As-salam-o-alaikum sabhi members, aaj aap sab ka waqt shukriya. Aaj ki baat chit ka mudda hoga NZD/USD pair ka takhliqi tajziya. NZD/USD ka daam 0.6166 ilaqa mein chal raha hai. NZD/USD ka daam abhi ek nisbatan chhota range mein trading kar raha hai. Agar aap NZD/USD ke banae gaye pattern ko dekhte hain, toh ek imkaan hai ke Somwar ko, NZD/USD baar baar barh sakta hai. Isi tarah, mujhe lagta hai ke NZD/USD ko mad-e-nazar rakhte hue kharidne ka alternative ab bhi qeemti hai. NZD/USD ke kharidar haal hi mein barqarar Relative Strength Index (RSI) aur haal mein dhimi taraqqi se daga mili hai. Ek hi waqt mein, moving average convergence divergence (MACD) indicator manfi level ke thoda sa upar trading kar raha hai. NZD/USD ka 50-EMA aur 20-EMA ke upar barqarar trading bullish bias ko support kar sakta hai. NZD/USD ke liye foran ka rukawat darja 0.6336 hai. Agar kharidne ki dabao zyada hoti hai, daam nazdeeki muddai rukawat ilaqa ko 0.6712 par test kar sakta hai. Jab yeh rukawat paar ki jaaye gi, toh bailon ka nishaandah lambi muddati muntaqil hone wale sudhaar rukawat 0.7196 par jo radar par hai, woh teesra rukawat darja hai. Ek aur manzar hai ke daam palat kar girne shuru ho sakta hai aur 0.5792 support ko dobara test karne ke liye. Doosri taraf, is time frame mein, foran ka support 0.5488 2nd line of defense ka kaam kar sakta hai agar jodi palat kar neeche jaye. Uske baad, agar NZD/USD ka daam gir jaaye aur 0.5121 ilaqa ko guzar jaaye, toh nashonuma option mumkin nahi hoga. Is halat mein, hum 0.6712 ka maqsad rakhte hue baarh ki jaari hone ka intezar kar sakte hain. Mujhe yakeen hai ke yeh waqt hai ke traders ko NZD/USD ke baare mein sochna shuru karna chahiye. Main ne bohot se mazameen parhe hain aur videos dekhi hain jo is saal NZD/USD ke bare mein baat karha hai

No announcement yet.

X

Collapse

new posts

-

#2056 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2057 Collapse

NZD/USD Tanqeed

Forex trading ke dynamic duniya mein, NZD/USD currency pair ka khaas tawajjo hasil ki gayi hai, khaaskar is ke haal ki qeemat ke hawale se jo 0.60 ke ahem darje par musalsal ghoomti rehti hai. Jabke zehni asrat bila shuba market ki jazbat par asar andaaz hote hain, sirf in pe bharosa karne se shayad market ka rawaiya ka mukammal tajziya nahi mil sakta. Is liye, zaroori hai ke NZD/USD pair ke fluctuations ko chalane wale zehni aur bunyadi asrat ke darmiyan takrar ko samajhne ke liye gehrai se mutala karna.

Psychological Asar 0.60 Darje Ko Toorna:

0.60 darja traders aur investors ke liye zehni tor par ahmiyat rakhta hai. Ye ek ahem sahara aur resistance darja hai, jo market ki jazbat ko buland maqam par badalne ka ek eham nuqta hai. Agar ye darja neeche se toot jaye to ye ek zehni rukawat banata hai, kyunke traders mazeed farokht order shuru karne mein ehtiyaat barat sakte hain, mazeed nichle risks se darte hue. Mukhtalif, agar pair 0.60 ke oopar pohanch jaye, to yeh khareedaron mein itminan bhar sakta hai, shayad bullish rally ko chalu karne ki koshish kare. Is liye, is darje ke ird gird mojood zehni dynamics ko samajhna market ke jazbat aur qeemat ke maamle ko jaanne ke liye ahem hai.

Khabron Ki Events Ka Kirdar Forex Trading Mein:Zehni asrat ke ilawa, khabron ki events forex market ki harkat mein aham kirdar ada karte hain, jaise NZD/USD pair ke hawale se. Khabron ki announcements, jaise ke maeeshati indicators, central bank ki statements, aur geopolitcal developments, currency pairs ke sudden shifts ko paida karne ki qudrat rakhte hain, inki direction aur momentum ko mutasir karte hain. Masalan, New Zealand se musbat maeeshati data ya America ke maeeshat ke mutaliq musbat taraqqiyan NZD ko USD ke mukablay mein mazboot kar sakti hain, pair ko upar le ja sakti hain. Mukhtalif, New Zealand ki maeeshat ke mutaliq manfi khabrein ya America mein musbat taraqqiyan NZD ko USD ke mukablay mein kamzor kar sakti hain, pair ko neeche le ja sakti hain.

