USD/CAD Price Insights

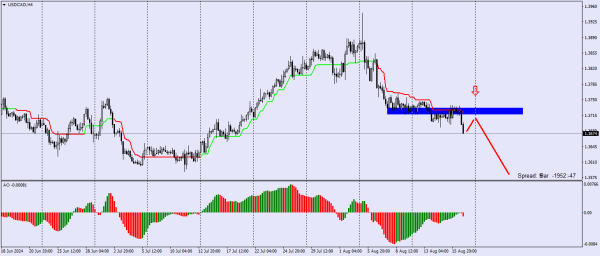

Abhi hum USD/CAD currency pair ke price action ko evaluate kar rahe hain. USD/CAD currency pair ek consistent downward trajectory par hai, jahan pehla potential barrier trend line ke qareeb 1.363 mark par hai. Yeh abhi tak clear nahi ke yeh instrument recent low ko break karega ya nahi, lekin yeh mumkin hai, kyun ke abhi tak koi visible liquidity level nahi dekha gaya. De-Marker oscillator abhi tak oversold zone mein nahi pohcha, jo yeh indicate karta hai ke bears price ko aur neeche push kar sakte hain. Friday ki daily candle ne descending trend ko aur reinforce kiya, jo intraday aur intra-week short positions ko advisable banata hai.

USD/CAD iss haftay bhi neeche ki taraf move kar raha hai, jo pehle ke haftay se start hui decline ka extension hai. Halan ke weekly decline relatively modest thi—kareeban 74 points—yeh kaafi tha ke weekly chart par bearish engulfing pattern activate ho jaye.

Yeh pair apni descent jari rakhega, aur support zone 1.359 ke qareeb pohchne ka potential hai. Yeh area ek achi opportunity provide kar sakta hai buying ke liye, yeh soch kar ke shayad rebound ya bullish reversal ho. Historically, iss support level ne aksar pair ko upar push kiya hai, aur recent rebound ne isse 1.3944 ka high touch karne ka moka diya tha kuch haftay pehle. Pair mostly bearish direction mein trade kar raha hai, jaisa ke daily chart par dekha ja sakta hai. Ab yeh dekhna hai ke downward trend jari rahega ya koi alternative scenario samne aayega. Indicators strongly suggest kar rahe hain ke Monday ke technical analysis ke liye sell-off ki advice hai: moving averages selling ko recommend karte hain, aur technical indicators bhi iss sentiment ke saath align hain, jo bearish continuation ki taraf ishara karte hain.

Aane wali news ke mutabiq, Monday ko US Leading Economic Index release hone wali hai, aur forecasts negative outcome predict kar rahe hain. Jab ke Canada se koi significant news expected nahi hai.

Abhi hum USD/CAD currency pair ke price action ko evaluate kar rahe hain. USD/CAD currency pair ek consistent downward trajectory par hai, jahan pehla potential barrier trend line ke qareeb 1.363 mark par hai. Yeh abhi tak clear nahi ke yeh instrument recent low ko break karega ya nahi, lekin yeh mumkin hai, kyun ke abhi tak koi visible liquidity level nahi dekha gaya. De-Marker oscillator abhi tak oversold zone mein nahi pohcha, jo yeh indicate karta hai ke bears price ko aur neeche push kar sakte hain. Friday ki daily candle ne descending trend ko aur reinforce kiya, jo intraday aur intra-week short positions ko advisable banata hai.

USD/CAD iss haftay bhi neeche ki taraf move kar raha hai, jo pehle ke haftay se start hui decline ka extension hai. Halan ke weekly decline relatively modest thi—kareeban 74 points—yeh kaafi tha ke weekly chart par bearish engulfing pattern activate ho jaye.

Yeh pair apni descent jari rakhega, aur support zone 1.359 ke qareeb pohchne ka potential hai. Yeh area ek achi opportunity provide kar sakta hai buying ke liye, yeh soch kar ke shayad rebound ya bullish reversal ho. Historically, iss support level ne aksar pair ko upar push kiya hai, aur recent rebound ne isse 1.3944 ka high touch karne ka moka diya tha kuch haftay pehle. Pair mostly bearish direction mein trade kar raha hai, jaisa ke daily chart par dekha ja sakta hai. Ab yeh dekhna hai ke downward trend jari rahega ya koi alternative scenario samne aayega. Indicators strongly suggest kar rahe hain ke Monday ke technical analysis ke liye sell-off ki advice hai: moving averages selling ko recommend karte hain, aur technical indicators bhi iss sentiment ke saath align hain, jo bearish continuation ki taraf ishara karte hain.

Aane wali news ke mutabiq, Monday ko US Leading Economic Index release hone wali hai, aur forecasts negative outcome predict kar rahe hain. Jab ke Canada se koi significant news expected nahi hai.

تبصرہ

Расширенный режим Обычный режим