taqat ko check kiya aur isay kamyaabi se paar kar liya. Yeh level price ko rebound karne aur growth ko dobara shuru karne ki anumati deta hai, jisme signal area ke ooper yields shamil hain. Magar, yeh isay target zone tak aur amli amal karne se rokta hai. Isi doran, price chart ne green supertrend zone mein dakhil ho gaya hai, jo dikhata hai ki control ab buyers ke paas chala gaya hai.

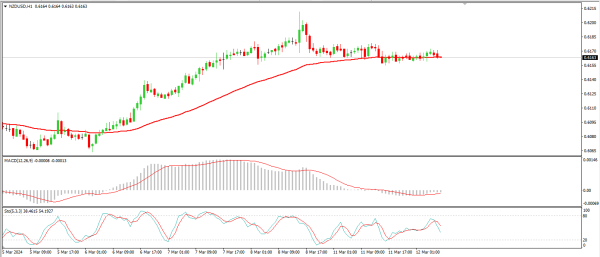

Takneeki tahlil ke nazariye se, hum giraavat ki taraf lean karte hain, jo stochastic ke negative characteristics lene par mabni hai, jisme indicator ne 4-hour time frame mein upward momentum gawana shuru kar diya hai.

Is tarah, niche ki taraf jaana sab se pasandeeda hai, aur target 0.5930 hai. Agar price ise tod deti hai, toh yeh seedha neeche jaakar tez ho jayegi. Isi raste mein 0.5910 tak pahunch sakti hai. Baad mein nuksan ko 0.5830 tak bhi badha ja sakta hai. Price dobara 0.6021 aur 0.6040 ke upar stabilize hone par, downside opportunities ko der kar dega, aur hum 0.6120 aur 0.6150 ko retest karne ki taraf manzoor hain.

H-4 Timeframe Analysis

Pair abhi apne haftay ke highs ke kafi upar trading kar raha hai. Key support areas dabaav mein aaye, lekin unhon ne apni mazbooti ko qaim rakhne mein kamiyabi hasil ki aur price ko upar rebound karwaya, jo upward vector ki taraf raai rakh raha hai. Ab, price ko yeh confidently 0.6126 ke status ke upar consolidate karna hoga, jo ke major support zone ko border karta hai, jisme ek local correction ki zaroorat ho sakti hai. Is level ko dobara test karna aur uske baad ka rebound, upward momentum ko jaari rakhne ka mauka dega, jiska target hoga 0.6249 aur 0.6303 ke beech ka area.

Agar support toot jaata hai aur price 0.6082 turning level ke neeche jaati hai, toh current scenario ko cancel karne ka signal mil jaayega. Chart neeche dekhein:

Takneeki tahlil ke nazariye se, hum giraavat ki taraf lean karte hain, jo stochastic ke negative characteristics lene par mabni hai, jisme indicator ne 4-hour time frame mein upward momentum gawana shuru kar diya hai.

Is tarah, niche ki taraf jaana sab se pasandeeda hai, aur target 0.5930 hai. Agar price ise tod deti hai, toh yeh seedha neeche jaakar tez ho jayegi. Isi raste mein 0.5910 tak pahunch sakti hai. Baad mein nuksan ko 0.5830 tak bhi badha ja sakta hai. Price dobara 0.6021 aur 0.6040 ke upar stabilize hone par, downside opportunities ko der kar dega, aur hum 0.6120 aur 0.6150 ko retest karne ki taraf manzoor hain.

H-4 Timeframe Analysis

Pair abhi apne haftay ke highs ke kafi upar trading kar raha hai. Key support areas dabaav mein aaye, lekin unhon ne apni mazbooti ko qaim rakhne mein kamiyabi hasil ki aur price ko upar rebound karwaya, jo upward vector ki taraf raai rakh raha hai. Ab, price ko yeh confidently 0.6126 ke status ke upar consolidate karna hoga, jo ke major support zone ko border karta hai, jisme ek local correction ki zaroorat ho sakti hai. Is level ko dobara test karna aur uske baad ka rebound, upward momentum ko jaari rakhne ka mauka dega, jiska target hoga 0.6249 aur 0.6303 ke beech ka area.

Agar support toot jaata hai aur price 0.6082 turning level ke neeche jaati hai, toh current scenario ko cancel karne ka signal mil jaayega. Chart neeche dekhein:

تبصرہ

Расширенный режим Обычный режим