- NZDUSD

- Mentions 0

-

سا0 like

-

#2058 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

New Zealand Dollar Thursday ko overall weak ho raha hai jab New Zealand ka leading indicator of consumer confidence February mein tezi se bigar gaya. Currency ko aur bhi pareshani ka samna hai ek economy se jo high inflation aur low growth ka shikaar hai, jo central bank ko koi manevor karne ka kamra nahi chhodta. Bura economic data yeh darust karta hai ke Reserve Bank of New Zealand mushkil mein hai; yeh ko inflation ko kam karne ke liye unchai dar muddon par 5.5% ki high interest rates ko banaye rakhna chahiye, lekin woh tajwez kehne wale honge ke interest rates ko kam karke growth ko tezi dena pasand karenge. Yeh New Zealand Dollar par dabao dalne ka ek aur factor hai. Keemat moving averages ke nichayi taraf hai, lekin pair ne 0.59724 ke darja tak pohanch gaya hai, jo October 2023 ke bullish mahiney ke candle impulse ka adha hai. Yeh ishara kar sakta hai ek upward correction ki mumkinat tak demand zone ki taraf, jo 0.6042-0.6067 hai, halankeh dominant downtrend ko 0.5860 tak complete hone ke baad dobara shuru hone ki umeed hai

New Zealand Dollar kam hua ek tezi se girne ke baad Roy Morgan ka consumer confidence indicator, ek leading index jo economic activity mein consumers ki confidence ko napta hai, ke tez girne ke baad. Kal jaari kiye gaye data ne dikhaya ke index February mein 86.4 tak gir gaya tha jo January ke 94.5 se, ANZ Bank ke mutabiq July 2023 se sab se kam level tha. Pair ek neeche ki taraf trend mein move kar raha hai aur aaj 0.5953, mid-month average, ke pehle target tak pohanch gaya, lekin target ab bhi weekly control zone 0.59333-0.59193 hai. Jab selling zone 0.5989-0.5997 tak pohanch jaye aur ek pattern bana jaye, to mein ek sell position mein dakhil hoonga pehla target 0.5953 ke saath

- Mentions 0

-

سا0 like

-

#2059 Collapse

NZD/USD Technical Analysis (NZD/USD Takneeki Tahlil):

NZD/USD pair nay lagta hai ke 0.6007 ke qareeb resistance ka samna kiya, jis ne keemat mein baad mein kami ka sabab bana. Pichle haftay ke trading session ka tajziya ishara deta hai ke market ne bearish trend mein rehna jari rakha. Is haftay, mojooda trend ab bhi neeche ki taraf janib nazar aata hai.

Trend Analysis (Trend Tahlil):

Bari timeframes ke trend ko dekhtay hue, yeh ishara deta hai ke market apni neeche ki raftar mein qaim hai. Is liye, pichle haftay ke trading session mein dekhi gayi bearish faaliyat neeche ki raftar ka jaari rehna ishara kar sakti hai. Farokht karne ki dabao ke imkaanat jari rahenge, jo keematon par neeche ki taraf dabao daal sakta hai. Is tajziya ke mutabiq, NZD/USD pair mein mazeed neeche ki raftar ki umeed hai. Traders ko mojooda bearish trend ke mutabiq apni strategies ko tarteeb dena chahiye, aur farokht ki moqaat ya short positions par tawajjo deni chahiye. Magar, market ke tajurbaat ko qareeb se nigrani mein rakhna aur badalte haalaat ke jawab mein trading strategies ko tabdeel karne ke liye tayyar rehna bhi zaroori hai.

Risk Management (Khatra Nigrani):

Kul mila kar, yeh tajziya NZD/USD pair mein bearish trend ka jaari rehne ka ishara deta hai, jahan farokht karne ki dabao qareeb ki muddat mein jari rahegi. Traders ko apni trading activities mein ihtiyaat aur hoshmandi barqarar rakhni chahiye. Trading mein intezamiyo ka hona ahem hai, pehle se mutayyan khatra nigrani strategies aur trading plans ko palan karna chahiye. Jazbaati discipline bhi zaroori hai, kyun ke khauf aur lalach impulsive trading decisions par le ja sakta hai.

