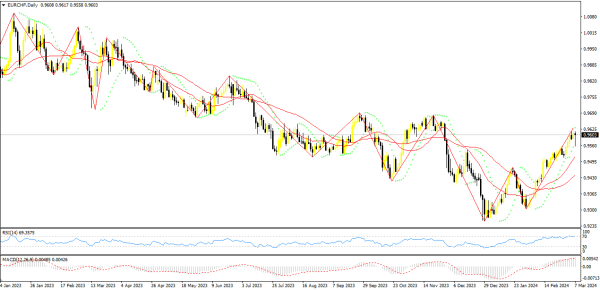

EUR/CHF DAILY FORECAST:

Assalam o Alaikum, Traders aur Moderators. Musfirah forum profile aur Instagram trading platform par aapka khush aamdeed. EUR/CHF ke transactions ka tajziya aur trading tips. 0.9527 ka imtehan MACD OSSCILATOR line ne zero se upar ki taraf jhukte hue liya. Ye ek khareed signal ko utpann kiya, jo ke 200 pips se zyada ke price increase mein muntaqil hua. Magar, jodi 0.9879 ke maqam tak nahi pohanchi. America mein poor jobless claims data aur trade balance dollar ke girawat aur Euro ki izzafah mein izafah kar degi. Fed Chairman Jerome Powell aur FOMC member Loretta Mester ke bayanat bazaar ke dynamics par asar nahi dalengi. Lambi positions ke liye, Swiss franc 0.9630 par pohanchte waqt khareedain aur faida 0.9987 par lain. Euro ke ECB meeting ke baad uthal puthal bazaar mein izafah hone par bull market mein izafa hoga. Yaqeeni banayein ke MACD oscillator line zero ke upar yaad barhti hai khareedte waqt. Euro ko 0.9457 ke do mazid imtehanon ke baad bhi khareed sakte hain. Magar, MACD oscillator line oversold region mein honi chahiye, kyun ke bazaar 0.9630 aur 0.9987 ke mukhalif khaasa hoga. Chhoti positions ke liye, pound ko 0.9457 par bechain aur faida 0.9275 par lain. America ke mazid mazid data aur mukhlis paish raiyon ke saath nakam mazid dabao barhega. Bechne ke waqt, MACD oscillator line zero ke neeche yaad us se niche ki taraf utrne ki bhi zaroorat hai. Pound ko 0.9630 ke do mazid imtehanon ke baad bhi bech sakte hain. MACD line overbought region mein honi chahiye, kyun ke bazaar 0.9457 aur 0.9275 par muttafiq ho ga.

تبصرہ

Расширенный режим Обычный режим