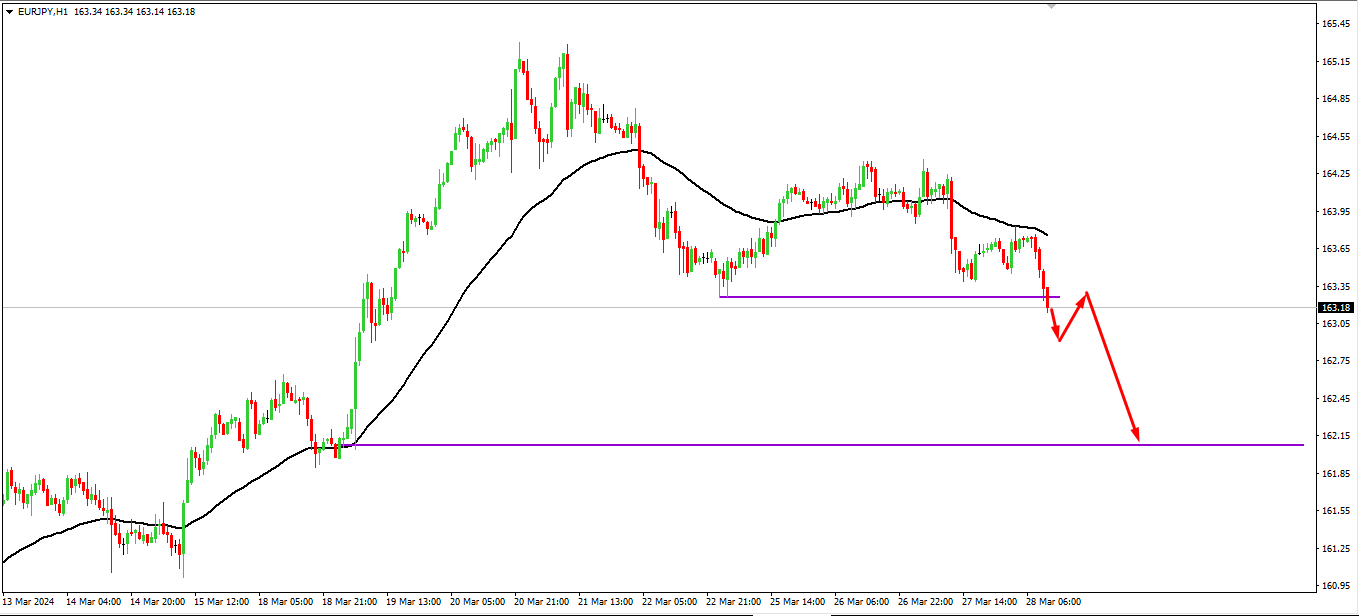

Kal EURJPY market pair par trading phir se forokhton ya forokhton ke qabze mein tha jo kharidaron ki keemat ko rokne mein kamyab rahe ya rahe jinhone 164.30-164.25 ke qeemat par resistance area mein bulishness ko kam karke aur rok kar rakha jo bad mein farokhton ne keemat ko bearishly neeche le jane ke liye istemal kiya.

Teeno mazid trading sessions ke doran, EUR/JPY currency pair ke qeemat ne farokht ke amal ka samna kia jo ise 163.98 ke darjay tak le gaya, jo ke taaqatwar ijraat ke baad aam hai, jo ke phir 165.33 ke resistance level ki taraf chali gayi. Farokht ke amal ko barhane wale asaar woh khabarain thin jinhein Japan ke currency officials ki taraf se di gayi khaas darjay ki bakhshish di gayi thi ke market movements ko nazar andaaz kiya ja raha hai. Forex currencies aur ke liye market mein dakhal ki jaane ki tawajjo hai taake currency ke keemat ka mazeed girne ko roka ja sake. EUR/JPY ke qeemat taqreeban 164.00 ke resistance level ke aas paas qaim hai jab tajziya likhne ka waqt hai.

Dusri satah par, stock market front... Frankfurt's DAX ne Monday ko 0.3% izafa kar ke 18,268 ka ek aur record high darj kia, peechle haftay ki mazid taaqatwar momentum ko jari rakhte hue aur bade global central banks ke dovish signals se faida uthate hue. Amooman, monetary policymakers ke liye ek barh rahi hai ke woh kam interest rates ki idea ko manwane par tayyar hain, jis se pehle April ke ibtedai dinon mein European Central Bank ki meeting se pehle financial markets mein interest rate cuts ka taqreeban pura percentage point daakhil ho chuka hai.