Fundamental Analysis (Asaasi Tahlil):

Is ke ilawa, New Zealand dollar aur US dollar ko mutasir karne wale key economic events aur developments ke mutalliq maloomat haasil karna ahem hai. GDP growth, inflation rates, employment data, aur central bank policies jaise ma'ashi indicators currency valuations par asar andaaz hote hain. Traders ko aise events aur unke NZD/USD pair par ke asraat ko dekhna chahiye.

Technical Analysis (Technical Tahlil):

Technical analysis ke zariye keemat ki harkaton aur moqaat farokht karne ke liye ahem insights faraham ki ja sakti hai. Traders technical indicators, chart patterns, aur support aur resistance levels ka istemal entry aur exit points ko pehchaan ne ke liye kar sakte hain. Magar, yeh yaad rakhna zaroori hai ke technical analysis sirf aik component hai comprehensive trading strategy ka. Technical factors ke ilawa, traders ko fundamental analysis aur market sentiment ko bhi mad e nazar rakhna chahiye.

Conclusion (Nateeja):

Mukammal taur par, jab ke NZD/USD pair bearish trend ka saamna kar raha hai, traders ko apne tajurbaat ko barkarar rakhna aur apni approach mein lazzat dena chahiye. Maloomat haasil karke, disciplined risk management ka istemal karke, aur technical aur fundamental analysis ka ek combination istemal karke, traders currency markets mein asani se chal sakte hain aur trading opportunities ko faida utha sakte hain.

- NZDUSD

- Mentions 0

-

سا0 like

-

#2060 Collapse

NZD/USD Ki Tahlil (Analysis):

NZD/USD pair ne neeche 0.6000 ke support level ko toor kar ek neeche ki taraf rally dikhaya hai. Yeh neeche ki raftar jari reh sakti hai jab tak yeh daily timeframe par 0.5894 - 0.5859 ke demand area tak pohanch jaaye. Pichle hafto mein US Dollar ke liye support karne wale ma'ashi data ki kami ke bawajood, market players ne currency ko khareedna jari rakha hai, jo ke New Zealand Dollar ko shamil karke doosri bari currencies par dabao daal raha hai.

Trend Ki Tahlil (Trend Analysis):

Jab ke mojooda trend NZD/USD pair par bearish hai, lekin daily timeframe par mukhtasir trend bullish hai, jo medium term mein ek upar ki raftar ka imkaan dikhata hai. Magar, is ke liye keemat ko 0.6000 level ya 200-day Simple Moving Average (SMA) ke oopar chala jana zaroori hai.

Indicators Ki Tahlil (Indicators Analysis):

Awesome Oscillator (AO) indicator ne downtrend ka ishara diya hai, jahan histogram lagatar 0 level ke neeche hai, haalaanki volume tang hai. Dusri taraf, Stochastic indicator oversold zone mein dakhil ho gaya hai, jo ke keemat ki kami ka potential ikhtitaam dikhata hai. Ulat hone ka tasdeeq Stochastic parameters ke crossover ke zariye ke intezar ka hai.

Trading Strategies (Karobari Tadabeer):

Short-term trading ke liye, traders ko bearish trend shiraa'at ke shirayanaafar shirayanaafar moke ka intezar karna chahiye. 0.5984 ke support level ko agar keemat theek karne ke baad inkaar hota hai, to yeh ek daakhilayi nukta ke taur par kaam kar sakta hai. Tasdeeq ke liye Stochastic parameters ke crossover ka intezar kiya jaa sakta hai, behter toor par 50 ke qareeb ya us se oopar. Mazeed, AO histogram neeche 0 level ke neeche rahega takay downtrend ki raftar ka imkaan tasdeeq kar sake. Maqsad take-profit level daily timeframe par 0.5894 - 0.5859 ke demand area ka hai, jahan ke stop-loss ko 0.6007 ke buland keemat ke aas paas set kiya ja sakta hai.

