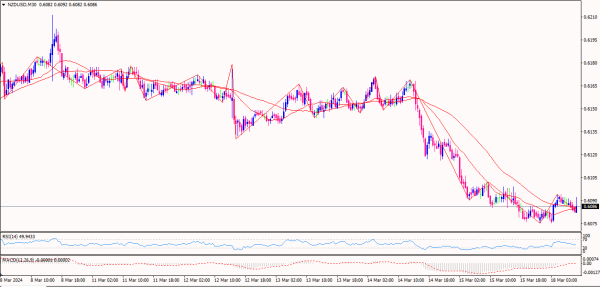

AUD/USD: Aaj Ka Bazaar Ka Aghaz

AUD/USD ke liye aaj bazaar khulta hai bila kisi hairat ke. Keemat Asiai session mein uttar ki taraf adjust kar rahi hai, lekin main samajhta hoon ke Europe ya US ke qareeb se dakshini harkat jaari rahegi aur keemat abhi bhi qareeb kaam kar rahi hai. Support level, jo ke meri marking ke mutabiq 0.64870 par hai. Agar sab kuch jaise ummeed ki gayi hai, to is support level ke qareeb hone wale maqamat mein halaat ko barhane ke liye do manazir ban sakte hain.

Taraqqi ka pehla manzar takreeban is support level ke saath jura hota hai. Agar yeh manzoor hota hai, to main keemat ka resistance level 0.65950 par wapas lautne ka intezar karta hoon. Agar keemat is resistance level se oopar se guzar jati hai, to main ek mazeed uttar ki taraf rawana harkat ka intezar karta hoon jo ke resistance level 0.66677 par hai. Is resistance level ke qareeb, main ek trade setup ka intezar karta hoon, jo ke trade ke mazeed rukh ka taayun karne mein madadgar sabit hoga.

Bila shak, keemat ko mukhtalif wajah se global uttar rukh ke hisaab se is resistance level 0.67289 tak aur bhi uttar ki taraf daba sakte hain, lekin yahan aapko halaat aur tamam background news ka jayeza lena hoga. Kuch is par munhasar hoga ke keemat mazeed uttar ki taraf rawana harkat kaise karti hai aur kaise mukhtalif oonchi hedefon tak pohanchti hai.

Jab support level 0.64870 tak pohanch jaye, to keemat ke qadam uthane ka ek dusra manzar yeh bhi ho sakta hai ke keemat is level ke neeche stabilize hoti hai aur mazeed dakshin ki taraf rawana harkat karti hai. Agar yeh manzoor hota hai, to main keemat ka support level 0.64428 torne ka intezar karta hoon. Main is support level ke qareeb bullish signals ka intezar karta rahunga, umeed hai ke keemat ke faayde ko dubara shuru karde.

Mujhe aaj yeh pehchan hai ke chhote uttar ki taraf ke baad, dakshini rawana harkat dobara shuru hogi aur keemat nazdeeki support level par kaam karegi, phir main bullish signals ka intezar karunga. Main naye taraqqi ka intezar kar raha hoon.

AUD/USD ke liye aaj bazaar khulta hai bila kisi hairat ke. Keemat Asiai session mein uttar ki taraf adjust kar rahi hai, lekin main samajhta hoon ke Europe ya US ke qareeb se dakshini harkat jaari rahegi aur keemat abhi bhi qareeb kaam kar rahi hai. Support level, jo ke meri marking ke mutabiq 0.64870 par hai. Agar sab kuch jaise ummeed ki gayi hai, to is support level ke qareeb hone wale maqamat mein halaat ko barhane ke liye do manazir ban sakte hain.

Taraqqi ka pehla manzar takreeban is support level ke saath jura hota hai. Agar yeh manzoor hota hai, to main keemat ka resistance level 0.65950 par wapas lautne ka intezar karta hoon. Agar keemat is resistance level se oopar se guzar jati hai, to main ek mazeed uttar ki taraf rawana harkat ka intezar karta hoon jo ke resistance level 0.66677 par hai. Is resistance level ke qareeb, main ek trade setup ka intezar karta hoon, jo ke trade ke mazeed rukh ka taayun karne mein madadgar sabit hoga.

Bila shak, keemat ko mukhtalif wajah se global uttar rukh ke hisaab se is resistance level 0.67289 tak aur bhi uttar ki taraf daba sakte hain, lekin yahan aapko halaat aur tamam background news ka jayeza lena hoga. Kuch is par munhasar hoga ke keemat mazeed uttar ki taraf rawana harkat kaise karti hai aur kaise mukhtalif oonchi hedefon tak pohanchti hai.

Jab support level 0.64870 tak pohanch jaye, to keemat ke qadam uthane ka ek dusra manzar yeh bhi ho sakta hai ke keemat is level ke neeche stabilize hoti hai aur mazeed dakshin ki taraf rawana harkat karti hai. Agar yeh manzoor hota hai, to main keemat ka support level 0.64428 torne ka intezar karta hoon. Main is support level ke qareeb bullish signals ka intezar karta rahunga, umeed hai ke keemat ke faayde ko dubara shuru karde.

Mujhe aaj yeh pehchan hai ke chhote uttar ki taraf ke baad, dakshini rawana harkat dobara shuru hogi aur keemat nazdeeki support level par kaam karegi, phir main bullish signals ka intezar karunga. Main naye taraqqi ka intezar kar raha hoon.

تبصرہ

Расширенный режим Обычный режим