki position lena hoga kyunke NzdUsd market par kharidaron ka asar ek sab se badi quwwat hai. Jald hi, shama 0.61700 ke qareebi had tak pohanchne ki koshish kar sakti hai, jo aglay bullish safar ka maqsood hai. Jo bullish trend kuch dino pehle shuru hua tha, wo agle haftay jari rahega. Haftay ke ibtedayi dour mein market ka mahol abhi bhi ek nichey ki sudhar mein hai, shayad 0.61070 tak ja sakta hai. Haftay ke darmiyan dakhil hone ke baad, shama ek bullish pattern ka mutabaadil kar sakti hai.Aakhir mein, NzdUsd ki keemat bullish pattern ke mutabiq agay barhti rahi sakti hai takay traders ka maqsood pohanch sake. Aglay haftay mein, keemat ka ek dilchasp mauqa hai ke woh agay ke design ke saath jari rahe, kam az kam is se oopar ki satah ko test karne ka. Chahe keemat ka agla bullish maqsad haasil ho jane ka imkan ho ya na ho, agar ye kaam kamyab hota hai

تبصرہ

Расширенный режим Обычный режим