- NZDUSD

- Mentions 0

-

سا0 like

-

#2061 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

NZD/USD Takniki Tahlil (Technical Analysis):

NZD/USD pair abhi 0.5980 ke qareeb phel gaya hai, jahan se 0.5900 zone ki taraf ek sambhav downward raftar ka samna hai. Fibonacci retracement levels ke mabaini tajziya bhi 0.6000 par rukawat ka ishaara deti hai, jo ke ek ahem rok tha. In mukhalefaton ke bawajood, RSI aur Stochastic readings jaise indicators oversold halaat ka ishaara dete hain, jo ke qareebi mustaqbil mein ek mawafiqa punaruddhar ka ishaara dete hain. Agar kharidari ke interest mein izafa ho, to pair ko izafa ho sakti hai, jo ke moving average range 0.6070-0.6100 ko guzarne ki koshish karega. Aise kadam se aage badhne se, 0.6160 ke darmiyan resistance level ka imtehan liya ja sakta hai. Magar, is rukawat ko nihayat tor par toor dena, ek focus shift ka ishaara de sakta hai jo January se barqarar hai, 0.6220 ke aas paas mojood downtrend line ki taraf.

Mukhtasir (Summary):

Istehkam se, NZD/USD pair ek complex manzar ka samna kar raha hai, jo turant niche ki dabavat aur oversold halaaton ki mawafiqa upar ki raftar ke darmiyan tasfiya karta hai. Is tarah, main umeed karta hoon ke NZD/USD agle dino mein kam hoga. Uper di gayi chart mein madad aur mudda maqamoon ki nazar, ham dekh sakte hain ke market ki shakal kahan ja rahi hai. 0.6842 par rukawat ka darja pehla imtehan dene ke liye dikh raha hai. Mojooda qeemat ke harkaat agle taqatwar rukawat darjat ko test karne ke liye izafi buland resistance level 0.7134 ko test karne ke liye buland ho sakti hain. Karobari log Fibonacci retracements aur moving averages jaise ahem darjaat ko qareena samajhne ke liye nigrani kar rahe hain takay pair ke raftar ka andaza lagaya ja sake. Kharidari fa'alat mein izafa hararat ja sakta hai, jo ke rukawat darjat ko challenge kar sakte hain aur mojooda trend ko tasfiya kar sakte hain.

-

#2062 Collapse

NZD/USD pair abhi 0.5980 ke qareeb phel gaya hai, jahan se 0.5900 zone ki taraf ek sambhav downward raftar ka samna hai. Fibonacci retracement levels ke mabaini tajziya bhi 0.6000 par rukawat ka ishaara deti hai, jo ke ek ahem rok tha.Mukhalif mawadon ke bawajood, RSI aur Stochastic readings jaise indicators oversold halaat ka ishaara dete hain, jo ke qareebi mustaqbil mein ek mawafiqa punaruddhar ka ishaara dete hain. Yeh oversold halaat ek sambhav bullish reversal ka imkaan zahir karte hain.Market analysis ke mutabiq, NZD/USD pair mein 0.5980 ke qareeb se neeche ki raftar ka jari rehna hai aur 0.5900 zone ki taraf girawat ka imkaan hai. Fibonacci retracement levels aur mukhalif mawadon ki roshni mein, 0.6000 ke qareeb rukawat ka mawafiqa saboot hai.

Traders ko market ki halat par nazar rakhni chahiye aur oversold halaat ke istemal karke ek sambhav bullish reversal ki tawaqquf karni chahiye. Zaroori hai ke stop loss orders ka istemal karke apne positions ko mazbooti se manage karna taake nuqsaan ki sambhavna ko kam kiya ja sake.Overall, NZD/USD pair ke neeche ki raftar ka jari rehna traders ke liye girawat ki taraf ishaara karta hai, lekin oversold halaat aur mukhalif mawadon ki roshni mein, ek sambhav bullish reversal ka imkaan mojood hai. Traders ko cautious rehna chahiye aur market ki harkat ko mazbooti se dekhna chahiye taake munafa haasil karne ka behtar mauqa pa sakein.

-

#2063 Collapse

NZD/USD

Hum ab NZD/USD currency pair ki keemat ki behavio ko tajziya kar rahe hain. American session ke shuru mein, wo acche se niche chal gaye, lekin phir unhone girawat ka hissa wapas hasil kiya. Mainay apni kaam ki H4 khola, aur keh sakta hoon ke NZD/USD 0.5981 ke neeche trading kar raha hai, iska matlab hai ke pair ke liye niche ki taraf movement ka priority hai, aur chart mein south direction mein Zig-Zag ki formation ke liye tayyariyan hain. lekin yeh sirf tayyari hai. Waktan-fawran koi niche ki taraf ki movement nahi hai. Iska matlab hai ke 0.5981 ke level ki tooti par trading ka option ab apni attractiveness aur relevance kho chuka hai. Aam tor par, hum keh sakte hain ke 0.6000 ke neeche jaane ke baad jo koi yaqeen tha, woh ab mojooda flat movement ki wajah se dhundla ho gaya hai, aur is tarah chart par koi priority nahi hai, aur mujhe is pair ke saath kuch karne ka koi irada nahi hai. Haan, aur saath hi, aaj Jumma hai, aur yeh meri pasandida din trading ke liye nahi hai. Market phir se kharab mood mein hai. Har ghanta ke baad woh idhar-udhar hilta rehta hai. Ab phir gir gaya hai aur 0.5991 ke mark ko cross kar gaya hai. Aur koi zyada risks lena ab munasib nahi hai. Hamain shares bechne ki zaroorat hai. Oh, kitna chahta hoon ke 0.5991 ke level par classic correction ka intezar karon.