Stock trading platforms ke mutabiq, Frankfurt mein motorcycle companies ke shares tez izafa haasil kiye, jabke BMW aur Volkswagen ke shares 1% aur 2% izafa kar gaye, jabke Mercedes aur Continental ke shares green zone mein khatam hue. Is ke ilawa, Allianz ke shares zyada se zyada 1% izafa kar gaye, jo ke financial sector ke liye aik musbat session ko sath le kar aaya. Dosri taraf, healthcare giants ke shares ne kisi bhi satah par mazid izafa haasil kiya, peechle haftay izafa ke baad unke gains ko kam karte hue, jahan tak ke Merck ke shares 1.4% aur Sartorius ke shares 3% gir gaye.

Aam taur par. European stock markets ne Monday ko izafa kiya takay taaqatwar momentum ko barqarar rakhen, peechle haftay mukhtalif central bank meetings ke keya dovish turns se faida uthate hue. Euro zone Stoxx 50 index ne 0.4% izafa kiya 5,046 tak, sirf 10 points door 23 saal ki unchi tak pohanch gaya jo ke Thursday ko chhooi gayi thi, jabke pan-European Stoxx 600 index record high ke saath marginally flat line ke upar tha band hone par. At 510.

Teeno mazid trading sessions ke doran, EUR/JPY currency pair ke qeemat ne farokht ke amal ka samna kia jo ise 163.98 ke darjay tak le gaya, jo ke taaqatwar ijraat ke baad aam hai, jo ke phir 165.33 ke resistance level ki taraf chali gayi. Farokht ke amal ko barhane wale asaar woh khabarain thin jinhein Japan ke currency officials ki taraf se di gayi khaas darjay ki bakhshish di gayi thi ke market movements ko nazar andaaz kiya ja raha hai. Forex currencies aur ke liye market mein dakhal ki jaane ki tawajjo hai taake currency ke keemat ka mazeed girne ko roka ja sake. EUR/JPY ke qeemat taqreeban 164.00 ke resistance level ke aas paas qaim hai jab tajziya likhne ka waqt hai.

Dusri satah par, stock market front... Frankfurt's DAX ne Monday ko 0.3% izafa kar ke 18,268 ka ek aur record high darj kia, peechle haftay ki mazid taaqatwar momentum ko jari rakhte hue aur bade global central banks ke dovish signals se faida uthate hue. Amooman, monetary policymakers ke liye ek barh rahi hai ke woh kam interest rates ki idea ko manwane par tayyar hain, jis se pehle April ke ibtedai dinon mein European Central Bank ki meeting se pehle financial markets mein interest rate cuts ka taqreeban pura percentage point daakhil ho chuka hai.

Stock trading platforms ke mutabiq, Frankfurt mein motorcycle companies ke shares tez izafa haasil kiye, jabke BMW aur Volkswagen ke shares 1% aur 2% izafa kar gaye, jabke Mercedes aur Continental ke shares green zone mein khatam hue. Is ke ilawa, Allianz ke shares zyada se zyada 1% izafa kar gaye, jo ke financial sector ke liye aik musbat session ko sath le kar aaya. Dosri taraf, healthcare giants ke shares ne kisi bhi satah par mazid izafa haasil kiya, peechle haftay izafa ke baad unke gains ko kam karte hue, jahan tak ke Merck ke shares 1.4% aur Sartorius ke shares 3% gir gaye.

Aam taur par. European stock markets ne Monday ko izafa kiya takay taaqatwar momentum ko barqarar rakhen, peechle haftay mukhtalif central bank meetings ke keya dovish turns se faida uthate hue. Euro zone Stoxx 50 index ne 0.4% izafa kiya 5,046 tak, sirf 10 points door 23 saal ki unchi tak pohanch gaya jo ke Thursday ko chhooi gayi thi, jabke pan-European Stoxx 600 index record high ke saath marginally flat line ke upar tha band hone par. At 510.

تبصرہ

Расширенный режим Обычный режим