Aik Afraad Saal ke Chhoti Chhutiyan ke Doran Ahem Ma'ashiyati Ijraat ki Umeedon ke Darmiyan, Mangar Market Gir Gaya, Jis Ne Dow Jones aur Standard & Poor's 500 indekse mein Teen Martaba Girawat Ka Markaz Bana Diya Karobarion Ki Umeed-e-Tawaqqu'at Hai Jab Unhone Federal Reserve Policy Mein Mumkin Tabdiliyon Ka Jaiza Liya

Tesla (TSLA.O) CEO Elon Musk ke Elaan Par 2.92% Barh Gai Jab Unhone Kaha Ke Wo Khud Ko Khud Chaal Chalan Teknoloji Ki Tajarba Karay Ga Jo Company Ke Gaariyon Ke Liye Dastiyab Hogi, Naaye Aur Mojudah Mushtarkon Ke Liye America Mein Maujooda Haftay Mein, Stock Ke Keemat Ko Lagbhag 4% Barha Diya Gaya Hai, Haalaanki Saal Bhar Unke Ma'ashiyat Mein Kami Aai Hai Jis Ke Natije Mein Unki Quotes Mein Se 28% Se Ziyada Girawat Aa Gayi Hai. Koi Bunyadi Waqiyat Bhi Nahi Hain Aksar Central Bank Ke Amla Din Bhar Mehsoos Kiye Jaate Hain, Kyunki In Speeches Mein Se Bohat Si Speeches Calendar Par Nahi Aati Hain Calendar Mein Muqarrar Amla Ki Speeches Hoti Hain, Magar Sawal Jawab Ya Mukhtalif Radio Programs Ya Podcasts Mein Shirkat Ka Naam Nahi Hota Lekin Har Surat Mein Bazaar Is Waqt In Amla Ke Baray Mein Kisi Bhi Shorawali Bayan Ka Intezaar Nahi Karta. Budh Ko Naa to Koi Macroeconomic Ya Bunyadi Waqiyat Hain Shadid Taiz Rahegi, Aur Dono Joriyan Buland Ho Sakti Hain. Magar Woh Dhaar Me Rehte Hain, Hum Samajhte Hain Ke Aap Ko Naye Farokht Ke Signals Dhoondhna Chahiye.

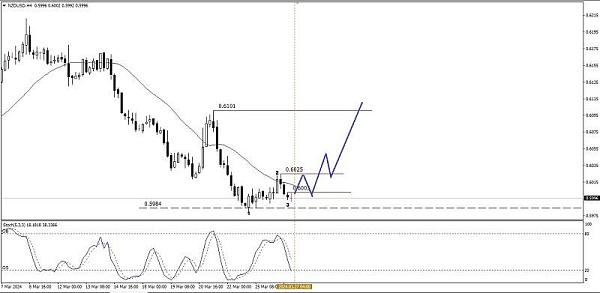

Aur Kyunki Jori Neeche Ke Raaste Par Chal Rahi Hai, Iska Yeh Ke Sharai Hona Is Se Taqatwar Hone Ka Behtar Imkan Hai Har Koi Theek Se Taqatwar Farokhti Signals Nahi Hain Is Waqt. Char Ghanton Ke Chart Par, NZD/USD Maal Ke Currency Pairs Mein Lagta Hai Ke Bullish 123 Pattern Ka Zaahir Hone Lag Gaya Hai Jahan Ye Kiwi Ki Tadbeer Ko Mazbooti Se Bahaal Karne Ka Imkan Deta Hai, Jahan Tak Ke Jab Taqat 0.5979 Ke Darjaat Se Kam Ho Jaye, To Ye Maal Ke Currency Pairs Ko Mazbooti Se Bahaal Karne Ka Imkan Hai Aur Darj Karne Ka Imkan Hai 0.6003 Ke Darjaat Ko Agar Oopar Torh Liya Jaye, To NZD/USD Aaj Apne Bahaal Honay Ka Silsila Jari Rakhega Taqreeban 0.6025 Tak Aur Agar Momentam Aur Taiz Aamad Bhi Madad Kar Rahe Hain, To 0.6101 Darjaat Agla Maqsad Hoga

Aur Kyunki Jori Neeche Ke Raaste Par Chal Rahi Hai, Iska Yeh Ke Sharai Hona Is Se Taqatwar Hone Ka Behtar Imkan Hai Har Koi Theek Se Taqatwar Farokhti Signals Nahi Hain Is Waqt. Char Ghanton Ke Chart Par, NZD/USD Maal Ke Currency Pairs Mein Lagta Hai Ke Bullish 123 Pattern Ka Zaahir Hone Lag Gaya Hai Jahan Ye Kiwi Ki Tadbeer Ko Mazbooti Se Bahaal Karne Ka Imkan Deta Hai, Jahan Tak Ke Jab Taqat 0.5979 Ke Darjaat Se Kam Ho Jaye, To Ye Maal Ke Currency Pairs Ko Mazbooti Se Bahaal Karne Ka Imkan Hai Aur Darj Karne Ka Imkan Hai 0.6003 Ke Darjaat Ko Agar Oopar Torh Liya Jaye, To NZD/USD Aaj Apne Bahaal Honay Ka Silsila Jari Rakhega Taqreeban 0.6025 Tak Aur Agar Momentam Aur Taiz Aamad Bhi Madad Kar Rahe Hain, To 0.6101 Darjaat Agla Maqsad Hoga

تبصرہ

Расширенный режим Обычный режим