Meinay pehlay hi ek candle par paisa kamana chahta tha. Main 0.5995 ke level par stop par kam nuksan hoga. Stop ke baad, jald hi, koi bhi bet, umeed ya tawaqo nahi hogi. Graph kahin aur nahi ja sakta, balki sirf niche hi jayega. Shakhsiyati maal ki growth ki zone 0.5996 aur 0.6005 ke areas mein hogi. Market ke ghair-mutawaqqa movement ko dekhte hue, main regular tor par galat faislay ke mool par paisa lagane ke ghatnayen ke negative mor par sochta rehta hoon. Lekin main divident ko bhi nahi bhoolta, jo ke prudent aur calculated risk se investments ko involve karte hain. Toh, apni aankhen hawa mein uda dete hain, hum pair ke par. 0.6010 Ek uthan ke baad, hamesha ek giravat hoti hai. Is qaid ko jaante hue, main samajhta hoon ke 0.5983 ke aas paas hi transaction ko rokna zaroori hai. Aur agar is halat mein bhi, profit us ke size mein apni jagah par set stop ke muqable mein use paanch guna zyada hoga. Shayad hum apni chahat ki manzil tak na pohanchen. Main shaam ko deal ko band karunga, aur ise kal tak nahi chhodunga. Koi bhi khabar sabko naraz kar deti hai aur market mein afra-tafri peda karti hai. Main asoolon par trade nahi karta.

-

#2064 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Haftay ki chart par NZD/USD ki taza qeemat ka amal aik maqami mukhalif darja par aham imtehaan dikhata hai jo 0.61068 par mojood hai, is ke baad palat aur qabil-e-bharosa jari darja ka jari rahna. Ye harkat aik bearish candle ka banne ka natija hai, jo bearish jazbat ko mazeed taqwiyat dene ki alamat hai, khas tor par agar qeemat 0.59962 ke saath neechay toot jaye

Aage dekhtay hain, 0.59401 ke qareebi support level par ghor karne ke liye do buniyadi manazir hain. Pehla manzar hai ke is level ke neeche qeemat ka mustahkam hona, jo mazeed southern harkat ka sabab bana sakta hai. Agar ye manzar waqya ho, to tawajjo 0.58540 ke support level par hogi, jahan aik maqsood 0.57732 par ho sakta hai. Magar asal natija mukhtalif factors par mabni hoga, jin mein market ki khabrein aur taraqqiyat shamil hain

Mukhtalif, agar qeemat 0.59401 ke support level ke qareeb bullish candlestick pattern banae, to uttar ki correction harkat ho sakti hai. Is tara par, traders ko 0.59962 ya 0.60382 par mukhalif darjaon ki taraf wapas jane ka intezar ho sakta hai. Magar ehtiyaat baratna zaroori hai, kyun ke ye resistance levels ke qareeb palatna, harkat ko mukhtalif darjaon mein jaari rakh sakta hai

Barayi market ke context ko mad e nazar rakhtay hue, aik emergent global southern trend ke isharaat hain. Market ki jazbat aur positioning bhi mustaqbil ke qeemat ke trendon par asar andaz hoti hain. Market ke hissaydaar ke darmiyan mojooda bearish bias NZD/USD jori par nichle dabao ko mazeed taqwiyat de sakta hai

Traders aur investors ko hoshiyar rehne aur apni strategies ko mutabiq karne ka mashwara diya jata hai. Short-term trading ke moqay aise logon ke liye uplabdh ho sakte hain jo intraday ya swing trading strategies ka istemal karte hain, khaaskar maujooda downtrends ke saath milti julti hain. Magar forex market ke mahool mein nuqsaanat ko kam karne ke liye risk management ko ahem tor par taraqqi dena zaroori hai

