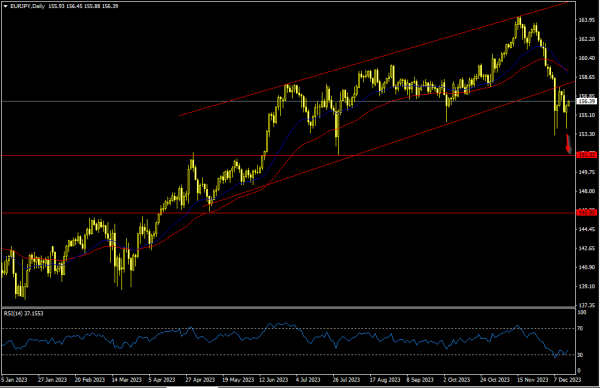

Shaam bakhair! Abhi ham wait-and-see mode mein hain, EUR/JPY pair par mazeed momentum ka intezaar karte huye. Jaise hamain pata hai, EUR/JPY ne kal mein khaas tor par kamzor hota hua mehsoos kiya. Keemat jo barhne ki koshish ki, woh apne mazbooti ko barqarar rakhne mein nakam rahi, khaas karke SMA-50 H4 par rukawat aur keemat SMA-100 H4 tak pahunchne mein nakam rahi. Keemat, jo H4 time frame mein dekhi ja rahi thi, aakhirkaar is dopahar tak neeche dhakka khaya jab kamzori ne 153.93 par support tak pahuncha. Stochastic ke saath, jo market conditions ko pehle se saturated batata hai, keemat 153.93 par support par atki hui hai, aur is par sudharati hui movement hoti hai. Keemat 154.81 area mein ghusne ki koshish kar rahi hai. Agar yeh mazbooti se inkar kare, to bechne ka mauka phir se paida ho sakta hai, khaas karke agar bechne waale dabav 153.93 area ko paar kar sake taki kamzori ek aur level tak gir sake. Ulti sthiti mein, agar 153.81 area tod diya jata hai, to phir se bechna tayar kiya ja sakta hai, khaas karke 155.82–156.95 area ke aas-paas. Hamare paas EUR/JPY currency pair ke liye 157.075 ke star par moolya hai, jo hamein khareedne ke liye tayyar karta hai. Ab pehla target 157.743 ke level par tay kiya gaya hai, aur doosra sabse ummedwar 158.528 ke level par hai. Tezi se vriddhi aur 158.528 ke upper target ke pura hone ke saath, aap sabhi lambi positions ko poori tarah se fix kar sakte hain aur bechne par kaam karna shuru kar sakte hain. Jab aap 157.075 par lambi position kholte hain, to stop loss ko 156.958 ke level par set karein. Isse hamari nuksan ko kam kiya ja sakta hai. Aur jab keemat 156.958 ke level se neeche jati hai, to bechne ka aarambh kar sakte hain. Phir toh, beshak, maqasid poori tarah se alag honge, aur sabse pehle aapko 156.173 ke level par gehraai se gaur karna chahiye

Sadharan harkat muaqqat moharrikon ke liye (exponential, 9 aur 22 douron ke doran) istemaal karte hain. Trading signals ke liye 156.811 par bharosa karne layak taqatwar mulaqat dhoondhein. Is stratigi mein, chhote price pullback ke baad market mein dakhil ho jaayein, 1:3 risk-profit ratio ko laagu karein. Ek mazboot 20-point stop ka istemal hota hai. Haaliya keemat 156.10 tak neeche gayi lekin upper limit tak pahunchne se pehle mud gayi. Jab aap 157.10 range ka jhoota breakout banate hain, to aise jhootay breakout ke baad girawat jari ho sakti hai. Shayad 157.10 ke range ka tod bhi bechna jari rakhne ke liye ek achha signal hoga. Shayad aaj khareedne waale 157.10 ko todne mein kamyab honge, aur aisa breakout bechna ke liye ek signal hoga. Lekin jab hum 155.50 ke range ko tod kar wahin par jam gaye honge, to yeh bechna ke liye ek achha signal hoga. Sudharati vriddhi ke baad, girawat jari rahegi.

Neem ka naqsha kaatne ke liye lower channel border ko 155.64 par rearrange kiya gaya hai; 158.19 tak ek oopari movement ke liye mukhalif point. Ek chhota position ko madde nazar rakhein; Stochastic indicator support zone mein hai. Haaliya 156.08 ke paas ke trading ko girawat jari rahegi, doosre support level ko tod kar 154.08 ko girane ka khatra hai. Ya toh, ek mudde ki taraf rukh badalne par resistance level ko dobara test kiya ja sakta hai 158.33 ke level par. Faisla karne se pehle market trends ko madde nazar rakhein; khush trading

Sadharan harkat muaqqat moharrikon ke liye (exponential, 9 aur 22 douron ke doran) istemaal karte hain. Trading signals ke liye 156.811 par bharosa karne layak taqatwar mulaqat dhoondhein. Is stratigi mein, chhote price pullback ke baad market mein dakhil ho jaayein, 1:3 risk-profit ratio ko laagu karein. Ek mazboot 20-point stop ka istemal hota hai. Haaliya keemat 156.10 tak neeche gayi lekin upper limit tak pahunchne se pehle mud gayi. Jab aap 157.10 range ka jhoota breakout banate hain, to aise jhootay breakout ke baad girawat jari ho sakti hai. Shayad 157.10 ke range ka tod bhi bechna jari rakhne ke liye ek achha signal hoga. Shayad aaj khareedne waale 157.10 ko todne mein kamyab honge, aur aisa breakout bechna ke liye ek signal hoga. Lekin jab hum 155.50 ke range ko tod kar wahin par jam gaye honge, to yeh bechna ke liye ek achha signal hoga. Sudharati vriddhi ke baad, girawat jari rahegi.

Neem ka naqsha kaatne ke liye lower channel border ko 155.64 par rearrange kiya gaya hai; 158.19 tak ek oopari movement ke liye mukhalif point. Ek chhota position ko madde nazar rakhein; Stochastic indicator support zone mein hai. Haaliya 156.08 ke paas ke trading ko girawat jari rahegi, doosre support level ko tod kar 154.08 ko girane ka khatra hai. Ya toh, ek mudde ki taraf rukh badalne par resistance level ko dobara test kiya ja sakta hai 158.33 ke level par. Faisla karne se pehle market trends ko madde nazar rakhein; khush trading

تبصرہ

Расширенный режим Обычный режим