EUR/JPY Technical Analysis:

Ascension channel mein daal rate H4 chart par hai. Pichle hafte pair mein izafa hua aur umeed thi ke pair oopar ki taraf jaega, lekin pair oopar ki taraf nahi gaya, pehle hi palat kar neeche jaane laga. Neeche jaate hue, pair ke rate 160.36 ke level tak gir gaye, aur ab tak giravat yahan ruki hai. Ab agar price peer ko palat kar oopar ki taraf jaati hai, toh pair oopar ki taraf ja sakta hai, yani 165.78 ke level tak. Aur agar price neeche jaari rahe aur ascension channel se neeche nikal gaya, toh pair 158.07 ke level tak gir sakta hai.

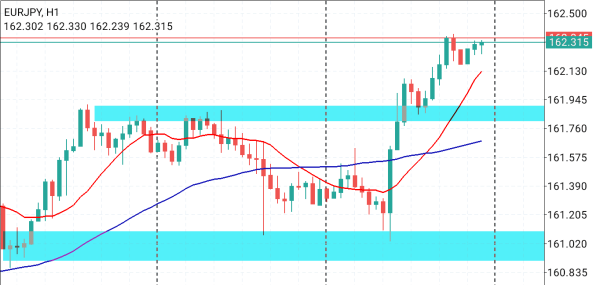

Currency pair - EURJPY, haftay ki shuruaat se hi Kharidari ki taraf murne laga, mukhya bearish trend ke khilaf, lekin hum dekh rahe hain ke 162.14 ke Resistance ke oopar nahi utha sakte, trend dheere dheere khareed rahe hain. Abhi currency 162.78 ke level par hai, koshish ki ja rahi hai ke price toot kar 162.67 ke tootey hue darmiani level ko test kare. Jo chart n1 par saaf dikh raha hai. Main maanta hoon ke Bullish raaste ko jaari rakhne ke liye, ab zaroori hai ke 159.14 ke Resistance ko todein, jisse ke oopar ki taraf ek channel khula ja sake. Khareedne walon ki taqat se tasdeeq ki jaegi, jab tootey hue zone par consolidation hogi. Lekin phir bhi, main maanta hoon ke jald hi woh price ko neeche ki taraf chhod denge - 156.24 ke Testing ke liye.

Ascension channel mein daal rate H4 chart par hai. Pichle hafte pair mein izafa hua aur umeed thi ke pair oopar ki taraf jaega, lekin pair oopar ki taraf nahi gaya, pehle hi palat kar neeche jaane laga. Neeche jaate hue, pair ke rate 160.36 ke level tak gir gaye, aur ab tak giravat yahan ruki hai. Ab agar price peer ko palat kar oopar ki taraf jaati hai, toh pair oopar ki taraf ja sakta hai, yani 165.78 ke level tak. Aur agar price neeche jaari rahe aur ascension channel se neeche nikal gaya, toh pair 158.07 ke level tak gir sakta hai.

Currency pair - EURJPY, haftay ki shuruaat se hi Kharidari ki taraf murne laga, mukhya bearish trend ke khilaf, lekin hum dekh rahe hain ke 162.14 ke Resistance ke oopar nahi utha sakte, trend dheere dheere khareed rahe hain. Abhi currency 162.78 ke level par hai, koshish ki ja rahi hai ke price toot kar 162.67 ke tootey hue darmiani level ko test kare. Jo chart n1 par saaf dikh raha hai. Main maanta hoon ke Bullish raaste ko jaari rakhne ke liye, ab zaroori hai ke 159.14 ke Resistance ko todein, jisse ke oopar ki taraf ek channel khula ja sake. Khareedne walon ki taqat se tasdeeq ki jaegi, jab tootey hue zone par consolidation hogi. Lekin phir bhi, main maanta hoon ke jald hi woh price ko neeche ki taraf chhod denge - 156.24 ke Testing ke liye.

تبصرہ

Расширенный режим Обычный режим