Ikhtisar mein, NZD/USD ke liye manzar southward harkat ka jari rahna nazar ata hai, jisme technical aur sentiment indicators ke buniyadi taur par trading ke moqay pesh aayenge. Jaisa ke hamesha, market ke taraqqiyat ke baray mein maaloomat rakhte rehna aur trading strategies mein mustaqil hone ki ahmiyat ko samajhna asanefarosh mahol mein tajziya karne ke liye klidi hai

- NZDUSD

- Mentions 0

-

سا0 like

-

#2065 Collapse

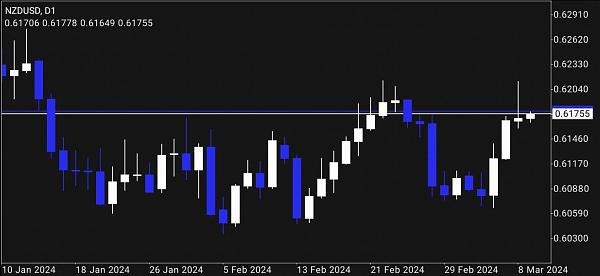

NZDUSD currency pair ke mutalliq aapki dekhi hui analysis ka shukriya. Resistance level par manfi qabooliyat ka zikar karna aham hai, khaaskar agar wo level 0.62060 hai. Ye dekha gaya hai ke is level ko paar karna mushkil ho sakta hai, jo ke aapke trading ke faislon par asar daal sakta hai. Resistance levels traders ke liye aham hote hain kyunki ye woh jagah hoti hain jahan market kaafi baar ruk kar rehti hai ya phir palat jaati hai. Agar ek currency pair ka resistance level cross nahi hota, toh yeh ek indication ho sakti hai ke market ka trend opposite direction mein jaane ki sambhavna hai. Is tarah ke levels ko monitor karna zaroori hai taake aap apne trading strategies ko sahi tareeqe se adapt kar sakein.

Halaanke, aapne sahi farmaaya ke daily time frame mein aabadiyon ke conditions abhi bhi numaindah nazar aate hain. Daily chart se aapko lamba mudda kaafi achi tarah se dekhai deta hai, aur is se aap market ke trends aur patterns ko sahi taur par samajh sakte hain. Lekin, ek cheez jo yaad rakhni chahiye, wo hai ke kisi bhi technical analysis ke results ko pure taur par depend kar ke trading nahi karni chahiye. Market mein hamesha badlav hota rehta hai aur kai factors us par asar daalte hain. Isliye, risk management aur market analysis ke saath aapko flexible rehna chahiye.

Aakhir mein, aapko apni trading strategy ko apne personal goals aur risk tolerance ke saath munsalik karna chahiye. Technical analysis ke alawa, fundamental analysis bhi important hoti hai taake aap market ke broader trends ko samajh sakein. Is tarah se, aap apne trading journey ko aur bhi maharat hasil kar sakte hain aur successful trading kar sakte hain.

- NZDUSD

- Mentions 0

-

سا0 like

-

#2066 Collapse

NZD/USD, ya New Zealand Dollar aur United States Dollar ka currency pair, forex market mein aham hota hai. Iski keemat mein girawat aur izafay ka amal amooman trading mein dekha jata hai. Is hawale se, aapne 0.6106 tak ki girah ka zikar kiya hai, jo aam tor par forex charts par darust hota hai. Girah ya retracement ka zikar karte waqt, yeh hota hai jab ek currency pair ki keemat mein temporary decline hota hai, lekin trend ka overall direction wahi rehta hai. Yeh market mein normal hota hai aur traders iska fayda uthate hain taake unhe munafa mil sake. Retracement ke doran, price ko pehle wale trend ki taraf wapas le jaya jata hai.

Baad mein reversal ka zikar karte hue, yeh hota hai jab ek trend apni direction badal deta hai. Iska matlab hai ke pehle jo trend upar ya neeche ja raha tha, ab woh opposite direction mein ja raha hai. Reversals trading mein crucial moment hote hain kyunki yeh market sentiment ko indicate karte hain aur traders ke liye naye opportunities peda karte hain. NZD/USD ke liye 0.6106 tak ka girah dekhne ka matlab hai ke price temporary decline kiya aur phir usne retracement ke doran wapas upar jaane ki koshish ki. Lekin phir ek reversal ka samna kiya gaya, jo ke price ko neeche le gaya. Yeh scenario trading mein common hai aur experienced traders is tarah ke situations ka fayda uthate hain.

