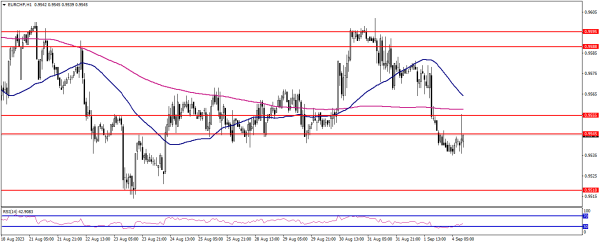

EURCHF pair ki keemat ka andaza lagate hue, yeh taqatwar bearish halat mein muntazir nazar ata hai. Pichli keemat jo EMA 50 ke oopar thi, 0.9675 par resistance ko azmana chahti thi lekin jhooti tooti ka samna kar ke 0.9426 ke support ki taraf wapas chali gayi. Kharidari karne walay ab bhi keemat ko oopar dhakelne ki koshish kar rahe hain lekin SBR area 0.9532 tak pohonchne ke baad nakam ho gaye. Haqeeqat mein, forokhton ne keemat ko nicha daba diya taake naye support ko qaim kia jaye jo kareeb 0.9281 par ban gaya. Es waqt, keemat SBR 0.9426 area ko azmana ja rahi hai jo pehle support tha lekin 0.9281 par wapas na aane ke baad ab support ke tor par wahan laut rahi hai. Agar keemat EMA 50 aur SBR area 0.9426 ke oopar baar baar chalay jaye to keemat agle SBR area 0.9532 ko azma sakti hai. Magar, Stochastic indicator ke parameters overbought zone mein dakhil ho gaye hain aur muntaqil hone ki nishandahi kar rahe hain, jisse ke oopar ki raily jald khatam ho jayegi. Mazeed, Awesome Oscillator (AO) indicator ka momentum abhi bhi yaqeeni nahi dikhata kyun ke histogram volume jo ke level 0 ke aas paas bana hai bohot chota hai. Sath hi, keemat ke pattern ka dhancha jo ke abhi bhi lower low - lower high banane mein mustaqil hai, tasawar ki ja rahi keemat ka rukh girne ki taraf hai.

Position entry setup:

Trade karne ke options kafi wazeh hain ke bearish trend ki shirayat mein SELL waqt ka intezar par fokus karna chahiye. SBR 0.9426 area jo ke EMA 50 par aik sath aa raha hai, ko position entry point ke tor par istemal kia ja sakta hai. Position ko open karne ka tasdeeq Stochastic indicator ke parameters overbought zone ko muntaqil karte hue aur AO indicator ka histogram level 0 ke neeche hone ke baad kiya jaye. Take profit ka nishan 0.9281 ya 0.9253 ke qareeb keeematain hain, jab ke 0.9532 resistance stop loss hai.

EUR/CHF pair ne pichle haftay ko bullish candle ke sath band kia, jaise ke mutawaqqa tha. Aur technicals dheere-dheere ek upri palat ki ishara dete hue hain. Halankeh yeh global nazar mein uttar ki mukammal shidat se baat karne ke liye bohot jaldi hai. Magar char ghante ke chart par, indicators mazeed uttar ki taraf ke movement ko poori tarah se support karte hain, sirf weak hints of local correction hain, mukhya signal upar ki taraf ishara karta hai. Is liye, mere liye abhi tak kharidari ko zyada tarji di jati hai. Rozana ke chart par, indicators mazeed uttar ki taraf ke movement ko support karte hain, lekin sath hi, pair ne bullish zone mein dakhil ho gaya hai Bollinger Bands channel mein. Agar yeh yahan mustaqil hota hai aane wale waqt mein, to lambi muddat ke nazarie se long positions ko kholna mumkin hoga. Mazeed, Bollinger Bands channel ne neeche ki haddi ko daboch diya hai jabke upri haddi wahi rehti hai, to yeh mazeed uttar ki taraf ke movement ka aik aur ishara hai. Magar phir se, mein dohrata hoon, abhi ke liye mein sirf ek mukhtasir nazarie se uttar ki taraf dekh raha hoon, zyada global nazarie par baat karne ka muzakara baad mein ho sakta hai jese ke technical component ki tasdeeq ke sath.

Position entry setup:

Trade karne ke options kafi wazeh hain ke bearish trend ki shirayat mein SELL waqt ka intezar par fokus karna chahiye. SBR 0.9426 area jo ke EMA 50 par aik sath aa raha hai, ko position entry point ke tor par istemal kia ja sakta hai. Position ko open karne ka tasdeeq Stochastic indicator ke parameters overbought zone ko muntaqil karte hue aur AO indicator ka histogram level 0 ke neeche hone ke baad kiya jaye. Take profit ka nishan 0.9281 ya 0.9253 ke qareeb keeematain hain, jab ke 0.9532 resistance stop loss hai.

EUR/CHF pair ne pichle haftay ko bullish candle ke sath band kia, jaise ke mutawaqqa tha. Aur technicals dheere-dheere ek upri palat ki ishara dete hue hain. Halankeh yeh global nazar mein uttar ki mukammal shidat se baat karne ke liye bohot jaldi hai. Magar char ghante ke chart par, indicators mazeed uttar ki taraf ke movement ko poori tarah se support karte hain, sirf weak hints of local correction hain, mukhya signal upar ki taraf ishara karta hai. Is liye, mere liye abhi tak kharidari ko zyada tarji di jati hai. Rozana ke chart par, indicators mazeed uttar ki taraf ke movement ko support karte hain, lekin sath hi, pair ne bullish zone mein dakhil ho gaya hai Bollinger Bands channel mein. Agar yeh yahan mustaqil hota hai aane wale waqt mein, to lambi muddat ke nazarie se long positions ko kholna mumkin hoga. Mazeed, Bollinger Bands channel ne neeche ki haddi ko daboch diya hai jabke upri haddi wahi rehti hai, to yeh mazeed uttar ki taraf ke movement ka aik aur ishara hai. Magar phir se, mein dohrata hoon, abhi ke liye mein sirf ek mukhtasir nazarie se uttar ki taraf dekh raha hoon, zyada global nazarie par baat karne ka muzakara baad mein ho sakta hai jese ke technical component ki tasdeeq ke sath.

تبصرہ

Расширенный режим Обычный режим