Traders aise movements ko samajh kar apni trading strategies banate hain aur market ke changes ko anticipate karte hain. In situations mein, technical analysis, jaise ke support aur resistance levels, trend lines, aur indicators ka istemal kiya jata hai. Is tarah ke tools traders ko market ka mood samajhne mein madad karte hain aur unhe sahi decisions lene mein guide karte hain. Overall, NZD/USD ke liye 0.6106 tak ka girah aur phir retracement aur reversal ka amal, trading community mein aam hai aur traders is tarah ke situations ko handle karne ke liye taiyar rehte hain. Is tarah ke market movements se traders ko naye opportunities milte hain aur unhe apni trading skills ko improve karne ka mauka milta hai.

- NZDUSD

- Mentions 0

-

سا0 like

-

#2067 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

NZD/USD forex pair mein keemat ka amal ne haal hi mein ek dilchasp muddat dekhi hai. Is muddat mein, yeh girah 0.6105 tak aik girah mein gira aur phir retracement aur baad mein reversal ka samna kiya. Is halat ka samajhna aur is par guftagu karna mahatvapurn hai. Pehle to, NZD/USD ka price action analysis karna zaroori hai. Is muddat mein, NZD/USD ka price 0.6105 tak gira, jo aam tor par ek sannata se kam nahi tha. Yeh girah kisi na kisi khaas wajah se ho sakta hai, jaise ke geopolitical tensions, economic indicators ki kharabi, ya phir technical levels ko toorna.

Phir, retracement ka mudda aata hai. Retracement, price mein aam tor par temporary reversal hota hai, jahan price apni current trend ke khilaf kuch dair ke liye chalay jaati hai, phir woh trend ke mutabiq wapas aati hai. Is muddat mein, 0.6105 se price mein giravat ke baad, kuch tijaratkaron ne is giravat ko ek mauka samjha aur price mein uthao shuru kiya. Yeh uthao temporary tha aur trend ko barqarar rakhne ki koshish mein kiya gaya. Aakhir mein, reversal ka samna kiya gaya. Reversal, jab trend bilkul badal jata hai, hota hai. Is muddat mein, jab price ne retracement ke baad phir se girah 0.6105 ko paar kiya, yeh ek mukhtalif rukh ki taraf ishara tha. Yeh reversal ho sakta hai ki kisi naye trend ka aghaz ho, ya phir sirf temporary reversal ho, jise dobara retracement ke baad original trend barqarar ho sakta hai.

Is maamle mein, tijaratkaron ko mukhtalif factors ko mad-e-nazar rakhte hue tajziya karna chahiye. Geopolitical situations, economic indicators, aur technical analysis sabhi tijaratkaron ke liye ahem hoti hain. Is muddat mein, yeh girah 0.6105 tak ka giravat aur phir retracement aur reversal, sirf market ke natural fluctuations ka ek hissa hai, aur tijaratkaron ko is par mazid tajziya aur tasdeeq karne ki zaroorat hai. Is tarah se, NZD/USD ke price action ka yeh safar ek mahatvapurn sabaq hai tijaratkaron ke liye, jo market ke mukhtalif halat aur situations ke samajhne aur un par tajziya karne mein madad karta hai.

- NZDUSD

- Mentions 0

-

سا0 like

-

#2068 Collapse

On the H4 timeframe, there has been a sustained uptick following a decline that reached the oversold territory at the RSI level of 30. Moreover, the downtrend has encountered bearish rejection in the RBS area range at 0.5953. This suggests a significant opportunity for a potential price surge to initiate a correction phase, particularly aiming to reach the ma50 (red) moving area around 0.6010. The upper boundary within the resistance zone at 0.6027 could serve as a pivotal area for a potential further bullish correction phase, targeting the supply area above around 0.6085. Considering short-term purchases for the upcoming week's market, it seems prudent to plan entry within the range of 0.5960-0.5970. The targets for this price range increase are TP 1 at the 0.6010 level and TP 2 to approach the 0.6085 level. This purchasing strategy could position the risk of loss below the lowest price area of this week within the range of 0.5950.

Focusing on purchasing amid the possibility of a trend reversal into the bullish phase entails movement above the resistance area within the moving range of ma200 (blue) at 0.6103. As for sales considerations, it remains intriguing to explore opportunities following the continuation of the bearish trend, with the sell re-entry position being within the supply area range and the ma50 (red) movement limit within the range of 0.6010-0.6020. The downside target appears to have the potential to establish a new lower low, breaching the 0.5950 level and attempting to reach the Zero area below it within the 0.5900 range.

-

#2069 Collapse

NZD/USD ke liye qeemat ka amal ne aik girah 0.6108 tak phir wapsi aur baad mein reversal ka samna kiya. Is tarah ki qeemat ka amal ki wapsi aur reversal aam tor par forex market mein dekhe jane wale phenomenon hain. Ye aksar technical analysis ke zariye samjha jata hai, jisme traders past price movements aur volume data ko analyze karte hain taki future price trends ko predict kiya ja sake.

Jab NZD/USD ka qeemat girah 0.6108 tak pohanchi aur phir wapis aayi, ye ek potential support level ko darust karta hai. Support level ek point hota hai jahan traders expect karte hain ke price gir kar ruk jayega ya phir wapas ooper jaega. Agar is girah par price ne wapis se upar ja kar stabilize kiya, to yeh indicate karta hai ke market mein buying pressure mojood hai aur traders ne is level ko support kiya hai. Lekin, jab price phir se reversal ka samna karta hai, yani ke girah 0.6108 ke upar jaane ke baad phir se neeche girne lagta hai, to ye ek potential resistance level ko darust karta hai. Resistance level ek point hota hai jahan traders expect karte hain ke price gir kar rukega ya phir wapas neeche jaega. Agar price is girah par phir se neeche aane lagta hai, to yeh indicate karta hai ke market mein selling pressure mojood hai aur traders ne is level ko resistance diya hai.

Is tarah ke price action se traders ko market ke trend ka pata chalta hai aur wo apne trading strategies ko adjust karte hain. Agar price support level ko test karta hai aur phir se upar jaata hai, to traders long positions le sakte hain, yaani ke wo ummid karte hain ke price mazeed upar jaega. Jab price resistance level ko test karta hai aur phir se neeche jaata hai, to traders short positions le sakte hain, yaani ke wo ummid karte hain ke price mazeed neeche jaega. Overall, NZD/USD ke liye yeh qeemat ka amal ek mukhtasir samay mein hota hai, jisme traders ko market ke dynamics aur potential future movements ke baare mein maloomat milti hai. Lekin, is tarah ke analysis mein hamesha risk mojood hota hai aur traders ko proper risk management ke saath trading karna chahiye.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2070 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Kal, NZD/USD currency pair ka din mushkil trend wala tha jab is ne 0.6103 ko tora aur buhat unchai ki janib barhne laga. Ye movement market participants ke liye interesting aur challenging tha, aur isne trading strategies ko adapt karne ka mauka diya. Pehle toh, NZD/USD currency pair ki movement observe karte hue, yeh pata chalta hai ke iska value US dollar ke mukabley New Zealand dollar ke sath kis tarah se change ho raha hai. Is din, jab yeh 0.6103 ko tora, yeh indicate karta hai ke New Zealand dollar ki value mei izafa hua. Is tarah ka sudden aur significant movement traders ke liye attention grabbing hota hai kyunki isse trading opportunities create hoti hain.

Is movement ka mukhya karan bhi samajhna zaroori hai. Market analysis ke tehat, kuch factors aise hote hain jo currency pairs ki movement ko influence karte hain jaise economic indicators, geopolitical events, central bank policies, aur global market sentiments. Agar is din NZD/USD pair ki value barhi hai, toh iske piche kuch fundamental reasons ho sakte hain jaise New Zealand ki strong economic data release, ya phir US dollar ke mukabley New Zealand dollar ki strong performance. Traders ko aise situations mein apni trading strategies ko adapt karna hota hai. Kuch traders short-term trading strategies istemal karte hain jaise scalping ya day trading, jabki doosre long-term positions hold karte hain. Scalpers aur day traders ko market ke quick movements se fayda uthane ka mauka milta hai jabke long-term traders ko fundamental analysis aur market trends ko dhyan mein rakhkar positions hold karna hota hai.

Risk management bhi ek crucial aspect hai jab market mein aise volatile movements hote hain. Traders ko apni positions ke liye stop-loss orders lagana chahiye taake excessive losses se bacha ja sake. Isi tarah, position sizing aur diversification bhi important hai taake trading portfolio ko protect kiya ja sake. Overall, NZD/USD currency pair ka kal ka din mushkil trend wala tha lekin is tarah ke challenging situations mein traders ko apni skills aur knowledge ka istemal karke opportunities ko maximize karne ka mauka milta hai. Market ki volatility aur movements ko samajh kar, traders ko apni strategies ko adapt karte hue trading decisions leni chahiye taake unhein consistent profits hasil ho sake.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 03:22 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим